Technology

Bitcoin Price In The Limelight, Gearing Up For $50k Ahead of Spot BTC ETF Approval – Crypto News

Bitcoin price regains ground above $45,000 as FOMO builds ahead of the spot BTC ETF approval this week.

Published 36 mins ago

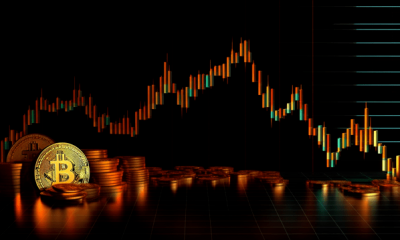

The crypto community is breathlessly waiting for the imminent approval of the first spot Bitcoin exchange-traded funds (ETFs) in the US by the Securities and Exchange Commission (SEC). Although cryptos faced intense headwinds over the weekend, the outlook from the Bitcoin price perspective elucidates the likelihood of a massive breakout.

Bitcoin Price On The Move To $50k As Spot ETF Approval Beckons

Investors are looking forward to the positive impact the ETF would have on Bitcoin price and across the board. Increased capital flow into Bitcoin and the validation of the sector to firms on Wall Street could usher in a commendable bullish era.

Meanwhile, the SEC has given spot ETF applicants until Monday, January 8 to file amended S-1 forms as the last step ahead of the greenlighting. Companies that have made this last filing include Black Rock, WisdomTree, Fidelity, Invesco, Ark Invest/21Shares, VanEck, and Valkyrie.

The operators of the ETFs also included in the filings their sponsor fees. BlackRock settled for 0.3% in sponsor fees but investors can expect lower levels as far as 0.2% in the initial year, or until the ETF crosses the $5 billion in assets milestone.

Damn, the fee for BlackRock’s Bitcoin ETF will be 0.30% as per their just filed S-1. This is much cheaper than I predicted. Life just got a LOT tougher for everyone else. The ETF Terrordome is no joke. pic.twitter.com/RZrfO8x61s

— Eric Balchunas (@EricBalchunas) January 8, 2024

VanEck boasts the lowest sponsor fee at 0.25%, while WisdomTree takes the top spot for the highest at 0.5%, according to Bloomberg’s ETF analyst Eric Balchunas on X.

VanEck is in at 0.25%. In one hot minute Fidelity’s 0.39% went from wow, cheapest in group to mid. Altho they’re Fidelity and have a distribution capability that many of the other issuers don’t. pic.twitter.com/6pYq9aXZI0

— Eric Balchunas (@EricBalchunas) January 8, 2024

Bitcoin price has just crossed above $45,000 in the wake of a clear ascending triangle breakout. Based on the short-term technical structure, the largest cryptocurrency is in the bulls’ hands and might close the gap to $50,000 before the weekend.

The Relative Strength Index (RSI) exhibits a bullish outlook after regaining ground above the midline (50) in the neutral zone. With a four-hour candle close above $45,000, traders would be less worried about Bitcoin retreating and more confident in the potential breakout to $50,000.

Recommended for you: Crypto Price Prediction For January 8: ETH, MKR, AXL

A buy signal presented by the. Moving Average Convergence Divergence (MACD) indicator validated the bullish thesis. Traders will be obliged to enter new long positions backed by the blue MACD line holding above the red signal line.

Failure to make consecutive four-hour candle closes above $45,000 could introduce the risk of a trend correction. With that in mind, it would be prudent to watch out for potential support areas, including the 20 Exponential Moving Average (EMA) (blue) at $44,067, the 50 EMA (in red) at $43,780 and the 200 EMA (purple) at $42,464.

Although highly unlikely with the spot ETF approval on the horizon, further price correction could seek to bounce off $42,000 and $40,000 support areas if push comes to shove.

Related Articles

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Metaverse1 week ago

Metaverse1 week agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoStop panicking about AI. Start preparing – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain2 days ago

Blockchain2 days agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Technology5 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH price prediction as Ethereum prepares for ERC-8004 mainnet rollout – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

Cryptocurrency6 days ago

Crypto News: Strategy Bitcoin Underwater After 30% BTC Crash – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoEthereum’s Fusaka upgrade lands today – Crypto News

-

Technology4 days ago

GLXY Stock Price Falls as Mike Novogratz’s Galaxy Digital Reports $482 Million Q4 Loss – Crypto News

-

others4 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Technology3 days ago

Technology3 days agoEmbedded Payments Help SaaS as AI Reshapes Workflows – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoY Combinator Offers Startups Stablecoins Instead of Cash – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMetaplanet boosts forecasts despite Bitcoin write-down clouding annual results – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

De-fi1 week ago

De-fi1 week agoEthereum is for Institutions: Danny Ryan Says Tokenization Isn’t Enough – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoIn a multi-test series, this is just the first innings: Vaishnaw on AI evolution – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAI Tool of the Week: When translation understands context – Crypto News

-

Business7 days ago

Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoBig Moves Brewing Above $2 – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoGoogle Gemini launches JEE Main mock test papers: IIT Kharagpur alumnus Sundar Pichai goes nostalgic, ‘If I could…’ – Crypto News

-

Business6 days ago

India’s Crypto Taxation Unchanged as the Existing 30% Tax Retains – Crypto News

-

Technology6 days ago

Bitcoin Falls Below $80K as Crypto Market Sees $2.5 Billion In Liquidations – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

others6 days ago

Is the Crypto Sell-Off Just Starting? Raoul Pal Flags US Liquidity Crisis From Govt. Shutdown – Crypto News

-

others6 days ago

Is the Crypto Sell-Off Just Starting? Raoul Pal Flags US Liquidity Crisis From Govt. Shutdown – Crypto News

-

Business5 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology5 days ago

Technology5 days agoExclusive-OpenAI is unsatisfied with some Nvidia chips and looking for alternatives, sources say – Crypto News

-

Technology5 days ago

Technology5 days agoGeoff Keighley confirms date for The Game Awards 2026 in Los Angeles: All you need to know – Crypto News

-

others4 days ago

others4 days agoGoogle Agrees To Pay $68,000,000 Settlement To Customers After Being Accused of Listening to Private Conversations on Android Phones – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoBitcoin Unrealized Losses Reach 22% – Still No Capitulation Phase – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft shares slide as AI spending surges – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

Technology1 week ago

Technology1 week agoOracle Stock Drops by More Than Half Amid AI Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoPlayStation Plus February lineup revealed: Undisputed, Subnautica: Below Zero and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Historical Performance Shows How Low The Price Will Go Before A Bottom – Crypto News

-

others7 days ago

Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B – Crypto News

-

others7 days ago

Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B – Crypto News

-

others7 days ago

Expert Predicts Ethereum Crash Below $2K as Tom Lee’s BitMine ETH Unrealized Loss Hits $6B – Crypto News

-

Business6 days ago

Bitcoin Falls Below $80K as Crypto Market Sees $2.5 Billion In Liquidations – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

others6 days ago

others6 days agoUSD/JPY treads water above 155.00 as BoJ reinforces gradual tightening path – Crypto News

-

others6 days ago

others6 days agoUSD/JPY treads water above 155.00 as BoJ reinforces gradual tightening path – Crypto News

-

others6 days ago

others6 days agoUSD/JPY treads water above 155.00 as BoJ reinforces gradual tightening path – Crypto News