others

Natural Gas sees February turn blood red with questions on LNG’s sustainability in the near future – Crypto News

- Natural Gas in its eighth day of consecutive losses.

- Traders are sending Gas prices already 20% lower since the start of February.

- The US Dollar Index roared on the back of red-hot inflation, consolidating gains this Wednesday.

Natural Gas (XNG/USD) is eking out more losses with February being outright negative for the fossil fuel. The additional move this time comes with Shell issuing an outlook where Liquefied Natural Gas (LNG) demand will be substantially decreased by 2040, seeing the current pushes worldwide to abandon fossil fuels. The outlook supports the overall trend seen in both Oil and Gas with several administrations worldwide taking measures to further limit and phase out usage on all fronts.

The US Dollar (USD) is trying to consolidate its current position after it booked some substantial gains on the back of a red-hot US inflation report that pointed to sticky price pressures being present. Markets had to push back further their expectations of an initial rate cut by the US Federal Reserve (Fed) from June into July. This made equities nosedive, though those are recovering at the moment ahead of the US opening bell.

Natural Gas is trading at $1.70 per MMBtu at the time of writing.

Natural Gas market movers: Bleak outlook

- Shell said in its outlook that demand for LNG by 2040 will be lower than first anticipated.

- Some tightening in European gas prices is showing that traders are focussing on the restocking of European gas storage ahead of next winter.

- Europe will need to look for 5% more LNG supply in order to reach the same levels of gas storage seen in 2023 ahead of winter.

- The warm front is closing in as expected and would see temperatures rise to unseasonable levels with London projected to reach 13 degrees Celsius.

Natural Gas Technical Analysis: More downturn ahead

Natural Gas is unable to halt the current downturn which has been going on for eight straight days already. More downturn looks to be at hand with supply still very much flowing and demand remaining rather tepid. Add several more calls for the longer term outlook where LNG and other fossil fuels are being phased out, and a quick return to higher levels looks not to be in the cards anytime soon.

On the upside, Natural Gas is facing some pivotal technical levels to get back to. First, $1.99, which saw an accelerated decline. Next is the blue line at $2.13 with the triple bottoms from 2023. In case Natural Gas sees sudden demand pick up, possibly $2.40 could come into play.

Keep an eye on $1.80, which was a pivotal level back in July 2020 and should act as a cap now. Should US President Biden’s moratorium be lifted, together with the additional supply from Canada – which is exporting more to fill the gap from the US – $1.64 and $1.53 (low of 2020) are targets to look out for.

XNG/USD (Daily Chart)

Natural Gas FAQs

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

-

Technology4 days ago

Technology4 days agoChatGPT users are mass cancelling OpenAI subscriptions after GPT-5 launch: Here’s why – Crypto News

-

Technology1 week ago

Binance to List Fireverse (FIR)- What You Need to Know Before August 6 – Crypto News

-

Technology1 week ago

Technology1 week agoBest computer set under ₹20000 for daily work and study needs: Top 6 affordable picks students and beginners – Crypto News

-

Technology1 week ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

Cryptocurrency1 week ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

others1 week ago

others1 week agoBank of America CEO Denies Alleged Debanking Trend, Says Regulators Need To Provide More Clarity To Avoid ‘Second-Guessing’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Business1 week ago

Analyst Spots Death Cross on XRP Price as Exchange Inflows Surge – Is A Crash Ahead ? – Crypto News

-

De-fi1 week ago

De-fi1 week agoTON Sinks 7.6% Despite Verb’s $558M Bid to Build First Public Toncoin Treasury Firm – Crypto News

-

De-fi1 week ago

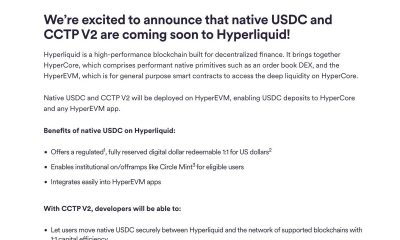

De-fi1 week agoCircle Extends Native USDC to Sei and Hyperliquid in Cross-Chain Push – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Business1 week ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions down to ¥89.2K from previous ¥106.6K – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Trade Meme Coins in 2025 – Crypto News

-

others1 week ago

others1 week agoIs Friday’s sell-off the beginning of a downtrend? – Crypto News

-

others1 week ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

Business1 week ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

Technology1 week ago

Technology1 week agoOppo K13 Turbo, K13 Turbo Pro to launch in India on 11 August: Expected price, specs and more – Crypto News

-

Blockchain1 week ago

Shiba Inu Team Member Reveals ‘Primary Challenge’ And ‘Top Priority’ Amid Market Uncertainty – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI releases new reasoning-focused open-weight AI models optimised for laptops – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoCrypto Market Might Be Undervalued Amid SEC’s New Stance – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoChatGPT won’t help you break up anymore as OpenAI tweaks rules – Crypto News

-

De-fi6 days ago

De-fi6 days agoCoinbase Pushes for ZK-enabled AML Overhaul Just Months After Data Breach – Crypto News

-

Cryptocurrency3 days ago

DWP Management Secures $200M in XRP Post SEC-Win – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

others1 week ago

SharpLink Buys the Dip, Acquires $100M in ETH for Ethereum Treasury – Crypto News

-

others1 week ago

others1 week agoVisa and Mastercard’s Payment Dominance Not Threatened by Stablecoins, According to Execs – Crypto News

-

Business1 week ago

Breaking: U.S. CFTC Kicks off Crypto Sprint, Explores Spot and Futures Trading Together – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLido Slashes 15% of Staff, Cites Operational Cost Concerns – Crypto News

-

others1 week ago

MetaPlanet Launches Online Clothing Store As Part of ‘Brand Strategy’ – Crypto News

-

Technology7 days ago

Technology7 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

Technology7 days ago

Technology7 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

others6 days ago

others6 days agoUS President Trump issues executive order imposing additional 25% tariff on India – Crypto News

-

Business6 days ago

Analyst Predicts $4K Ethereum Rally as SEC Clarifies Liquid Staking Rules – Crypto News

-

De-fi6 days ago

De-fi6 days agoSEC Says Some Stablecoins Can Be Treated as Cash, but Experts Warn of Innovation Risk – Crypto News

-

Business6 days ago

XRP Price Prediction As $214B SBI Holdings Files for XRP ETF- Analyst Sees Rally to $4 Ahead – Crypto News

-

others5 days ago

others5 days agoEUR firmer but off overnight highs – Scotiabank – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump to Sign an EO Over Ideological Debanking: Report – Crypto News

-

De-fi5 days ago

De-fi5 days agoRipple Expands Its Stablecoin Payments Infra with $200M Rail Acquisition – Crypto News

-

others4 days ago

others4 days agoRipple To Gobble Up Payments Platform Rail for $200,000,000 To Support Transactions via XRP and RLUSD Stablecoin – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoHarvard Reveals $116 Million Investment in BlackRock Bitcoin ETF – Crypto News

-

Technology4 days ago

Technology4 days agoHumanoid Robots Still Lack AI Technology, Unitree CEO Says – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Festival Sale 2025 vs Flipkart Freedom Sale: Comparing MacBook deals – Crypto News

-

Business1 week ago

India’s Jetking Targets 21,000 Bitcoin By 2032 As CFO Foresees $1M+ Price – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Stall as Trump’s Crypto Policy Report Fails to Spark Momentum – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSharpLink Buys $54M in ETH, Holdings Reach $1.65B – Crypto News