De-fi

Thorchain Loans Spike With Weekly Flows Of $100M – Crypto News

Lending on the decentralized liquidity protocol has skyrocketed more than threefold in the past week.

Traders are rushing to take out zero-interest loans on Thorchain after the cross-chain liquidity protocol lifted its collateral limit.

There is now $120 million in ETH and BTC collateral on the protocol, compared with $36 million before the cap was lifted.

On March 8, Thorchain announced it would burn 60 million of the protocol’s native RUNE token, worth $500 million at today’s price. The move opened up an additional $160 million worth of collateral capacity for ETH and BTC — or roughly 2,000 BTC and 36,000 ETH.

Investors have deposited 1,005 BTC (or $67.3 million), up from 400 BTC on March 8, according to NineRealms, an institutional liquidity protocol for Thorchain. Meanwhile, there is now 15,279 ETH (approximately $53 million) locked up for loans, a 400% increase.

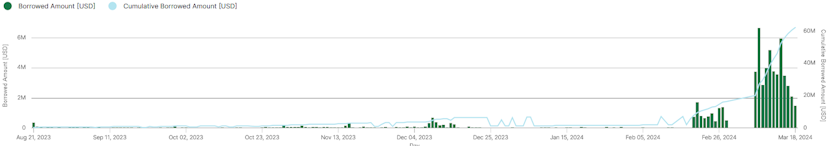

Across the board, Thorchain activity from traders, investors, borrowers, and lenders is up. Although loans peaked following the March 8 announcement, when traders borrowed $6.6 million, interest has since waned, according to a dashboard from Flipside Crypto.

Daily loans opened have also surged, spiking to triple digits in ten of the past eleven days. Thorchain’s volume has also ramped back up this month, while its total value locked (TVL) surpassed $500 million on March 12.

Thorchain offers interest-free loans against major crypto assets like Bitcoin and Ether, with no liquidations or fixed expiration dates. As part of the latest upgrade, collateralization ratios for BTC and ETH were reduced to 200%, meaning users can borrow half the value of their assets.

When a loan is opened on Thorchain, the collateral asset is sold for RUNE, while the difference between the collateral value and the loan value is burned. Conversely, when loans are repaid, RUNE is minted and swapped for the original collateral asset, which is returned to the borrower.

Thorchain has piqued the interest of prominent crypto investor, Fred Krueger, who is now using the platform to leverage a loan on Bitcoin to acquire more Bitcoin.

“I’m doing a small-scale test of borrowing BTC against my BTC using ShapeShift,” Krueger tweeted on March 17. “So far, I am liking what I am seeing,” he added.

Krueger, who describes himself as a “Bitcoin maxi” on his X bio, triggered the ire of other so-called Bitcoin maximalists, who believe giving up Bitcoin as collateral to be exchanged for a different token is akin to blasphemy. Critics of Krueger’s Thorchain adventure compared the protocol with failed lenders previously operating in the Centralized Finance (CeFi) sector.

“Blockfi springs to mind. Oh and Celsius. Same shit, different year. Will end badly,” wrote one user, with several others asking if Krueger’s play was a paid sponsorship. Another Bitcoiner foresees that Krueger will “learn a lesson the hard way.”

But Thorchain is different from BlockFi in several aspects.

The DeFi protocol runs on a transparent and open blockchain, allowing all to scrutinize the collateralization and health of loans taken out from the protocol. Additionally, Thorchain requires 200% collateral for any loan.

BlockFi and Celsius, on the other hand, went under for using customers’ funds to take risky bets without disclosing those investments.

Still, using decentralized protocols does not come without some risks.

A potential vulnerability of Thorchain’s design is excessive minting of RUNE if too many borrowers rush to redeem their collateral at the same time, even as the team has put multiple safeguards in place to mitigate the risk. The protocol is also just springing back from a string of exploits and code vulnerabilities.

Even so, zero-interest loans against BTC and ETH are proving attractive enough to outweigh those concerns.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoVanEck’s Solana ETF nears launch after SEC 8-A filing – Details – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoVanEck’s Solana ETF nears launch after SEC 8-A filing – Details – Crypto News

-

De-fi1 week ago

De-fi1 week agoZEC Jumps as Winklevoss‑Backed Cypherpunk Reveals $100M Zcash Treasury – Crypto News

-

Business7 days ago

December Fed Meeting 2025: Rate Cut or Hold? Key levels to Watch – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

De-fi1 week ago

De-fi1 week agoKraken’s xStocks Hit $10B in Total Trading Volume – Crypto News

-

others7 days ago

December Fed Meeting 2025: Rate Cut or Hold? Key levels to Watch – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin faces quantum risk: why SegWit wallets may offer limited protection – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoYour deep research tool may save you time, but can it save you embarrassment? – Crypto News

-

Technology5 days ago

Technology5 days agoPerplexity faces harsh crowd verdict at major San Francisco AI conference: ‘Most likely to flop’ – Crypto News

-

Technology5 days ago

Japan’s ¥17 Trillion Stimulus Plan: A Turning Point for Global Liquidity Shifts – Crypto News

-

De-fi1 week ago

De-fi1 week agoSKY Surges 14% as Savings TVL Passes $4 Billion – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUAE makes Bitcoin wallets a crime risk in global tech crackdown – Crypto News

-

De-fi1 week ago

De-fi1 week agoEthereum Sees First Sustained Validator Exit Since Proof-of-Stake Shift – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP’s Big Moment? Why Nov. 13 Could Be the Day Ripple Investors Have Waited For – Crypto News

-

De-fi1 week ago

De-fi1 week agoXPL Rallies After Plasma Reveals Collaboration with Daylight Energy – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin (BTC) battles macro headwinds despite improved ETF inflows – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAI-driven phishing scams and hidden crypto exploits shake Web3 security – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhy the Future of Blockchain Payments Could Stay Narrow – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCrypto market’s weekly winners and losers – TEL, STRK, ICP, CC – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBitcoin Indicator Sounds Buy Alarm For The First Time Since March — Return To $110K Soon? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCrypto update: Bitcoin ETFs see $300M inflow as investors ‘buy the dip’ – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoTLC Coin Price Prediction 2026, 2030, &2040: Trillioner Forecast » InvestingCube – Crypto News

-

De-fi1 week ago

De-fi1 week agoTrump Tokens Outperform After US President Teases ‘Tariff Dividends’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoFoxconn reports strong Q3 profit driven by AI server boom, teases OpenAI announcement – Crypto News

-

others1 week ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

Business1 week ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

De-fi1 week ago

De-fi1 week agoFlare TVL Nears Record High as Firelight Teases XRP Liquid Staking – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Drops to $94,000 Following Second-Largest Daily ETF Outflows – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Drops to $94,000 Following Second-Largest Daily ETF Outflows – Crypto News

-

Technology5 days ago

Technology5 days agoAI chatbots like ChatGPT and Gemini may be ‘bullshitting’ to keep you happy, new study finds – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoA16z’s Sees Arcade Tokens As Key To Crypto Evolution – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoBlackRock XRP ETF Speculation Hit New Highs As XRPC Performance Shocks Markets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Path To $1 Million Clears With OG Sellers Fading: Weisberger – Crypto News

-

Technology1 week ago

Breaking: USDC Issuer Circle Explores Native Token for Arc Network – Crypto News

-

De-fi1 week ago

De-fi1 week agoXRP Surges as First US Spot ETF Debuts on Nasdaq – Crypto News

-

Business1 week ago

Ethereum Price Sheds 10% but Lands on the $3,150 Accumulation Base — Is a Buy-the-Dip Bounce Ahead? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZcash Revival Sparks Debate on Bringing Privacy Back to Bitcoin – Crypto News

-

De-fi7 days ago

De-fi7 days agoIs DYOR Dead? Building a Safer Web3 with Alex Katz – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoAnt International and UBS Team on Blockchain-Based Deposits – Crypto News

-

Business1 week ago

Arthur Hayes Buys UNI as CryptoQuant CEO Says Supply Shock ‘Inevitable’ for Uniswap – Crypto News

-

Business1 week ago

Cardano News: Wirex Partners EMURGO To Launch First Ever ADA Card – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUniswap finally turns the fee switch – Crypto News

-

Business1 week ago

U.S. Government Shutdown Set to End as House Panel Approves Senate Funding Deal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMatthew McConaughey, Michael Caine Team Up With ElevenLabs to Recreate Their Voices Using AI – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMajor Ethereum Upgrade Scheduled for December – Crypto News

-

Business1 week ago

Death Cross Triggers Sell Signals for Cardano Price— Will ADA Retest $0.50? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCanary XRP ETF gets green light for Nasdaq launch tomorrow – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Slips After Rebound, Struggling to Keep Momentum Above $3,500 – Crypto News