De-fi

The Battle Royale — what lies ahead amid regulatory clash and hack mayhem? – Crypto News

The following is a guest post by Nikita Ovchinnik,

DeFi may be “in the crosshairs” of the SEC, as Forbes magazine recently stated after the SEC action against Uniswap. Still, the matter raises valid concerns that DeFi simply must address for the sake of its future.

According to Uniswap, the Wells notice suggests potential enforcement action, alleged acting both as an unregistered securities broker and an unregistered securities exchange. The SEC alleges that certain tokens traded on Uniswap, such as those issued through ICOs, constitute investment contracts and, therefore, securities. By enabling the trading of these tokens without appropriate registration and regulatory oversight, Uniswap is alleged to have violated federal securities laws.

The SEC contends that Uniswap Labs exercises significant control over the platform’s operations, rendering it a central entity responsible for the trading activities. Uniswap Labs, in turn, contends that it is only the developer responsible for building the front-end portal. The Uniswap protocol itself is separate, just autonomous code released for public use. To my mind, the fact that the protocol can be interacted with without using the front end supports this defense.

It has to be said that the SEC’s action was not unexpected, given pre-existing rumors and signs. While it’s concerning, Uniswap’s solid foundation and favorable position in the regulatory landscape suggest it has a robust case to present. In the short term, we may see market uncertainties impacting investor confidence and token values.

For Uniswap, the ultimate consequences are unlikely to be severe. Uniswap is not only navigating these challenges successfully but also reinforcing its role as a legitimizing and stabilizing force in DeFi. This could be a turbulent period for all of DeFi, lasting many years, but Uniswap at least looks ready for the fight. The company’s strategic responses and inherent strengths may enable it to emerge stronger, continuing its legacy as a “white knight” for the industry.

The SEC’s action against Uniswap is part of a broader regulatory trend targeting decentralized platforms, which naturally raises concerns around overreach. Unfortunately, the SEC has decided to focus on good actors like Uniswap; however, it may at least serve as a wake-up call to others.

Time for DeFi Leaders to Do Their Homework

While dismay over the crackdown on Uniswap is understandable, the reality is that the SEC’s concerns do carry weight. Recent reports paint a sobering picture, with DeFi projects suffering staggering losses. In January, $133 million was lost to hacks and fraud; February saw a further $67 million; and March witnessed another $136 million. In contrast, centralized finance platforms reported zero incidents of hacking or fraud for the same period.

As innovative as DeFi may be, its rapid growth and adoption have outpaced its ability to address fundamental security issues effectively. Its open-source nature, rightly celebrated for its transparency and collaboration, has become a double-edged sword. The public availability of code, of course, fosters innovation, but it also exposes vulnerabilities to malicious actors who can study it at their leisure.

DeFi proponents would be wise to heed the concerns and take decisive action to bolster industry security as the battle lines are drawn. Failure to do so may result in further regulatory crackdowns, stifling innovation, and undermining the very principles upon which DeFi was founded. The commission is determined to establish its authority and ensure that DeFi operates within the confines of securities laws. This clash is outcome will surely shape the industry’s future trajectory and relationship with regulatory bodies.

Distant from CeFi, Yet Still Striving for True Decentralization

In March, the NFT game Munchables, built on Ethereum layer-2 blockchain Blast, suffered a $62.5 million exploit. The attacker manipulated the proxy contract to assign themselves an enormous balance of Ether before withdrawing much of it. The culprit was a pseudonymous rogue developer hired by the company and three others, who had all vouched for the attacker.

After the hack, the on-chain researcher ZachXBT investigated and determined that all four were likely the same person, potentially linked to the infamous North Korean cybercriminals, the Lazarus Group. Perhaps this revelation inspired the attackers to hand over the private keys needed to restore the stolen funds, which took place after talks with the hacker. The incident underscores the importance of robust security measures and due diligence in hiring practices. Maintaining control over deployment processes and thoroughly understanding the code pushed to the blockchain is crucial.

From a broader perspective, the Munchables hack exposes the tension between decentralization and user protection. Initial calls for the Blast team to intervene and roll back the chain represent a stark departure from the ethos of decentralization, where transactions are immutable and censorship-resistant. However, in this case, the magnitude of the exploit and the potential impact on user trust understandably suggest a more interventionist approach.

The Journey Towards a Brighter Future

Ultimately, the DeFi space must confront security challenges to mature and gain mainstream acceptance. This requires technical improvements in smart contract development and a cultural shift towards greater transparency, accountability, and risk management.

Security should permeate every layer of operations, from smart contract development to user interface design. Leaders must prioritize compliance without compromising the core principles to navigate these turbulent waters and chart a course toward a brighter future.

DeFi protocols must undergo rigorous audits and penetration testing, leveraging the expertise of seasoned cybersecurity professionals to identify and mitigate vulnerabilities proactively. Embracing bug bounty programs is another crucial step. Projects can address weaknesses by incentivizing ethical hackers to uncover vulnerabilities before they can be exploited.

Crucially, this security-centric approach must be accompanied by a renewed commitment to transparency and open communication with regulators. By proactively engaging with regulatory bodies and demonstrating a willingness to collaborate on establishing industry-wide standards and best practices, DeFi leaders can help shape a regulatory framework that fosters innovation while ensuring consumer protection.

The road ahead is arduous, but the rewards of a secure and compliant DeFi ecosystem are immense. By prioritizing security, embracing collaboration, and maintaining an open dialogue with regulators, the industry can pave the way for mainstream adoption and unlock its true potential.

Mentioned in this article

-

Technology1 week ago

XRP Ledger Secures Major Win, Powering China’s Top Supply Chain Firm – Crypto News

-

De-fi1 week ago

De-fi1 week agoBinance Lists Dolomite’s DOLO Token, Adds Fifth Lira Pair – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

others1 week ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

others1 week ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

Business3 days ago

Business3 days agoPYMNTS’ Summer of Big Quotes, From Tariffs to Trust Codes – Crypto News

-

Business1 week ago

Gemini Launches XRP Credit Card Amid Ripple-Backed IPO Plans – Crypto News

-

Technology1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

Business1 week ago

BlackRock Buys $300M in Ethereum as Crypto ETF Inflows Return – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Dives As On-Chain Data Shows Every Cohort Now Selling – Crypto News

-

Business1 week ago

Pi Network Hackathon Winner Hints at Coinbase Listing Amid Pi Open Source Transition – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDecoding Google’s Layer-1 blockchain: what it means and what we know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGoogle’s Rich Widmann shares LinkedIn update on Universal Ledger blockchain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPhilippine Senator Suggests Putting National Budget On-chain – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAnimoca, Antler’s Ibex Launch Fund to Tokenize Japan’s IP – Crypto News

-

Business1 week ago

Donald Trump Jr.’s VC Firm Invests ‘Millions’ in $1B Crypto Platform Polymarket – Crypto News

-

Business1 week ago

Scott Bessent Says 11 ‘Strong’ Candidates in Line to Replace Fed Chair Powell – Crypto News

-

Technology1 week ago

Technology1 week agoMint Explainer | A web for machines, not humans: Decoding ex-Twitter CEO Parag Agrawal’s next big move – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoSouth Korea Busts Hacking Syndicate After Multi-Million Dollar Crypto Losses – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCanary Capital Files “American-Made” Crypto ETF Amid SEC Delays – Crypto News

-

Business1 week ago

Pepe Price Forecast as $19M Net Outflows Signal Accumulation: Is a 130% Rally Next? – Crypto News

-

Business1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

others1 week ago

Breaking: U.S. Government to Begin Issuing GDP Data on Blockchain in Latest Crypto Push – Crypto News

-

Technology1 week ago

Pump.fun Buys Back $58M PUMP Tokens; Price Up 4% – Crypto News

-

Business1 week ago

CR7 Meme Coin Hits $5M Market Cap Then Dumps Following $143M Rug Pull – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto and DeFi in 2026: Adoption, Innovation, and the Road Ahead – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop Crypto Market Makers and How to Choose One – Crypto News

-

Technology1 week ago

SEC Delays WisdomTree XRP ETF Decision Until October – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago215% PENGU Rally Incoming? Analyst Says Token ‘Inches’ From Next Leg Up – Crypto News

-

Cryptocurrency1 week ago

Why Kanye West’s YZY Meme Coin is Down 82% Juts a Week After Launch? – Crypto News

-

Technology1 week ago

Technology1 week agoPUMP circulating supply shrinks as Pump.fun’s total buybacks surpass $58M – Crypto News

-

De-fi1 week ago

De-fi1 week agoPrediction Market Kalshi to Expand Onchain Presence – Crypto News

-

De-fi1 week ago

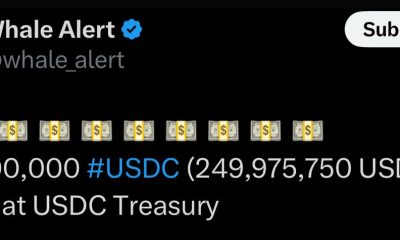

De-fi1 week agoCircle Mints $500 Million USDC in $250 Million Batches, Hits $25 Billion USDC on Solana in 2025 – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle is working on Quick Share for iPhone: Here’s everything we know so far – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

De-fi1 week ago

De-fi1 week agoStablecoins Just Got Real: The Future of Programmable Money in the GENIUS Era – Crypto News

-

others1 week ago

SEC Pushes Back Decision on Grayscale’s Cardano ETF – Crypto News

-

others1 week ago

Breaking: Canary Capital Files S-1 For Trump Coin ETF With U.S. SEC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago5 memecoins positioned to skyrocket as social buzz grows in August – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSynthetix price soars 20% amid volume spike: here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoAave’s new Horizon allows institutions to borrow stablecoins using real-world assets – Crypto News

-

De-fi1 week ago

De-fi1 week agoSony’s Soneium Debuts Scoring System to Record Onchain Participation – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

others1 week ago

others1 week agoGold price in India: Rates on August 26 – Crypto News

-

others1 week ago

others1 week agoXAG/USD rises toward $39.00 due to increased safe-haven demand – Crypto News

-

Business1 week ago

Donald Trump Jr.’s VC Firm Invests ‘Millions’ in $1B Crypto Platform Polymarket – Crypto News

-

Business1 week ago

MetaPlanet Launches $881M International Stock Issuance for BTC Purchases – Crypto News

-

Technology1 week ago

Technology1 week agoTrump Media teams with Crypto.com in $100M CRO token deal – Crypto News

-

others1 week ago

others1 week agoDow Jones slows to a crawl amid quiet markets – Crypto News