De-fi

From staking to recursive lending – Crypto News

The following is a guest article from Vincent Maliepaard, Marketing Director at IntoTheBlock.

Staking

Staking is a fundamental yield generation strategy in DeFi. It involves locking a blockchain’s native tokens to secure the network and validate transactions, earning rewards in transaction fees and additional token emissions.

The rewards from staking fluctuate with network activity—the higher the transaction volume, the greater the rewards. However, stakers must be mindful of risks such as token devaluation and network-specific vulnerabilities. Staking, while generally stable, requires a thorough understanding of the underlying blockchain’s dynamics and potential risks.

For example, some protocols, like Cosmos, require a specific unlock period for stakers. This means that when you’re withdrawing your assets from staking, you won’t be able to actually move your assets for a 21-day period. During this time, you are still subject to price fluctuations and can’t use your assets for other yield strategies.

Liquidity Providing

Liquidity providing is another method of generating yield in DeFi. Liquidity providers (LPs) usually contribute an equal value of two assets to a liquidity pool on decentralized exchanges (DEXs). LPs earn fees from each trade executed within the pool. The returns from this strategy depend on trading volumes and fee tiers.

High-volume pools can generate substantial fees, but LPs must be aware of the risk of impermanent loss, which occurs when the value of assets in the pool diverges. To mitigate this risk, investors can choose stable pools with highly correlated assets, ensuring more consistent returns.

It is also important to remember that the projected returns from this strategy are directly dependent on the total liquidity in the pool. In other words, as more liquidity enters the pool, the expected reward decreases.

Lending

Lending protocols offer a straightforward yet effective yield-generation method. Users deposit assets, which others can borrow in exchange for paying interest. The interest rates vary based on the supply and demand for the asset.

High borrowing demand increases yields for lenders, making this a lucrative option during bullish market conditions. However, lenders must consider liquidity risks and potential defaults. Monitoring market conditions and utilizing platforms with strong liquidity buffers can mitigate these risks.

Airdrops and Points Systems

Protocols often use airdrops to distribute tokens to early users or those who meet specific criteria. More recently, points systems have emerged as a new way to ensure these airdrops go to actual users and contributors of a specific protocol. The concept is that specific behaviors reward users with points, and these points correlate to a specific allocation in the airdrop.

Making swaps on a DEX, providing liquidity, borrowing capital, or even just using a dApp are all actions that would generally earn you points. Points systems provide transparency but are by no means a fool-proof way of earning returns. For example, the recent Eigenlayer airdrop was limited to users from specific geographical areas and tokens were locked upon the token generation event, sparking debate among the community.

Leverage in Yield strategies

Leverage can be used in yield strategies like staking and lending to optimize returns. While this increases returns, it also increases the complexity of a strategy, and thus its risks. Let’s look at how this works in a specific situation: lending.

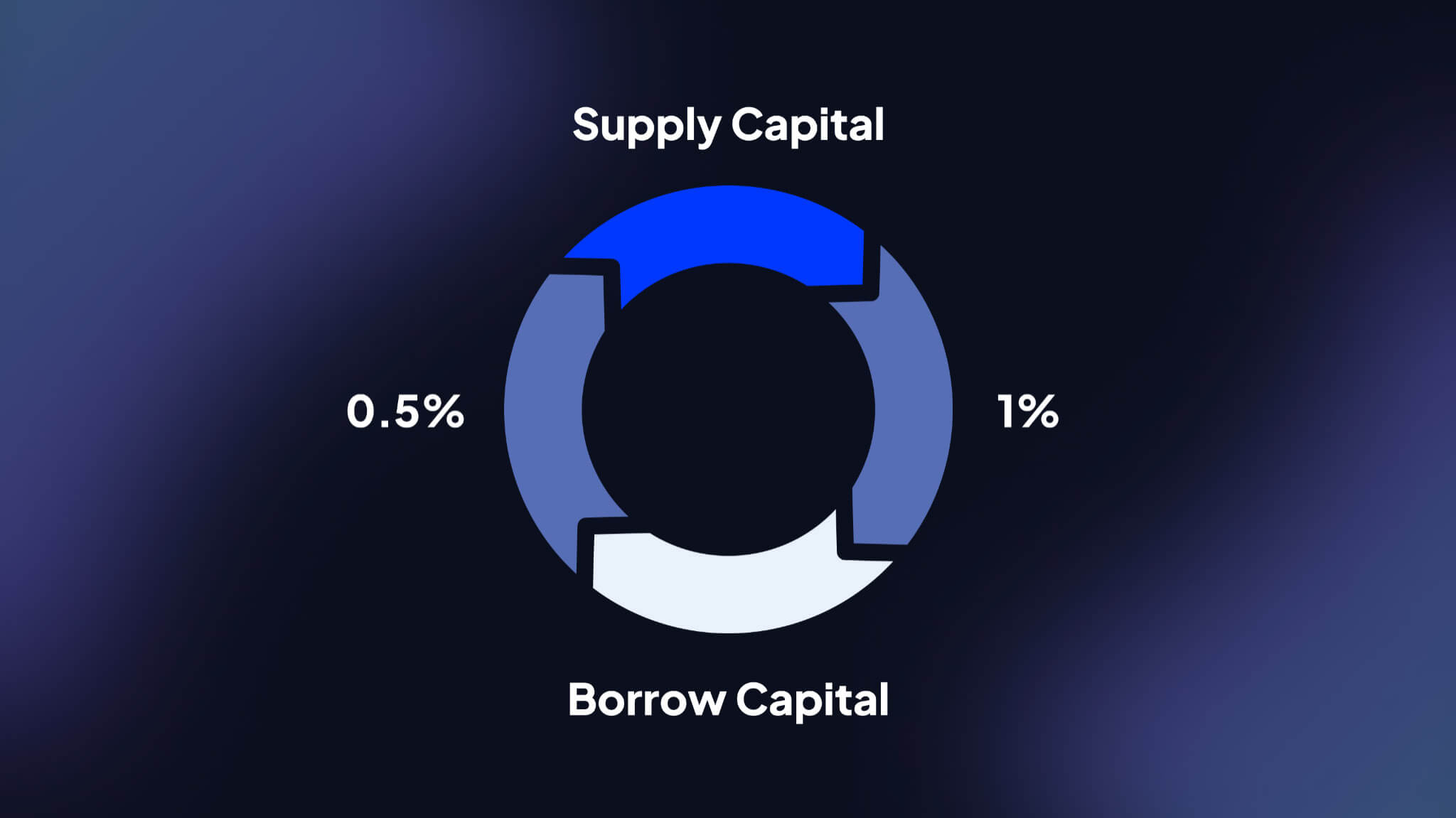

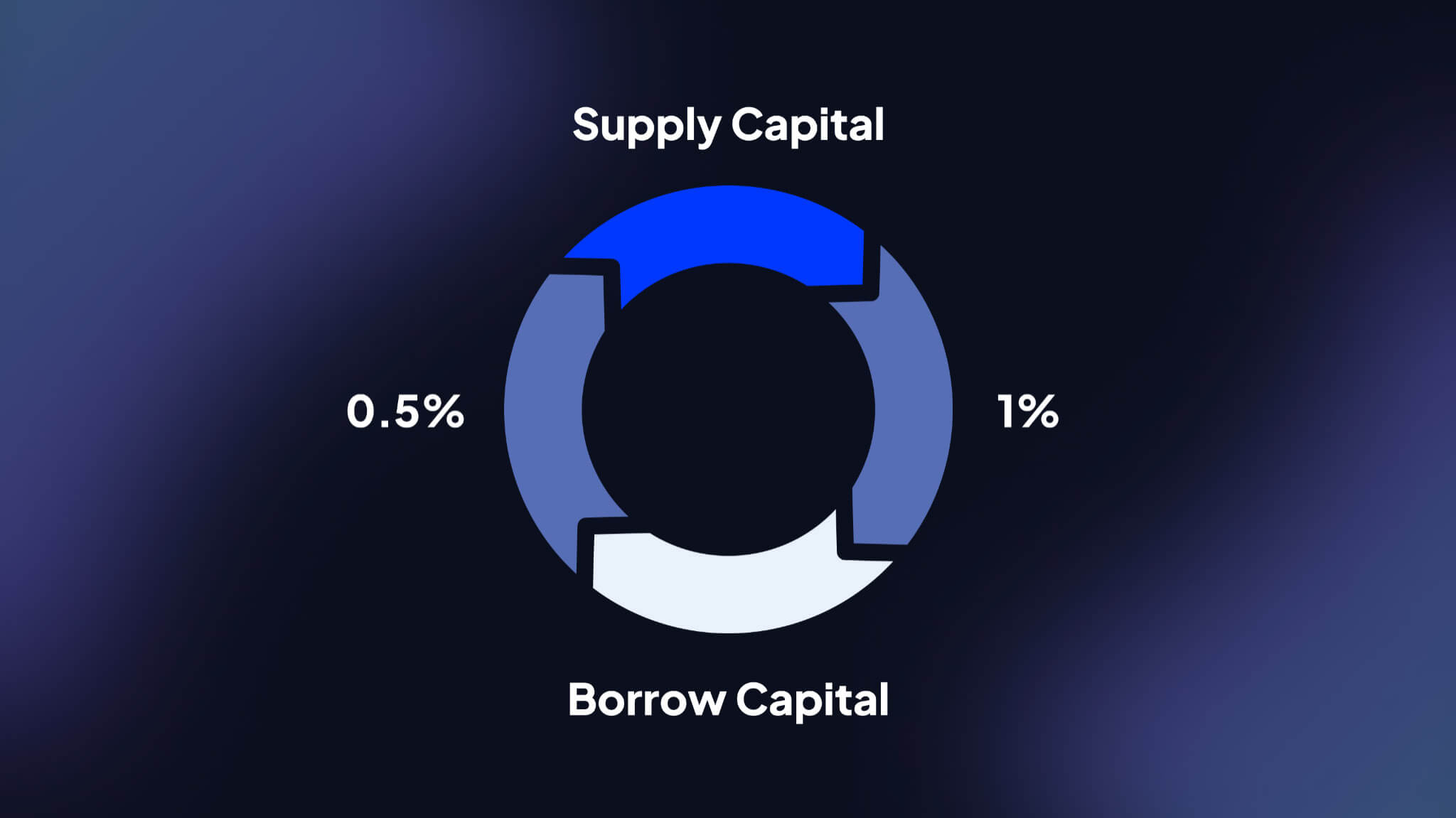

Recursive lending capitalizes on incentive structures within DeFi lending protocols. It involves repeated lending and borrowing of the same asset to accrue rewards offered by a platform, significantly enhancing the overall yield.

Here’s how it works:

- Asset Supply: Initially, an asset is supplied to a lending protocol that offers higher rewards for supplying than the costs associated with borrowing.

- Borrow and Re-Supply: The same asset is then borrowed and re-supplied, creating a loop that increases the initial stake and the corresponding returns.

- Incentive Capture: As each loop is completed, additional governance tokens or other incentives are earned, increasing the total APY.

For example, on platforms like Moonwell, this strategy can transform a supply APY of 1% to an effective APY of 6.5% once additional rewards are integrated. However, the strategy entails significant risks, such as interest rate fluctuations and liquidation risk, which require continuous monitoring and management. This makes strategies like this one more suitable for institutional DeFi participants.

The future of DeFi & Yield Opportunities

Until 2023, DeFi and traditional finance (TradFi) operated as separate silos. However, increasing treasury rates in 2023 spurred a demand for integration between DeFi and TradFi, leading to a wave of protocols entering the “real-world asset” (RWA) space. Real-world assets have primarily offered treasury yields on-chain, but new use cases are emerging that leverage blockchain’s unique characteristics.

For example, on-chain assets like sDAI make accessing treasury yields easier. Major financial institutions like BlackRock are also entering the on-chain economy. Blackrock’s BUIDL fund, offering treasury yields on-chain, amassed over $450 million in deposits within a few months of launching. This indicates that the future of finance is likely to become increasingly on-chain, with centralized companies deciding whether to offer services on decentralized protocols or through permissioned paths like KYC.

This article is based on IntoTheBlock’s most recent research paper on institutional DeFi. You can read the full report here.

Mentioned in this article

-

Technology6 days ago

Technology6 days agoMeet Matt Deitke: 24-year-old AI whiz lured by Mark Zuckerberg with whopping $250 million offer – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoXRP inflows drop 95% since July spike, while Chaikin data signals possible rally – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBank of America Sees Interest in Tokenization of Real-World Assets – Crypto News

-

Technology1 week ago

Technology1 week agoIs AI causing tech worker layoffs? Thats what CEOs suggest, but the reality is complicated – Crypto News

-

others7 days ago

Breaking: Strategy Files $4.2 Billion STRC Offering To Buy More Bitcoin – Crypto News

-

others7 days ago

XRP NIGHT Token Airdrop: Snapshot, Claim Date and What to Expect? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSEC Crypto ETFs Ruling Brings Structural Fix, Not Retail Shakeup – Crypto News

-

Business1 week ago

Breaking: Solana ETFs Near Launch as Issuers Update S-1s With Fund Fees – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoAltcoin Rally To Commence When These 2 Signals Activate – Details – Crypto News

-

Cryptocurrency5 days ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

Business1 week ago

Business1 week agoChase Launches $4 Million Grant Program as Restaurants Struggle – Crypto News

-

others1 week ago

Ripple Swell 2025: Top Speakers and Panelists to Watch this November – Crypto News

-

Technology7 days ago

Technology7 days agoOppo K13 Turbo series confirmed to launch in India with in-built fan technology: Price, specs and everything expected – Crypto News

-

others1 week ago

others1 week agoBlockchain Gaming Is Growing Up – What’s Behind the Sector’s Quiet Comeback – Crypto News

-

Business1 week ago

Stablecoins Won’t Boost Treasury Demand, Peter Schiff Warns – Crypto News

-

Technology1 week ago

Coinbase to Offer Tokenized Stocks and Prediction Markets in U.S. – Crypto News

-

others7 days ago

others7 days agoCanadian Dollar under pressure amid weak GDP, Trump tariff threat, and strong US data – Crypto News

-

Business6 days ago

Bitpanda Co-Founder & Co-CEO Paul Klanschek Steps Down as Firm Eyes Frankfurt IPO – Crypto News

-

Technology4 days ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

others1 week ago

others1 week agoEUR/USD dives as the US Dollar outperforms with all eyes on the Fed decision – Crypto News

-

others1 week ago

Breaking: PayPal to Let Merchants Accept Payments in Over 100 Cryptocurrencies – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSEC Gives Green Light to In-Kind Transactions for Crypto ETPs – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoOpenAI rolls out ‘Study Mode’ in ChatGPT: What is it? How to use? All your questions answered… – Crypto News

-

Technology1 week ago

Breaking: BlackRock’s Ethereum ETF Staking Proposal Advances As SEC Acknowledges Filing – Crypto News

-

Technology1 week ago

Ethereum Price Prediction- Bulls Target $5,400 Amid DeFi Revival and Soaring TVL – Crypto News

-

Technology1 week ago

Technology1 week agoCoinbase exchange targets alleged cybersquatter in lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoWhite House Crypto Report Recommends Expanding CFTC’s Role in Crypto Regulation – Crypto News

-

Technology6 days ago

Technology6 days agoBig Tech’s Big Bet on AI Driving $344 Billion in Spend This Year – Crypto News

-

Cryptocurrency6 days ago

CME XRP Futures Hit Record Highs in July Amid ETF Approval Optimism – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoStablecoins Are Finally Legal—Now Comes the Hard Part – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Technology1 week ago

Technology1 week agoSpotify hits 276M subscribers and strong user growth in Q2, but revenue and profit fall short of targets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAltcoins update: Dogecoin and Injective signal recoveries as Ethereum eyes $4,000 – Crypto News

-

Business1 week ago

Breaking: CBOE Files For Rule Change To List Crypto ETFs Without SEC Approval – Crypto News

-

Technology1 week ago

Technology1 week agoSolana DEX volume dips 20% after co-founder slams meme coins – Crypto News

-

Technology7 days ago

Technology7 days agoTim Cook confirms Apple will ramp up AI spending, ‘open’ to acquisitions – Crypto News

-

Technology7 days ago

Technology7 days agoOppo K13 Turbo series confirmed to launch in India with in-built fan technology: Price, specs and everything expected – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoStrategy Expands STRC Offering Twice in One Week – Crypto News

-

Technology5 days ago

Will The First Spot XRP ETF Launch This Month? SEC Provides Update On Grayscale’s Fund – Crypto News

-

Technology5 days ago

Technology5 days agoAmazon Great Freedom Sale deals on smartwatches: Up to 70% off on Samsung, Apple and more – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Business4 days ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology4 days ago

Technology4 days agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

Technology4 days ago

Technology4 days agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase and JPMorgan Chase partner for crypto integration – Crypto News

-

others1 week ago

others1 week agoGold slides below $3,300 as traders await Fed policy decision – Crypto News

-

others1 week ago

others1 week agoGold slides below $3,300 as traders await Fed policy decision – Crypto News

-

Technology1 week ago

Technology1 week agoNintendo Direct Partner showcase highlights third-party titles coming to Switch and Switch 2 – Crypto News