Blockchain

Tariffs, Whales, And Volatility Ahead – Crypto News

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin traders are preparing for a jam-packed and potentially turbulent week. From looming tariffs to whale-sized BTC bid activity, here are five major factors that market participants need to keep on their radar.

#1 US Tariffs Poised To Escalate On April 2

The global stage is bracing for what US President Donald Trump has dubbed “Liberation Day” on April 2. According to The Kobeissi Letter (@KobeissiLetter), the administration’s plan for “reciprocal tariffs” promises to be a watershed moment in ongoing international trade disputes.

“President Trump has been discussing this Wednesday, April 2nd, for weeks. This is a day that he has named ‘Liberation Day’ where widespread new tariffs are coming. We believe April 2nd will be the biggest escalation of the trade war to date,” The Kobeissi Letter writes via X.

These tariffs will layer on top of a slew of existing US duties that span steel, aluminum, Canadian goods, Mexican goods, and many Chinese imports. The Kobeissi Letter points out that 25% levies on auto imports and on countries purchasing Venezuelan oil will also take effect this week. With retaliatory measures from Canada, China, the EU, and Mexico in the pipeline, they warn of a “massive trade war,” intensifying uncertainty for global markets.

Related Reading

Beyond trade specifics, the coming days could see inflation pressure intensify due to higher consumer costs on imported goods. Citing an uptick in the Economy Policy Uncertainty Index, The Kobeissi Letter highlights: “Policy uncertainty is currently above just about any crisis in modern US history. We are seeing ~80% HIGHER uncertainty levels than 2008. As a result, market swings are widening, and we expect an extremely volatile week.”

Add in President Trump’s latest threats regarding Iran—where “secondary tariffs” and potential levies on Russian oil are on the table—and there are multiple international flashpoints that may feed into market volatility.

#2 Bitcoin Whale Activity

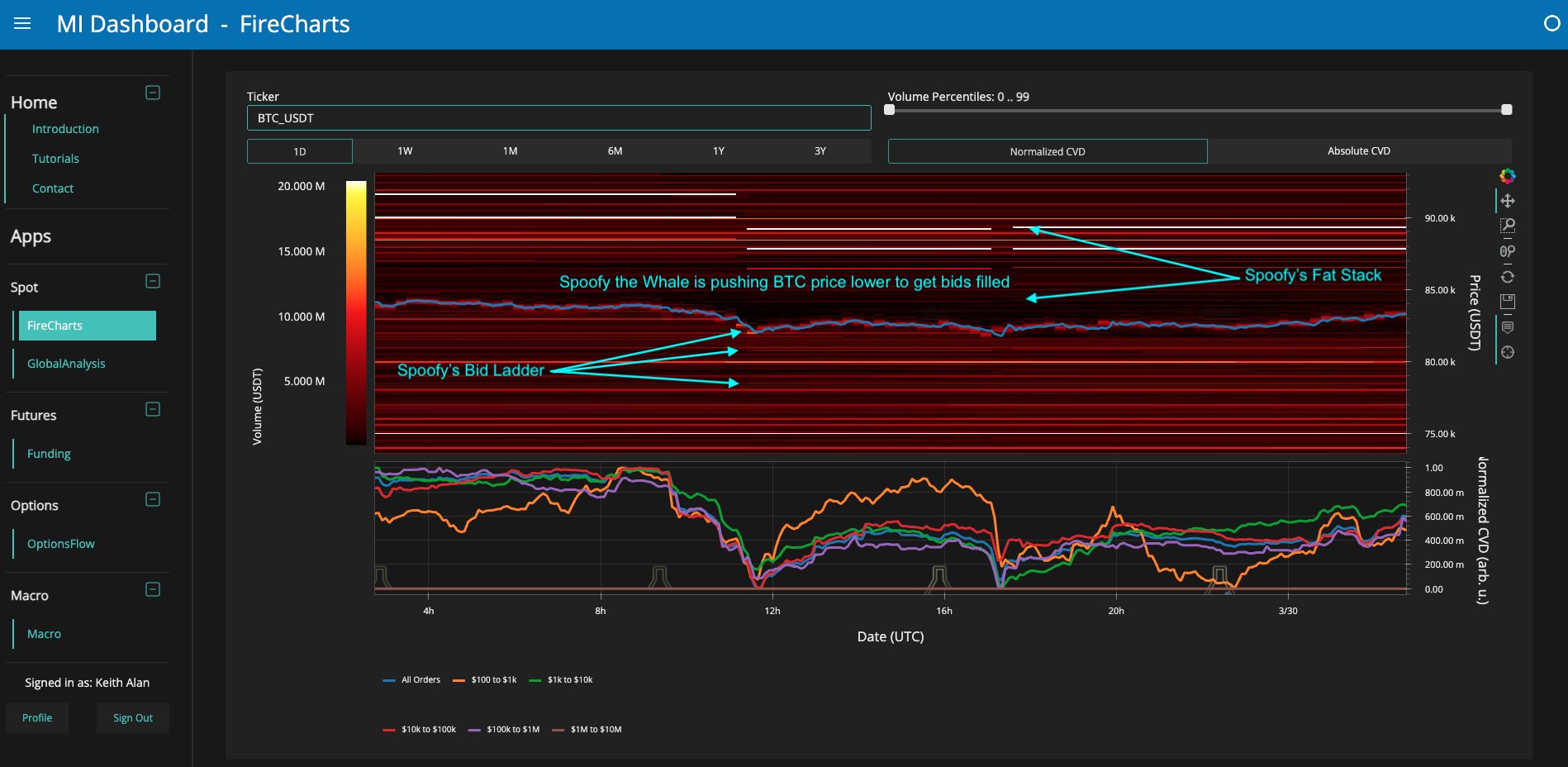

In the Bitcoin arena, large-scale liquidity maneuvers remain a focal point. Keith Alan (@KAProductions), co-founder of Material Indicators, drew attention to a potential whale strategy in action—attributed to a figure he dubs “Spoofy the Whale.”

“My first clue that something was up came with a sequence of micro movements that seemed to be a little different than his typical price adjustment of his massive blocks of ask liquidity. At a closer look I noticed a ladder of BTC bid liquidity perfectly aligned and moving with the ask liquidity. While I have no real way of confirming that it is the same entity using ask liquidity to herd price into their own bids, it certainly appears that Spoofy has been buying this dip and has bids laddered down to $78k,” Alan wrote on Sunday.

He also noted the convergence of several news events—Sunday’s weekly close, Monday’s monthly close, and the expected tariff implementation midweek—that may catalyze further price swings. While acknowledging BTC could still go lower, he underlined the whale’s apparent commitment to accumulating at current levels: “In the grand scheme of things, none of this means BTC price can’t go lower, but it does mean that the whale that has been suppressing BTC price for the last 3 weeks is using a DCA strategy to buy this dip…and so am I.”

#3 Bitcoin Bearish Flag Breakdown

Technical analyst Kevin (@Kev_Capital_TA) is warning traders to keep a close eye on pivotal support levels following a bearish flag breakdown: “We were tracking this bearish flag pattern all last week and as we can see we had a breakdown of that weakness. If BTC does lose the golden pocket here at $81K and follows through with that measured move target, then the $70K–$73K range … would be the ‘Measured Move’ target.”

Still, Kevin posits that, given widespread negative sentiment around April 2 (“Armageddon Day” in some corners of the media), there is a possibility of a contrarian twist: “Will the Tariff implementation on April 2nd be a rare ‘sell the rumor buy the news event’? … Everyone thinks the world is suddenly going to end.”

Related Reading

He also added: “A little bit of long liquidity at the $78K-$80K level but a lot of juice in the $87K-$89K (Dark Yellow) range for market makers to transact in right before the CNBC proclaimed “Armageddon Day” on April 2nd. Makes me wonder.”

#4 Seasoned Players Accumulate

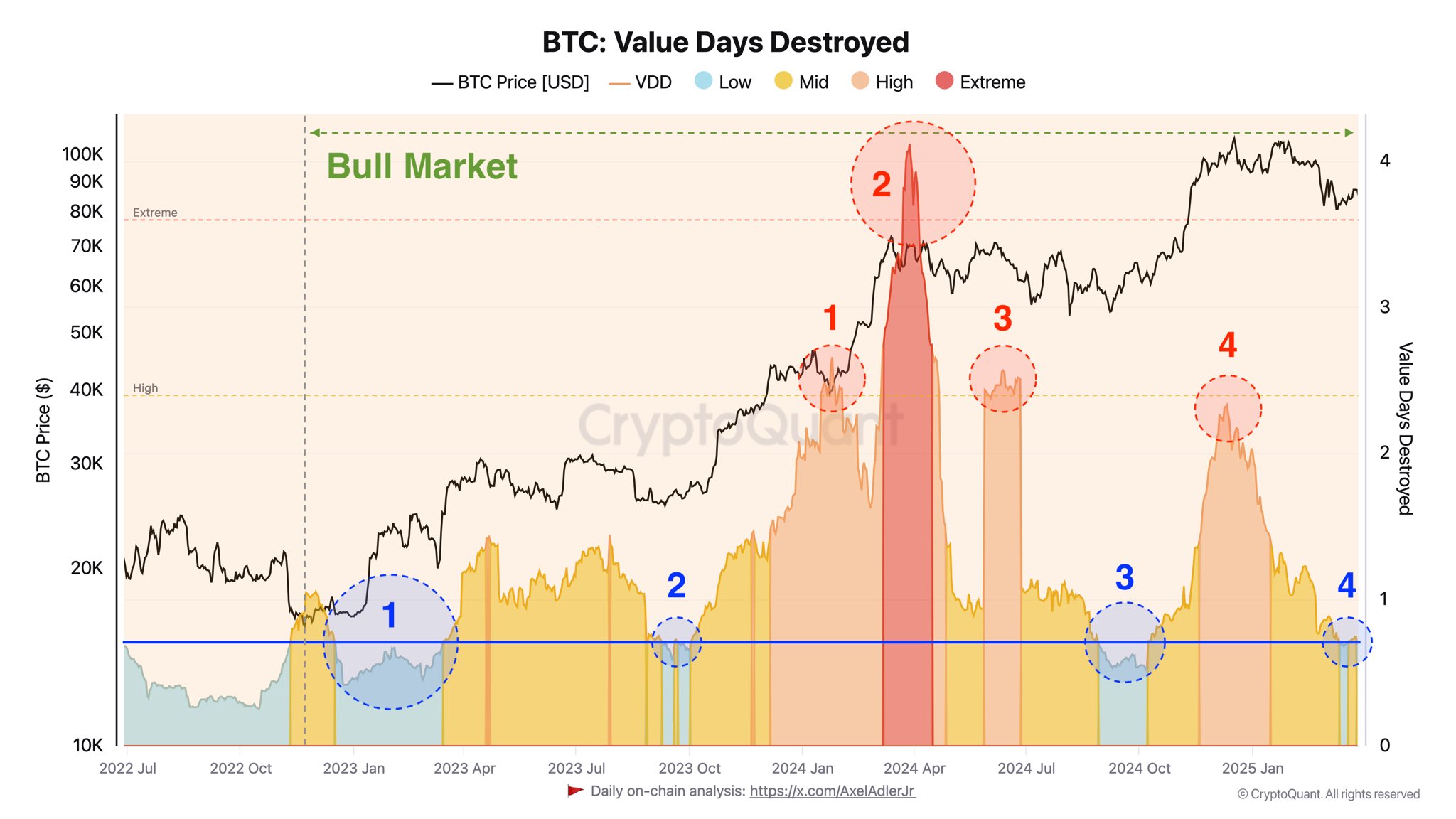

From an on-chain perspective, Axel Adler Jr, an analyst at CryptoQuant, observes that experienced market participants are moving into a new accumulation phase. Drawing from the Value Days Destroyed (VDD) indicator, Adler identifies a series of four distinct accumulation periods since early 2023, marking the current cycle as ripe for potential long-term upside:

“The absence of significant selling in the current phase demonstrates the confidence of these experienced players that the current BTC price level is not favorable for profit-taking.” Adler underlines that historical data shows low VDD periods often precede price increases, suggesting a bullish medium-term outlook—provided macro factors, including global economic policy shifts, do not derail market sentiment.

#5 CME Gap

Lastly, traders need to watch the CME (Chicago Mercantile Exchange) gap formation, which has been a notable feature in Bitcoin’s price action. Rekt Capital (@rektcapital) highlighted the recent filling of a gap between $82,000 and $85,000: “BTC has filled the general CME Gap area from $82k–$85k. Moreover, Bitcoin will probably develop a brand new CME Gap over this weekend … Which could set BTC up for a move into at least $84k next week.”

CME gaps often act as magnets for price action, and Rekt Capital’s analysis suggests a possible retracement to fill newly formed gaps or a continuation move that takes BTC higher, depending on how broader market forces unfold this week.

At press time, BTC traded at $82,010.

Featured image created with DALL.E, chart from TradingView.com

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoStop panicking about AI. Start preparing – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMakinaFi hit by $4.1M Ethereum hack as MEV tactics suspected – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

others1 week ago

others1 week agoPBOC sets USD/CNY reference rate at 6.9843 vs. 6.9929 previous – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent? – Crypto News

-

Business1 week ago

Japan Set to Launch First Crypto ETFs as Early as 2028: Nikkei – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRYO Digital Announces 2025 Year-End Milestones Across Its Ecosystem – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Technology2 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

others1 week ago

U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty – Crypto News

-

others1 week ago

others1 week ago478,188 Americans Warned After Hackers Strike Government-Related Firm Handling Sensitive Personal Data – Crypto News

-

Technology1 week ago

Crypto Events to Watch This Week: Is the Market Entering a New Recovery Phase? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Won’t Return to Binance, Bullish on Bitcoin Supercycle – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Slips Further As Bears Target Deeper Support Zones – Crypto News

-

Technology1 week ago

Technology1 week agoIs TikTok still down in the United States? Check current status – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThe productivity bull case for almost everything – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid explained: The $3 trillion DEX that’s shaking up crypto trading – Crypto News

-

Cryptocurrency1 week ago

Pi Network Price Prediction as 134M Token Unlock in Jan 2026 Could Mark a New All-Time Low – Crypto News

-

Technology1 week ago

Pi Network Price Prediction as 134M Token Unlock in Jan 2026 Could Mark a New All-Time Low – Crypto News