De-fi

Crypto Markets Gain on Regulatory Clarity and Fed Optimism – Crypto News

Bitcoin, Ethereum, and major altcoins rise following the SEC and CFTC sharing a statement on spot crypto trading.

Major digital assets ticked up for a second day on Wednesday, Sept. 3, boosted by macro optimism and regulatory tailwinds after the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) said that regulated exchanges are not prohibited from facilitating certain spot crypto trades.

Bitcoin (BTC) rose 1.2% over the past 24 hours to $112,000. Ethereum (ETH) is up 3.8% on the day to $4,459. XRP increased 2.8% to $2.87, while Solana (SOL) ticked up 5% to $210.

“The whale rotation from Bitcoin to Ethereum that took BTC below $110,000 has taken a pause and most likely is almost complete now,” Paul Howard from Wincent said in comments shared with The Defiant. “What I expect we see is a gradual grind higher with institutional flows coming back into BTC.”

He explained that while September is historically a poorly-performing month from a price perspective, he believes it could “surprise by month-end given institutional interest and the consistent volumes we are seeing from OTC buyers this week.”

In the altcoin space, Maple Finance’s SYRUP surged 12% on Wednesday amid news that the asset manager is expanding syrupUSDC to Arbitrum. ONDO is also up 7% after announcing it would launch tokenized U.S. Stocks on Ethereum.

The broader total cryptocurrency market capitalization climbed nearly 2% over the past 24 hours to $3.96 trillion, with Bitcoin dominance at 56.3% and Ethereum at 13.6%, according to CoinGecko.

Liquidations and ETFs

Over the past 24 hours, around $171 million in crypto positions were liquidated, including $52 million of long positions and $119 million of shorts, per CoinGlass. Ethereum led with over $53 million in liquidations, followed by Bitcoin at $35 million.

Spot Bitcoin exchange-traded funds (ETFs) attracted $332 million in net inflows on Tuesday, Sept. 2, according to SoSoValue.

By contrast, spot Ethereum ETFs suffered outflows for the second straight day, with nearly $135 million withdrawn on Sept. 2.

Regulatory Developments

The market rise comes as investor confidence improved after the SEC and CFTC staff issued a joint statement on Sept. 2, clarifying their views that registered exchanges “are not prohibited from facilitating the trading of certain spot commodity products.”

“[Tuesday’s] joint staff statement represents a significant step forward in bringing innovation in the crypto asset markets back to America,” said SEC Chair Paul Atkins. “Market participants should have the freedom to choose where they trade spot crypto assets. The SEC is committed to working with the CFTC to ensure that our regulatory frameworks support innovation and competition in these rapidly evolving markets.”

Meanwhile, the Federal Reserve announced earlier today that it will host a Payments Innovation Conference on Oct. 21 to explore emerging technologies, including decentralized finance (DeFi), stablecoins, and tokenized financial products.

“Innovation has been a constant in payments to meet the changing needs of consumers and businesses,” said Governor Christopher J. Waller. “I look forward to examining the opportunities and challenges of new technologies, bringing together ideas on how to improve the safety and efficiency of payments, and hearing from those helping to shape the future of payments.”

The possibility of the Fed lowering interest rates on Sept. 17 has also fueled risk-taking, helping to boost major digital assets, experts say. The odds of a cut currently stand at 91%, according to MacroMicro.

-

Technology1 week ago

XRP Ledger Secures Major Win, Powering China’s Top Supply Chain Firm – Crypto News

-

De-fi1 week ago

De-fi1 week agoBinance Lists Dolomite’s DOLO Token, Adds Fifth Lira Pair – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s Gemini 2.5 Flash Image does it all – From blurring backgrounds to multi-image fusion – Crypto News

-

others1 week ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

others1 week ago

Ripple’s RLUSD Launches on Aave’s Horizon RWA Market as Adoption Expands – Crypto News

-

Business3 days ago

Business3 days agoPYMNTS’ Summer of Big Quotes, From Tariffs to Trust Codes – Crypto News

-

Business1 week ago

Gemini Launches XRP Credit Card Amid Ripple-Backed IPO Plans – Crypto News

-

Technology1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

Business1 week ago

BlackRock Buys $300M in Ethereum as Crypto ETF Inflows Return – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Dives As On-Chain Data Shows Every Cohort Now Selling – Crypto News

-

Business1 week ago

Pi Network Hackathon Winner Hints at Coinbase Listing Amid Pi Open Source Transition – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDecoding Google’s Layer-1 blockchain: what it means and what we know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGoogle’s Rich Widmann shares LinkedIn update on Universal Ledger blockchain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPhilippine Senator Suggests Putting National Budget On-chain – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAnimoca, Antler’s Ibex Launch Fund to Tokenize Japan’s IP – Crypto News

-

Business1 week ago

Donald Trump Jr.’s VC Firm Invests ‘Millions’ in $1B Crypto Platform Polymarket – Crypto News

-

Business1 week ago

Scott Bessent Says 11 ‘Strong’ Candidates in Line to Replace Fed Chair Powell – Crypto News

-

Technology1 week ago

Technology1 week agoMint Explainer | A web for machines, not humans: Decoding ex-Twitter CEO Parag Agrawal’s next big move – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoSouth Korea Busts Hacking Syndicate After Multi-Million Dollar Crypto Losses – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCanary Capital Files “American-Made” Crypto ETF Amid SEC Delays – Crypto News

-

Business1 week ago

Pepe Price Forecast as $19M Net Outflows Signal Accumulation: Is a 130% Rally Next? – Crypto News

-

Business1 week ago

Morgan Stanley Flips to September Rate Cut Call: Here’s What Changed – Crypto News

-

others1 week ago

Breaking: U.S. Government to Begin Issuing GDP Data on Blockchain in Latest Crypto Push – Crypto News

-

Technology1 week ago

Pump.fun Buys Back $58M PUMP Tokens; Price Up 4% – Crypto News

-

Business1 week ago

CR7 Meme Coin Hits $5M Market Cap Then Dumps Following $143M Rug Pull – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto and DeFi in 2026: Adoption, Innovation, and the Road Ahead – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTop Crypto Market Makers and How to Choose One – Crypto News

-

Technology1 week ago

SEC Delays WisdomTree XRP ETF Decision Until October – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago215% PENGU Rally Incoming? Analyst Says Token ‘Inches’ From Next Leg Up – Crypto News

-

Cryptocurrency1 week ago

Why Kanye West’s YZY Meme Coin is Down 82% Juts a Week After Launch? – Crypto News

-

Technology1 week ago

Technology1 week agoPUMP circulating supply shrinks as Pump.fun’s total buybacks surpass $58M – Crypto News

-

De-fi1 week ago

De-fi1 week agoPrediction Market Kalshi to Expand Onchain Presence – Crypto News

-

De-fi1 week ago

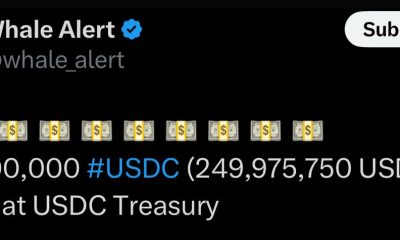

De-fi1 week agoCircle Mints $500 Million USDC in $250 Million Batches, Hits $25 Billion USDC on Solana in 2025 – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle is working on Quick Share for iPhone: Here’s everything we know so far – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

De-fi1 week ago

De-fi1 week agoStablecoins Just Got Real: The Future of Programmable Money in the GENIUS Era – Crypto News

-

others1 week ago

SEC Pushes Back Decision on Grayscale’s Cardano ETF – Crypto News

-

others1 week ago

Breaking: Canary Capital Files S-1 For Trump Coin ETF With U.S. SEC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSynthetix price soars 20% amid volume spike: here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoAave’s new Horizon allows institutions to borrow stablecoins using real-world assets – Crypto News

-

De-fi1 week ago

De-fi1 week agoSony’s Soneium Debuts Scoring System to Record Onchain Participation – Crypto News

-

De-fi1 week ago

De-fi1 week agoPantera Capital Seeks $1.25 Billion to Build Solana Investment Vehicle – Crypto News

-

others1 week ago

others1 week agoGold price in India: Rates on August 26 – Crypto News

-

others1 week ago

others1 week agoXAG/USD rises toward $39.00 due to increased safe-haven demand – Crypto News

-

Business1 week ago

Donald Trump Jr.’s VC Firm Invests ‘Millions’ in $1B Crypto Platform Polymarket – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago5 memecoins positioned to skyrocket as social buzz grows in August – Crypto News

-

Business1 week ago

MetaPlanet Launches $881M International Stock Issuance for BTC Purchases – Crypto News

-

Technology1 week ago

Technology1 week agoTrump Media teams with Crypto.com in $100M CRO token deal – Crypto News

-

others1 week ago

others1 week agoDow Jones slows to a crawl amid quiet markets – Crypto News