others

BoJ is expected to keep interest rates unchanged with eyes on Takaichi’s new policies – Crypto News

The Bank of Japan (BoJ) meets on Thursday and is expected to keep its benchmark interest rate unchanged at 0.5%, awaiting the first moves of Prime Minister Sanae Takaichi’s new cabinet.

Market hopes that the BoJ will continue normalising its monetary policy remain intact, and some central bank policymakers have confirmed that theory. Expectations of an interest rate hike in October, nevertheless, have receded, following the election of the fiscal dove Takaichi as Japan’s Prime Minister in mid-October.

In this context, investors will keep their focus on the vote split, expecting to see some dissenting voices, and on the tone of BoJ Governor Kazuo Ueda’s press conference, seeking validation of a rate hike in December or, at the latest, in January.

What to expect from the BoJ interest rate decision?

As it stands, the BoJ is expected to maintain its monetary policy unchanged for the sixth consecutive meeting in October and reiterate its commitment to gradual monetary tightening.

A recent Reuters poll showed that 60% of analysts expect the Bank of Japan to raise its benchmark interest rate to 0.75% from the current 0.5% before the year-end. Data from the overnight swaps market, however, revealed that the chances of an October hike have dropped to about 24%, from 68% last month.

The new Prime Minister Takaichi, an assistant of former Prime Minister Shinzo Abe, has defended a looser fiscal policy and pledged to reassert the government’s authority over the Bank of Japan and its monetary policy. This has raised concerns about the central bank’s independence, dampening market expectations of immediate rate hikes.

With this in mind, the stubbornly strong inflation is likely to pose a serious challenge to Takaichi’s aim of an expansive monetary policy. Data released last week revealed that the National Consumer Price Index (CPI) accelerated to 2.9% in September, from the previous 2.7%, remaining above the central bank’s target for price stability.

Beyond that, service-sector inflation has picked up for the second consecutive time in September, endorsing the BoJ’s view that rising labour costs will keep price pressures sustainably above the central bank’s 2.0% target in the coming months.

Against this background, some BoJ policymakers have called for immediate rate hikes. Board Member Hajime Takata said last week that now is the appropriate time to raise interest rates, noting that inflation has remained above the bank’s target for three and a half years already, and the economic risks stemming from US tariffs have eased. BoJ Governor Ueda, however, has been showing a more cautious view.

How could the Bank of Japan’s monetary policy decision affect USD/JPY?

In this context, investors have already assumed a delay of the next rate hike, but they are likely to look for confirmation that the plan to keep normalising the monetary policy remains in play. A dovish hold, with no mention of upcoming rate hikes, might disappoint markets and send the Japanese Yen (JPY) on a tailspin.

The Yen lost more than 2% against the US Dollar (USD) in the week after Takaichi secured support to form a cabinet in mid-October. This week, USD/JPY has whipsawed, pulling back following the agreement between the US and Japan, and higher hopes of a China-US trade deal, to bounce up again following Chairman Jerome Powell’s hawkish comments after the Fed’s monetary policy decision on Wednesday.

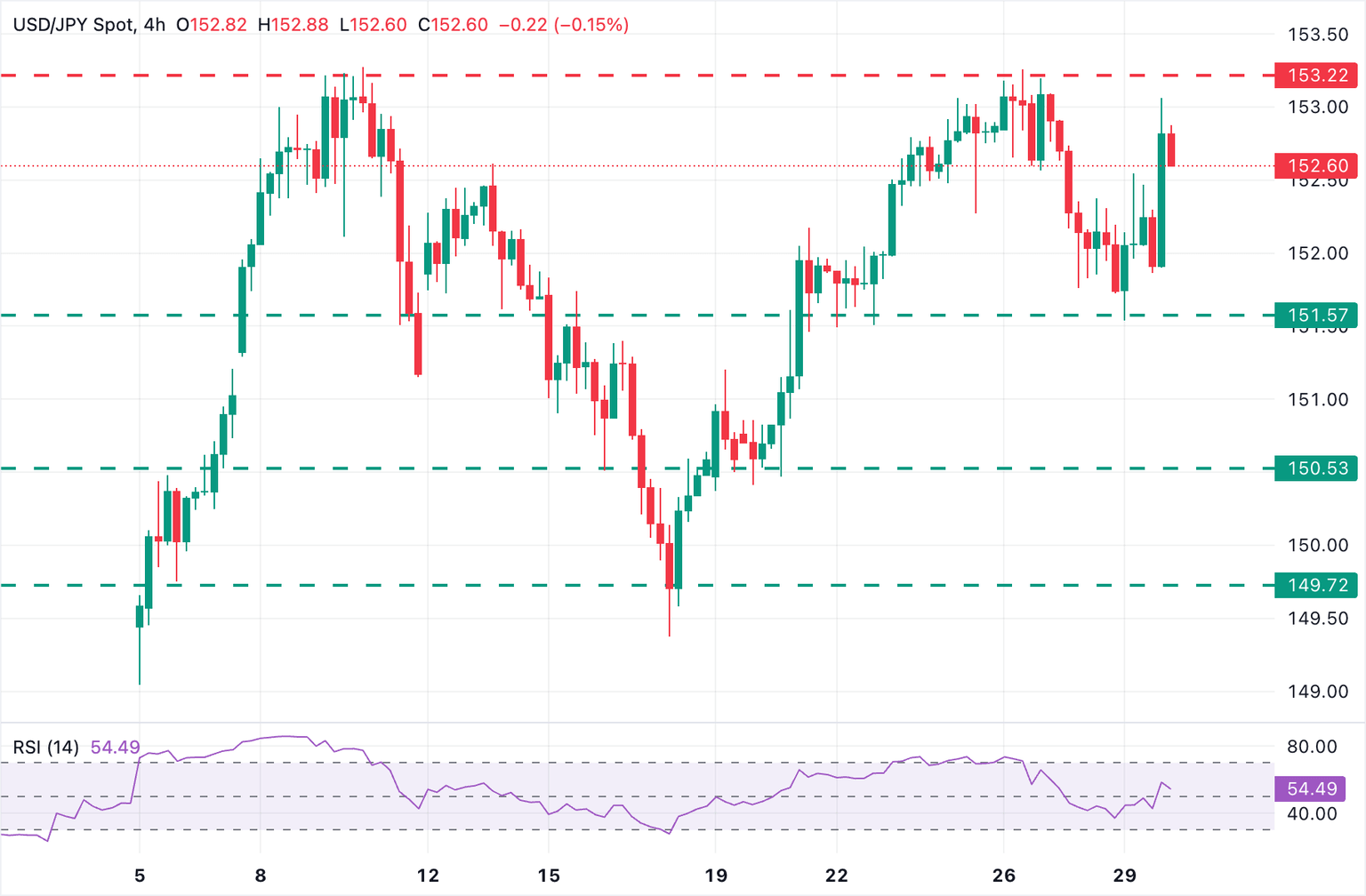

USD/JPY 4-Hour Chart

From a technical perspective, Guillermo Alcalá, FX analyst at FXStreet sees the USD/JPY pair looking for direction with key resistance below the 153.20 area: “The risk is on a too dovish BoJ statement, which might disappoint investors and send the pair back beyond the eight-month highs, at the 153.25 area, aiming for mid-February highs, at 154.80.”

“On the other hand, clear signals hinting at a rate cut in December or a high number of dissenters would give fresh hopes for Yen bulls to retest the October 21 and 22 lows, at the 151.50 area,” says Alcala.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Economic Indicator

BoJ Monetary Policy Statement

At the end of each of its eight policy meetings, the Policy Board of the Bank of Japan (BoJ) releases an official monetary policy statement explaining its policy decision. By communicating the committee’s decision as well as its view on the economic outlook and the fall of the committee’s votes regarding whether interest rates or other policy tools should be adjusted, the statement gives clues as to future changes in monetary policy. The statement may influence the volatility of the Japanese Yen (JPY) and determine a short-term positive or negative trend. A hawkish view is considered bullish for JPY, whereas a dovish view is considered bearish.

Next release:

Thu Oct 30, 2025 03:00

Frequency:

Irregular

Consensus:

–

Previous:

–

Source:

Bank of Japan

-

Blockchain1 week ago

Blockchain1 week agoTokenized Deposits for Payments, Treasury – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech layoffs: From Meta, Amazon to Google — these IT majors have cut AI related jobs – Crypto News

-

Technology1 week ago

$1.68 Trillion T. Rowe Price Files for First Active Crypto ETF Holding BTC, ETH, SOL, and XRP – Crypto News

-

Cryptocurrency1 week ago

Robinhood Lists HYPE As Hyperliquid Flips Aster, Lighter In Perp DEX Volume – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoBezos fund believes AI can save the planet. Nvidia, Google are all-in. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto update: Bitcoin and Ethereum are stable as market’s focus shifts to US inflation data – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple Unveils ‘Ripple Prime’ After Closing $1.25B Hidden Road Deal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump plans to pick Michael Selig to lead CFTC: Report – Crypto News

-

Business7 days ago

White House Crypto Czar Backs Michael Selig as ‘Excellent Choice’ To Lead CFTC – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBinance Stablecoin Outflow On A Steady Rise — What This Means For The Market – Crypto News

-

Business1 week ago

Breaking: Trump To Meet China’s President On October 30, Bitcoin Bounces – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAfrica Countries Pass Crypto Laws to Attract Industry – Crypto News

-

others6 days ago

JPY soft and underperforming G10 in quiet trade – Scotiabank – Crypto News

-

De-fi6 days ago

De-fi6 days agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

Business1 week ago

How the Crypto Market Could React to the Next Fed Meeting on October 29? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago155 Filings Across 35 Assets, Analyst Backs Index Funds – Crypto News

-

Technology1 week ago

Technology1 week agoSundar Pichai hails ‘verifiable’ quantum computing breakthrough as Google’s Willow surpasses ability of supercomputers – Crypto News

-

Technology1 week ago

Technology1 week ago‘It just freezes’: Spotify users fume over app crashes on Android devices, company responds – Crypto News

-

others1 week ago

JPY weak and underperforming – Scotiabank – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDOGE to $0.33 in Sight? Dogecoin Must Defend This Key Level First – Crypto News

-

Technology1 week ago

Technology1 week agoFrom Studio smoke to golden hour: How to create stunning AI portraits with Google Gemini – 16 viral prompts – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoISM Data Hints Bitcoin Cycle Could Last Longer Than Usual – Crypto News

-

Technology7 days ago

Technology7 days agoNothing OS 4.0 Beta introduces pre-installed apps to Phone (3a) series: Co-founder Akis Evangelidis explains the update – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoEntire Startup Lifecycle to Move Onchain – Crypto News

-

De-fi6 days ago

De-fi6 days agoHYPE Jumps 10% as Robinhood Announces Spot Listing – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoEthereum Rebounds From Bull Market Support: Can It Conquer The ‘Golden Pocket’ Next? – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoNEAR’s inflation reduction vote fails pass threshold, but it may still be implemented – Crypto News

-

others6 days ago

Platinum price recovers from setback – Commerzbank – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

Technology6 days ago

Technology6 days agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology3 days ago

Technology3 days agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKadena Shuts Down Operations – Team Confirms Immediate Cease Of All Activities – Crypto News

-

Technology1 week ago

Technology1 week agoYouTube brings a new feature to stop you from endlessly scrolling Shorts: here’s how it works – Crypto News

-

Technology1 week ago

Technology1 week agoSolana’s RWA market surpasses $700M all-time high as adoption accelerates – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoJito’s JTO token rises on a16z’s $50 million investment in Solana staking protocol – Crypto News

-

Technology1 week ago

Dogecoin Price Crash Looms as Flag, Death Cross, Falling DOGE ETF Inflows Coincide – Crypto News

-

De-fi1 week ago

De-fi1 week agoSolana DEX Meteora Launches Native MET Token – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle and Apple face extra UK scrutiny over strategic role in mobile platforms – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLedger Nano Gen5 feels like Flex for less – Crypto News

-

De-fi1 week ago

De-fi1 week agoAster Rallies on ‘Rocket Launch’ Incentives Campaign – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Whale From 2009 Moves Coins After 14 Years Asleep – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFetch.ai and Ocean Protocol move toward resolving $120M FET dispute – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI announces major Sora update: Editing, trending cameos, and Android launch on the way – Crypto News

-

Business1 week ago

HBAR Price Targets 50% Jump as Hedera Unleashes Massive Staking Move – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat next for Avantis price after the 73% recovery? – Crypto News

-

Technology1 week ago

Technology1 week agoUniswap Foundation (UNI) awards Brevis $9M grant to accelerate V4 adoption – Crypto News

-

Business1 week ago

PEPE Coin Price Prediction as Weekly Outflows Hit $17M – Is Rebound Ahead? – Crypto News