Metaverse

Is AI a circular money machine? 3 reasons not to worry. – Crypto News

AI looks like a circular money machine. Microsoft owns a major stake in OpenAI, which in turn invests in AMD. Nvidia puts billions of dollars into OpenAI and holds equity in CoreWeave, one of Microsoft’s cloud suppliers. The same dollars are simply bouncing between balance sheets, rather than creating new economic activity. Equity markets are soaring, paying little mind to this web of financing.

So alarmists say. But the evidence suggests something different, a powerful technological transformation that remains grounded in fundamentals. There is little reason to panic about an AI bubble—at least not yet.

A bubble requires euphoric overvaluation and a disconnect between price and performance. Today’s AI boom shows neither. The market is concentrated in highly profitable incumbents with real earnings, strong cash flows, and global-scale innovation. There is plenty of excitement, but that is different from irrational exuberance.

It is true that AI-related companies, specifically those in the Magnificent Seven, account for roughly three-quarters of S&P 500 returns, 80% of earnings growth, and 90% of capital-spending growth since late 2022. No wonder more than half of fund managers surveyed by Bank of America called AI stocks a bubble and ranked an AI-driven equity bubble as the biggest risk facing markets. This seems doubly alarming given the financial links between these firms.

Yet these links are more likely just signs of evolving corporate strategies and risk management. AI is still sorting out its business models. Partial equity stakes allow companies to share risks and profits as they figure out how to leverage layers of the AI stack—chips, data, software, or applications—to deliver the most value. Antitrust regulators likely would have blocked full mergers, so looser forms of vertical integration may be the only practical way for these firms to innovate across corporate boundaries.

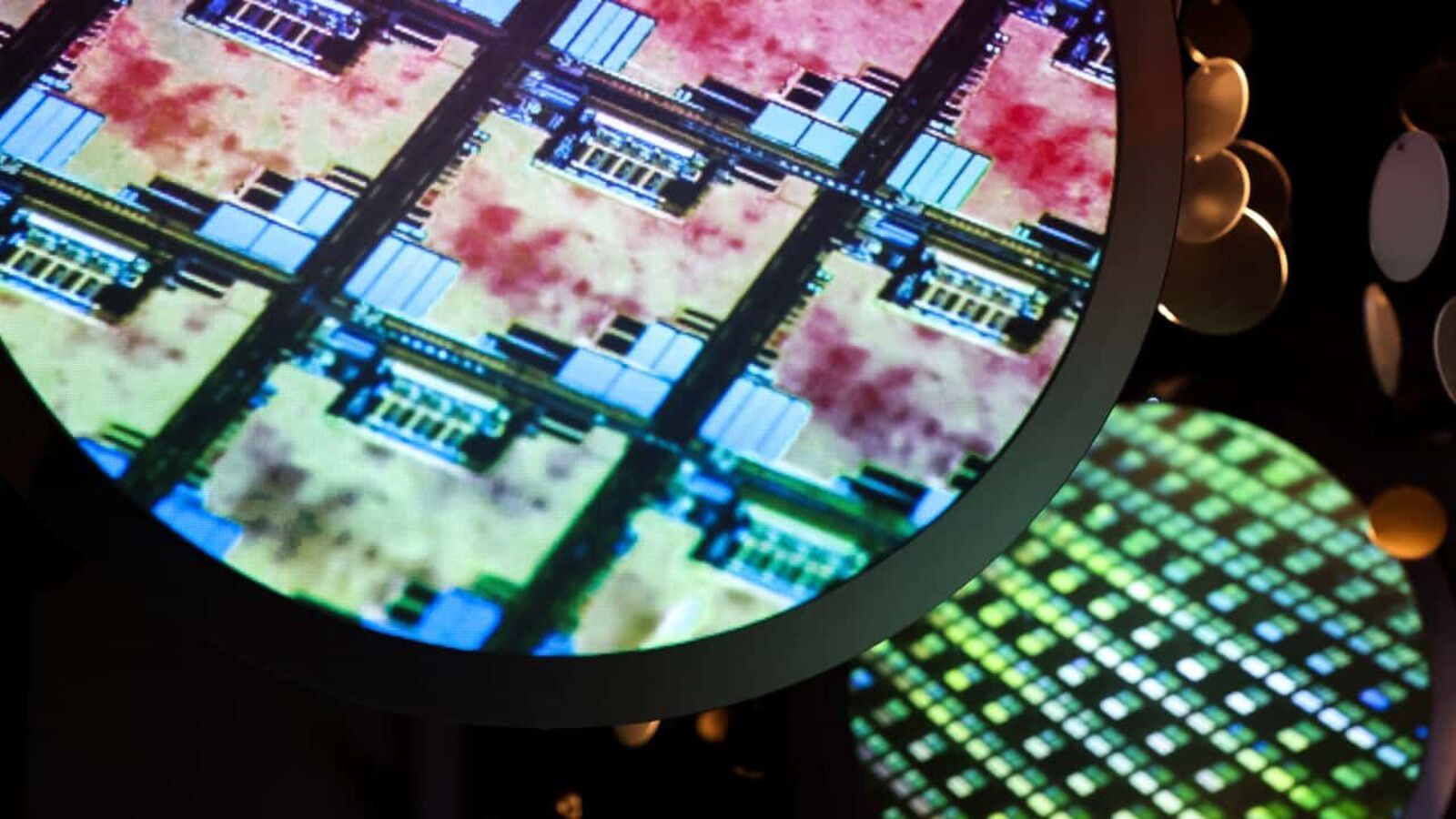

Global spending on AI is expected to top $375 billion this year. Spending on data centers alone could hit $3-4 trillion annually by 2030. Some see echoes of the late-1990s telecom and internet boom, when fiber-optic firms were valued by the number of cities they promised to serve, not the profits they actually earned.

AI companies are different. Most AI-related capital spending is financed through free cash flow, not debt. The Mag 7 have strong balance sheets, post average returns on equity near 46%, and trade at roughly half the earnings multiples of dot-com era darlings.

James Pethokoukis, my colleague at AEI, has noted that today’s valuations reflect solid profits, “fortress-like balance sheets,” and disciplined forecasts, not blind exuberance. The AI capital expenditure boom looks more like a race than a bubble—one fueled by genuine technological advances and intense global competition, particularly with China.

Unlike the internet bubble, where clicks stood in for cash, AI is already producing measurable economic gains. Small businesses using AI see productivity gains approaching 40%. AI systems have long powered Amazon’s logistics, Netflix’s content suggestions, and Meta’s advertising efficiency. Generative tools are cutting costs in design and coding. And large-language-model users are beginning to bypass traditional search engines entirely, creating new advertising markets for AI companies.

Still, investors and policymakers should keep an eye on a few pressure points. First, profitability. Some firms experimenting with AI are falling short. Many by now are familiar with the MIT study that found 95% of organizations report earning zero return on investment on their AI projects, largely from their failure to make meaningful change.

Power is another problem. Data centers are already straining U.S. electric grids. Their power needs are expected to triple by 2028. Yet some utilities hesitate to expand capacity without support of federal regulators, who are worried about impacts on rates.

Third, regulation: Europe is trying to stymie U.S. AI companies with a regime of fines, and China is a politically risky market.

The real test for AI will be in how firms respond to disruption—whether by shrinking from it, as the MIT study found, or by embracing it, as Amazon and Goldman Sachs have done.

For now though, what we are witnessing doesn’t look like a bubble. It looks, to me, more like the early stage of a decades-long technological supercycle. The challenge isn’t unrealistic dreams, but too little electricity to power them and too much regulation that squelches them.

Guest commentaries like this one are written by authors outside the Barron’s newsroom. They reflect the perspective and opinions of the authors. Submit feedback and commentary pitches to ideas@barrons.com.

-

Technology5 days ago

Crypto Lawyer Bill Morgan Praises Ripple’s Multi-Chain Strategy as RLUSD Hits $1.1B – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoIlluminating progress: Is a $140K income ‘poor’? – Crypto News

-

others5 days ago

others5 days agoGold holds strong at $4,200 as Fed-cut anticipation builds – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoAnalyst Reveals What You Should Look Out For – Crypto News

-

others1 week ago

Why Is Crypto Market Recovering? – Crypto News

-

Technology1 week ago

Breaking: First U.S. Chainlink ETF Goes Live as Grayscale Launches ‘GLNK’ – Crypto News

-

Cryptocurrency1 week ago

Crypto Platform Polymarket Relaunches in U.S. Following CFTC Approval – Crypto News

-

others1 week ago

$12T Charles Schwab to Launch Bitcoin and Ethereum Trading in Early 2026, CEO Confirms – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago‘Get it done on time’ – Lawmakers push regulators on GENIUS Act rollout – Crypto News

-

Business1 week ago

Crypto Platform Polymarket Relaunches in U.S. Following CFTC Approval – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUK recognises crypto as property in major digital asset shift – Crypto News

-

others6 days ago

Bitcoin Price Forecast as BlackRock Sends $125M in BTC to Coinbase — Is a Crash Inevitable? – Crypto News

-

Technology6 days ago

Technology6 days agoWorking on a screen all day? These 8 LED monitors in Dec 2025 are kinder on your eyes – Crypto News

-

Technology6 days ago

Technology6 days agoSamsung Galaxy S25 Ultra 5G for under ₹80,000 on Flipkart? Here’s how the deal works – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoFlorida Appeals Court Revives $80M Bitcoin Theft – Crypto News

-

others4 days ago

Breaking: Labor Department Cancels October PPI Inflation Report Ahead of FOMC Meeting – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoArgentina moves to reshape crypto rules as banks prepare for Bitcoin services – Crypto News

-

others1 week ago

Strategy CEO Says Bitcoin Sales Unlikely Before 2029 After Creating $1.44B Dividend Reserves – Crypto News

-

Business1 week ago

Sui Price Surges 10% As Vanguard Group Adds SUI to Bitwise 10 Crypto Index – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRipple CTO Shares Hilarious Email from Jed McCaleb Impersonator – Crypto News

-

Business1 week ago

Senator Tim Scott Floats December 17 and 18 For Crypto Market Bill Markup – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBTC staking platform Babylon teams up with Aave for Bitcoin-backed DeFi insurance – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Cools Off After Rally While Market Eyes a Resistance Break – Crypto News

-

others6 days ago

others6 days agoThe rally to 7120 continues – Crypto News

-

others6 days ago

Morgan Stanley Turns Bullish, Says Fed Will Cut Rates by 25bps This Month – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCrypto Holiday Gift Guide 2025 – Crypto News

-

others5 days ago

others5 days agoNasdaq futures hold key structure as price compresses toward major resistance zones – Crypto News

-

others5 days ago

others5 days agoNasdaq futures hold key structure as price compresses toward major resistance zones – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoStripe and Paradigm Open Tempo Blockchain Project to Public – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSHIB Exec Calls FBI, RCMP and Interpol to Action on Surging Cyber Attacks – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs ChatGPT working again? OpenAI’s latest update as users report outages – Crypto News

-

Business1 week ago

Trump Sets Early 2026 Timeline for New Fed Chair Pick – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoVanguard reverses course, opens door to Bitcoin, Ethereum, XRP, and Solana ETFs – Crypto News

-

others1 week ago

XRP News: Ripple Expands Payments Service With RedotPay Integration – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoLedger Finds Chip Flaw Allowing Complete Phone Takeover – Crypto News

-

Business1 week ago

Kalshi, Robinhood and Crypto com Face Cease & Desist Order in Connecticut – Crypto News

-

Technology7 days ago

Technology7 days agoCloudflare Resolved Services Issues Caused by Software Update – Crypto News

-

Technology6 days ago

Technology6 days agoFrom security camera to gaming hub: 6 Easy tricks to make your old smartphone genuinely useful again – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBitcoin Buries The Tulip Myth After 17 Years: Balchunas – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoWhy Ethereum strengthens despite whale selling – Inside Asia premium twist – Crypto News

-

Technology4 days ago

Technology4 days agoStarlink India pricing revealed: How much does monthly plan cost and what are its benefits? – Crypto News

-

Business1 week ago

Kraken to Acquire Backed Finance, Expanding Tokenized Equities Ahead of 2026 IPO – Crypto News

-

Business1 week ago

Litecoin Price Jumps 10% as Vanguard Opens LTCC Access — How High Can LTC Go? – Crypto News

-

Technology1 week ago

Technology1 week agoMeet the Indian-origin AI founders dominating Forbes’ latest 30 Under 30 list – Crypto News

-

Cryptocurrency1 week ago

Hedera Price Surges 10% After Canary Capital HBAR ETF Goes Live on Vanguard – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoLeveraged ETFs Tied To Strategy Suffer Major Losses – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIndian enterprises all-set to take an AI leap as partners guide adoption – Crypto News

-

Business1 week ago

December Fed Rate Cut Prospects Strengthen After ADP Shows Deepening Labor Market Weakness – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTaiwan to Pass Stablecoin Regulations in Late 2026: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEric Trump’s American Bitcoin Steadies After ‘First Major Unlock’ of Shares – Crypto News