Cryptocurrency

The dollar needs a new bonfire of the bills – Crypto News

This is a segment from The Breakdown newsletter. To read full editions, subscribe.

Fiat money was invented in colonial America, and to convince people it had value, the colonies that issued it periodically lit their tax revenue on fire.

Paper money dates to 11th-century China, but historian Dror Goldberg argues that fiat — money valued primarily because the state demands it for taxes — was invented by the colony of Massachusetts in 1690.

Colonial Americans didn’t call it money at the time; to them, “real money” was metallic coins like Spanish pieces of eight, and the most-common form of paper their local governments printed was referred to as “bills of credit.”

But (as discussed yesterday) very little “real” money was available in the colonies, so bills of credit circulated as money instead.

Counterintuitively, when the bills circulated back to the government as taxes, they were burned.

This goes against our modern expectation of governments collecting taxes to use for current or future spending.

But at that early stage of monetary history, money-issuing governments knew they had to give people reason to believe the paper they printed in arbitrary amounts had value.

To make the public “cherish” its money, the government had to prove it could make that money scarce.

“Whereas it is of the greatest importance to preserve the credit of the paper currency of this colony,” the Virginia legislature resolved in 1760, “nothing can contribute more to that end than a due care to satisfy the publick that the paper bills of credit, or treasury-notes, are properly sunk.”

To that end, the legislature appointed a committee to ensure that, “at least twice a year,” all the bills of credit that had been collected in taxes were “burnt and destroyed.”

This bonfire of the taxes was often conducted in public, to make a memorable show of the government’s fiscal responsibility.

“The burning was an event,” Andrew David Edwards writes, “advertised in public newspapers and marked in legislative records.”

By making a public display of making money more scarce, the government hoped to maintain its value.

300 years later, that’s still sort of how it works.

Over the past three and half years, the Federal Reserve has “burned” about 2.4 trillion of the bills of credit (aka, dollars) it printed after the pandemic (in the form of bank reserves).

Technically, the Fed makes money more scarce by reducing the amount of debt it holds: US dollars are created when the Fed buys bonds from banks (which adds to banks’ reserves), and destroyed when the Fed lets those bonds mature (reducing bank reserves).

As a demonstration of responsible monetary policy, that’s not quite as dramatic as lighting bills of credit on fire.

Nor is the money destroyed very publicly: The Fed’s role in creating and destroying money did not get a mention in today’s FOMC’s statement, which announced only its decision on interest rates (a quarter-point cut).

In his press conference, however, Chair Powell additionally announced that the FOMC had decided to “cease run-off” of the debt it holds.

This is a modern way of saying it will not burn any more money.

In fact, it might soon be printing it again.

Reserves “have to be ample,” Powell said in the Q&A, adding that “at a certain point, you want reserves to start gradually growing.”

The Fed grows reserves by buying bonds.

In other words, the Fed will soon be printing money again (by buying bonds), because $6.6 trillion of bank reserves is no longer “ample” in today’s monetary regime.

There are a lot of monetary plumbing reasons for that, most of which are beyond my newsletter-writer understanding.

But the announced change of direction highlights perhaps the biggest difference between burning bills of credit in 1760 and reducing bank reserves today: It was fiscal policy back then and monetary policy now.

“Colonial Americans burned their money because each bill represented a tax debt that had been repaid,” Andrew David Edwards explained.

Of course, that’s not what’s happening now.

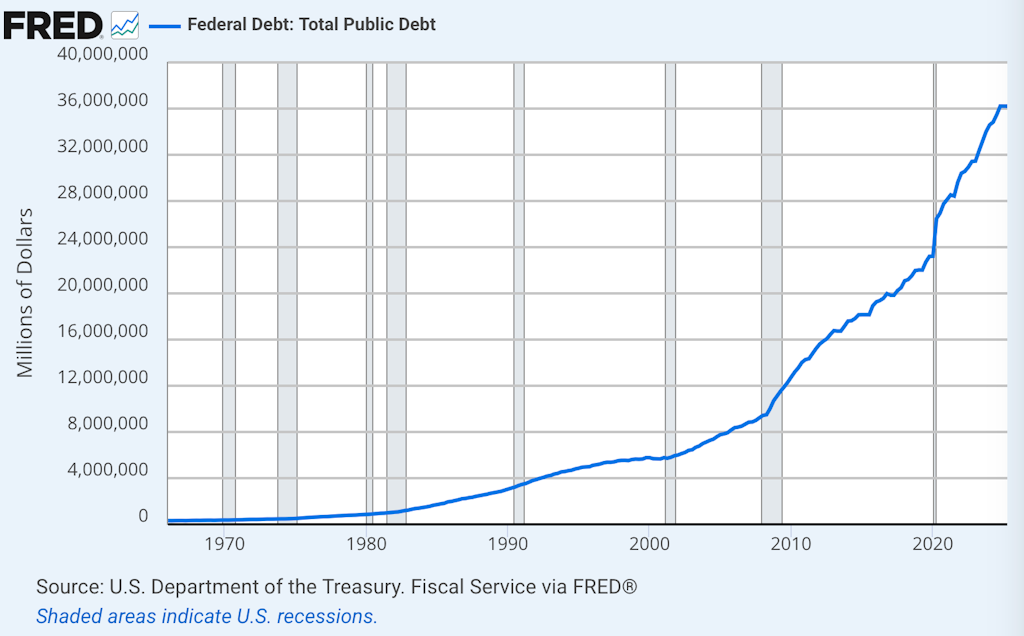

In the time the Federal Reserve responsibly burned $2.4 trillion of reserves, the federal government somewhat irresponsibly added $6 trillion of debt.

George Washington, who used his farewell address to advise that governments’ “vigorous exertions in time of peace to discharge the debts,” would not approve.

Despite a strong economy, the US has made no effort at all to reduce its debt, and that has gotten people worried about fiat money again.

There’s not much the Fed can do about that, because burning bank reserves will never be as convincing as burning tax receipts.

Get the news in your inbox. Explore Blockworks newsletters:

-

others1 week ago

JPY soft and underperforming G10 in quiet trade – Scotiabank – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology7 days ago

Technology7 days agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

De-fi6 days ago

De-fi6 days agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

others1 week ago

GBP/USD holds steady after UK data, US inflation fuels rate cut bets – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto wrap: Bitcoin, Ethereum, BNB, Solana, and XRP muted after CPI report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Accumulation Patterns Show Late-Stage Cycle Maturity, Not Definite End: CryptoQuant – Crypto News

-

Technology1 week ago

Ethereum Supercycle Strengthens as SharpLink Gaming Withdraws $78.3M in ETH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Rebounds From Bull Market Support: Can It Conquer The ‘Golden Pocket’ Next? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoHYPE Jumps 10% as Robinhood Announces Spot Listing – Crypto News

-

others1 week ago

Platinum price recovers from setback – Commerzbank – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoMint Explainer | India’s draft AI rules and how they could affect creators, social media platforms – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEntire Startup Lifecycle to Move Onchain – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNEAR’s inflation reduction vote fails pass threshold, but it may still be implemented – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

others7 days ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

De-fi7 days ago

De-fi7 days agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others7 days ago

others7 days agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

Technology6 days ago

Technology6 days agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Business6 days ago

Business6 days agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News