Cryptocurrency

Rangebound markets, resilient onchain lending – Crypto News

This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

While crypto prices have shown a modest recovery in the short term, negative breadth and relative underperformance to TradFi benchmarks on the monthly suggests a prevailing bearish environment.

Zooming out, we look at the secular growth trends within stablecoins and lending as durable sectors for multi-year growth.

Indices

Crypto markets remain rangebound after November’s harsh selloff. The past week has shown a modest recovery, with BTC at $90,400 now being 12% off of its recent correction low of $80,700. Over the trailing 24 hours, the AI and Modular sectors were the top winners, with TAO (+6.4%) and TIA (+6.2%) as notable contributors to this short-term strength. The Perp Index was the top loser, with DYDX (-3.1%) and HYPE (-0.6%) accounting for the sector’s weakness.

Zooming out to the monthly, the picture remains unfavorable. TradFi benchmarks like Gold, Nasdaq and the S&P 500 are all green over the past month, while every crypto index we track is measuring negative returns.

Breadth is decisively negative on the monthly for all crypto indices, with no safe haven provided. Notably, the Protocol Revenue index is the top performing among crypto sectors, suggesting relative strength in protocols with strong fundamental positioning.

Despite recent strength, it remains to be determined whether this rally is countertrend to a prolonged downtrend, or if the low is in for the rest of 2025.

Market Update

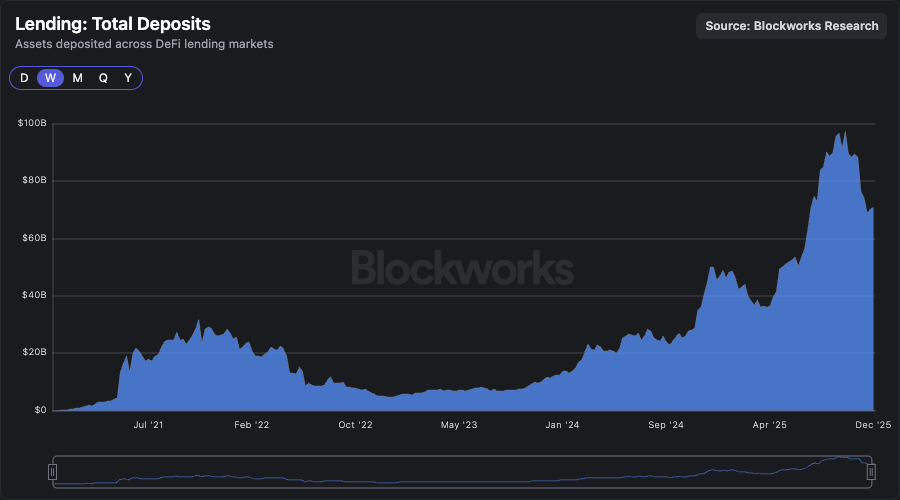

Amid the downtrend, don’t lose sight of the bigger picture, and take a moment to appreciate just how far we’ve come. At the bear market low, lending applications within DeFi accounted for just $5 billion in deposits, a rounding error within the larger financial system. In the years since, this figure has grown to $71 billion in deposits, having just previously tagged near $100 billion.

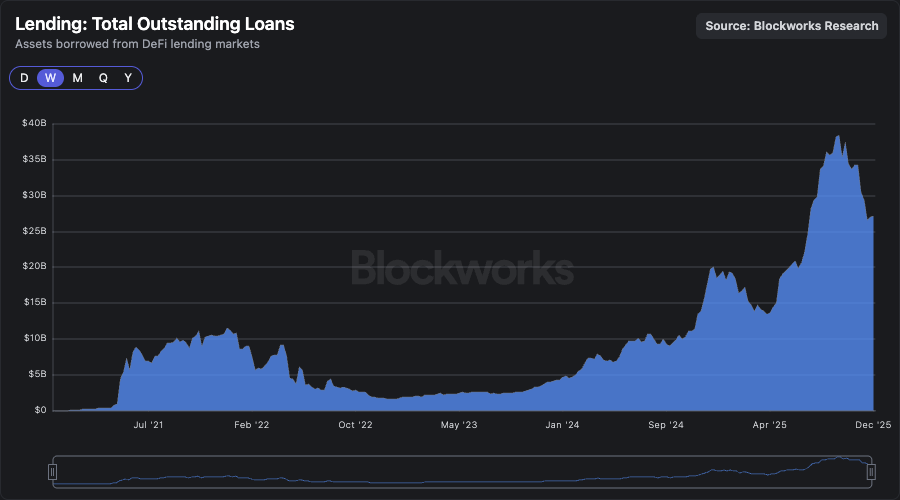

Similarly, loans outstanding on these applications amounted to $1.6 billion at the bear-market low. Since, active loans have risen to over $27 billion now, and recently passed $38 billion. These figures have grown to a scale worth paying attention to, not just for the crypto native. Variance can cut both ways, to the upside and to the downside, for both key metrics and spot prices. But 20x growth in topline metrics in just a few years suggests this sector is a long way off from its terminal growth rate.

Amid the drawdown in crypto prices, the aggregate stablecoin supply has retraced back up to its all-time high of $310 billion, after a brief period of -$10 billion in outflows.

The growth in stablecoins is a trend that I would not bet against. Onchain money markets stand as primary beneficiaries of the growing stablecoin supply, purporting to be the primary applications for utilization. Stablecoin lenders seek yield, while borrowers look for leverage. While spot assets will remain volatile, this secular trend should remain a persistent and durable tailwind for DeFi applications.

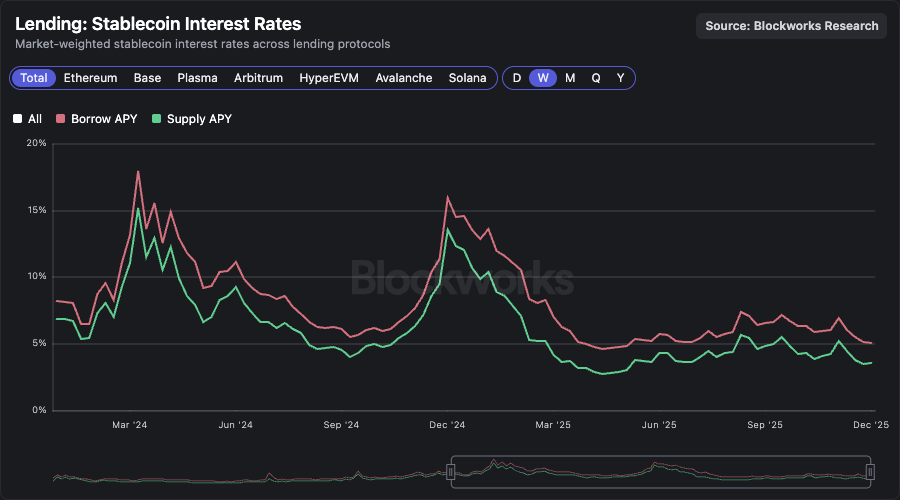

Notably, continued growth in the stablecoin supply comes amid very modest onchain yields. Benchmark supply rates on lending applications are reading 3.6%, a discount to SOFR at 3.9%. Growing depth in onchain stablecoin liquidity may continue to dampen the upside in supply rates, and absent a material risk premium to legacy rates, growth in stablecoin utilization on money markets may falter.

Get the news in your inbox. Explore Blockworks newsletters:

-

Technology1 week ago

Technology1 week agoEmbedded Payments Help SaaS as AI Reshapes Workflows – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

others1 week ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat’s Next for XRP? Ripple Teases Big Updates at This Key Event – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoY Combinator Offers Startups Stablecoins Instead of Cash – Crypto News

-

Business1 week ago

Gold vs BTC: Why JPMorgan Suggests Buying Bitcoin Despite Price Crash? – Crypto News

-

Business1 week ago

Japan’s Metaplanet Pledges to Buy More Bitcoin Even as BTC Price Crashes to $60k – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Unrealized Losses Reach 22% – Still No Capitulation Phase – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes Deeper Correction As Bearish Pattern Targets $40 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoFigure Expands Access to Its On-Chain Public Equity Network – Crypto News

-

Business6 days ago

XRP News: Ripple’s RLUSD Gets Boost as CFTC Expands Approved Tokenized Collateral – Crypto News

-

Blockchain7 hours ago

Blockchain7 hours agoThe Market Starts to Splinter – Crypto News

-

Technology1 week ago

How Low Could Robinhood (HOOD) Stock Go in February? – Crypto News

-

Technology1 week ago

Technology1 week agoIndias digital transformation rooted in open, secure, inclusive Internet: IT Secy Krishnan – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoWhiteboard your 30-page strategy with Gemini’s nanobanana – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoWhiteboard your 30-page strategy with Gemini’s nanobanana – Crypto News

-

De-fi6 days ago

De-fi6 days agoBithumb Mistakenly Airdrops $30 Billion of Bitcoin – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWeb 2-Web3 GameFi Platform Playnance Makes First Official Announcement, Reveals Growth Plans – Crypto News

-

De-fi1 week ago

De-fi1 week agoETHZilla to Tokenize $4.7 Million in Manufactured Home Loans on Ethereum Layer 2 – Crypto News

-

Business1 week ago

Bitcoin Price Prediction as Funding Rate Tumbles Ahead of $2.1B Options Expiry – Crypto News

-

Technology1 week ago

Kevin Warsh Nomination Hits Roadblock as Democrats Demand Answers on Powell, Cook – Crypto News

-

Business1 week ago

Just-In: Binance Buys Additional 1,315 BTC for SAFU Fund – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago‘We’re in crypto winter’- Bitwise turns bearish as Bitcoin price slips below $75K – Crypto News

-

others1 week ago

MSTR Stock at Risk? Peter Schiff Predicts Deeper Bitcoin Losses for Strategy Amid Crypto Crash – Crypto News

-

Business1 week ago

Bitcoin Crashes to $67K as Crypto Market Erases $2T in Market Cap Since October Record High – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoOpenAI unveils new service, Frontier – How does it work? All you need to know – Crypto News

-

Business1 week ago

Is Bhutan Selling Bitcoin? Government Sparks Sell-Off Concerns as BTC Crashes – Crypto News

-

Business1 week ago

Is the Sell-Off Just Starting? BlackRock Bitcoin ETF Sees Records $10B in Notional Volume – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIREN & CleanSpark Signal Evolution: $SUBBD Solves New Needs – Crypto News

-

Business1 week ago

BlackRock Signals More Selling as $291M in BTC, ETH Hit Coinbase Amid $2.5B Crypto Options Expiry – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoBinance SAFU Fund Adds 3,600 Bitcoin ($233M) As Market Faces Pressure – Crypto News

-

De-fi6 days ago

De-fi6 days agoZcash Down Over 50% Since Winklevoss-Backed DAT’s Last Purchase – Crypto News

-

Technology1 week ago

Technology1 week agoThe AI-Only Social Network Isn’t Plotting Against Us – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Reclaims $71K, But How Long Will It Hold? – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoHow Low Can Pi Network’s PI Go? Shocking Bear-Market AI Scenarios After the Latest ATLs – Crypto News

-

others7 days ago

others7 days agoVolatility to stay high on flows – MUFG – Crypto News

-

Business7 days ago

ETH Price Fears Major Crash As Trend Research Deposits $1.8B Ethereum to Binance – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoBTC Shows Signs of Recovery After Brutal November Sell-Off – Crypto News

-

others7 days ago

$40B Bitcoin Airdrop Error: Bithumb to Reimburse Customer Losses After BTC Crash To $55k – Crypto News

-

others6 days ago

United Kingdom CFTC GBP NC Net Positions up to £-13.9K from previous £-16.2K – Crypto News

-

Cryptocurrency6 days ago

Crypto Markets Brace as Another Partial U.S. Government Shutdown Looms Next Week – Crypto News

-

Business6 days ago

Experts Predict COIN Stock Rally Above $200 as Coinbase CEO Warns of U.S. Falling Behind – Crypto News

-

De-fi6 days ago

De-fi6 days agoEthereum Falls Below $2,000 as Crypto Sell-Off Deepens – Crypto News

-

De-fi6 days ago

De-fi6 days agoAptos-Based Perp DEX Merkle Trade Shutters Business – Crypto News

-

Business1 week ago

BlackRock Signal Further Downside for Bitcoin And Ethereum As It Moves $170M to Coinbase – Crypto News

-

Business1 week ago

Trump’s World Liberty Faces House Probe Amid Claims of Major UAE Investment – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin prices fall: Will 2026 mirror BTC’s 2022 bear market? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin prices fall: Will 2026 mirror BTC’s 2022 bear market? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEU Tokenization Companies Urge Fixes to DLT Pilot Rules – Crypto News

-

others1 week ago

others1 week agoEUR/USD slides after ECB hold as risk-off flows lift US Dollar – Crypto News