Cryptocurrency

Litecoin: A rise in sell pressure could still reap these LTC holders some profits – Crypto News

- Litecoin’s short-term sellers could benefit from LTC’s ongoing price action

- Litecoin ranked #1 as the largest cryptocurrency by median holding

Crypto investors that bought Litecoin [LTC] after the FTX crash were reaping the benefits following its bullish performance. LTC turned out to be the best cryptocurrency to hold in the medium term. However, Litecoin’s current outlook suggested that it might be about to give up some of its recent gains.

read Litecoin’s [LTC] price predictions 2023-2024

In its latest upgrade, the Litecoin Foundation noted that LTC took the number 1 spot as the largest cryptocurrency by median hold. This means that Litecoin holders had lower losses than other coins in the medium term and this was largely because of its upside.

Ranking the biggest cryptocurrencies by median holding period: #LiteCoin is in the #1 spot 🥇

As of this time last year it was 93 days. Now it’s 101 days. $LTC is the most HODL’d digital currency. pic.twitter.com/73WrMunfxF

— Litecoin Foundation ⚡️ (@LTCFoundation) November 28, 2022

Litecoin delivered an overall positive performance after finding favor with investors. It rallied by as much as 72% from its monthly low to its current monthly high. A look at its latest price action revealed an interesting observation that might indicate a potentially sizeable bearish retracement ahead.

A comparison between Litcoin’s price and Relative Strength Index (RSI) revealed a price-RSI divergence. LTC’s price managed to achieve a new monthly high last week compared to the previous high in the first week of November. Interestingly, Litecoin’s RSI achieved a lower high last week as compared to the previous high.

This pattern can be considered bearish because it underscores the lower relative strength for the underlying asset. In this case, Litecoin price action might be about to experience a surge in sell pressure. Especially if the overall market conditions fail to improve in favor of the bulls.

Is Litecoin selling pressure building up?

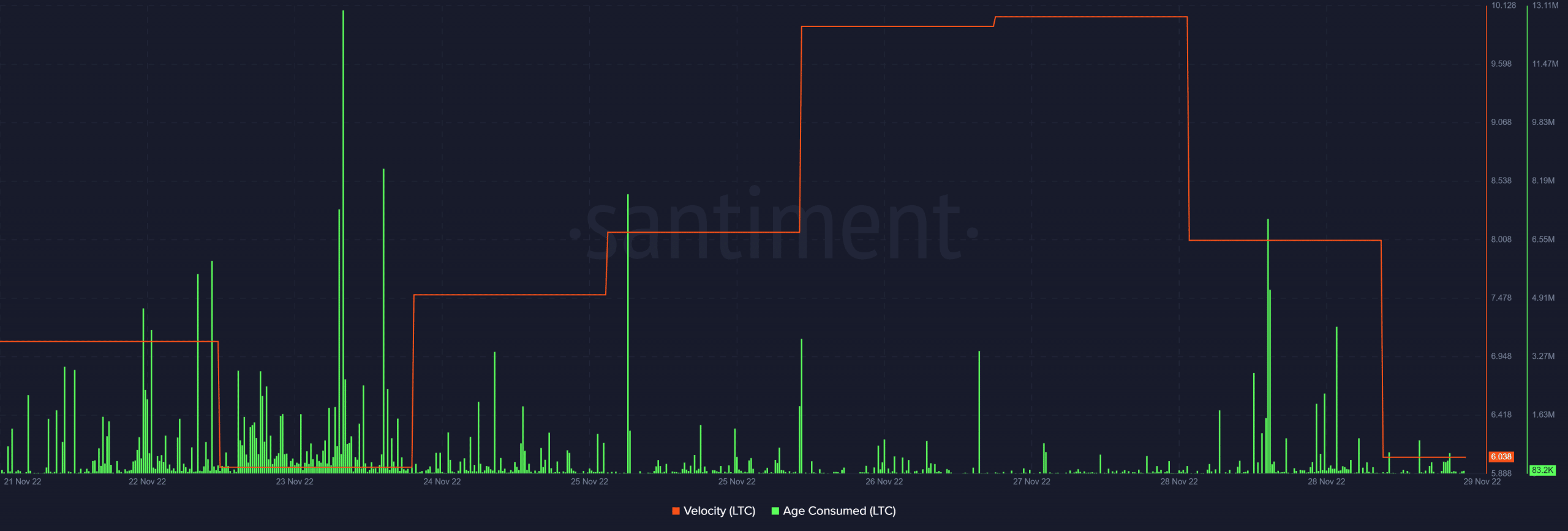

A look at some Litecoin metrics already indicated that some notable changes were occurring. For example, its velocity slowed down between 27 and 29 November. At the same time, the Age Consumed metric registered more activity, indicating that coins that have been held for some time were exchanging hands.

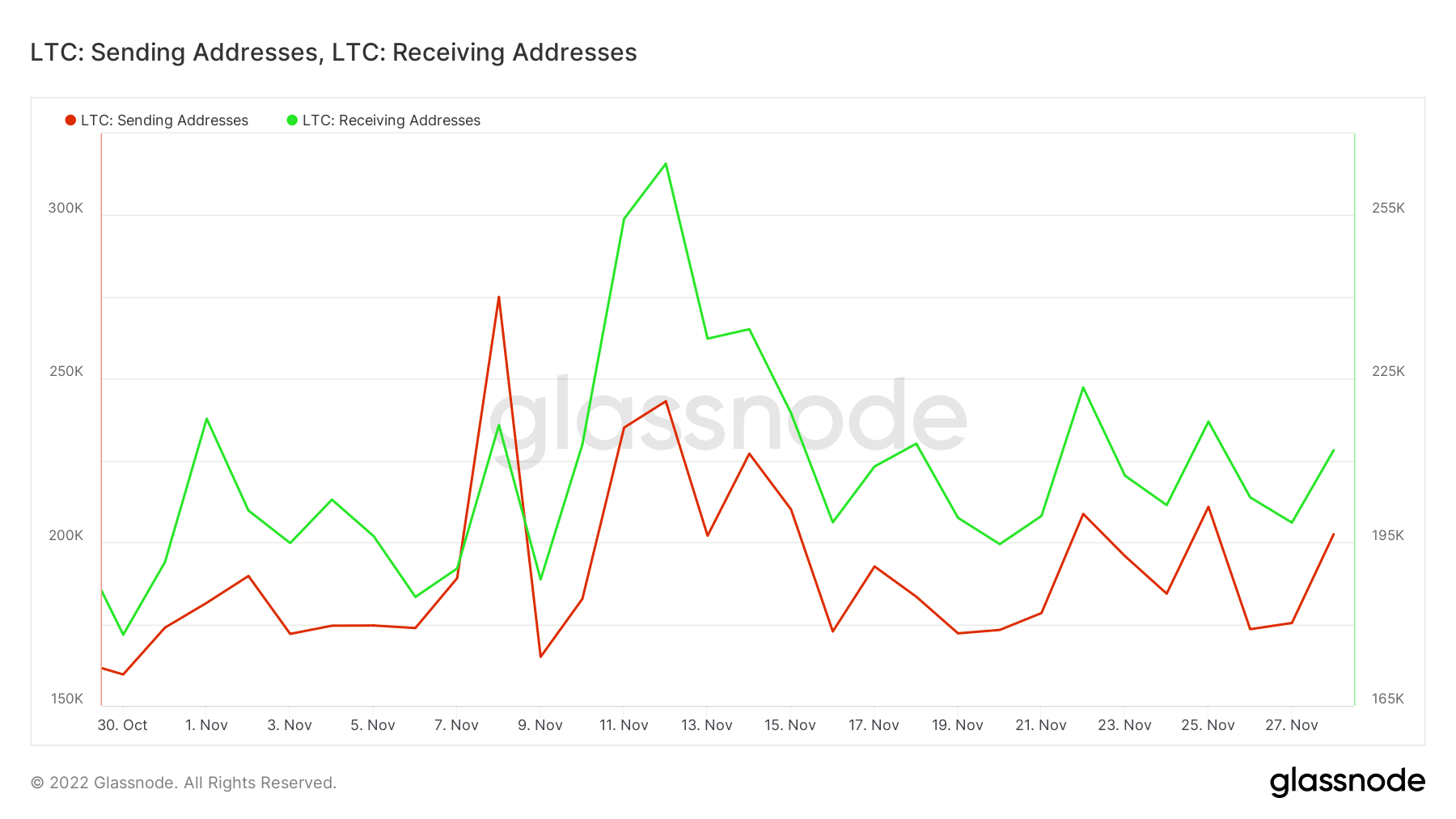

The above metrics confirmed that there was a notable increase in selling pressure observed between 27 and 29 November. A look at address flows revealed an increase in both the sending and receiving addresses during the last 48 hours. This was confirmation of increased activity but the number of receiving addresses were slightly higher than sending addresses.

The higher receiving addresses confirmed that there was still some demand at LTC’s current level. However, this may not provide a comprehensive view of where demand is headed. A look at Litecoin’s supply distribution might be better suited to gauge directional momentum.

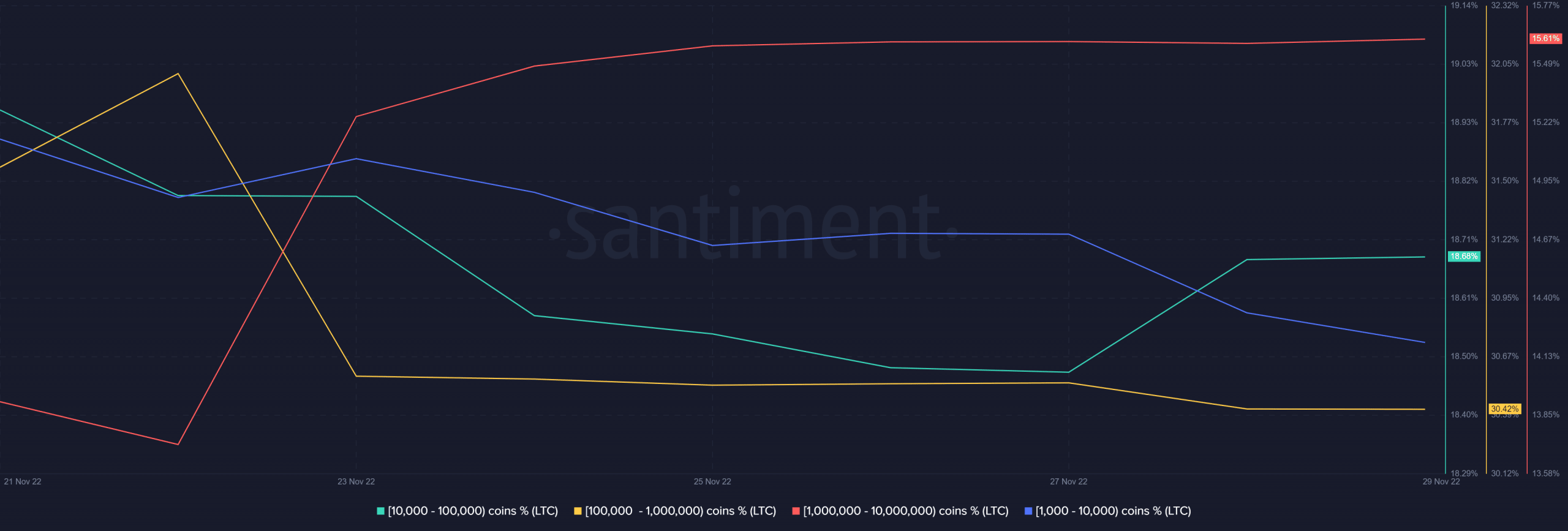

The supply distribution metric revealed that most of the large address categories leveled out. In other words, they weren’t contributing to sell or buy pressure. That being said, addresses holding between 1,000 and 10,000 LTC have continued trimming their balances in the last two days.

This supply distribution metrics observation suggested a higher likelihood of sell pressure dominating Litecoin in the next few days. If these observations turn out to be accurate, then short sellers might have an opportunity ahead.

-

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-400x240.jpg)

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-80x80.jpg) others1 week ago

others1 week agoSkies are clearing for Delta as stock soars 13% on earnings beat – Crypto News

-

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-400x240.jpg)

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-80x80.jpg) others1 week ago

others1 week agoSkies are clearing for Delta as stock soars 13% on earnings beat – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoInsomnia Labs Debuts Stablecoin Credit Platform for Creators – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAnt Group Eyes USDC Integration Circle’s: Report – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBinance Founder Backs BNB Treasury Company Aiming For US IPO – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKraken and Backed Expand Tokenized Equities to BNB Chain – Crypto News

-

others1 week ago

others1 week agoEUR/GBP posts modest gain above 0.8600 ahead of German inflation data – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow Brands Can Deepen Customer Connections in the Metaverse – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaks New Record at $111K, What’s Fueling the $120K Price Target? – Crypto News

-

Technology1 week ago

XRP Eyes $3 Breakout Amid Rising BlackRock ETF Speculation – Crypto News

-

Technology1 week ago

Breaking: SharpLink Purchases 10,000 ETH from Ethereum Foundation, SBET Stock Up 7% – Crypto News

-

others1 week ago

others1 week agoEUR/GBP climbs as weak UK data fuels BoE rate cut speculation – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Hits All-Time High as Crypto Legislation Votes Near – Crypto News

-

Business1 week ago

PENGU Rallies Over 20% Amid Coinbase’s Pudgy Penguins PFP Frenzy – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Bulls Roar — $3K Beckons After 5% Spike – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAustralia Banks Join Digital Currency Trial for Tokenized Assets – Crypto News

-

Business1 week ago

Did Ripple Really Win XRP Lawsuit Despite $125M Fine? Lawyer Fires Back at CEO – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP price forecast as coins surges 2.19% to $2.33 – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity launches Comet, an AI-powered browser to challenge Google Chrome; OpenAI expected to enter the space soon – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSUI Chart Pattern Confirmation Sets $3.89 Price Target – Crypto News

-

others1 week ago

Trump Jr. Backed Thumzup Media To Invest In ETH, XRP, SOL, DOGE And LTC – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle’s worst nightmare? OpenAI’s new AI web browser is coming soon to challenge Chrome – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Hits Record Peak. How High Can It Surge in 2025? – Crypto News

-

Technology1 week ago

VC Firm Ego Death Capital Closes $100M Funding to Back Bitcoin-Based Projects – Crypto News

-

Cryptocurrency1 week ago

Tokenized Securities Are Still Securities, US SEC Warns Robinhood, Kraken – Crypto News

-

others1 week ago

others1 week agoNovaEx Launches with a Security-First Crypto Trading Platform Offering Deep Liquidity and Institutional-Grade Infrastructure – Crypto News

-

others1 week ago

others1 week agoAnthony Scaramucci Says $180,000 Bitcoin Price Explosion Possible As BTC ‘Supremacy’ Creeps Up – Here’s His Timeline – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaks New Record at $111K, What’s Fueling the $120K Price Target? – Crypto News

-

Business1 week ago

US Senate To Release CLARITY Act Draft Next Week – Crypto News

-

others1 week ago

others1 week ago$687,220,000 in Bitcoin Shorts Liquidated in Just One Hour As BTC Explodes To $116,000 – Crypto News

-

Business1 week ago

Business1 week agoS&P Global Downgrades Saks Global’s Credit Rating – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Technology1 week ago

Technology1 week ago10 Smartchoice tablets from top brands, curated for everyday use, up to 45% off before Amazon Prime Day Sale – Crypto News

-

others1 week ago

China’s Ant Group With 1.4B Users Taps Circle to Integrate USDC – Crypto News

-

De-fi1 week ago

De-fi1 week agoOusted Movement Labs Co-Founder Sues Startup in Delaware Court – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSei Network Unlocks Japan Market After Hitting $626M in TVL – Crypto News

-

Business1 week ago

Breaking: US SEC Delays Grayscale Avalanche ETF Launch – Crypto News

-

Business1 week ago

XRP Set for Big Week as ProShares ETF Launches July 18 – Crypto News

-

Technology1 week ago

Hyperliquid Hits Record $10.6B OI As HYPE Price Records New ATH – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

others1 week ago

others1 week agoJapanese Yen recovers few pips from two-week low against USD; not out of the woods yet – Crypto News

-

De-fi1 week ago

De-fi1 week agoLarge-Cap Cryptos Climb as Trump’s Tariff Threats Stir Market Uncertainty – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Forms Inverse Head And Shoulders Pattern, Why A Surge To $3.3 Is Possible – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBlockchain Can Aid Action Against Criminals – Crypto News

-

Business1 week ago

Reserve Bank of Australia Advances Project Acacia To Test CBDCs, Stablecoins – Crypto News

-

others1 week ago

others1 week agoUS Government To Add Another $10,000,000,000,000 to National Debt by 2029, According to Prediction Markets – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft Outlook down: Global outage hit users worldwide, login and mail issues persist – Crypto News