De-fi

The case for institutional-grade tools for DeFi – Crypto News

The past decade has seen a dramatic increase in the accessibility of financial services. From online banking to mobile investing apps, more people than ever before have been able to join in. However, we are still far from making it an even playing field, with large institutions such as hedge funds dominating the game to the detriment of the ‘little guy.’

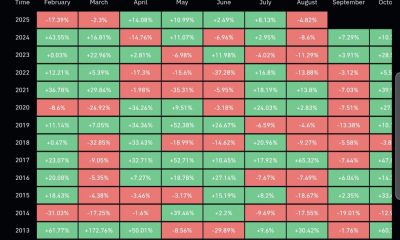

The data bears this out. In the US, for example, the top 10% own 84% of all stocks, Furthermore, retail traders consistently lose money to professionals, as evidenced by the fact that less than 1% of the day trading population predictably earns any profit.

Even barring day trading, the average retail investor underperforms the market by about 1.5% per annum. One of the critical reasons for this is that large institutions have always had an edge in access to information and technology. As a result, they can afford to pay for expensive data feeds and trade execution tools, as well as the salaries of highly skilled traders and analysts.

These same dynamics play out in cryptocurrency and decentralized finance (DeFi). Institutional-grade tooling is needed to make sense of the rapidly evolving landscape, but these tools are often out of reach for retail investors.

The recent collapse of FTX, which left over a million retail investors out of pocket, is just the latest example of how the system isn’t built for the small investor. While the platform claimed to be transparent, it turned out that it was using its own token, FTX, as collateral and could not meet the demands of its users when the details became public.

The need for institutional-grade tooling

Institutional-grade tooling in TradFi and in DeFi are very different. In the world of traditional finance, institutional investors have always had an advantage when it comes to data and execution; they can pay for expensive Bloomberg terminals and trade on private exchanges with lower fees.

In DeFi, however, the playing field is much more level. Public blockchains offer a public record of all transactions that anyone can access and analyze. Furthermore, decentralized exchanges (DEXs) such as Uniswap provide low-cost trading for all.

That said, retail and institutional investors still need tools to make sense of the data. The DeFi space is incredibly complex, with a large number of protocols and products all vying for attention. As a result, it can be challenging to keep track of one’s positions, let alone analyze historical performance.

Even large institutions commonly use tools like Excel or alternatives such as Zapper and Debank, which only report on an investor’s static positions rather than historical performance. Unfortunately, these tools simply aren’t adequate for the task at hand.

This is where institutional-grade tooling comes in. These types of tools provide visibility into an investor’s portfolio, including detailed performance reports and analytics. This data type is essential for understanding how one’s positions perform and making informed decisions about where to deploy capital.

That said, DeFi tooling needs a lot of work to be on par with TradFi. Chiefly, user-friendliness is a significant issue. The current crop of tools is often complex and confusing, which makes it difficult for retail investors to get started. In addition, many available tools are aimed at developers rather than traders and investors. This is a significant problem because it means that the average person is effectively locked out of space.

How tooling can boost inclusion

When the topic of financial inclusion comes up, the focus is often on products and services such as credit and banking. However, access to information and technology is just as important. This is where institutional-grade tooling can make a real difference.

By making data more accessible and easy to understand, tooling can level the playing field for retail investors. With better data, retail investors can make informed decisions about where to allocate their capital. This, in turn, will lead to better outcomes for them.

Inclusion goes beyond just increasing access to products and services; it’s also about empowering people with the knowledge and tools they need to be successful. Institutional-grade DeFi tools are a crucial step in this direction.

True financial inclusion in DeFi requires more than just making platforms available to everyone with an Internet connection. It necessitates rethinking how those platforms are designed and governed so that they can serve the needs of the broadest range of users, not just a privileged few.

Inclusive design is good for business. A studies by McKinsey found that $12 trillion, or 11% of global GDP, could be added to global GDP by 2025 by advancing women’s equality.

The same principle holds true for DeFi. By making our platforms accessible and easy to use for everyone, we can create a level playing field where the best ideas win rather than the projects with the most well-connected insiders. This increased competition has already led to lower fees and better terms for users across the board. And as DeFi matures, we can expect even more innovation and improvements in the available products and services.

There’s still a long way to go before we achieve true financial inclusion in DeFi, but the benefits of doing so are clear. By working to make our platforms accessible to all, we can create a more robust, more vibrant ecosystem that delivers value for everyone.

The state of DeFi tooling

Today, there are only around 4.8 million DeFi walletsrepresenting a small fraction of the potential market for DeFi, and an even more minuscule portion of the traditional banking population.

Not only are there relatively few people using DeFi applications, but the amount of capital locked in DeFi protocols is also still relatively small. For example, the total value locked (TVL) in DeFi is currently around $53 billionrepresenting just 7% of the overall cryptocurrency market capitalization of $800 billion.

With such a small base of users and capital, it’s no surprise that the current state of DeFi tooling is lacking. They’re also commonly jargon-heavy and challenging to use, reducing accessibility.

For DeFi to reach its full potential, the community must unite to improve education and make tooling more accessible. This is the only way to ensure everyone has a fair chance to participate in the space. We can create a brighter future for all with better tools and increased inclusion.

About the author: Elie Azzi is the co-founder and CPO of VALK, building an ecosystem of powerful decentralized tools for smart trading and investing in DeFi for retail and professional users. Elie was previously an entrepreneur in residence at R3 and a blockchain architect at BNP Paribas.

-

Business6 days ago

Business6 days agoPYMNTS’ Summer of Big Quotes, From Tariffs to Trust Codes – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSouth Korea Busts Hacking Syndicate After Multi-Million Dollar Crypto Losses – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoA Stable Investment Backed by Real-World Assets – Crypto News

-

De-fi1 week ago

De-fi1 week agoStablecoin Platform M0 Raises $40 Million in Polychain-Led Series B – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions rose from previous ¥77.6K to ¥84.5K – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoEtherealize Raises $40M to Market Ethereum to Finance Firms – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAs US Data Moves to Blockchain, Should Businesses Follow? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUS and Dutch Authorities Take Down Crypto-Fueled Fake ID Marketplace – Crypto News

-

others4 days ago

CFTC Gives Crypto Prediction Platform Polymarket Greenlight To Launch In the U.S. – Crypto News

-

others3 days ago

others3 days agoXAG/USD bounces at $40.50, approaching $41.00 – Crypto News

-

Cryptocurrency1 week ago

Strategy Investors Drop Class Action Over Bitcoin Accounting Misrepresentation – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoRipple (XRP) Slips 5% Weekly But Analysts See Potential for a New ATH – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoReverse-takeover DATs are a grab bag of risks for investors – Crypto News

-

De-fi1 week ago

De-fi1 week agoSolana Leads Major Altcoins as Buyers Pile In Ahead of Treasury Companies – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXYZVerse (XYZ) at $0.0054 Chosen Over Solana and Cardano for $10 This Bull Run Target – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAI Travel Assistance: Can AI assistants really plan a perfect vacation for you? Here’s the truth – Crypto News

-

Technology1 week ago

Technology1 week agoMeta may tap OpenAI, Google models to power AI features across WhatsApp, Instagram and Facebook: Report – Crypto News

-

Business6 days ago

Business6 days agoTariffs Leave Businesses Struggling With Pricing Decisions – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoHistoric Bitcoin-S&P decoupling fuels altseason hopes – All the details! – Crypto News

-

others1 week ago

others1 week agoUS Dollar Index drops to near 98.00 amid caution ahead of US PCE inflation data – Crypto News

-

Technology1 week ago

Technology1 week agoAI can’t match human creativity, says Fields medalist Manjul Bhargava – Crypto News

-

Technology1 week ago

Gaming Firm Gumi Launches XRP Treasury to Accelerate Blockchain Push – Crypto News

-

Technology1 week ago

Fear Grips Crypto Investors as “Trump is Dead” Speculation Spreads: Details – Crypto News

-

Technology1 week ago

Technology1 week agoiPhone 17 Pro Max vs iPhone 16 Pro Max: 7 big upgrades expected at Apple’s ‘Awe Dropping’ event – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Long-Term Holders Realize 2.37M BTC ($260.7B) in Second Most Profitable Cycle Amid Signs of Late Phase and October-November Peak – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoChainlink, Commerce Department Bring Data to Blockchain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThursday links: ATMs, dad logic and zombie tokens – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft AI product lead explains why org charts may disappear in the age of AI agents – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoRegulatory Certainty for Crypto Front and Center on SEC’s Agenda – Crypto News

-

De-fi5 days ago

De-fi5 days agoKraken, Backed Expand Tokenized US Stocks to Ethereum via xStocks – Crypto News

-

![Car Group Limited – CAR Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Car-Group-Limited-–-CAR-Elliott-Wave-technical-analysis-Video-400x240.jpg)

![Car Group Limited – CAR Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Car-Group-Limited-–-CAR-Elliott-Wave-technical-analysis-Video-80x80.jpg) others2 days ago

others2 days agoDuluth Holdings (DLTH) tops Q2 earnings and revenue estimates – Crypto News

-

Technology1 week ago

Lisa Cook Sues Trump as Fed Drama Intensifies Ahead of Crucial September FOMC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Open Interest declines 30% as price consolidate below $3 – Crypto News

-

De-fi1 week ago

De-fi1 week agoEliza Labs Files Lawsuit Against Elon Musk’s X – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoUkraine’s Parliament Supports Crypto Tax Bill at First Reading – Crypto News

-

Business4 days ago

1inch Taps Ondo Finance to Unlock Access to Tokenized RWAs – Crypto News

-

others4 days ago

others4 days agoDow Jones falls flat as tech stocks rise – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoCardano Founder Says Chainlink Quoted Them An ‘Absurd Price’, Here’s Why – Crypto News

-

Cryptocurrency3 days ago

XRP Army Played Key Role in Ripple SEC Lawsuit, John Deaton Says – Crypto News

-

Business3 days ago

AlphaTON Capital Launches $100M TON Treasury Strategy, Rebrands as ATON on Nasdaq – Crypto News

-

others3 days ago

What’s Fueling Today’s Crypto Market Crash? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDogecoin to Proof of Stake? Cofounder Shares His 2 Cents – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin – Here’s what could drive BTC’s next push to $115K – Crypto News

-

De-fi1 week ago

De-fi1 week agoTether to Launch USDT Natively on Bitcoin via RGB – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoJPMorgan says Bitcoin is undervalued compared to gold as volatility plummets – Crypto News

-

Technology1 week ago

Technology1 week agoPYTH skyrockets 60% as US government taps Pyth Network to verify economic data on-chain – Crypto News

-

others1 week ago

others1 week agoIndian Rupee trades calmly, outlook remains grim amid US tariffs and FIIs outflows – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum eyes breakout to $5,000 as Cathie Wood bets on ETH treasury firm – Crypto News

-

Technology1 week ago

Technology1 week agoClaude AI will train on your personal conversations by default — unless you change this setting – Crypto News

-

others1 week ago

others1 week agoEUR/USD steady despite strong US GDP as Greenback stays under pressure – Crypto News