others

GBP/JPY advances towards 160.00 ahead of United Kingdom Retail Sales data – Crypto News

- GBP/JPY is approaching 160.00 as investors are still confused about forward Bank of Japan’s policy stance.

- The Bank of England might discover a meaningful downward trend in inflation from the late spring amid tight monetary policy.

- Bank of Japan could look for an exit from the expansionary policy as inflation is steadily rising.

- GBP/JPY might display a power-packed action after the release of the United Kingdom Retail Sales data.

GBP/JPY has extended its recovery move above the critical resistance of 159.00 in the early European session. The cross is marching towards the round-level resistance of 160.00 ahead of the United Kingdom Retail Sales data.

On Thursday, the asset rebounded from 157.70 after the Bank of Japan (BOJ) maintained the status quo by keeping the interest rates and yields target unchanged. Bank of Japan (BoJ) Governor Haruhiko Kuroda kept the interest rate at -0.10% and the 10-year Japanese Government bonds (JGBs) around 0% steady, commented that there is “no need to further expand the bond target band.” He further added that Japan’s economy is still on the path towards recovery from the pandemic and the BoJ is aiming to achieve a 2% inflation target sustainably, stably in tandem with wage growth.

BOE’s Bailey sees a sheer declining inflation trend in the late spring

Policymakers at the Bank of England (BOE) have put severe efforts for decelerating the pace of the Consumer Price Index (CPI) by accelerated interest rates, December’s CPI report has shown a consecutive decline in the inflation trend for the first time since the Covid-19 pandemic period, led by declining energy prices. The United Kingdom has been one of the laggards in slowing down the pace of inflation.

On Thursday, Bank of England Governor Andrew Bailey cited “He expects that inflation will fall quite rapidly this year, probably starting in the late spring. While commenting on the terminal rate, the Bank of England Governor sees the interest rate peak near market expectations at 4.5%. The Bank of England Governor is seeing a shallower recession than the historic ones.

Earlier, Bank of England policymakers cited rising wages as responsible for escalating inflation. Bargaining power has been shifted in favor of job-seekers due to a shortage of labor.

Investors await United Kingdom Retail Sales for fresh cues

For further guidance, investors will keep an eye on the United Kingdom Retail Sales data, which is scheduled for Friday. As per the projections, the annual Retail Sales (Dec) data could contract by 4.1% vs. a contraction of 5.9% reported in the prior same period. However, the monthly economic data is expected to expand by 0.5% against a contraction of 0.4%. A recovery in the retail demand on a monthly basis could be the outcome of rising employment bills due to employees’ bargaining power, which is leaving more funds in the palms of households for disposal.

A better-than-projected retail demand could spur forward inflation expectations, which could accelerate hawkish Bank of England bets.

Mixed Japan’s inflation fails to provide any boost to the Japanese Yen

Bank of Japan’s unchanged monetary policy-inspired gains in GBP/JPY faded later as investors still believe that the central bank will look for an exit from its decade-long ultra-loose monetary policy. A rising trend in inflation and the administration’s effort to increase wages could end the expansionary monetary policy ahead. However, the release of the National CPI indicates that investors should wait further before reaching a conclusion.

Japan’s National headline CPI has landed at 4.0%, lower than the consensus of 4.4% but higher than the former release of 3.8%. While the core inflation that excludes oil and food prices has soared to 3.0% higher than the expectations of 2.9% and the prior release of 2.8%. The National CPI that excludes fresh food has remained in line with the estimates at 4.0%.

GBP/JPY technical outlook

The recovery move from GBP/JPY around the upward-sloping trendline of the Ascending Triangle charts The pattern plotted from January 13 low at 155.65 has pushed it above the 20-period Exponential Moving Average (EMA) at 159.22. There is no denying the fact that the short-term trend is bullish now. The horizontal resistance of the volatility contraction chart pattern is placed from January 9 high at 160.92.

Meanwhile, the Relative Strength Index (RSI) (14) has scaled above 60.00, which indicates that the upside momentum is active now. Broadly, the cross might find barricades after reaching the horizontal resistance mentioned above.

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Technology1 week ago

Technology1 week agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

others1 week ago

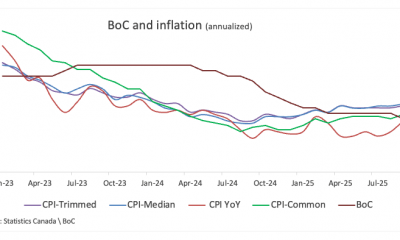

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

Business1 week ago

Business1 week agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Phones Struggle as Solana Quietly Pulls Plug on Saga – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

Crypto Market Tumbles as Jerome Powell Says December Rate Cut ‘Far From Certain’ – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

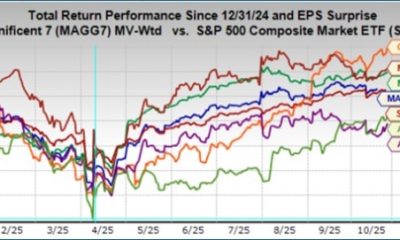

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Cryptocurrency1 day ago

Cryptocurrency1 day agoAndrew Tate Buys $5 Million Worth of Bitcoin Hours Before Crash – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News

-

Business1 week ago

$2.5T Citigroup Partners With Coinbase to Enable Stablecoin Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoArgentine Stablecoin Use Surged Ahead of President Milei’s Midterm Election Win – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency5 days ago

After 1,993% Burn Spike, Is Shiba Inu Price Set for a Major Trend Reversal? – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News