Cryptocurrency

AAVE’s price consolidation could end at this range: Will investors benefit – Crypto News

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AAVE could break out from its recent parallel channel pattern.

- Holders sustained a decline in gains during the price consolidation period.

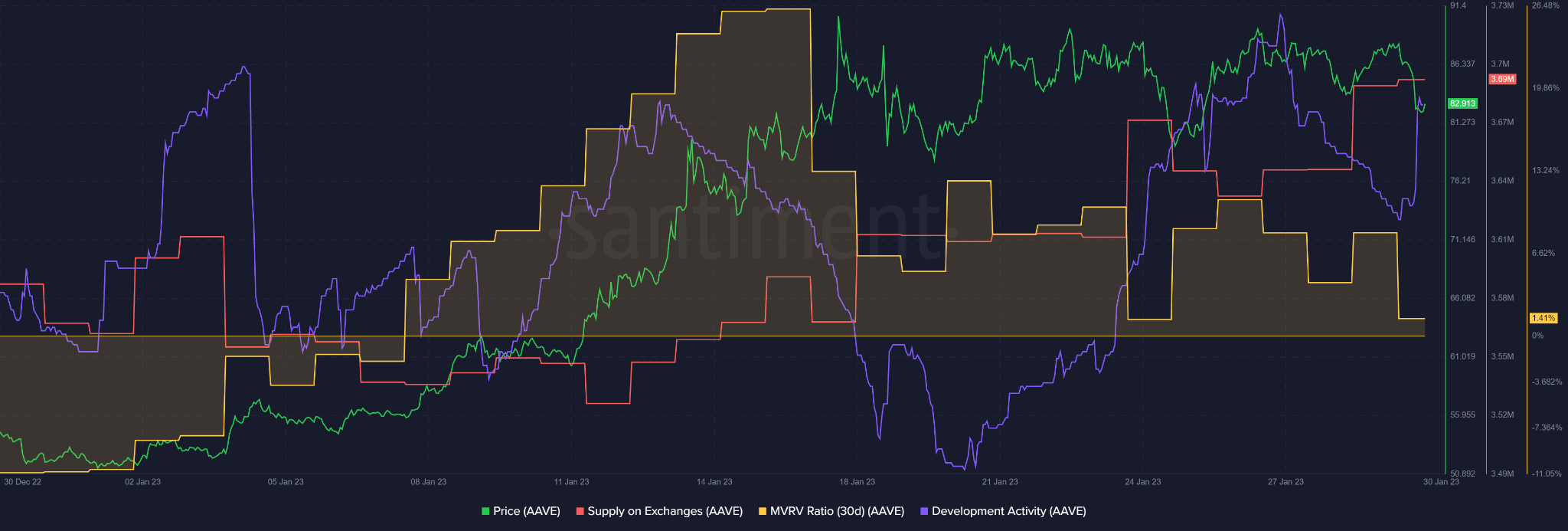

Ave’s [AAVE] The recent rally offered investors and traders impressive returns. It rose from $52 to $91, posting over 70% gains. However, the price consolidation that followed after hitting $91 undermined additional profits.

read Ave’s [AAVE] Price Prediction 2023-24

At the time of publication, AAVE’s value was $83.20 and could attempt to break out of its current price consolidation range.

The price consolidation range of $79 – $90: Is a breach likely?

Since mid-January, AAVE oscillated between $79 and $90, curving a parallel channel pattern (yellow). Notably, the price action was predominantly in the upper range of $85 – $90 in the same period.

how much is 1,10,100 AAVEs worth today,

In the next few hours/days, bulls could attempt to break above the parallel channel and aim at the bullish target of $97.7 based on the channel’s height. However, bulls must clear the hurdles at the channel’s mid-range level of $85 and overhead resistance level of $90 for such a move to be feasible.

Alternatively, bears could gain leverage and inflict a bearish breakout below the channel’s lower boundary of $79. The move would invalidate the above bullish bias. But such a drop could settle at the bearish target of $71.3, with a couple of potential stable grounds along the way.

AAVE’s development activity spiked, but hodlers’ profits fluctuated

According to Santiment, AAVE recorded a sharp increase in development activity, indicating the network saw massive building growth at press time. This could boost investors’ confidence and the token’s value in the long run.

However, holders’ profits fluctuated, as evidenced by fluctuating MVRV, because AAVE’s price was restricted in a consolidation range. Nevertheless, a 10% gain was likely if a bullish breakout happened in the next few hours/days.

But traders and investors must be cautious with the short-term sell pressure, which was indicated by the spike in Supply on Exchanges.

-

Blockchain1 week ago

Blockchain1 week agoXRP ETFs Listed On DTCC Ahead Of Possible Launch – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum (ETH) Holds Strong as Analysts Target $4,400 Despite ETF Outflows – Crypto News

-

Technology1 week ago

Breaking: Coinbase Launches Token Sales Platform for Retail Investors – Crypto News

-

Business1 week ago

Michael Saylor Hints Bitcoin Buy As Goldman Sachs Predicts Three Fed Rate Cuts – Crypto News

-

Business1 week ago

Breaking: Coinbase Launches Token Sales Platform for Retail Investors – Crypto News

-

Technology1 week ago

Filecoin Price Rockets 51% as Grayscale’s FIL Holdings Hit Record High — What’s Next for FIL? – Crypto News

-

Business1 week ago

Trump Tariffs: Crypto Market Surges After $400B Dividend Announcement for Americans – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow Strive’s $162M Bitcoin bet could make it the next MicroStrategy – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat is the Fusaka Upgrade? Ethereum’s Biggest Scaling Bet Yet – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhat’s in India’s first AI rulebook? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin faces quantum risk: why SegWit wallets may offer limited protection – Crypto News

-

Business1 week ago

Post-Giveaway Supply Shock: Impact on FUNToken’s Liquidity and Market Depth – Crypto News

-

Technology1 week ago

Michael Saylor Hints Bitcoin Buy As Goldman Sachs Predicts Three Fed Rate Cuts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Turns Positive Amid Market Calm — Does the Trend Have Legs? – Crypto News

-

De-fi6 days ago

De-fi6 days agoZEC Jumps as Winklevoss‑Backed Cypherpunk Reveals $100M Zcash Treasury – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Hovers Around $105,000 as Government Shutdown Progress Lifts Markets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSquare Enables Bitcoin Payments for Sellers – Crypto News

-

others1 week ago

Breaking: Canary XRP ETF Gets Approval with 8-A Filing to List on Nasdaq – Crypto News

-

De-fi5 days ago

De-fi5 days agoKraken’s xStocks Hit $10B in Total Trading Volume – Crypto News

-

Business1 week ago

Bitget Taps Ex-Adobe Marketer as CMO to Push Towards ‘Universal Exchange’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAmerican Bitcoin Now Holds Over 4,000 BTC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDecred defies market downtrend, jumps to 4-year high: analysts see path to $100 – Crypto News

-

others1 week ago

others1 week agoGold retreats from three-week high but retains bullish outlook – Crypto News

-

De-fi1 week ago

De-fi1 week agoThreshold Network Upgrades tBTC Bridge to Link Institutional Bitcoin with DeFi – Crypto News

-

De-fi1 week ago

De-fi1 week agoTrump Tokens Outperform After US President Teases ‘Tariff Dividends’ – Crypto News

-

De-fi7 days ago

De-fi7 days agoXPL Rallies After Plasma Reveals Collaboration with Daylight Energy – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin (BTC) battles macro headwinds despite improved ETF inflows – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhat is Kimi AI? Chinese chatbot beats ChatGPT, Claude on major benchmarks – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity AI is finally bringing Comet browser to Android: here’s who gets access first – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump Media Reveals Bitcoin and Cronos Holdings Amid Q3 Loss – Crypto News

-

others1 week ago

others1 week agoUS Senate advances government funding bill to end shutdown – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar loses ground despite stronger Westpac Consumer Confidence – Crypto News

-

others1 week ago

Bitcoin News: BTC Exchange Reserves Fall as Tether Mints $1B USDT – Crypto News

-

De-fi1 week ago

De-fi1 week agoMonad Faces Community Backlash After Unveiling Tokenomics – Crypto News

-

De-fi1 week ago

De-fi1 week agoInstitutional Sentiment is Turning Bearish on Crypto: Sygnum – Crypto News

-

Technology1 week ago

Technology1 week agoChinas cryptoqueen jailed in UK over $6.6 billion Bitcoin scam – Crypto News

-

De-fi1 week ago

De-fi1 week agoEthereum Sees First Sustained Validator Exit Since Proof-of-Stake Shift – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoYour deep research tool may save you time, but can it save you embarrassment? – Crypto News

-

others7 days ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

Business7 days ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

De-fi6 days ago

De-fi6 days agoSKY Surges 14% as Savings TVL Passes $4 Billion – Crypto News

-

De-fi5 days ago

De-fi5 days agoXRP Surges as First US Spot ETF Debuts on Nasdaq – Crypto News

-

Technology3 days ago

Technology3 days agoPerplexity faces harsh crowd verdict at major San Francisco AI conference: ‘Most likely to flop’ – Crypto News

-

Business1 week ago

Post-Giveaway Supply Shock: Impact on FUNToken’s Liquidity and Market Depth – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLearn How This New Altcoin is Merging XRP and Solana Together in 2025 – Crypto News

-

Technology1 week ago

Technology1 week agoWho is Noam Shazeer? AI leader Google paid $2.7 billion to hire, now sparking internal tensions – Crypto News

-

Business1 week ago

XRP Set for a Big Week as Canary Capital ETF Launches on November 13 – Crypto News

-

Cryptocurrency1 week ago

Can Dogecoin Price Hold Above $0.17 Amid Weekly Surge? – Crypto News