Metaverse

AI could create the first $10 trillion company. This stock pro lays out how. – Crypto News

Hoffmann-Burchardi joined UBS in 2023 after 25 years at Tudor Investments, where she was an early investor in digital disruption and the likes of Nvidia. Now, she helps guide institutional investors and ultrahigh-net-worth clients as chief investment officer of global equities for UBS Global Wealth Management, which oversees nearly $4.2 trillion in assets. At the end of this month, she will add the title of CIO of Americas.

We spoke with Hoffmann-Burchardi in late May and again via e-mail on June 13 to learn why she’s confident about the U.S. market and economy. We also delved into spending related to artificial intelligence, where the first $10 trillion company might come from, and why the U.S. fiscal deficit actually could offer U.S. stocks some support.

Barron’s: What’s your framework for thinking about the market and stocks? You seem less concerned than your peers about the traditional categories for stocks, like growth and value.

Hoffmann-Burchardi: We have three perspectives important to formulate our views: an understanding of the macro situation, particularly real GDP growth and real interest rates; an understanding of specific companies; and transformational opportunities.

Only 1% of public companies create 80% of the wealth in equity markets, so understanding the large-cap players is critical. Over the past 30 years, the style factors that are so predominant in investing—size and value or growth—accounted for just 5% of equity returns. We have to rethink the framework of how we allocate portfolios, since over 50% of returns are company-specific. So, we ask how we can find these companies or factors driving wealth creation: Transformational innovations are key and underappreciated by the investment community.

What are some of the big transformational innovations of the past?

We looked at which companies hit certain market cap thresholds. General Motors was the first $10 billion company, and then IBM with the invention of the PC was the first $100 billion company. Apple became the first $1 trillion company. Every time these companies reach a new market cap threshold, it is because they were in a vortex of some innovation transformation. Now, we think AI, electrification, and longevity are the opportunities, and the first $10 trillion company will likely arise within those innovations.

More immediately, what does the conflict between Israel and Iran mean for the market?

Our base case is that this conflict does not escalate, given U.S. and international pressures. But we are watching for signs, in particular, that Iran attempts to close the Strait of Hormuz, the world’s most critical oil chokepoint, which would risk global escalation. We carry a gold allocation in the portfolio to serve as a crisis hedge as well as a hedge against inflation and dollar downside.

What’s your general expectation for the market?

After the recent rally in the S&P 500 index, we downgraded the U.S. to neutral but still see upside to our 12-month price target of 6400. Given the difficult fiscal situation in the U.S., with debt at more than 120% of gross domestic product, the policy path is likely to be along a fiscal tightrope, imposing guardrails for an economic policy that needs to be growth-oriented while fiscally prudent.

Similar historical episodes of high debt levels, such as the U.S. and United Kingdom after World War II and Canada in the 1990s, suggest that economic growth is one of the key factors in lowering deficits. That makes us believe from a tariff and an economic-policy perspective there can’t be a risk to the economy slowing. When it comes to trade policy, we are trying to differentiate between negotiating strategy and intended outcome.

What is your base case for trade policy?We think the 25% effective tariffs announced on [April 2] were a starting point to negotiations, but will ultimately settle closer to 15% by year end. The recent court rulings give negotiating partners more leverage. The longer these proceedings last, the more likely it is that tariffs will turn out to be more moderate than feared. Equally important is how selective tariffs are going to be. For imported goods that cannot easily be substituted with U.S. goods, such as advanced AI chips or active pharmaceutical ingredients, high tariffs are economically more damaging.

What are the prospects for a U.S. recession?

There could be a bit of economic weakness in the next few months, as companies are reluctant to invest, given the tariff uncertainty. Policy uncertainty is at levels similar to Covid 19, also reflected in the high number of mentions of “uncertainty” in earnings calls.So far, earnings results have been strong in the first quarter, while second-quarter guidance is a bit more mixed, with some companies pulling or issuing scenario-based guidance. We have not yet seen an impact on employment, likely because companies have learned from Covid-19 that layoffs are not easily reversible. Despite the market rebound, there remains investor skepticism about the U.S. trade and fiscal position.

What is the U.S.’s real edge at this point?

If we look at transformational innovation opportunities, most companies poised to pursue them are based in the U.S. There could be hiccups, but we are not as pessimistic as a lot of people are. I think about where growth could come from. AI is one of those opportunities that will lead to unprecedented productivity growth over the next few years, and the U.S. is in pole position.

The progress made by China’s DeepSeek raised concerns that AI would require less spending on chips, hardware, and power generation. How do you see it?

The market interpreted DeepSeek as AI becoming so much more efficient that we don’t need hardware and chips because it’s only using a fraction of the compute. Our view is different: If a resource becomes more efficient, you are going to use more of it.In the semiconductor market, the cost of a transistor has dropped by 99.99% over the past 50 years, but the total market value (price multiplied by volume sold) has increased more than 100 times. That’s a phenomenon called the Jevons paradox, which states that when technology makes it more efficient or cheaper to use a resource, people use more of it, increasing rather than decreasing the total size of the market. The more efficient AI gets, the more widely it can be adopted. We are early in this.

What else is underappreciated about AI?

It’s the first technology in human history that is self-improving. That’s why we are seeing such unprecedented change and why it’s more unpredictable than innovations that are more linear.

Right now, our AI usage is based on question-and-answer AI interactions, but as we transition toward bigger-enterprise use cases—including lengthy document creation for regulatory filings and reports and then agentic AI, where agents will autonomously complete more-complex tasks—AI will require more compute. In our estimates, compute demand for generative AI workloads could be five times higher than the current compute supply, driven mainly by the reasoning intensity of agentic AI.

That makes us believe that the “picks and shovel” layer of AI—cloud companies and AI chips—will still be a key part of the investment thesis. At some point, it will move toward the applications layer, but a lot of that may happen in private markets. Companies that own the whole vertical stack for AI—chips, intelligence, and application layers, such as several of the big-tech companies and hyperscalers in the U.S.—offer the best risk/reward opportunity.

What are the best investment opportunities in electrification?

We see an imbalance in the demand and supply for electricity over the next decade. On the demand side, it is driven by electrification of the physical economy from transportation to buildings. AI compute demand plays a role, as well: We see 8% of the electricity demand increase between now and 2030 coming from AI data centers. On the supply side, we face an outdated electric grid that is at or beyond its intended lifespan. In the U.S., more than 70% of the transmission lines are over 25 years old, many approaching the end of their 50-to-80-year service life, according to the U.S. Department of Energy.

What’s another big investment theme?

Longevity is a slower-moving theme. We will see more 65-year-olds and older by 2034 versus those 18-years-old or younger. Drug discovery is being helped by large language model AI. AlphaFold [an AI program] uses LLM to predict the 3-D structure of proteins—a big breakthrough for drug discovery. Some companies are focused on using AI for certain diseases like Alzheimer’s. We are investing in that theme through pharma and medical devices. It’s still early on its impact on shifting consumer trends and patterns, but it will have a lot of implications.

How do these themes connect with the geopolitical debates weighing on markets?

Understanding these transformational innovations is very important to the geopolitical stakes. Why do we have export restrictions on AI chips [to China]? Because, ultimately, AI is viewed as the key geopolitical tool, and supremacy in AI means a lot. The same administration is looking at [tariffs and restrictions] related to semiconductors and pharmaceuticals.

What we have seen from Trump 1.0 and more recent remarks is that his approach is a diplomatic one. A more de-escalatory diplomatic path is a positive geopolitically. But if anything happens in Taiwan—though the probability is sparse—the potential impact is vast. The only way to protect a portfolio from these types of tail risks is with diversifiers such as gold. Gold has run a lot, but we still like it as a buffer or diversifier. Higher-quality companies within the vortex of these transformational companies is also a place where over the long term we have high conviction.

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

De-fi7 days ago

De-fi7 days agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Technology7 days ago

Technology7 days agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Business7 days ago

Business7 days agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

De-fi7 days ago

De-fi7 days agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

GBP flat vs. USD with notably muted reaction to retail sales & PMI data – Scotiabank – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Reversal Sends Price Towards $1, DOGE Treasury to Go Public, Bitcoin Beats Gold, Binance’s CZ Pardoned — Top Weekly Crypto News – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

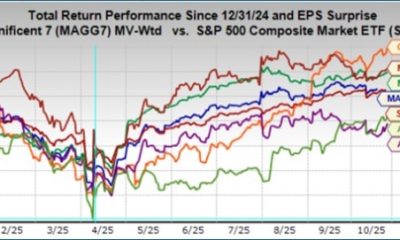

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News