Metaverse

AI spending is propping up the economy, right? It’s complicated. – Crypto News

We’re already there when looking at the eye-watering tallies for artificial intelligence investment from the four biggest hyperscalers. Microsoft, Amazon, Facebook parent Meta Platforms, and Google parent Alphabet are likely to spend a staggering $340 billion this year alone in building out their AI data centers and developing their individual products.

Looking further ahead, a recent McKinsey report pegged the collective outlay needed to meet AI demand over the next five years at around $7 trillion.

But that doesn’t mean experts share a consensus view on the impact that AI spending is likely to have on the world’s biggest economy.

Some statistics suggest second-quarter AI spending powered nearly half of GDP growth. Others say the money being spent will ultimately find its way overseas.

AI deployments will nudge growth figures higher, as users get more efficient with using the technology, according to some economists. One Nobel laureate, however, became famous for proving that information technology spending has little immediate impact on productivity statistics.

David Laidlaw, portfolio manager at Carnegie Investment Counsel, is in the former camp.

“The productivity gains associated with AI could easily be multiples of the capital expenditures themselves,” he wrote in a spring report on the impact of surging tech investment.

“The economic stimulus from the AI data center build is a secular trend that will power the U.S. economy for the next few years,” he said.

Digging into the data from the Bureau of Economic Analysis’ second-quarter GDP report underscores his prescience.

Amazon, Microsoft, Google parent Alphabet, and Facebook parent Meta Platforms spent around $69 billion over the three months ending in June, according to economist Paul Kedroksy, equating to an annual pace of $276 billion.

That’s around half of the annualized amount of domestic IT equipment spending. As a result, Kedrosky estimates the contribution of AI capex to second-quarter GDP was around 1.3 percentage points of the 3% advance estimate.

“This would be an even larger share than that contributed to GDP by AI capex in the first quarter,” he wrote in a blog post. “For practical purposes, it ate Q2 GDP growth.”

However, Samuel Tombs, chief U.S. economist at Pantheon Macroeconomics, notes that President Donald Trump’s trade policies make drawing conclusions from the AI spending wave a challenge.

“It’s difficult to judge how much of this leap (in IT investment) was due to the ongoing flood of money being poured into AI infrastructure or a one-time bump linked to companies stockpiling tech-related goods, rather than risk paying tariffs,” he said in a recent client note.

Still, AI capex has been a powerful force in 2025. Callie Cox, chief market strategist at Ritholtz Wealth Management, notes that AI spending over the first half of the year has grown by $152 billion, more than double the $77 billion increase in consumer spending over the same span.

But she adds an important caveat.

“You could say, okay, ‘AI is propping up the economy and is adding more than this component of the economy that is so large and so dominant,’” she told Ritholtz’s Josh Brown on The Compound and Friends podcast earlier this week. “Or you could say ‘Consumer spending is really setting a low bar.’ It’s stalling out,” she added. “I think it’s the latter.”

“AI capex is going gangbusters, but can it prop up the economy? I’m not so sure,” Cox said. “I don’t think you have a thriving U.S. economy without the consumer.”

Peter Berezin, chief global strategist at BCA Research, is also skeptical of the idea that AI investments are a pure driver of U.S. growth.

The combined spending of Amazon, Microsoft, Google, and Meta over the past year is equal to around 1% of domestic GDP, he argued in a report earlier this week, but noted that “most of this capex consists of spending on Nvidia chips and other tech equipment, much of which isn’t manufactured in the U.S.”

“Although it is possible that some of this spending will be re-shored back to the U.S., it will take a while for that to happen,” he added. He noted that construction spending in tech-related manufacturing and data center construction has been trending down and “employment in computer manufacturing and related sectors is near record lows.”

His final citation was from Noble Prize-winning economist Robert Solow, creator of the Solow paradox, which argues that tech investment doesn’t immediately make workers more efficient.

“You can see the computer age everywhere but in the productivity statistics,” Solow wrote in a 1987 New York Times review of “The Myth of the Post-Industrial Economy.”

Is it different this time? Maybe ChatGPT will know the answer.

Write to Martin Baccardax at martin.baccardax@barrons.com

-

Blockchain1 week ago

Blockchain1 week agoAfrica Countries Pass Crypto Laws to Attract Industry – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple Unveils ‘Ripple Prime’ After Closing $1.25B Hidden Road Deal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDOGE to $0.33 in Sight? Dogecoin Must Defend This Key Level First – Crypto News

-

others1 week ago

JPY soft and underperforming G10 in quiet trade – Scotiabank – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoISM Data Hints Bitcoin Cycle Could Last Longer Than Usual – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat next for Avantis price after the 73% recovery? – Crypto News

-

Technology1 week ago

Technology1 week agoNothing OS 4.0 Beta introduces pre-installed apps to Phone (3a) series: Co-founder Akis Evangelidis explains the update – Crypto News

-

Technology5 days ago

Technology5 days agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump plans to pick Michael Selig to lead CFTC: Report – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Rebounds From Bull Market Support: Can It Conquer The ‘Golden Pocket’ Next? – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin’s institutional surge widens trillion-dollar gap with altcoins – Crypto News

-

Technology1 week ago

Technology1 week agoUniswap Foundation (UNI) awards Brevis $9M grant to accelerate V4 adoption – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBinance Stablecoin Outflow On A Steady Rise — What This Means For The Market – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Technology1 week ago

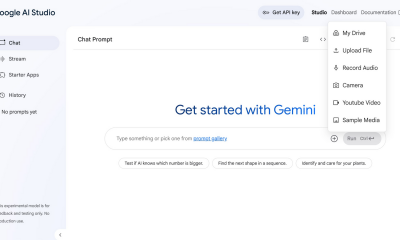

Technology1 week agoFrom Studio smoke to golden hour: How to create stunning AI portraits with Google Gemini – 16 viral prompts – Crypto News

-

Business1 week ago

PEPE Coin Price Prediction as Weekly Outflows Hit $17M – Is Rebound Ahead? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHYPE Breaks Out After Robinhood Listing and S-1 Filing: What’s Next? – Crypto News

-

De-fi1 week ago

De-fi1 week agoHYPE Jumps 10% as Robinhood Announces Spot Listing – Crypto News

-

others1 week ago

Platinum price recovers from setback – Commerzbank – Crypto News

-

others1 week ago

others1 week agoGold trims losses after softer US inflation reinforces dovish Fed outlook – Crypto News

-

Business1 week ago

White House Crypto Czar Backs Michael Selig as ‘Excellent Choice’ To Lead CFTC – Crypto News

-

others1 week ago

Bitcoin Price Eyes $120K Ahead of FED’s 98.3% Likelihood to Cut Rates – Crypto News

-

Technology1 week ago

Technology1 week agoMint Explainer | India’s draft AI rules and how they could affect creators, social media platforms – Crypto News

-

others1 week ago

GBP/USD holds steady after UK data, US inflation fuels rate cut bets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFetch.ai and Ocean Protocol move toward resolving $120M FET dispute – Crypto News

-

Technology1 week ago

Can Hype Price Hit $50 After Robinhood Listing? – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI announces major Sora update: Editing, trending cameos, and Android launch on the way – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoGemini in Gmail automates meeting schedules effortlessly – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEntire Startup Lifecycle to Move Onchain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNEAR’s inflation reduction vote fails pass threshold, but it may still be implemented – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

others7 days ago

others7 days agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Silver consolidates below $49 amid Fed rate-cut bets – Crypto News

-

Business1 week ago

HBAR Price Targets 50% Jump as Hedera Unleashes Massive Staking Move – Crypto News

-

others1 week ago

others1 week agoEUR/USD hovers at 1.1600 as muted CPI data fails to alter Fed stance – Crypto News

-

Business1 week ago

Trump Picks SEC Crypto Counsel Michael Selig to Lead CFTC Amid Crypto Oversight Push – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPump.Fun Rallies 10% After Acquisition Of Trading Terminal Padre – Crypto News

-

Technology1 week ago

Analyst Eyes Key Support Retest Before a Rebound for Ethereum Price Amid $93M ETF Outflows and BlackRock Dump – Crypto News

-

Business1 week ago

Ripple Explores New XRP Use Cases as Brad Garlinghouse Reaffirms Token’s ‘Central’ Role – Crypto News

-

others1 week ago

Tether’s Stablecoin 1.0 Era Is Over – Now the Industry Needs 2.0 – Crypto News

-

De-fi1 week ago

De-fi1 week agoAave Labs Acquires Stable Finance to Expand DeFi Access – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKyrgyzstan Launches Stablecoin While Confirming Future CBDC – Crypto News