others

AUD/NZD refreshes four-day high at 1.0970 on downbeat NZ Employment data – Crypto News

- AUD/NZD has refreshed its four-day high at 1.0970 as NZ Employment has missed estimates.

- A decline in labor demand and higher jobless rate might trim inflation projections in the NZ region ahead.

- The Australian Dollar remained extremely volatile this week following the release of the downbeat Retail Sales data.

The AUD/NZD pair has printed a fresh four-day high at 1.0970 in the early Asian session. The cross has gained strength after the release of downbeat New Zealand Employment (Q4) data. The Employment Change dropped to 0.2% from the expectations of 0.3% and the earlier release of 1.3%. While the Unemployment Rate has increased to 3.4% from the consensus and the prior release of 3.3%.

Signs of losing threads in the tight labor market of New Zealand indicate that inflation projections will trim further as retail demand may get dented. Meanwhile, the Labor cost index has remained mixed, which will still be a concern for the Reserve Bank of New Zealand (RBNZ) ahead. The quarterly labor cost index has landed at 1.1% lower than the estimates of 1.3% but similar to the prior release of 1.1%. On an annual basis, the economic data has remained in line with the expectations of 4.3% and higher than the 3.8% the prior release.

The interest rate hike spells by the RBNZ Governor Adrian Orr is not paused yet as the Consumer Price Index (CPI) is still beyond 7%. However, lower employment generation might trim inflation projections ahead.

On the Australian front, the Australian Dollar has picked up strength on upbeat S&P Global Manufacturing PMI data. The economic data has climbed to 50.0 vs. the consensus and the former release of 49.8. This week, the Australian Dollar remained extremely volatile following the release of the downbeat monthly Retail Sales (Dec) data. Lower retail demand might force the firms to look for easing prices of goods and services at factory gates. This would also delight the Reserve Bank of Australia (RBA) ahead.

For further guidance, the New Zealand Dollar and the Australian Dollar will dance to the tunes of the Caixin Manufacturing PMI (Jan) data, which is seen higher at 49.5 from the earlier release of 49.0. It is worth noting that the Antipodeans are the leading trading partners of China.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhale Sells $407K TRUMP, Loses $1.37M in Exit – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRobinhood Dealing With Fallout of Tokenized Equities Offering – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Breaches $120K, Institutional FOMO Takes and House Debate Propel Gains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Technology5 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency1 week ago

Why Is Bitcoin Up Today? – Crypto News

-

others5 days ago

others5 days agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Business5 days ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Business4 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

Technology1 week ago

Hyperliquid Hits Record $10.6B OI As HYPE Price Records New ATH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoZiglu Faces $2.7M Shortfall as Crypto Fintech Enters Special Administration – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano’s $1.22 target: Why traders should be aware of THIS ADA setup – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Technology5 days ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNear-Term Resistance at $170 But Bullishness Stays – Crypto News

-

Cryptocurrency1 week ago

XRP, Solana and ADA Rally, Is Altcoin Season Back This July 2025? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStrategy Resumes Bitcoin Buys, Boosting Holdings to Over $72 Billion in BTC – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Business7 days ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

others5 days ago

others5 days agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

De-fi5 days ago

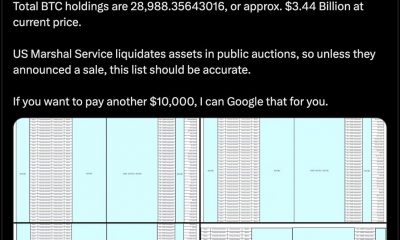

De-fi5 days agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others5 days ago

others5 days agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency5 days ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoNasdaq Exchange Files SEC Form to List Staking Ethereum ETF – Crypto News

-

others1 week ago

others1 week agoGold rises as USD aversion and tariff tensions boost safe-haven demand – Crypto News

-

Business1 week ago

Next Week To Make US The “Crypto Capital”, Says Bo Hines – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum ETFs record $3.6B inflows this week – Crypto News

-

Technology1 week ago

Peter Schiff Reignites Bitcoin Criticism, Calls 21M Supply Arbitrary – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Prime Day Sale 2025: Best earphones and headphone deals with up to 70% off – Crypto News

-

others1 week ago

others1 week agoJPMorgan Chase CEO Says Traders May Be Seriously Mistaken on Fed Rate Cuts: Report – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: The rise of zero-sum thinking – Crypto News

-

others1 week ago

others1 week agoCrypto Hacker Who Drained $42,000,000 From GMX Goes White Hat, Returns Funds in Exchange for $5,000,000 Bounty – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPump.fun Concludes $500M ICO in 12 Minutes — But Something Doesn’t Add Up – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are So Many Crypto Games Shutting Down? Experts Weigh In – Crypto News

-

De-fi1 week ago

De-fi1 week agoRobinhood Opens Ether and Solana Staking to US Users – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUK Banks Should not Issue Stablecoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Jr. backs social media startup aiming to become a crypto powerhouse – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Liquidity Supercycle Has Just Begun: Hedge Fund CEO – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Anthropic, OpenAI and xAI join US defence to tackle national security with AI – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News