others

AUD/USD extends rally as buyers’ eye 0.6700 ahead of Aussie’s job data – Crypto News

- Australian Dollar gained over 1% against the US Dollar, on Wednesday.

- US April CPI rose by 0.3% MoM, core CPI dipped as expected.

- Australian wages grew less than estimated, hinting at easing inflationary pressures.

The Australian Dollar surged more than 1% against the US Dollar on Wednesday after data showed that consumer inflation moderated in April, with the underlying Consumer Price Index (CPI) edging lower for the first time in six months. As Thursday’s Asian session begins, the AUD/USD trades at 0.6695, virtually unchanged.

AUD/USD climbs as inflation moderates in both Australia and the US

Inflation in the US began to show signs of cooling after posting consecutive readings of stalling, which sparked a change of tone amongst Federal Reserve officials.

The US Department of Labor revealed that April’s CPI rose by 0.3% MoM, down from March’s 0.4% and estimates. The so-called core CPI, which excludes volatile items like food and energy, dipped from 0.4% to 0.3% as expected.

At the same time, Retail Sales were unchanged in April, at 0% MoM, missing projections of a 0.6% increase as higher borrowing costs and mounting debt, weighed on American consumers.

Minneapolis Fed President Neel Kashkari stated that, given the higher government debt, achieving the 2% inflation target might necessitate higher borrowing costs in the near term. He expressed surprise at the resilience of consumer spending and highlighted the critical question of “how restrictive monetary policy is.”

On the Aussie’s front, wages increased less than estimated in Q1 2024, hinting that inflationary pressures could be easing. The Wage Price Index (WPI) came at 0.8% QoQ, down from 1% in Q4 2023, and missed estimates of 0.9%.

Ahead in the economic docket is Australia’s Employment report. Estimates suggest the economy added 23.7K employees to the workforce after laying off 6.6K in March. The unemployment rate is forecast to increase to 3.9% after ticking higher to 3.8% previously.

AUD/USD Price Analysis: Technical outlook

The daily chart suggests that the AUD/USD uptrend will continue, but buyers must decisively surpass the 0.6700 figure. Momentum is on their side, as the Relative Strength Index (RSI) aims up, shy of turning overbought.

That said, once 0.6700 is cleared, the next stop would be the psychological 0.6750 figure, followed by the 0.6800 mark. Conversely, if AUD/USD stays below 0.6700, look for a pullback to the May 3 high at 0.6647, ahead of diving to 0.6600.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoStop panicking about AI. Start preparing – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCourt Crushes Lawsuit Against Ripple – Crypto News

-

Blockchain22 hours ago

Blockchain22 hours agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Business1 week ago

XRP Payments Utility Expands as Ripple Launches Treasury Platform – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Laundering On Centralized Exchanges Declines: Report – Crypto News

-

others1 week ago

others1 week agoFundstrat’s Tom Lee Says Earnings Growth, Dollar Weakness Primed To Drive Stocks Higher – Here’s His Target – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Business1 week ago

Strategic Bitcoin Reserve: South Dakota Introduces Bill to Invest in BTC as U.S. States Explore Crypto – Crypto News

-

Business1 week ago

Trump’s Crypto Adviser Confirms Probe Into Alleged Theft From U.S. Crypto Reserve – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid: The frontend wars – Blockworks – Crypto News

-

Technology1 week ago

Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem – Crypto News

-

others1 week ago

others1 week agoCrypto Exchange Kraken Announces DeFi-Level Yields for Users in US, EU and Canada – Crypto News

-

Technology4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others2 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNB Chain’s Prediction Markets Soar As Volume Crosses $20B – Crypto News

-

Technology1 week ago

Trump Speech in Iowa Today: Possible Impact on Stocks and Crypto Market – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin, Ethereum, Crypto News & Price Indexes – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Breaks Back To $3K As Traders Question Follow-Through – Crypto News

-

others1 week ago

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago4 In 10 US Merchants Now Accept Crypto – Crypto News

-

Business1 week ago

XRP Price Prediction After Ripple Treasury launch – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft shares slide as AI spending surges – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMetaplanet boosts forecasts despite Bitcoin write-down clouding annual results – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH price prediction as Ethereum prepares for ERC-8004 mainnet rollout – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI Tool of the Week: When translation understands context – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

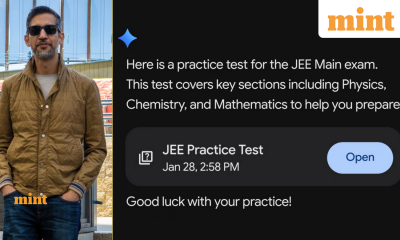

Metaverse5 days ago

Metaverse5 days agoGoogle Gemini launches JEE Main mock test papers: IIT Kharagpur alumnus Sundar Pichai goes nostalgic, ‘If I could…’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

Business4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology3 days ago

GLXY Stock Price Falls as Mike Novogratz’s Galaxy Digital Reports $482 Million Q4 Loss – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoBitcoin Unrealized Losses Reach 22% – Still No Capitulation Phase – Crypto News

-

Technology2 days ago

Technology2 days agoEmbedded Payments Help SaaS as AI Reshapes Workflows – Crypto News