others

AUD/USD keeps pushing against the 0.6800 resistance area on pre-holiday trading – Crypto News

- The Aussie, rejected at 0.6805, remains close to the 0.6800 resistance area.

- A mild risk aversion on the back of COVID-19 cases in China keeps AUD bulls in check.

- AUD/USD is set to end the year with a nearly 6.5% decline.

The Aussie has spiked up to two-week highs at 0.6805 during Friday’s European trading. although the pair is lacking follow-through above the 0.6800 resistance area and has retreated to 0.6795 so far.

The AUD remains bid on a sluggish market session

The Australian Dollar appreciates for the sixth consecutive day on Friday, unfazed by the moderate risk aversion, with the USD showing a soft tone across the board.

On Thursday, the US Department of Labor reported an increase of 9,000 on the weekly jobless claims, to a total amount of 225K. Continuous claims rose to 1.71M from 1.669M in the same week, which increased doubts about the US economic momentum and added selling pressure to the USD.

The pair however is hesitating at 0.6800 amid the growing uncertainty regarding the evolution of the recent COVID-19 outbreak in China, which has dampened previous hopes of a strong rebound in the Chinese economy and is casting doubts about the global economic outlook,

AUD/USD, on track to a nearly 6.5% decline in 2022

Looking back, the US Dollar is about to post solid performance in 2022, having appreciated about 6.5% over the last 12 months.

After a rather positive year opening, the risk-sensitive Aussie dropped steadily from March on, as the Russian invasion in Ukraine hammered risk appetite and heightened fears of a global economic slowdown.

At the same time, the aggressive monetary tightening pace adopted by the Federal Reserve, which has raised rates by 425 basis points in 2022 acted as a tailwind for the US Dollar.

The pair bottomed at a two-year low at 0.6175 in October and has been appreciating steadily ever since as speculation about an economic recession in the US and expectations of a slower fed Monetary tightening next year has hurt USD’s demand across the board.

Technical levels to watch

-

others1 week ago

David Schwartz To Step Down as Ripple CTO, Delivers Heartfelt Message to XRP Community – Crypto News

-

Technology1 week ago

Technology1 week agoEngineers are chasing ₹30 lakh offers—but not from startups – Crypto News

-

Technology1 week ago

Technology1 week agoEinride Raises $100 Million for Road Freight Technology Solutions – Crypto News

-

others1 week ago

Dogecoin Price Prediction – Chart Set-Up Highlights Perfect Buying Opportunity With Outflows Backing $0.45 – Crypto News

-

Technology1 week ago

Fed’s Goolsbee Cites Inflation Worries in Case Against Further Rate Cuts – Crypto News

-

others1 week ago

Ireland AIB Manufacturing PMI increased to 51.8 in September from previous 51.6 – Crypto News

-

Blockchain2 days ago

Blockchain2 days agoIt’s About Trust as NYSE Owner, Polymarket Bet on Tokenization – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCiti Integrates Token Services Platform With Clearing Solution – Crypto News

-

Technology1 week ago

Bloomberg Analyst Says XRP ETF Approval Odds Now 100% as Expert Eyes $33 Rally – Crypto News

-

Technology1 week ago

Breaking: BNB Chain Account Hacked With Founder CZ Shown Promoting Meme Coin – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin’s rare September gains defy history: Data predicts a 50% Q4 rally to 170,000 dollars – Crypto News

-

Technology1 week ago

Technology1 week agoWhich ChatGPT features are restricted under parental controls introduced by OpenAI? – Crypto News

-

Technology1 week ago

Technology1 week agoUS SEC weighs tokenised stock trading on crypto exchanges – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWatch These Key Bitcoin Metrics as BTC Price Prepares for ‘Big Move’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXPL, Not XRP: Why Are Whales Shoveling Ripple’s Rival? – Crypto News

-

Technology1 week ago

Technology1 week agoCAKE eyes 60% rally as PancakeSwap hits $772B trading all-time high – Crypto News

-

Technology1 week ago

Technology1 week agoNasdaq-listed Helius Medical Technologies rebrands as Solana Company – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto Market Prediction: Shiba Inu (SHIB) Moon Landing, Dogecoin (DOGE) Trapped in $0.23, XRP: Most Important Event for $3 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bullish Pattern That Suggests New Highs – Crypto News

-

others1 week ago

Japan Industrial Production (YoY) declined to -1.3% in August from previous -0.4% – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump Pulls Brian Quintenz Nomination for CFTC – Crypto News

-

Technology1 week ago

Breaking: BNB Chain Account Hacked With Founder CZ Shown Promoting Meme Coin – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Bounces as Crypto Market Turns Green: Where Do Prices Go Next? – Crypto News

-

Technology1 week ago

Technology1 week agoFTT price on the edge as FTX creditors brace for $1.6B payout on Sept. 30 – Crypto News

-

Cryptocurrency1 week ago

BREAKING: BlackRock Amends Bitcoin ETF (IBIT), Ethereum ETF (ETHA) Amid New Milestone – Crypto News

-

Technology1 week ago

Technology1 week agoiQOO 15 key specifications leaked ahead of launch: Here’s what to expect – Crypto News

-

others1 week ago

Japan Tankan Large All Industry Capex climbed from previous 11.5% to 12.5% in 3Q – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slips as U.S. Government Shutdown Looms – Crypto News

-

De-fi1 week ago

De-fi1 week agoAndre Cronje’s Flying Tulip Raises $200 Million Ahead of ICO – Crypto News

-

others1 week ago

others1 week agoEUR/GBP supported by dovish BoE tone and persistent UK fiscal headwinds – Crypto News

-

Business1 week ago

Legal Expert Breaks Down XRP’s Appeal as Ripple SWIFT Debate Heats Up – Crypto News

-

Technology1 week ago

SEC Chair Paul Atkins Says Crypto Is Top Priority At SEC CFTC Roundtable – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHorizen (ZEN) gains 12% to break above $7 – Crypto News

-

Technology1 week ago

Technology1 week agoAltcoins today: Perpetual tokens shed over $1.3B as ASTER, AVNT, and APEX tumble – Crypto News

-

De-fi1 week ago

De-fi1 week agoHyperliquid’s Hypurr NFTs Settle at $55,000 Floor Amid Ecosystem Expansion – Crypto News

-

Business1 week ago

Crypto Stakeholders Push Back as Banks Seek Yield Ban Provision in CLARITY Act – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle Nano Banana trend: 50 AI prompts to transform men’s selfies into retro-golden Durga Puja portraits – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWho is Alexandr Wang? Meta AI chief and 28-year-old billionaire urges teens to spend ‘all their time’ on this activity – Crypto News

-

Technology1 week ago

Technology1 week agoChainlink and Swift allow banks to access blockchain through existing systems – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks rose from previous ¥-1747.5B to ¥-963.3B in September 26 – Crypto News

-

Cryptocurrency1 week ago

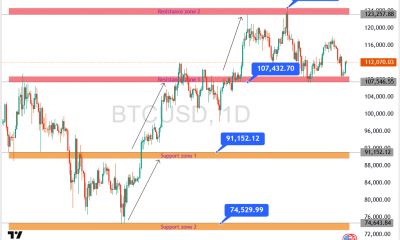

Cryptocurrency1 week agoBitcoin Climbs Above $112K, But $125K Resistance Looms Large – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum whales return to the market: Is ETH ready for $10K? – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Up as Investors Weigh Fed Moves and Government Shutdown Risks – Crypto News

-

others1 week ago

New Zealand ANZ Business Confidence fell from previous 49.7 to 49.6 in September – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDX Terminal Tops NFT Sales Count in September as Base Dominates Top 10 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDX Terminal Tops NFT Sales Count in September as Base Dominates Top 10 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Founder Dumps Billions In These Meme Coins, Is This A Repeat Of Shiba Inu In 2021? – Crypto News

-

Technology1 week ago

Breaking: SEC Moves To Allow On-Chain Stock Trading Alongside Crypto Amid Tokenization Push – Crypto News

-

Business1 week ago

SUI Price Eyes $4.5 as Coinbase Futures Listing Sparks Market Optimism – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Split Over Proposed Upgrade That Could Censor Transactions – Crypto News