others

AUD/USD softens to near 0.6300 as China’s CPI contracts in February – Crypto News

- AUD/USD edges lower to around 0.6305 in Monday’s early Asian session.

- China’s February CPI fell into negative territory for the first time since January last year.

- US Nonfarm Payrolls rose by 151,000 in February vs. 160,000 expected.

The AUD/USD pair weakens to near 0.6305 during the early Asian session on Monday. The disappointing Chinese economic data over the weekend weighs on the China-proxy Australian Dollar (AUD). However, the concerns over a looming slowdown in the US economy might help limit the pair’s losses.

Data released by the National Bureau of Statistics on Sunday showed that China’s Consumer Price Index (CPI) fell by 0.7% YoY in February, compared to 0.5% growth in January. This figure came in softer than the estimation of a 0.5% decline. On a monthly basis, Chinese CPI inflation came in at -0.2% in February versus January’s 0.7%, softer than -0.1% expected.

Meanwhile, the country’s Producer Price Index (PPI) declined 2.2% YoY in February, following a 2.3% fall in January. The data came in below the market consensus of -2.1%. Deflationary pressures continue to weigh on the world’s second-largest economy, which exerts some selling pressure on the Aussie.

On the other hand, the cautious stance from the Reserve Bank of Australia (RBA) might support the AUD against the US Dollar (USD). The RBA is cautious about lowering the benchmark interest rate further and the decision to reduce its rate in February does not mean that the central bank is committed to cutting again at coming meetings, the minutes of the RBA meeting held on February 17 and 18 showed.

The US Nonfarm Payrolls (NFP) rose by 151,000 in February, followed by the 125,000 increase (revised from 143,000) seen in January, the US Bureau of Labor Statistics (BLS) showed Friday. This figure came in weaker than the market expectation of 160,000. The weaker-than-expected job growth in the United States could undermine the Greenback and act as a tailwind for the AUD/USD.

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

De-fi7 days ago

De-fi7 days agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Technology1 week ago

Ethereum Supercycle Strengthens as SharpLink Gaming Withdraws $78.3M in ETH – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

Business7 days ago

Business7 days agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

De-fi7 days ago

De-fi7 days agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Technology7 days ago

Technology7 days agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Stock-To-Flow ModelIsn’t the Best BTC Forecast Model: Analyst – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

others1 week ago

GBP flat vs. USD with notably muted reaction to retail sales & PMI data – Scotiabank – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

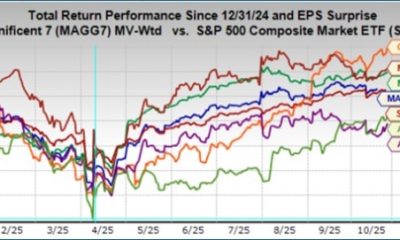

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Reversal Sends Price Towards $1, DOGE Treasury to Go Public, Bitcoin Beats Gold, Binance’s CZ Pardoned — Top Weekly Crypto News – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News