others

Australian Dollar attempts to snap recent losses as Australia’s inflation rises, commodity prices decline – Crypto News

- Australian Dollar snaps the losing streak due to a rise in monthly CPI.

- Australia’s inflation reported a reading of 5.2% as expected, up from the 4.9% prior.

- US Dollar (USD) trades around 106.30, the highest since December.

- Upbeat US Treasury yields are contributing support for the Greenback.

The Australian Dollar (AUD) looks to snap a two-day losing streak against the US Dollar (USD) after Australia’s inflation data release, which showed an expected rise in August. However, the AUD/USD pair is failing to capitalize on hot Australian Consumer Price Index (CPI) inflation data due to risk aversion. The decline in commodity prices is capping the upside in the AUD.

Reserve Bank of Australia’s (RBA) Minutes from the September monetary policy meeting suggested that if inflation proves to be more enduring than expected, there may be a need for further tightening.

However, the argument for keeping the current policy unchanged appeared to be more compelling. As a result, this could also potentially limit the upside potential of the AUD/USD pair.

The US Dollar Index (DXY) trades around its highest level since December. This strength in the US Dollar is supported by the upbeat US Treasury yields. The yield on the 10-year US bond note has risen to a level not seen since October 2007.

United States (US) upbeat data released on Tuesday is reinforcing the strength of the Dollar. US Consumer Confidence along with Building Permits and House Price Index improved in the reported period.

Moreover, most members of the US Federal Reserve (Fed) still anticipate further interest rate increases later in the year, which could be attributed to robust economic activities in the US. The Fed recently made the decision to keep the interest rate within the range of 5.25% to 5.50%, maintaining the status quo.

Daily Digest Market Movers: Australian Dollar looks to more downside amid firmer US Dollar

- Australia’s Monthly Consumer Price Index (YoY) for August rose to 5.2% as expected, up from the previous rate of 4.9%.

- The upcoming October 3 meeting, which will be Michele Bullock’s first as a Governor of RBA, is not currently anticipated by the market to result in a rate hike.

- Expectations for a rate increase are on the rise for the November and December meetings by RBA.

- According to Bloomberg’s World Interest Rate Probability (WIRP), the likelihood of another rate hike increases to 85% for the first quarter of the following year.

- Market participants will focus on Australia’s Retail Sales for August on Thursday, which is expected to grow by 0.3% lower than the previous rate of 0.5%.

- The hawkish remarks from Fed officials have led to a broad-based strengthening of the US Dollar (USD) and have acted as a headwind for the AUD/USD pair.

- US Consumer Confidence released on Tuesday for September rose by 103.0 from the previous reading of 108.7 in August.

- Building Permits improved to 1.541M in August from 1.443M prior. While the House Price Index (MoM) for July rose to 0.8% compared to the market expectations of 0.5% from the previous rate of 0.4%.

- Minneapolis Fed President Neel Kashkari stated on Tuesday that one more rate hike is expected through the end of this year 2023.

- Traders await the US Durable Goods Orders report to be released on Wednesday. Additionally, the Core Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred measure of consumer inflation, is due on Friday. The annual rate is expected to reduce from 4.2% to 3.9%.

Technical Analysis: Australian Dollar hovers around 0.6400 psychological level, barrier at 21-day EMA

Australian Dollar trades higher around 0.6400 psychological level during the Asian session on Wednesday. AUD/USD pair could find a barrier around the 21-day Exponential Moving Average (EMA) at 0.6433, followed by the 0.6450 psychological level. A firm break above the latter could support the Aussie Dollar (AUD) to explore the region around 26.6% Fibonacci retracement at 0.6484 level. On the downside, the AUD/USD pair could find the key support around the monthly low at 0.6357 aligned to the 0.6350 psychological level.

AUD/USD: Daily Chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

-

Technology3 days ago

Technology3 days agoChatGPT users are mass cancelling OpenAI subscriptions after GPT-5 launch: Here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoMeet Matt Deitke: 24-year-old AI whiz lured by Mark Zuckerberg with whopping $250 million offer – Crypto News

-

Technology1 week ago

Binance to List Fireverse (FIR)- What You Need to Know Before August 6 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoin Rally To Commence When These 2 Signals Activate – Details – Crypto News

-

Business1 week ago

Bitpanda Co-Founder & Co-CEO Paul Klanschek Steps Down as Firm Eyes Frankfurt IPO – Crypto News

-

Cryptocurrency1 week ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

Technology1 week ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

Technology1 week ago

Technology1 week agoBest computer set under ₹20000 for daily work and study needs: Top 6 affordable picks students and beginners – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStablecoins Are Finally Legal—Now Comes the Hard Part – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Business7 days ago

Analyst Spots Death Cross on XRP Price as Exchange Inflows Surge – Is A Crash Ahead ? – Crypto News

-

De-fi7 days ago

De-fi7 days agoTON Sinks 7.6% Despite Verb’s $558M Bid to Build First Public Toncoin Treasury Firm – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions down to ¥89.2K from previous ¥106.6K – Crypto News

-

Technology7 days ago

Technology7 days agoOppo K13 Turbo, K13 Turbo Pro to launch in India on 11 August: Expected price, specs and more – Crypto News

-

Blockchain6 days ago

Shiba Inu Team Member Reveals ‘Primary Challenge’ And ‘Top Priority’ Amid Market Uncertainty – Crypto News

-

others6 days ago

others6 days agoBank of America CEO Denies Alleged Debanking Trend, Says Regulators Need To Provide More Clarity To Avoid ‘Second-Guessing’ – Crypto News

-

Technology6 days ago

Technology6 days agoOpenAI releases new reasoning-focused open-weight AI models optimised for laptops – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoCrypto Market Might Be Undervalued Amid SEC’s New Stance – Crypto News

-

De-fi5 days ago

De-fi5 days agoCoinbase Pushes for ZK-enabled AML Overhaul Just Months After Data Breach – Crypto News

-

others1 week ago

Major Ripple Partner Reveals Bold Plans for RLUSD, ETFs And Global Payments – Crypto News

-

Technology1 week ago

Why is Toncoin Up Today Despite Crypto Market Crash? – Crypto News

-

Technology1 week ago

Will The First Spot XRP ETF Launch This Month? SEC Provides Update On Grayscale’s Fund – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Sale deals on smartwatches: Up to 70% off on Samsung, Apple and more – Crypto News

-

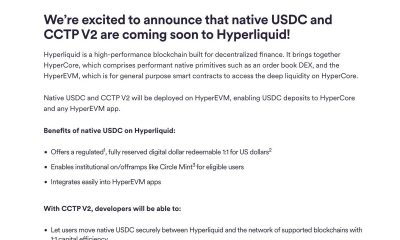

De-fi1 week ago

De-fi1 week agoCircle Extends Native USDC to Sei and Hyperliquid in Cross-Chain Push – Crypto News

-

Business1 week ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoLido Slashes 15% of Staff, Cites Operational Cost Concerns – Crypto News

-

others7 days ago

others7 days agoIs Friday’s sell-off the beginning of a downtrend? – Crypto News

-

others7 days ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

Business7 days ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

others6 days ago

MetaPlanet Launches Online Clothing Store As Part of ‘Brand Strategy’ – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoChatGPT won’t help you break up anymore as OpenAI tweaks rules – Crypto News

-

Technology6 days ago

Technology6 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

Technology6 days ago

Technology6 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

others5 days ago

others5 days agoUS President Trump issues executive order imposing additional 25% tariff on India – Crypto News

-

Business5 days ago

Analyst Predicts $4K Ethereum Rally as SEC Clarifies Liquid Staking Rules – Crypto News

-

Business5 days ago

XRP Price Prediction As $214B SBI Holdings Files for XRP ETF- Analyst Sees Rally to $4 Ahead – Crypto News

-

others4 days ago

others4 days agoEUR firmer but off overnight highs – Scotiabank – Crypto News

-

Blockchain4 days ago

Blockchain4 days agoTrump to Sign an EO Over Ideological Debanking: Report – Crypto News

-

De-fi4 days ago

De-fi4 days agoRipple Expands Its Stablecoin Payments Infra with $200M Rail Acquisition – Crypto News

-

Technology1 week ago

Technology1 week agoMeta AI could be a threat to your privacy: Here’s how to silence it on WhatsApp, Instagram and Facebook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Festival Sale 2025 vs Flipkart Freedom Sale: Comparing MacBook deals – Crypto News

-

Business1 week ago

India’s Jetking Targets 21,000 Bitcoin By 2032 As CFO Foresees $1M+ Price – Crypto News

-

others1 week ago

SharpLink Buys the Dip, Acquires $100M in ETH for Ethereum Treasury – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Stall as Trump’s Crypto Policy Report Fails to Spark Momentum – Crypto News

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg)