others

Australian Dollar consolidates near the major level post-release of the RBA minutes – Crypto News

- Australian Dollar continues to gain post-release of the RBA Meeting Minutes.

- RBA board members favored to maintain the current interest rates.

- US Dollar faces challenges due to the dovish comments made by multiple Fed members.

The Australian Dollar (AUD) extends its gains on the second successive day, remaining firmer against the US Dollar on Tuesday. The pair receives upward support after the hawkish Reserve Bank of Australia (RBA) minutes for the October 2023 meeting were released on Tuesday.

Australia’s central bank board was involved in the consideration of whether to raise interest rates by 25 basis points (bps) or to maintain the current rate. However, the board members concluded that the stronger case was to keep the rates steady. They made this judgment based on factors such as inflation data, employment figures, and updated forecasts, which would be available at the November meeting.

RBA’s board members acknowledged that there were significant concerns about upside risks to inflation. This suggests that the board is cautious about potential factors that could lead to an increase in inflation

Australian Weekly ANZ Roy Morgan Consumer Confidence survey, released on Tuesday, indicates a decline in the nation’s Consumer Confidence. The reading fell to 76.4 compared to the previous figure of 80.1. The decline is observed across all sub-indices, reflecting a more cautious or negative sentiment among consumers.

The US Dollar Index (DXY) faces downward pressure, and this is attributed to the dovish comments made by multiple Federal Reserve officials indicating that no further interest rate hikes are anticipated for the remainder of 2023. The dovish stance suggests a cautious approach by the central bank, emphasizing a reluctance to tighten monetary policy in the current economic environment.

Federal Reserve Bank of Philadelphia President Patrick Harker added to this sentiment by stating on Monday that the central bank should avoid creating new pressures in the economy by increasing the cost of borrowing. Harker further expressed the view that in the absence of a significant shift in the data, the Fed should maintain interest rates at their current levels.

Daily Digest Market Movers: Australian Dollar continues to gain on hawkish RBA minutes

- RBA could introduce a central bank digital currency (CBDC). Brad Jones, Assistant Governor (Financial System) at the RBA, discussed the tokenization of assets and money in the digital era at The Australian Financial Review Cryptocurrency Summit.

- Australian Consumer Inflation Expectations for October were reported at 4.8% on Thursday, reflecting a slight increase from the September figure of 4.6%. The rebound in inflation observed in August, primarily influenced by elevated oil prices, raises the likelihood of another interest rate hike by the RBA.

- The National Bureau of Statistics of China reported on Friday that Chinese inflation experienced a decrease in September. This development could exert pressure on the Australian Dollar (AUD). The Chinese data indicates ongoing economic challenges despite the recent government stimulus plan aimed at supporting the nation in achieving its 5% growth target.

- The ongoing conflict in the Middle East introduces an additional layer of complexity to the situation. This geopolitical factor could potentially prompt the RBA to implement a 25 basis points (bps) interest rate hike, reaching 4.35% by the end of the year.

- Investors appear to be exercising caution in making aggressive bets on the US Dollar (USD), given the uncertainty surrounding the Fed policy rate trajectory. The lack of a clear direction from the Fed on interest rates is influencing market sentiment and contributing to hesitancy among investors.

- The recovery in US Treasury yields from recent losses is seen as a potential factor that could provide support to the US Dollar. The 10-year US Treasury bond yield stands at 4.72%, by the press time.

- Additionally, the USD continues to benefit from safe-haven flows amid rising geopolitical tensions between Israel and Palestine. Safe-haven currencies, including the US Dollar, tend to attract demand during periods of heightened uncertainty and geopolitical risks.

- According to an undisclosed source to Reuters, US officials and Israel have engaged in discussions about the possibility of a visit by US President Joe Biden to Israel. The invitation for the visit reportedly came from Israeli Prime Minister Benjamin Netanyahu.

- Market participants will likely monitor the US Retail Sales and the Fed Beige Book report will also be eyed on Tuesday. The Australian employment data will be released on Thursday. Traders will take cues from these figures and find the trading opportunities around the AUD/USD pair.

Technical Analysis: Australian Dollar hovers around the psychological level at 0.6350 level

The Australian Dollar trades higher around the major level of 0.6350 during the Asian session on Tuesday. The 0.6300 emerges as the significant support level, which aligns with the monthly low at 0.6285. On the upside, a crucial resistance is observed at the major level of 0.6400. This level coincides with the 23.6% Fibonacci retracement level at 0.6429 and is lined up with the 50-day Exponential Moving Average (EMA) around the 0.6436 level. These technical indicators provide traders with insights into potential resistance zones that could influence the direction of the Australian Dollar.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.04% | 0.07% | 0.11% | -0.24% | -0.02% | -0.04% | 0.04% | |

| EUR | -0.05% | 0.03% | 0.05% | -0.28% | -0.08% | -0.09% | -0.01% | |

| GBP | -0.09% | -0.03% | 0.02% | -0.33% | -0.12% | -0.11% | -0.05% | |

| CAD | -0.10% | -0.06% | -0.03% | -0.34% | -0.13% | -0.14% | -0.07% | |

| AUD | 0.23% | 0.27% | 0.33% | 0.34% | 0.20% | 0.20% | 0.26% | |

| JPY | 0.02% | 0.07% | 0.11% | 0.13% | -0.21% | -0.01% | 0.06% | |

| NZD | 0.04% | 0.10% | 0.13% | 0.14% | -0.19% | 0.02% | 0.07% | |

| CHF | -0.05% | 0.01% | 0.05% | 0.07% | -0.27% | -0.07% | -0.07% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

-

Technology3 days ago

Technology3 days agoChatGPT users are mass cancelling OpenAI subscriptions after GPT-5 launch: Here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoMeet Matt Deitke: 24-year-old AI whiz lured by Mark Zuckerberg with whopping $250 million offer – Crypto News

-

Technology1 week ago

Binance to List Fireverse (FIR)- What You Need to Know Before August 6 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoin Rally To Commence When These 2 Signals Activate – Details – Crypto News

-

Cryptocurrency1 week ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

Technology1 week ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

Technology1 week ago

Technology1 week agoBest computer set under ₹20000 for daily work and study needs: Top 6 affordable picks students and beginners – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStablecoins Are Finally Legal—Now Comes the Hard Part – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Business1 week ago

Analyst Spots Death Cross on XRP Price as Exchange Inflows Surge – Is A Crash Ahead ? – Crypto News

-

De-fi7 days ago

De-fi7 days agoTON Sinks 7.6% Despite Verb’s $558M Bid to Build First Public Toncoin Treasury Firm – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions down to ¥89.2K from previous ¥106.6K – Crypto News

-

Technology7 days ago

Technology7 days agoOppo K13 Turbo, K13 Turbo Pro to launch in India on 11 August: Expected price, specs and more – Crypto News

-

Blockchain7 days ago

Shiba Inu Team Member Reveals ‘Primary Challenge’ And ‘Top Priority’ Amid Market Uncertainty – Crypto News

-

others7 days ago

others7 days agoBank of America CEO Denies Alleged Debanking Trend, Says Regulators Need To Provide More Clarity To Avoid ‘Second-Guessing’ – Crypto News

-

Technology6 days ago

Technology6 days agoOpenAI releases new reasoning-focused open-weight AI models optimised for laptops – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoCrypto Market Might Be Undervalued Amid SEC’s New Stance – Crypto News

-

De-fi5 days ago

De-fi5 days agoCoinbase Pushes for ZK-enabled AML Overhaul Just Months After Data Breach – Crypto News

-

Technology1 week ago

Why is Toncoin Up Today Despite Crypto Market Crash? – Crypto News

-

Technology1 week ago

Will The First Spot XRP ETF Launch This Month? SEC Provides Update On Grayscale’s Fund – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Sale deals on smartwatches: Up to 70% off on Samsung, Apple and more – Crypto News

-

others1 week ago

SharpLink Buys the Dip, Acquires $100M in ETH for Ethereum Treasury – Crypto News

-

De-fi1 week ago

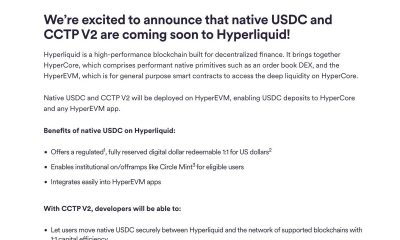

De-fi1 week agoCircle Extends Native USDC to Sei and Hyperliquid in Cross-Chain Push – Crypto News

-

Business1 week ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Trade Meme Coins in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLido Slashes 15% of Staff, Cites Operational Cost Concerns – Crypto News

-

others1 week ago

others1 week agoIs Friday’s sell-off the beginning of a downtrend? – Crypto News

-

others7 days ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

Business7 days ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

others7 days ago

MetaPlanet Launches Online Clothing Store As Part of ‘Brand Strategy’ – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoChatGPT won’t help you break up anymore as OpenAI tweaks rules – Crypto News

-

Technology6 days ago

Technology6 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

Technology6 days ago

Technology6 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

others6 days ago

others6 days agoUS President Trump issues executive order imposing additional 25% tariff on India – Crypto News

-

Business6 days ago

Analyst Predicts $4K Ethereum Rally as SEC Clarifies Liquid Staking Rules – Crypto News

-

Business5 days ago

XRP Price Prediction As $214B SBI Holdings Files for XRP ETF- Analyst Sees Rally to $4 Ahead – Crypto News

-

others5 days ago

others5 days agoEUR firmer but off overnight highs – Scotiabank – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump to Sign an EO Over Ideological Debanking: Report – Crypto News

-

De-fi5 days ago

De-fi5 days agoRipple Expands Its Stablecoin Payments Infra with $200M Rail Acquisition – Crypto News

-

Cryptocurrency3 days ago

DWP Management Secures $200M in XRP Post SEC-Win – Crypto News

-

Business1 week ago

Is Powell Next As Fed Governor Adriana Kugler Resigns? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Festival Sale 2025 vs Flipkart Freedom Sale: Comparing MacBook deals – Crypto News

-

Business1 week ago

India’s Jetking Targets 21,000 Bitcoin By 2032 As CFO Foresees $1M+ Price – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Stall as Trump’s Crypto Policy Report Fails to Spark Momentum – Crypto News

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg)