others

Australian Dollar rises above the psychological level on anticipation of Fed rate cuts – Crypto News

- Australian Dollar sustains a bullish sentiment on the dovish outlook from the Fed.

- Australian Trade Minister Don Farrell conveyed confidence that China will eliminate punitive tariffs on Australian wine.

- PBoC is scheduled to announce its Interest Rate Decision on Wednesday.

- Fed members’ comments on interest rate cut weigh on US Dollar.

The Australian Dollar (AUD) continues its winning streak that began on Wednesday. The AUD/USD pair received upward support in anticipation of rate cuts by the Federal Reserve (Fed), which weighs on the US Dollar (USD).

Australia’s economy showcases resilience, buoyed by strong employment outcomes and increasing incomes, as data released last week indicates. Additionally, the enhanced Purchasing Managers Index (PMI) data for December has bolstered the Australian Dollar.

Traders are expected to observe the Meeting Minutes from the Reserve Bank of Australia (RBA) set to be released on Tuesday, alongside Building Permits and Housing Starts data from Australia. Furthermore, on Wednesday, the People’s Bank of China (PBoC) is scheduled to announce its Interest Rate Decision, adding to the key events influencing the Aussie Dollar.

Australian Trade Minister Don Farrell expressed confidence on Sky News TV that China will remove punitive tariffs on Australian wine. Notably, China has already lifted trade restrictions on the majority of Australian exports that had been previously imposed, indicating a gradual improvement in relations between the two countries.

The US Dollar Index (DXY) grapples to maintain its position after rebounding from a four-month low at 101.77 marked on Thursday. The DXY received support from the improved short-term yield on the US Treasury bond. The 2-year US bond yield improved to 4.48% on Friday.

Additionally, the moderate preliminary Purchasing Managers Index (PMI) for December contributed support for the USD. S&P Global Services PMI rose to 51.3 from 50.8 prior. While Manufacturing PMI declined to 48.2 from 49.4. Investors will focus on Consumer Confidence and Existing Home Sales Change on Wednesday.

However, the Greenback encounters challenges stemming from a weakened sentiment, primarily influenced by the Federal Open Market Committee’s (FOMC) dovish statement. Additionally, dovish remarks from various Fed members exert pressure on the Greenback.

Atlanta Fed President Raphael Bostic, on Friday, anticipated a potential interest rate cut in the third quarter of 2024 if inflation follows the expected trajectory. Furthermore, Chicago Fed President Austan Goolsbee did not rule out the possibility of a rate cut at the Fed’s meeting next March.

Daily Digest Market Movers: Australian Dollar seems hawkish as economy shows resilience

- The preliminary Judo Bank Composite PMI improved to 47.4 from the previous reading 46.2. The Manufacturing PMI for the same period registered 47.8, a slight increase from the prior figure of 47.7. Additionally, the Services PMI grew to 47.6 compared to the previous reading of 46.0.

- Australia’s Consumer Inflation Expectations for December eased at 4.5% against the previous figures of 4.9%.

- The seasonally adjusted Aussie Employment Change (Nov) improved substantially to 61.5K compared to the expected 11.0K. Unemployment Rate rose to 3.9% from 3.7% previously.

- The People’s Bank of China (PBoC) kept its 1-year Medium-term Lending Facility (MLF) rate unchanged at 2.5%. Additionally, PBoC injected 1.45 trillion Yuan to bolster bank liquidity as 650 billion Yuan worth of MLF loans were matured.

- The National Bureau of Statistics of China revealed that Industrial Production (YoY) improved to 6.6% in November from 4.6% prior, exceeding the market expectation of 5.6%. However, China Retail Sales (YoY) rose to 10.1% from 7.6% prior, falling short of the market consensus of a 12.5% rise.

- Federal Reserve (Fed) maintained interest rates at 5.5% in its December policy meeting as expected. Markets are now projecting three rate cuts for 2024.

- US Retail Sales (MoM) rose 0.3% in November, compared to the expected decline of 0.1%. Initial Jobless Claims for the week ending on December 8 came in at 202K against the 220K expected.

Technical Analysis: Australian Dollar hovers around the 0.6700 post testing recent high

The Australian Dollar hovers around 0.6700 on Monday, having recently tested a five-month high at 0.6728 on Friday. A prevailing bullish sentiment could propel the AUD/USD pair to surpass the recent high and approach the pivotal barrier at 0.6750. On the downside, noteworthy support lies at 0.6650, followed by the 23.6% Fibonacci retracement at 0.6619, and subsequently reaching the psychological support at 0.6600, aligned with the 21-day Exponential Moving Average (EMA) at 0.6597.

AUD/USD: Daily Chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.14% | -0.17% | -0.03% | -0.22% | -0.06% | -0.45% | -0.11% | |

| EUR | 0.14% | -0.02% | 0.12% | -0.08% | 0.08% | -0.31% | 0.03% | |

| GBP | 0.17% | 0.03% | 0.13% | -0.06% | 0.08% | -0.28% | 0.06% | |

| CAD | 0.03% | -0.12% | -0.16% | -0.22% | -0.04% | -0.45% | -0.09% | |

| AUD | 0.22% | 0.08% | 0.06% | 0.20% | 0.16% | -0.23% | 0.11% | |

| JPY | 0.07% | -0.08% | -0.09% | 0.05% | -0.14% | -0.38% | -0.03% | |

| NZD | 0.45% | 0.31% | 0.28% | 0.43% | 0.23% | 0.39% | 0.34% | |

| CHF | 0.11% | -0.03% | -0.05% | 0.09% | -0.11% | 0.02% | -0.34% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

RBA FAQs

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

-

Blockchain7 days ago

Blockchain7 days agoEthereum Price Performance Could Hinge On This Binance Metric — Here’s Why – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoOpenLedger Invests $25 Million to Combat ‘Extractive’ AI Economy – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Ready to Ditch His Tesla Amid Musk Feud? (Report) – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump-Elon feud Erupts, Crypto falls, Coinbase to list Fartcoin – Crypto News

-

others1 week ago

others1 week agoCanadian Dollar gives back gains despite upbeat jobs data – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

others6 days ago

others6 days agoGold price in India: Rates on June 10 – Crypto News

-

Technology4 days ago

Technology4 days agoCircle IPO shows strong crypto market investor demand – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft integrates AI shopping into Copilot app, bringing price tracking and smart comparisons – Crypto News

-

Technology1 week ago

Technology1 week agoGemini can now schedule tasks, send reminders and keep you on track: Here’s how it works – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: Resident Evil Requiem release date revealed, OnePlus 13s makes India debut and more – Crypto News

-

Technology1 week ago

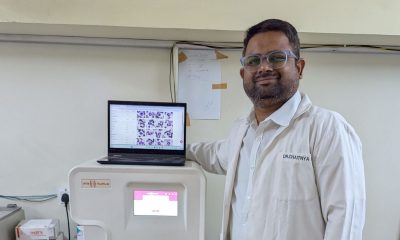

Technology1 week agoHow artificial intelligence caught leukaemia in Maharashtra’s Parbhani – Crypto News

-

Technology7 days ago

Technology7 days agoOpenAI CEO Sam Altman says AI is like an intern today, but it will soon match experienced software engineers – Crypto News

-

others1 week ago

others1 week agoGold prices fall as the USD extends gains post NFP – Crypto News

-

Technology7 days ago

Technology7 days agoIndia targets indigenous 2nm, Nvidia-level GPU by 2030 – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoTRON: Who’s fueling TRX’s breakout? It’s not whales, here’s the answer! – Crypto News

-

Technology1 week ago

Technology1 week agoThe Quiet Voices Questioning China’s AI Hype – Crypto News

-

others1 week ago

others1 week agoEUR/USD retreats from multi-week highs ahead of Eurozone GDP and consumption data – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus 13s review: A near-perfect compact phone, minus a few flagship perks – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

others5 days ago

others5 days agoStock Market Pullback in Sight As Several of America’s Problems Still Remain, Warns Former JPMorgan Strategist – Crypto News

-

Technology5 days ago

Technology5 days agoFather’s Day 2025 gift ideas: Smartwatch, Bluetooth speaker and more – Crypto News

-

others1 week ago

others1 week agoBitcoin Could Crash by Double-Digit Percentage Points in a ‘Quick Move’ if This Support Level Fails, Warns Crypto Trader – Crypto News

-

others1 week ago

others1 week agoGBP/USD slips as strong US jobs data cools Fed rate cut bets – Crypto News

-

others1 week ago

others1 week agoWidely Followed Analyst Outlines Bullish Path for Bitcoin, Says BTC Will Battle Gold and ‘Never Look Back’ – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-400x240.webp)

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStacks [STX] down 31% after Alex Protocol exploit – Details – Crypto News

-

others1 week ago

others1 week agoNew Yorkers Warned of Fake QR Codes Being Placed on Parking Meters That Steal Victims’ Payment Information – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUnion completes trusted setup to pave the way for trustless cross-chain DeFi – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoMaple Expands to Solana, Brings Yield-Bearing Stablecoin – Crypto News

-

Business1 week ago

Business1 week agoBusinesses Limit Pass-Through of Tariff Costs – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoThe transformer birthed GenAI. Meet the man who built it – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDeutsche Bank Considers Digital Asset Projects – Crypto News

-

Technology6 days ago

Technology6 days agoBP Puts AI at the Heart of Its Efforts to Boost Performance – Crypto News

-

others6 days ago

Japan Money Supply M2+CD (YoY) increased to 0.6% in May from previous 0.5% – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

De-fi5 days ago

De-fi5 days agoResolv Stablecoin Protocol’s Token Debuts at $300 Million Valuation – Crypto News

-

others1 week ago

others1 week agoS&P 500 reaches 6,000 for first time since February on NFP print – Crypto News

-

others1 week ago

others1 week agoMichael Saylor Doubling Down on Bitcoin Price Prediction As BTC Holds $100,000 Level – Crypto News

-

others7 days ago

others7 days agoAnalyst Says Bitcoin Has ‘Pretty Good’ Chance of Hitting Massive Price Target in 2026, Citing Three Technical Signals – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoResistance Persists at $2,700 But Buyer Appetite Grows – Crypto News

-

others5 days ago

others5 days agoARK Invest’s Cathie Wood Unveils Massive Price Target for Tesla (TSLA) in Five Years Fueled by Robotaxi Platform – Crypto News

-

Technology5 days ago

Technology5 days agoOne Tech Tip: How to protect your 23andMe genetic data – Crypto News

-

Technology4 days ago

Technology4 days agoOnePlus Nord 5 and Nord CE 5 tipped to launch on 8 July with big battery upgrades and MediaTek chipsets – Crypto News

-

Technology4 days ago

Technology4 days agoCloud Giants Hit Slow Lane as Legacy Systems Stall Upgrades – Crypto News

-

Business4 days ago

Business4 days agoDatabricks Projects $1 Billion Revenue From Data Warehouse Biz – Crypto News

-

Technology1 week ago

Technology1 week agoHong Kong stablecoin regulation: New crypto law explained – Crypto News