others

Bank of Canada set to cut interest rate for second consecutive meeting – Crypto News

The Bank of Canada (BoC) is widely expected to trim its benchmark interest rate by another quarter point on Wednesday, bringing it down to 2.25%. That would follow a similar move in September as the central bank continues its gradual easing cycle.

The case for more cuts has been building. Growth has stalled, the labour market has lost momentum, and inflation remains stubbornly above target. Canada’s economy shrank by 1.6% in the second quarter, worse than forecast, while the job market surprised with a 60K gain in September, keeping the Unemployment Rate steady at 7.1%.

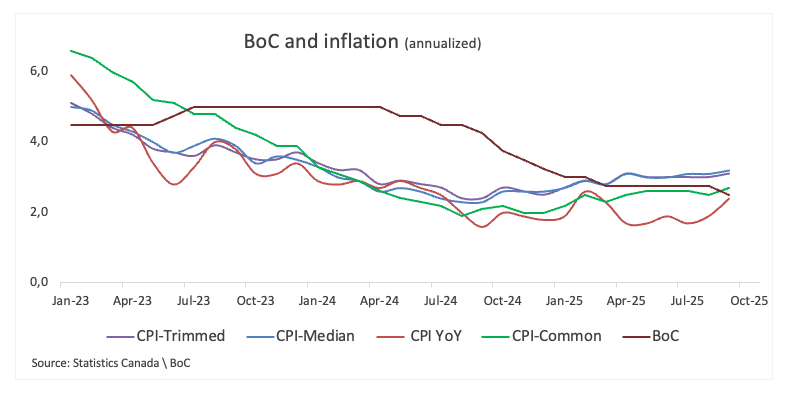

Inflation remains a sticking point. Headline CPI rose 2.4% YoY last month, surpassing expectations, and core CPI climbed to 2.8%. The Bank’s preferred measures—Common, Trimmed, and Median CPI—also nudged higher to 2.7%, 3.1%, and 3.2%, respectively.

Back in September, the BoC cut rates by 25 basis points to 2.50%, a move that markets had fully priced in. After that meeting, Governor Tiff Macklem struck a cautious tone, saying the inflation picture hadn’t changed much in the last few months. He pointed to mixed data and emphasised a meeting-by-meeting approach. While inflationary pressures appear somewhat more contained, he stressed that the Bank stands ready to act if risks start to tilt higher.

Previewing the BoC’s interest rate decision, analysts at TD Securities noted, “We look for the Bank of Canada to cut rates by 25 bps to 2.25% in October, which we believe will mark the endpoint of its easing cycle. We do not believe stronger September data will be enough to keep the Bank on hold, but it should contribute to a more balanced tone in the statement as the Bank stresses a data-dependent approach going forward.”

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision on Wednesday at 13:45 GMT, followed by Governor Tiff Macklem’s press conference at 14:30 GMT.

Markets are already braced for a rate cut and pricing around 31 basis points of easing by the end of the year.

According to FXStreet’s Senior Analyst Pablo Piovano, the Canadian Dollar (CAD) has been consolidating near the upper end of its recent range, near the key 1.4000 mark. He notes that as long as USD/CAD holds above the 200-day simple moving average (SMA) around 1.3950, the pair could have more room to climb.

A renewed bullish tone, Piovano adds, could see USD/CAD retesting the October peak at 1.4080 (October 14), before potentially eyeing the April high at 1.4414 (April 1).

On the flip side, he points out that strong support sits around the 200-day SMA at 1.3952, seconded by the transitory 55-day and 100-day SMAs at 1.3887 and 1.3799, respectively. A break below that zone might open the door to the September floor at 1.3726 (September 17), with the July base at 1.3556 (July 3) coming into view if selling pressure deepens.

“Momentum indicators are still tilted to the upside,” Piovano adds. “The Relative Strength Index (RSI) is hovering near 57, while the Average Directional Index (ADX) stands near 37, suggesting the trend remains strong.”

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

Technology1 week ago

Technology1 week agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

others1 week ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

others1 week ago

others1 week agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

others1 week ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

others1 week ago

Data Shows Bitcoin Short Squeeze Likely With Speculation of “Bullish” US CPI – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Recover Slightly as Fed Signals Rate Cut, End of QT – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar pares gains as US Dollar steadies on easing US-China tensions – Crypto News

-

Technology1 week ago

Technology1 week agoAWS says it has fixed the problem that crippled half the internet but many popular apps are still down – Crypto News

-

others1 week ago

others1 week agoAUD/USD rises on US-China trade hopes, Fed rate cut outlook – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Recover Slightly as Fed Signals Rate Cut, End of QT – Crypto News

-

Business1 week ago

Solana Price Eyes $240 Recovery as Gemini Launches SOL-Reward Credit Card – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Recover Slightly as Fed Signals Rate Cut, End of QT – Crypto News

-

others1 week ago

BREAKING: 21Shares Amends S-1 for Spot Dogecoin ETF Approval – Crypto News

-

Business1 week ago

Breaking: Michael Saylor’s Strategy Acquires 168 Bitcoin as Crypto Market Rebounds – Crypto News

-

others1 week ago

Analyst Predicts $10k ETH Price as Vitalik Buterin Launches Major Upgrade for Faster Proofs Systems – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Web Services outage: Here’s how many users are impacted and the downtime costs – Crypto News

-

Business1 week ago

Bitcoin Price Prediction as Gaussian Channel Turns Green Amid U.S.–China Trade Progress and Fed Rate Cut Hopes – Crypto News

-

Technology1 week ago

Technology1 week agoEthereum’s Vitalik Buterin applauds Polygon for pioneering ZK technology – Crypto News

-

Technology1 week ago

Technology1 week agoLayerZero outlook: ZRO price on the edge ahead of $43M token unlock – Crypto News

-

Technology1 week ago

Blockchain for Good Alliance and UNDP AltFinLab Launch Blockchain Impact Forum – Crypto News

-

Technology1 week ago

Blockchain for Good Alliance and UNDP AltFinLab Launch Blockchain Impact Forum – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoTokenized Deposits for Payments, Treasury – Crypto News

-

Business1 week ago

How Will “Unusual” US CPI Inflation Data Release Could Impact Fed Rate Cut, Crypto Market? – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi Earning Aggregator Turtle Raises $5.5 Million – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Whales Flood Binance With Massive Deposits – Selling Pressure Mounts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Weekly RSI Points To More Upside, But Can the Bulls Defend $107,000? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoTech layoffs: From Meta, Amazon to Google — these IT majors have cut AI related jobs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump Confirms Meeting With Xi Jinping on Oct 31, Markets Rally in Response – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAster price tanks 20% as sell-off pressure hits altcoins – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Founder Vitalik Buterin Explains GKR, Unbelievably Powerful Tech Scheme – Crypto News

-

Business1 week ago

Binance Founder CZ Predicts Bitcoin Will Flip Gold’s $30 Trillion Market – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoEight brilliant AI tools to supercharge productivity – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoEight brilliant AI tools to supercharge productivity – Crypto News

-

Technology1 week ago

ProShares Files for Index Crypto ETF Tracking Bitcoin, Ethereum, XRP, and Solana – Crypto News

-

Technology1 week ago

Technology1 week agoThinking of cancelling HBO Max? Subscription prices just went up – Here’s what you need to know – Crypto News

-

Technology7 days ago

$1.68 Trillion T. Rowe Price Files for First Active Crypto ETF Holding BTC, ETH, SOL, and XRP – Crypto News

-

others1 week ago

others1 week agoFocus shifts to Canadian inflation, trade jitters and US shutdown – Crypto News

-

![Nikkei Futures (NKD) reach historic highs, extending bullish rally [Video]](https://dripp.zone/news/wp-content/uploads/2025/10/Nikkei-Futures-NKD-reach-historic-highs-extending-bullish-rally-Video-400x240.jpg)

![Nikkei Futures (NKD) reach historic highs, extending bullish rally [Video]](https://dripp.zone/news/wp-content/uploads/2025/10/Nikkei-Futures-NKD-reach-historic-highs-extending-bullish-rally-Video-80x80.jpg) others1 week ago

others1 week agoNikkei Futures (NKD) reach historic highs, extending bullish rally [Video] – Crypto News

-

others1 week ago

Analyst Predicts $10k ETH Price as Vitalik Buterin Launches Major Upgrade for Faster Proofs Systems – Crypto News

-

Technology1 week ago

Fed’s Payments Conference: Waller Floats ‘Payment Account’ Framework to Support Crypto Innovation – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT down: Thousands of users unable to access AI chatbot, OpenAI says it is working on a fix – Crypto News

-

Business1 week ago

XRP Price Classical Pattern Points to a Rebound as XRPR ETF Hits $100M Milestone – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoBezos fund believes AI can save the planet. Nvidia, Google are all-in. – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoCrypto update: Bitcoin and Ethereum are stable as market’s focus shifts to US inflation data – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoFrom content creation to generation, influencers make AI part of their daily hustle – Crypto News

-

Technology1 week ago

Technology1 week agoDiwali 2025 last-minute sale alert: iPhone 16 under ₹35,000? Grab this festive deal on Flipkart before it ends – Crypto News

-

Technology1 week ago

Trump Tariffs: U.S. President Threatens 155% Tariff on China, Bitcoin Falls – Crypto News

-

others1 week ago

Analyst Predicts $10k ETH Price as Vitalik Buterin Launches Major Upgrade for Faster Proofs Systems – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar remains subdued as US Dollar corrects upwards – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoExclusive: YZi Labs leads $25M round for Sign – Crypto News