Cryptocurrency

Bitcoin – Here’s what’s next after sellers near exhaustion levels – Crypto News

- Profit-taking on Bitcoin has continued to shrink, as sellers in the market waned

- Market liquidity flows revealed that Bitcoin investors could be gaining confidence once again

As the cryptocurrency market gains ground, Bitcoin [BTC] has followed that pattern, with a 3.22% rally during this period. This seemed to indicate that market confidence is growing. However, that’s not all as several concurrent developments seemed to hint that a rally may be brewing. Especially as signs of seller fatigue begin to surface.

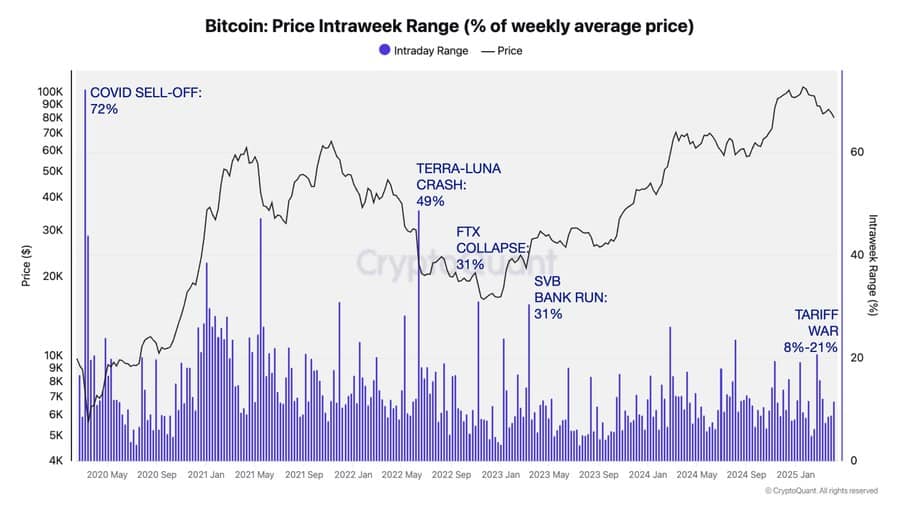

Naturally, when comparing the prevailing market performance to past episodes of turbulence, the setup feels eerily familiar.

Seller exhaustion is nearing

During the latest market drawdown – one of the largest in crypto market history – investors recorded major losses of upto $240 million. Such episodes typically invite aggressive selling pressure. In this particular case, the realized profits have continued to shrink.

This contraction could be a sign that sellers may be evidently running low on ammunition.

In fact, it pointed to exhaustion setting in among market participants – A condition that often precedes a rebound.

When we juxtapose the current setup with previous capitulation phases, like the U.S. tariff-triggered slide, the Covid-19 crash, the Terra-Luna and FTX meltdowns, or even the SVB banking scare, the resemblance is striking.

All of them were followed by periods of renewed buying energy.

To provide clearer guidance on potential market movements, AMBCrypto examined additional metrics to understand the actions of major investors. We discovered that a significant rebound may soon be approaching.

A major rebound could be closer

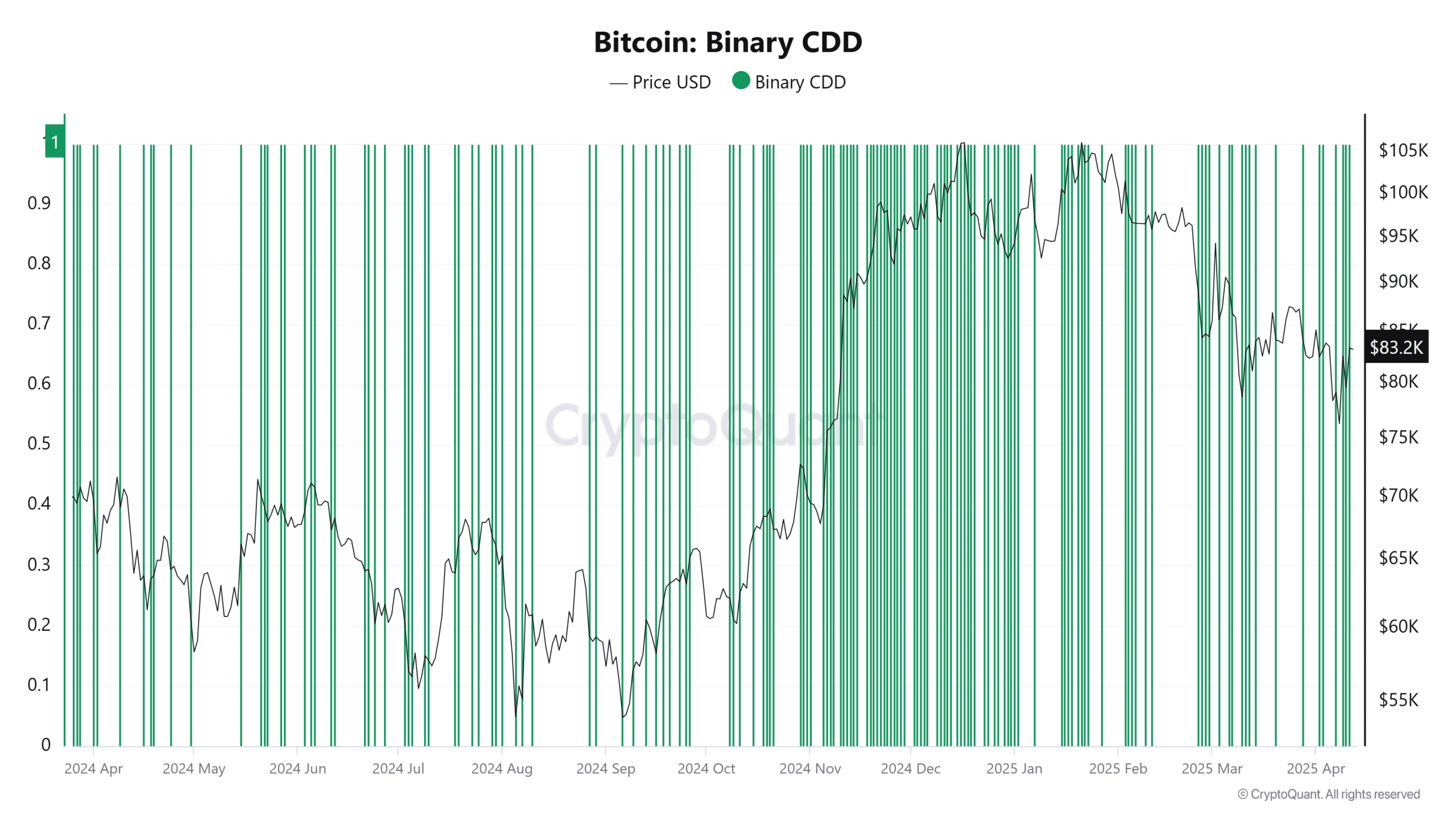

On top of that, the Binary Coin Days Destroyed (CDD) metric tells us a story of its own.

At the time of writing, it was flashing a reading of 1 – Indicative of the fact that long-term holders, often the stoic believers in Bitcoin, have joined the selling cohort.

That’s a potent signal. When long-term holders offload post-drop, it’s either to lock in gains or cut losses. These are both signs of capitulation.

Now, even though the market sentiment may be skewed towards selling, the tempo has been slowing down.

This blend of metrics—shrinking realized profits, a Binary CDD reading of 1, and historical parallels—all converge towards a familiar narrative. It is – Seller fatigue is here and a relief rally could very well be the next chapter.

In fact, building on signs of seller exhaustion, long-term holders may now be nearing their final phase of selling.

They could soon hold onto the rest. That’s especially true for institutions, who are shifting gears too.

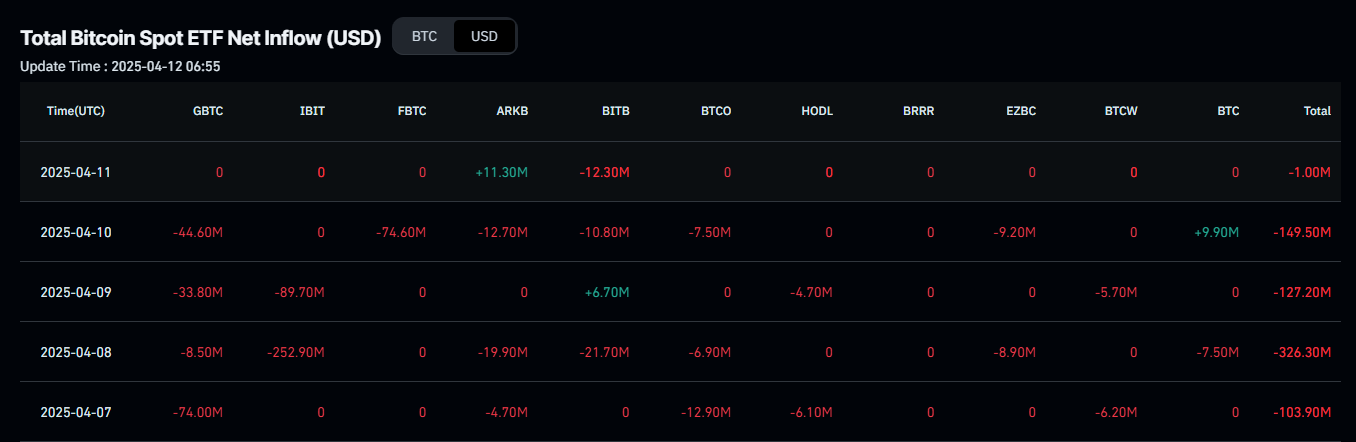

For example – Institutional netflows have dried up. Only $1 million in Bitcoin was sold recently, down from a $176.72 million four-day average.

That’s a massive drop. Naturally, this means confidence is creeping back into the hands of big-money players. These institutions don’t trade lightly. Their actions often shape Bitcoin’s next major move.

In the spot market, CryptoQuant’s data highlighted a new trend. Netflows flipped negative – Always a bullish signal. That suggested that accumulation is on and that Bitcoin is being moved into private wallets and away from exchanges.

In this phase, 1,959 BTC have been scooped up – Worth around $162 million. Average buy price? $83,000. If this pace holds, Bitcoin could continue soaking up the remaining sell pressure. A breakout may be closer than expected.

-

Blockchain2 days ago

Blockchain2 days agoThe CFO and Treasurer’s Guide to Digital Assets – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoRVNL Share Price Crashes Toward ₹317 as PSU Rail Stocks Tank on Global Panic – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMeme Crypto Rebounds Amid Market Volatility – Crypto News

-

Business6 days ago

Business6 days agoIs DOGE Decoupling from Elon Musk? – Crypto News

-

others6 days ago

others6 days agoGold struggles to capitalize on intraday recovery from multi-week low; remains below $3,050 – Crypto News

-

others6 days ago

others6 days agoGold struggles to capitalize on intraday recovery from multi-week low; remains below $3,050 – Crypto News

-

others6 days ago

others6 days agoGold struggles to capitalize on intraday recovery from multi-week low; remains below $3,050 – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT overload? Sam Altman pushes GPT-5 to later date, confirms new model launches this month – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoA defendant tried to use an AI avatar in a legal appeal. It didn’t work – Crypto News

-

others6 days ago

others6 days ago$109,000,000,000 in US Gold Reserves Now in Question as German Officials Demand to Count Bullion Bars At New York Fed: Report – Crypto News

-

Technology6 days ago

Technology6 days agoAs audio streaming comes of age, companies turn to AI for a growth slingshot – Crypto News

-

others6 days ago

others6 days agoMassive Counter-Trend Rally Could Be Coming for Bitcoin (BTC), According to Benjamin Cowen – Here’s When – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle and Amazon Seek Government Software Market Share – Crypto News

-

Technology7 days ago

Technology7 days agoWeekly Tech Recap: ChatGPT generates fake Aadhaar cards, Meta rolls out new Llama 4 AI models and more – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoCrypto plunges as Trump tariff ‘medicine’ brutalizes global stock markets – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoDogecoin Volume Remains Low As Price Tanks, Analyst Says Another Surge Is Coming – Crypto News

-

Technology6 days ago

Technology6 days agoArthur Hayes Expects Fed Rate Cuts Soon If This Happens – Crypto News

-

Technology6 days ago

Technology6 days agoArthur Hayes Expects Fed Rate Cuts Soon If This Happens – Crypto News

-

Technology6 days ago

Technology6 days agoArthur Hayes Expects Fed Rate Cuts Soon If This Happens – Crypto News

-

Business6 days ago

Business6 days agoDebt Restructuring Plan Gains Support, User Funds Recovery Imminent? – Crypto News

-

others6 days ago

others6 days agoDebt Restructuring Plan Gains Support, User Funds Recovery Imminent? – Crypto News

-

others6 days ago

others6 days agoOffered zero-for-zero tariffs to US for cars and all industrial goods – Crypto News

-

Technology6 days ago

Technology6 days ago4 Altcoins to Sell As Crypto Market Crash Triggers $1.4B in Liquidations – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoEthereum DApps are thriving with $1B in fees, but what about ETH’s price? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoMetaplanet repays 2B yen bonds early, CEO comments on BTC ‘down days’ – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoPeter Schiff Predicts Ethereum Price To Drop Below $1,000, Compares It To Bitcoin And Gold – Crypto News

-

Technology6 days ago

Technology6 days agoArthur Hayes Predicts 70% Bitcoin Dominance as BTC Whales Hit Peak Accumulation – Crypto News

-

others6 days ago

others6 days agoEuro eases slightly near 1.0900 but maintains bullish bias – Crypto News

-

Business6 days ago

Business6 days ago4 Reasons This is a Golden Opportunity to Buy Pi Coin – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBloomberg analyst predicts Bitcoin could sink back to $10,000 – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBitcoin on verge of largest ‘price drawdown’ of the bull market — Analyst – Crypto News

-

Technology1 week ago

Technology1 week agoUS SEC Rules Dollar-Backed Stablecoins Are Not Securities Under Federal Laws – Crypto News

-

Technology7 days ago

Technology7 days agoCrypto Market Finds New Buyers as Microsoft, Apple and Nvidia Lose $1 trillion in 3 Days – Crypto News

-

Business6 days ago

Business6 days agoKey Levels ETH Traders Must Watch as BTC Trades Below $80K – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBest Meme Coins to Buy as Solana TVL Reaches All-Time High – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin’s price consolidates, but altcoins drop: Breaking down how and why – Crypto News

-

Technology6 days ago

Technology6 days agoSave big on ACs, refrigerators, chimneys and more in Amazon Summer Fest: Get up to 60% off on home appliances – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoPanic Hits Crypto, Stocks, and Commodities at Levels Not Seen Since 2020 Covid Crash – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin Dips Below $75K As Markets Tremble: What’s Goin On? – Crypto News

-

Technology6 days ago

Technology6 days agoDebt Restructuring Plan Gains Support, User Funds Recovery Imminent? – Crypto News

-

Technology6 days ago

Technology6 days agoForget ChatGPT? China’s DeepSeek is working on smarter, self-improving AI models – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoEthereum Price Looks Set To Crash To $1,000-$1,500, But Can It Fill The CME Gaps Upwards To $3,933 – Crypto News

-

Business6 days ago

Business6 days agoShould You DCA These 3 Crypto Tokens This Black Monday for 5X Gains in April? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoBitcoin Goes Beast Mode—Mining Power Tops 1 Zetahash in First-Ever Surge – Crypto News

-

Technology6 days ago

Technology6 days agoSamsung Galaxy S25 Edge appears online ahead of launch: Specs, pricing and colours tipped – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoCrypto Analyst Warns Of Volume Drop That Could Trigger 60% Bitcoin Price Crash To $49,000 – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoVIX shows volatility will not be stopping anytime soon – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoXRP Dump? Engineer Says Panic Selling Makes No Sense – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBlackRock CEO Says Market Could Tank Another 20%—But It’s a ‘Buying Opportunity’ – Crypto News

-

Technology5 days ago

Technology5 days agoMeity, dept of science working with Cert-In to build quantum cyber framework – Crypto News

![Shiba Inu [SHIB] price prediction - A 70% rally next after 900%+ burn rate hike?](https://dripp.zone/news/wp-content/uploads/2025/04/Shiba-Inu-SHIB-price-prediction-A-70-rally-next-400x240.png)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 900%+ burn rate hike?](https://dripp.zone/news/wp-content/uploads/2025/04/Shiba-Inu-SHIB-price-prediction-A-70-rally-next-80x80.png)