Business

Bitcoin Price Hovers at $95K Amid Critical Cost Basis Analysis – Experts Predict Volatility or Breakout – Crypto News

The Bitcoin price remains a focal point for investors as it stabilizes near $95,000, a threshold analysts argue could determine its short-term trajectory. CryptoQuant CEO Ki Young Ju’s latest analysis of Bitcoin’s cost basis across investor cohorts has ignited debates about potential bearish signals or long-term resilience.

Bitcoin Price & Key Cost Basis Breakdown: Why $95K is Critical For Many Investors

Ki Young Ju’s February 19 tweet highlighted critical acquisition averages:

- ETFs/Custody Wallets: $89,000 (institutional entry point)

- Binance Traders: $59,000 (retail-heavy cohort)

- Mining Companies: $57,000 (historically a bear market trigger if breached)

- Old Whales: $25,000 (untested long-term support)

This reveals institutional investors are closest to break-even, while mining firms face heightened pressure. A drop below $57K could signal a bear market, as seen in 2018 and 2020. Meanwhile, MicroStrategy CEO Michael Saylor, a vocal Bitcoin advocate, doubled down on corporate adoption this week, stating,

“Bitcoin’s scarcity and institutional demand will redefine global treasury strategies.”

Michael Saylor’s $2B BTC Purchase Plan

Adding to the bullish narrative is MicroStrategy’s CEO and long-time Bitcoin advocate Michael Saylor’s announcement that reveals a plan to raise $2 billion to buy more BTC.

Strategy Announces Proposed Private Offering of $2.0B of Convertible Senior Notes. $MSTR https://t.co/EBOMdLlgdq

— Michael Saylor⚡️ (@saylor) February 18, 2025

Saylor’s Bitcoin acquisition spree is a barometer to gauge corporate confidence in BTC & cryptocurrencies. His recent announcement reinforced the narrative of Bitcoin as a hedge against inflation and a cornerstone of modern financial strategy, and it further adds credence to a Strategic Bitcoin Reserve implementation.

Key BTC Price Levels To Watch

With Bitcoin price crashing below $95K and catalyzing a liquidation of $340M in 24 hours, the market seems to be flushed. Let’s look at key levels to watch from a short-term and long-term scenario.

$BTC

Long-term

– Based on Mars-Vesta Cycle thesis, this cycle top could occur on Oct 6, 2025.

(Mars Vesta Cycle Thesis cc: @Yodaskk )Worst-case/MaxPain scenario

– A repeat of 2021 Cycle could see $75K-$70K bottom formation (MaxPain scenario)

– Cycle peak around $120K-$150K… pic.twitter.com/PDUiZNl2fz— MAXPAIN (@Mangyek0) February 18, 2025

Short-Term Scenarios:

Deviation Below VAL of $93.3K:

- Below the Value Area Low (VAL) of $93.3K suggests a sustained downtrend and a potential revisit of the established support level at $88.7K

Long Squeeze Target:

New All-Time High (ATH):

- The $120K Bitcoin price target is a conservative estimate for a new ATH in the short term.

- The $150K-$200K target is the optimistic scenario where market sentiment drives Bitcoin prices to higher levels.

Long-Term Scenarios:

Cycle Top Based on Mars-Vesta Cycle:

Worst-case/MaxPain Scenario:

- Bottom Formation: $75K-$70K. If Bitcoin were to follow a pattern similar to the 2021 cycle, this range is suggested as a potential bottom, representing a significant correction.

- Cycle Peak: $120K-$150K. This range is anticipated as the peak of the cycle in a worst-case scenario, suggesting a recovery after the bottom formation but not reaching the optimistic short-term targets.

Investors need to note that some of these levels coincide with the cost basis levels mentioned by the CEO of CryptoQuant, making them a key level to watch as Bitcoin price volatility increases.

The Bottom Line: Balancing Risk and Opportunity

While Bitcoin’s $95K cost basis tests investor resolve, long-term fundamentals remain strong. As Ki Young Ju notes, “Old whales at $25K show unshakable confidence,” while Michael Saylor’s MicroStrategy continues accumulating BTC despite volatility. For traders, the $57K–$95K range is critical; for hodlers, the 2025 halving cycle and institutional tailwinds suggest upward momentum.

<!–

–>

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Technology1 week ago

Technology1 week agoChip Designer Arm Plans to Become Chip Manufacturer – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

others6 days ago

others6 days agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Technology1 week ago

Technology1 week agoMacBook Air M3 15-inch model gets a ₹12,000 price drop on Amazon: Deal explained – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks declined to ¥-384.4B in February 7 from previous ¥-315.2B – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity takes on ChatGPT and Gemini with new Deep Research AI that completes most tasks in under 3 minutes – Crypto News

-

Technology1 week ago

Technology1 week agoLava Pro Watch X with 1.44-inch AMOLED display, in-built GPS launched in India at ₹4,499 – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAdvisers on crypto: Takeaways from another survey – Crypto News

-

others1 week ago

others1 week agoRemains subdued below 1.4200 near falling wedge’s lower threshold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago0xLoky Introduces AI-powered Intel for Crypto Data & On-chain Insights – Crypto News

-

Technology1 week ago

Technology1 week agoFactbox-China’s AI firms take spotlight with deals, low-cost models – Crypto News

-

Technology1 week ago

Technology1 week agoMassive price drops on Samsung Galaxy devices: Up to ₹10000 discount on Watch Ultra, Tab S10 Plus, and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Acquires a Minority Stake in Italian Football Giant Juventus – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoHow AI will divide the best from the rest – Crypto News

-

Business6 days ago

Business6 days agoWhat Will be KAITO Price At Launch? – Crypto News

-

Business6 days ago

Business6 days agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Business5 days ago

Business5 days agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹20,000 in February 2025: Poco X7, Motorola Edge 50 Neo and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPopular Investor Says Memecoin More Superior With ‘World’s Best Chart’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Technology7 days ago

Technology7 days agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

Business6 days ago

Business6 days agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

others6 days ago

others6 days agoForex Today: What if the RBA…? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology5 days ago

Technology5 days agoLuminious inverters for your home to never see darkness again – Crypto News

-

Technology3 days ago

Technology3 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoStrange Love: why people are falling for their AI companions – Crypto News

-

Technology1 week ago

Technology1 week agoFormer Google CEO warns of ‘Bin Laden scenario’ for AI: ‘They could misuse it and do real harm’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoYap-to-earn takes over Twitter – Blockworks – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSomeone Just Won $100K in Bitcoin From a $50 Pack of Trading Cards – Crypto News

-

Technology1 week ago

Technology1 week agoCyber fraud alert: Doctor duped of ₹15.50 lakh via fake trading app; here’s what happened – Crypto News

-

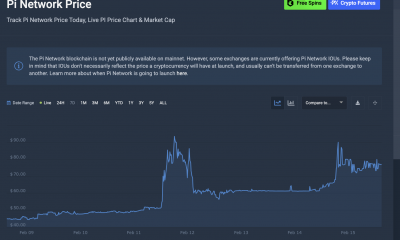

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Bullish Pennant Targets $15-$17 But Confirmation Is Required – Crypto News

-

Technology7 days ago

Technology7 days agoSouth Korea removes DeepSeek from app stores, existing users advised to ‘service with caution’ – Crypto News

-

Business6 days ago

Business6 days agoWhy Ethereum (ETH) Price Revival Could Start Soon After Solana Mess? – Crypto News

-

Business6 days ago

Business6 days agoMarket Veteran Predicts XRP Price If Ripple Completes Cup and Handle Pattern – Crypto News

✓ Share: