others

BoJ is expected to keep interest rates unchanged with eyes on Takaichi’s new policies – Crypto News

The Bank of Japan (BoJ) meets on Thursday and is expected to keep its benchmark interest rate unchanged at 0.5%, awaiting the first moves of Prime Minister Sanae Takaichi’s new cabinet.

Market hopes that the BoJ will continue normalising its monetary policy remain intact, and some central bank policymakers have confirmed that theory. Expectations of an interest rate hike in October, nevertheless, have receded, following the election of the fiscal dove Takaichi as Japan’s Prime Minister in mid-October.

In this context, investors will keep their focus on the vote split, expecting to see some dissenting voices, and on the tone of BoJ Governor Kazuo Ueda’s press conference, seeking validation of a rate hike in December or, at the latest, in January.

What to expect from the BoJ interest rate decision?

As it stands, the BoJ is expected to maintain its monetary policy unchanged for the sixth consecutive meeting in October and reiterate its commitment to gradual monetary tightening.

A recent Reuters poll showed that 60% of analysts expect the Bank of Japan to raise its benchmark interest rate to 0.75% from the current 0.5% before the year-end. Data from the overnight swaps market, however, revealed that the chances of an October hike have dropped to about 24%, from 68% last month.

The new Prime Minister Takaichi, an assistant of former Prime Minister Shinzo Abe, has defended a looser fiscal policy and pledged to reassert the government’s authority over the Bank of Japan and its monetary policy. This has raised concerns about the central bank’s independence, dampening market expectations of immediate rate hikes.

With this in mind, the stubbornly strong inflation is likely to pose a serious challenge to Takaichi’s aim of an expansive monetary policy. Data released last week revealed that the National Consumer Price Index (CPI) accelerated to 2.9% in September, from the previous 2.7%, remaining above the central bank’s target for price stability.

Beyond that, service-sector inflation has picked up for the second consecutive time in September, endorsing the BoJ’s view that rising labour costs will keep price pressures sustainably above the central bank’s 2.0% target in the coming months.

Against this background, some BoJ policymakers have called for immediate rate hikes. Board Member Hajime Takata said last week that now is the appropriate time to raise interest rates, noting that inflation has remained above the bank’s target for three and a half years already, and the economic risks stemming from US tariffs have eased. BoJ Governor Ueda, however, has been showing a more cautious view.

How could the Bank of Japan’s monetary policy decision affect USD/JPY?

In this context, investors have already assumed a delay of the next rate hike, but they are likely to look for confirmation that the plan to keep normalising the monetary policy remains in play. A dovish hold, with no mention of upcoming rate hikes, might disappoint markets and send the Japanese Yen (JPY) on a tailspin.

The Yen lost more than 2% against the US Dollar (USD) in the week after Takaichi secured support to form a cabinet in mid-October. This week, USD/JPY has whipsawed, pulling back following the agreement between the US and Japan, and higher hopes of a China-US trade deal, to bounce up again following Chairman Jerome Powell’s hawkish comments after the Fed’s monetary policy decision on Wednesday.

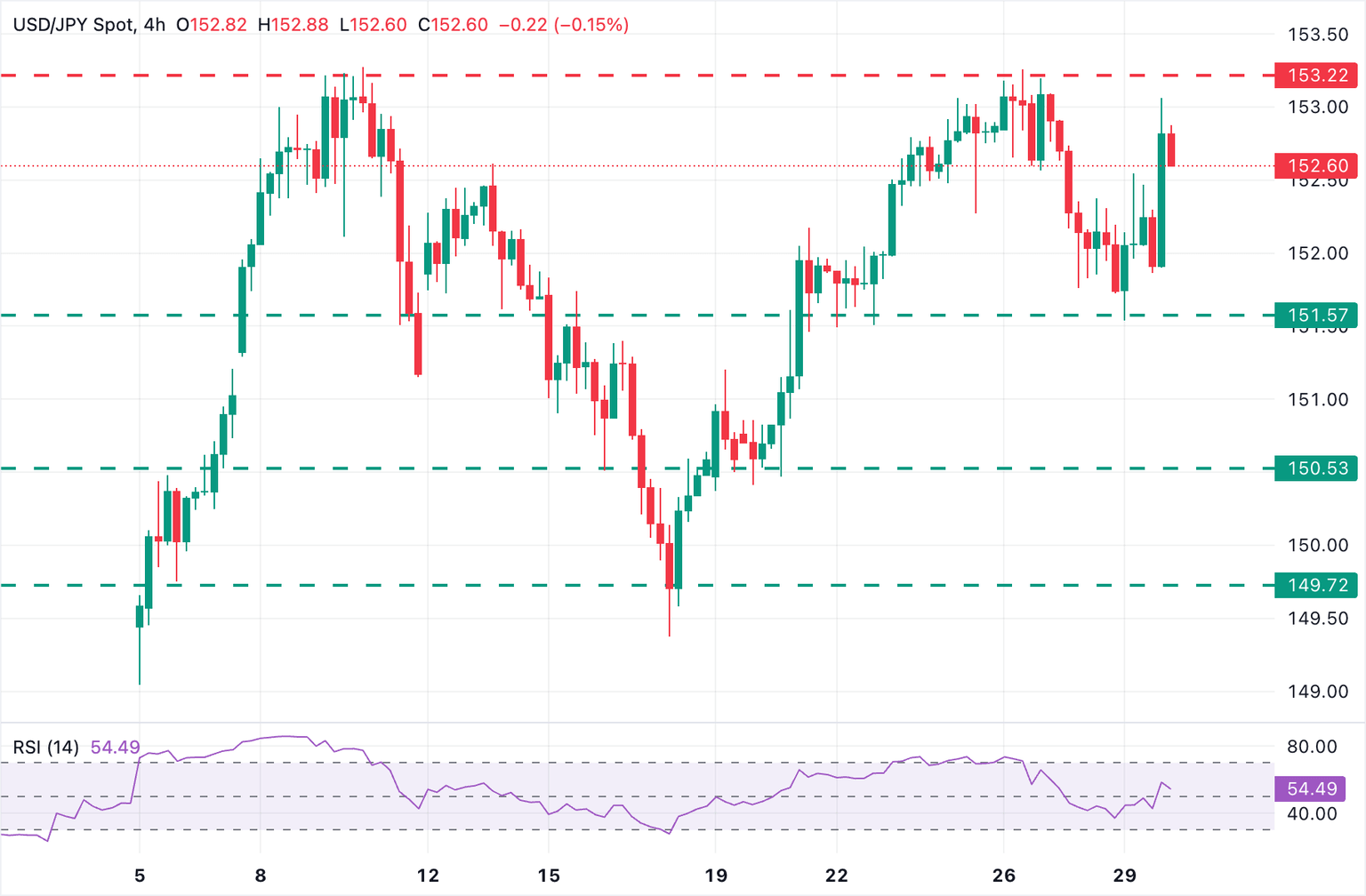

USD/JPY 4-Hour Chart

From a technical perspective, Guillermo Alcalá, FX analyst at FXStreet sees the USD/JPY pair looking for direction with key resistance below the 153.20 area: “The risk is on a too dovish BoJ statement, which might disappoint investors and send the pair back beyond the eight-month highs, at the 153.25 area, aiming for mid-February highs, at 154.80.”

“On the other hand, clear signals hinting at a rate cut in December or a high number of dissenters would give fresh hopes for Yen bulls to retest the October 21 and 22 lows, at the 151.50 area,” says Alcala.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Economic Indicator

BoJ Monetary Policy Statement

At the end of each of its eight policy meetings, the Policy Board of the Bank of Japan (BoJ) releases an official monetary policy statement explaining its policy decision. By communicating the committee’s decision as well as its view on the economic outlook and the fall of the committee’s votes regarding whether interest rates or other policy tools should be adjusted, the statement gives clues as to future changes in monetary policy. The statement may influence the volatility of the Japanese Yen (JPY) and determine a short-term positive or negative trend. A hawkish view is considered bullish for JPY, whereas a dovish view is considered bearish.

Next release:

Thu Oct 30, 2025 03:00

Frequency:

Irregular

Consensus:

–

Previous:

–

Source:

Bank of Japan

-

others1 week ago

others1 week agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

others1 week ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Recover Slightly as Fed Signals Rate Cut, End of QT – Crypto News

-

others1 week ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Recover Slightly as Fed Signals Rate Cut, End of QT – Crypto News

-

others1 week ago

others1 week agoAUD/USD rises on US-China trade hopes, Fed rate cut outlook – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Markets Recover Slightly as Fed Signals Rate Cut, End of QT – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar pares gains as US Dollar steadies on easing US-China tensions – Crypto News

-

Technology1 week ago

Technology1 week agoAWS says it has fixed the problem that crippled half the internet but many popular apps are still down – Crypto News

-

Business1 week ago

Solana Price Eyes $240 Recovery as Gemini Launches SOL-Reward Credit Card – Crypto News

-

others1 week ago

BREAKING: 21Shares Amends S-1 for Spot Dogecoin ETF Approval – Crypto News

-

others1 week ago

Analyst Predicts $10k ETH Price as Vitalik Buterin Launches Major Upgrade for Faster Proofs Systems – Crypto News

-

Business1 week ago

Breaking: Michael Saylor’s Strategy Acquires 168 Bitcoin as Crypto Market Rebounds – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Web Services outage: Here’s how many users are impacted and the downtime costs – Crypto News

-

Business1 week ago

Bitcoin Price Prediction as Gaussian Channel Turns Green Amid U.S.–China Trade Progress and Fed Rate Cut Hopes – Crypto News

-

Technology1 week ago

Blockchain for Good Alliance and UNDP AltFinLab Launch Blockchain Impact Forum – Crypto News

-

Technology1 week ago

Blockchain for Good Alliance and UNDP AltFinLab Launch Blockchain Impact Forum – Crypto News

-

Technology1 week ago

Technology1 week agoEthereum’s Vitalik Buterin applauds Polygon for pioneering ZK technology – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Whales Flood Binance With Massive Deposits – Selling Pressure Mounts – Crypto News

-

Technology1 week ago

Technology1 week agoLayerZero outlook: ZRO price on the edge ahead of $43M token unlock – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTokenized Deposits for Payments, Treasury – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoTech layoffs: From Meta, Amazon to Google — these IT majors have cut AI related jobs – Crypto News

-

Business1 week ago

How Will “Unusual” US CPI Inflation Data Release Could Impact Fed Rate Cut, Crypto Market? – Crypto News

-

Business1 week ago

Binance Founder CZ Predicts Bitcoin Will Flip Gold’s $30 Trillion Market – Crypto News

-

De-fi1 week ago

De-fi1 week agoDeFi Earning Aggregator Turtle Raises $5.5 Million – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Weekly RSI Points To More Upside, But Can the Bulls Defend $107,000? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Founder Vitalik Buterin Explains GKR, Unbelievably Powerful Tech Scheme – Crypto News

-

others1 week ago

others1 week agoFocus shifts to Canadian inflation, trade jitters and US shutdown – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoEight brilliant AI tools to supercharge productivity – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoEight brilliant AI tools to supercharge productivity – Crypto News

-

Technology1 week ago

Technology1 week agoThinking of cancelling HBO Max? Subscription prices just went up – Here’s what you need to know – Crypto News

-

Technology1 week ago

$1.68 Trillion T. Rowe Price Files for First Active Crypto ETF Holding BTC, ETH, SOL, and XRP – Crypto News

-

Technology1 week ago

Trump Tariffs: U.S. President Threatens 155% Tariff on China, Bitcoin Falls – Crypto News

-

![Nikkei Futures (NKD) reach historic highs, extending bullish rally [Video]](https://dripp.zone/news/wp-content/uploads/2025/10/Nikkei-Futures-NKD-reach-historic-highs-extending-bullish-rally-Video-400x240.jpg)

![Nikkei Futures (NKD) reach historic highs, extending bullish rally [Video]](https://dripp.zone/news/wp-content/uploads/2025/10/Nikkei-Futures-NKD-reach-historic-highs-extending-bullish-rally-Video-80x80.jpg) others1 week ago

others1 week agoNikkei Futures (NKD) reach historic highs, extending bullish rally [Video] – Crypto News

-

others1 week ago

Analyst Predicts $10k ETH Price as Vitalik Buterin Launches Major Upgrade for Faster Proofs Systems – Crypto News

-

Technology1 week ago

Fed’s Payments Conference: Waller Floats ‘Payment Account’ Framework to Support Crypto Innovation – Crypto News

-

Technology1 week ago

ProShares Files for Index Crypto ETF Tracking Bitcoin, Ethereum, XRP, and Solana – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT down: Thousands of users unable to access AI chatbot, OpenAI says it is working on a fix – Crypto News

-

Business1 week ago

XRP Price Classical Pattern Points to a Rebound as XRPR ETF Hits $100M Milestone – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoBezos fund believes AI can save the planet. Nvidia, Google are all-in. – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoCrypto update: Bitcoin and Ethereum are stable as market’s focus shifts to US inflation data – Crypto News

-

Technology1 week ago

Technology1 week agoDiwali 2025 last-minute sale alert: iPhone 16 under ₹35,000? Grab this festive deal on Flipkart before it ends – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCardano Could Be 2026 Game-Changer – Crypto News

-

others1 week ago

Analyst Predicts $10k ETH Price as Vitalik Buterin Launches Major Upgrade for Faster Proofs Systems – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar remains subdued as US Dollar corrects upwards – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoExclusive: YZi Labs leads $25M round for Sign – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus 15R full specifications leaked ahead of launch: here’s what to expect – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStreamer Sam Pepper Banned From Pump.fun, Kick After Injuring Girl With Firework Stunt – Crypto News

-

Business1 week ago

Crypto Czar David Sacks to Meet Senate Republicans In Bid To Advance Market Structure Bill – Crypto News

-

others1 week ago

Veteran Trader Peter Brandt Says “MSTR Could Go Underwater” If Bitcoin Repeats 1977 Soybean Crash – Crypto News