others

Can spot Bitcoin ETFs push Hong Kong to the crypto throne? – Crypto News

In this issue

- Bitcoin ETFs: Hong Kong has entered the chat

- Bitcoin Ordinals flip Ethereum NFTs

- IPO comes full circle

From the Editor’s Desk

Dear Reader,

The verdict is in. Sam Bankman-Fried, founder and former chief executive officer of failed cryptocurrency exchange FTX, has been found guilty in what U.S. government prosecutors labeled one of the biggest financial fraud cases in history.

As Bankman-Fried awaits a likely decades-long sentence for his part in FTX’s collapse — a truly catastrophic implosion that contributed in large part to the digital asset market’s travails over the past year — the industry is now looking forward.

And nowhere, arguably, is more forward-looking than Hong Kong when it comes to the digital economy.

The special administrative zone was again in the news this week as Hong Kong Securities and Futures Commission (SFC) head Julia Leung gave her first international media interview since taking office in January. Leung said that the regulator is happy to try any innovative digital asset proposal that “boosts efficiency and customer experience.”

Significantly, that willingness to engage with digital assets includes the much-heralded spot Bitcoin exchange-traded fund (ETF). The financial instrument — which allows investors to trade Bitcoin on a traditional exchange at any time throughout the day — is expected to bring much-needed institutional cash into the industry.

That’s particularly so in the U.S., where spot Bitcoin ETFs from the likes of investment giant BlackRock are reportedly just around the corner. With the U.S. spot Bitcoin ETF buzz causing a recent surge in the price of Bitcoin to over the US$35,000 mark, a ripple of fresh excitement has spread throughout the wider crypto market.

But Leung also advised caution. She added the caveat to her comments about a spot Bitcoin ETF that the regulator would only consider products that meet the jurisdiction’s strict requirements on customer protection.

Amid all the talk over a luxurious penthouse lifestyle for FTX executives in the Bahamas — where Bankman-Fried is also known to have cozied up to local officials — it is easy to forget that the exchange began life in Hong Kong. Added to that, the city has also just been through its own huge crypto scandal, with customers of the JPEX exchange losing out on over US$200 million in investments.

Particularly as Beijing continues to clamp down on crypto in the Chinese mainland, Leung is right to advise caution. Hong Kong is seen as a so-called “sandbox” for crypto innovation, an area where experiments — regulatory and otherwise — can be conducted with a degree of separation from the wider Chinese market.

Should the marriage between innovation and effective regulation work out as planned, Hong Kong has every chance of achieving what is now a key aim for the region — restoring its international reputation as a cutting edge financial center by becoming a global hub for the digital asset industry.

Until the next time,

Angie Lau,

Founder and Editor-in-Chief

Forkast.News

1. Bitcoin ETFs: Hong Kong has entered the chat

The Hong Kong Securities and Futures Commission (SFC) is considering the approval of ETFs investing directly in cryptocurrencies, with regulations to mitigate new risks.

- Two Bitcoin futures ETFs and one Ethereum futures fund have already been approved by the SFC, signaling a cautious advancement into institutionally accessible crypto-based financial products.

- According to Bloomberg, SFC Chief Executive Julia Leung emphasized the need for a “comprehensive regulatory framework” following a significant fraud case involving the Hong Kong Exchange JPEX, which saw HK$1.6 billion (US$204 million) in customer funds misappropriated.

- The SFC is refining its cryptocurrency regulations and developing new rules for stablecoins and asset tokenization, while the Hong Kong Monetary Authority (HKMA) is aiding banks in handling tokenized assets.

- In the U.S., the Securities and Exchange Commission (SEC) has been wary of approving Bitcoin ETFs, citing potential market manipulation and the need for secure handling of customer assets.

- BlackRock and Fidelity Investments are among several major investment giants that have applied to set up a spot Bitcoin ETF in the U.S., with Grayscale Investments looking to convert its Bitcoin trust into a spot ETF.

Forkast.Insights | What does it mean?

The spot Bitcoin ETF remains the news of the week, regardless of location. The crypto industry views the arrival of this financial instrument in the U.S. as the silver bullet needed to steady the listing ship of the crypto market, down some US$2 trillion over the past 18 months after the collapse of FTX, among a host of other digital asset firms.

But spot Bitcoin ETFs already exist in Europe, where they have been met with a muted reception. Bitcoin futures ETFs also already exist. But beyond an initial bump in the price of Bitcoin when ProShares first introduced a Bitcoin futures ETF in the U.S. in October 2021, they too have failed to pull up many trees.

But, the optimism is there. Bitcoin is up over 30% since mid-October just on the suggestion that a spot Bitcoin ETF in the U.S. is imminent. Some analysts argue that the past month’s price pump goes to show that the market had yet to price in the existence of a spot Bitcoin ETF. The rise in prices across crypto is just a way of factoring in the potential inflow of institutional cash this particular financial instrument is expected to bring.

But others, including former Wall Street banker Norbert Gehrker, believe that the improvements to the user experience for investors enabled by the creation of a spot Bitcoin ETF in the U.S. is enough to potentially attract further large scale inflows of money into the industry.

In a note to Forkast, Gehrke used the example of the first gold ETF. Introduced in 2004, it pulled in US$5 billion in the first 15 months and US$10 billion over the first 10 years, dramatically changing the gold market. Expectations are similar in the Bitcoin market. We could soon see multiple jurisdictions look to get in on the action in the near future, particularly if — as expected — the SEC makes an approval early in the new year.

2. Bitcoin Ordinals flip Ethereum NFTs

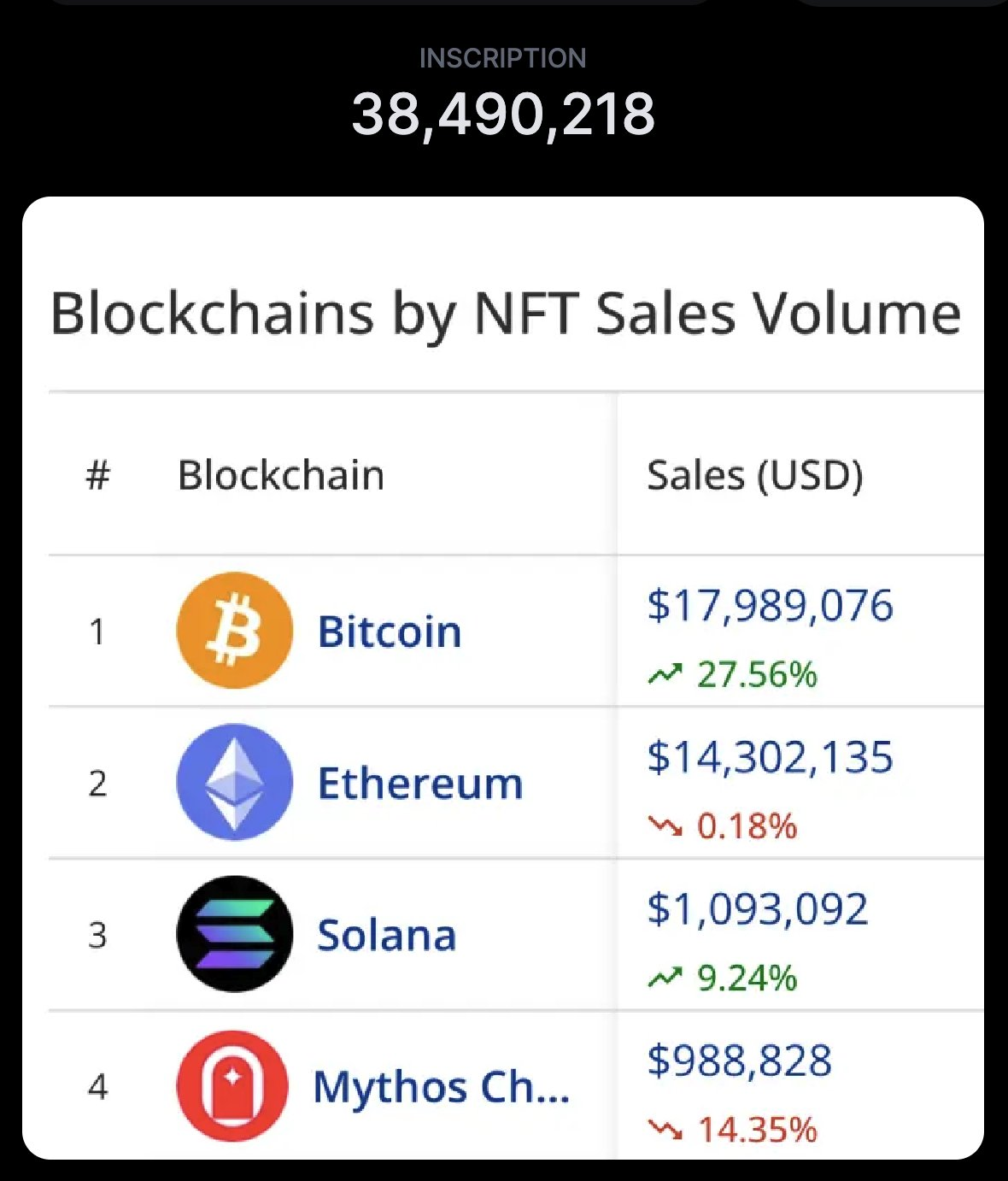

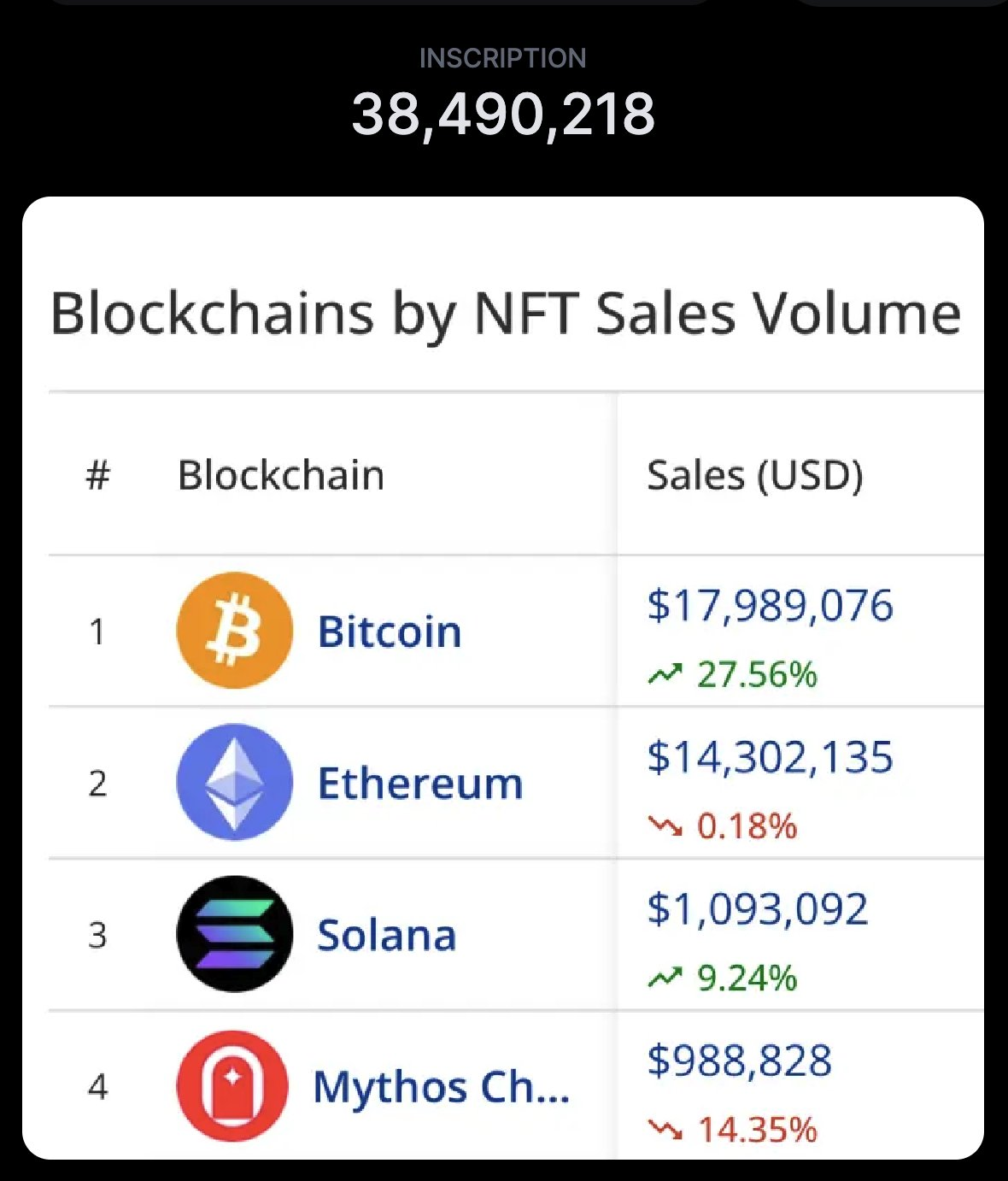

Bitcoin’s ecosystem of inscribed blockchain artifacts, Ordinals, BRC20s, and infinite future iterations, overtook Ethereum’s ecosystem of NFTs in sales volume this week for the first time.

- Bitcoin Ordinals and BRC20s saw over US$17.9 million in sales Tuesday, beating the combined sales volume of the next four blockchains.

- The Bitcoin ecosystem has traded for over US$57.6 million in November, reflecting a return to pre-summer levels of trading.

- $SATS BRC-20s are the top-selling NFT collection in the past seven days across blockchains, with US$25.2 million in sales.

Forkast.Insights | What does it mean?

A true milestone moment for Bitcoin happened this week. Not just for blockchain collectibles, artifacts, or NFTs. Instead, it’s a milestone for the Bitcoin blockchain itself, which is seeing its utility beyond payments legitimized.

Sales volume for Ordinals, an iteration of NFTs on the Bitcoin network, has been on the rise. The blockchain’s BRC20s, a fungible token standard powered by Ordinals, are really seeing an increase in sales. Seven of the top 10 collections on CryptoSlam are represented by BRC20s. These bundles of fungible tokens are being sold at a rate that we’ve not seen before, and Binance’s recent integration of ORDI tokens suggests there’s much more in store for this genesis of decentralized finance (DeFi) on the Bitcoin blockchain.

It’s fair to say that Bitcoin “flipping” Ethereum is a controversial statement. Most on the Ethereum side don’t accept it. Comparing BRC20s to NFTs is not apples to apples. But comparing non-fungible bundles of BRC20s to tokenized houses, profile pictures, cars, and fantasy sports assets shouldn’t require an apples to apples comparison.

The NFT ecosystem is young, and as it matures, clever technologists will find all kinds of ways to shoehorn strange use cases into NFTs. Last month, it was Pokemon cards stored in Brinks vaults, this month it’s BRC20s, and next year it just might be your entire bank account.

3. IPO comes full circle

Circle Internet Financial Ltd., the company behind USDC, the world’s second-largest stablecoin, is contemplating an initial public offering (IPO) in early 2024, Bloomberg reported Wednesday, citing unnamed sources.

- The sources reportedly said Circle is in talks with advisers over the potential listing, although the outcome and valuation remain uncertain.

- Circle canceled a previous attempt to go public via a SPAC merger. The company was valued at US$9 billion in 2022.

- Despite the aborted merger with Concord Acquisition Corp., Circle has attracted significant investment from heavyweights like Goldman Sachs and BlackRock.

- The stablecoin issuer faced a scare earlier this year due to its US$3.3 billion exposure to the defunct Silicon Valley Bank.

Forkast.Insights | What does it mean?

The landscape of public listings, particularly those through special purpose acquisition companies (SPACs), has been marked by considerable volatility. In early 2021, SPACs surged in popularity, comprising over 70% of IPOs in the U.S. for Q1. But by the next quarter, their prevalence dramatically dropped to just 23%. The decline was influenced by heightened scrutiny from the U.S. Securities and Exchange Commission (SEC) starting April 2021,when the regulator cautioned SPACs regarding their financial reporting. Then in March 2022, the SEC proposed rules that made SPAC mergers more difficult.

In mid-2021, amid this backdrop, Circle embarked on its own SPAC journey, before ultimately ditching its plans last December. But the SEC’s recent legal setbacks — including a partial defeat in the Ripple Labs case and a court directive to reassess the denial of Grayscale’s Bitcoin trust ETF conversion — may hint at a shifting regulatory tone, one more accommodating for cryptocurrency-related entities.

Meanwhile, the crypto sector is eyeing a resurgence. Bitcoin is trading at its highest price range this year. The ball is again in the SEC’s court as it deliberates on pending spot Bitcoin ETF proposals from heavyweight asset managers, including BlackRock and Fidelity.

For Circle, there’s a renewed sense of optimism. The clearer regulatory frameworks emerging in global financial centers such as Singapore, Hong Kong and Dubai, combined with the SEC’s recent legal challenges, could offer a more conducive environment for its IPO ambitions. A strategic window for going public has opened, and Circle may now look to take advantage.

-

Blockchain1 week ago

Blockchain1 week agoAfrica Countries Pass Crypto Laws to Attract Industry – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple Unveils ‘Ripple Prime’ After Closing $1.25B Hidden Road Deal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDOGE to $0.33 in Sight? Dogecoin Must Defend This Key Level First – Crypto News

-

others1 week ago

JPY soft and underperforming G10 in quiet trade – Scotiabank – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoISM Data Hints Bitcoin Cycle Could Last Longer Than Usual – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhat next for Avantis price after the 73% recovery? – Crypto News

-

Technology1 week ago

Technology1 week agoNothing OS 4.0 Beta introduces pre-installed apps to Phone (3a) series: Co-founder Akis Evangelidis explains the update – Crypto News

-

Technology5 days ago

Technology5 days agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump plans to pick Michael Selig to lead CFTC: Report – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Rebounds From Bull Market Support: Can It Conquer The ‘Golden Pocket’ Next? – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin’s institutional surge widens trillion-dollar gap with altcoins – Crypto News

-

Technology1 week ago

Technology1 week agoUniswap Foundation (UNI) awards Brevis $9M grant to accelerate V4 adoption – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBinance Stablecoin Outflow On A Steady Rise — What This Means For The Market – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

Technology1 week ago

Technology1 week agoFrom Studio smoke to golden hour: How to create stunning AI portraits with Google Gemini – 16 viral prompts – Crypto News

-

Business1 week ago

PEPE Coin Price Prediction as Weekly Outflows Hit $17M – Is Rebound Ahead? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHYPE Breaks Out After Robinhood Listing and S-1 Filing: What’s Next? – Crypto News

-

De-fi1 week ago

De-fi1 week agoHYPE Jumps 10% as Robinhood Announces Spot Listing – Crypto News

-

others1 week ago

Platinum price recovers from setback – Commerzbank – Crypto News

-

others1 week ago

others1 week agoGold trims losses after softer US inflation reinforces dovish Fed outlook – Crypto News

-

Business1 week ago

White House Crypto Czar Backs Michael Selig as ‘Excellent Choice’ To Lead CFTC – Crypto News

-

others1 week ago

Bitcoin Price Eyes $120K Ahead of FED’s 98.3% Likelihood to Cut Rates – Crypto News

-

Technology1 week ago

Technology1 week agoMint Explainer | India’s draft AI rules and how they could affect creators, social media platforms – Crypto News

-

others1 week ago

GBP/USD holds steady after UK data, US inflation fuels rate cut bets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFetch.ai and Ocean Protocol move toward resolving $120M FET dispute – Crypto News

-

Technology1 week ago

Can Hype Price Hit $50 After Robinhood Listing? – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI announces major Sora update: Editing, trending cameos, and Android launch on the way – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoGemini in Gmail automates meeting schedules effortlessly – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEntire Startup Lifecycle to Move Onchain – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNEAR’s inflation reduction vote fails pass threshold, but it may still be implemented – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

others7 days ago

others7 days agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Silver consolidates below $49 amid Fed rate-cut bets – Crypto News

-

Business1 week ago

HBAR Price Targets 50% Jump as Hedera Unleashes Massive Staking Move – Crypto News

-

others1 week ago

others1 week agoEUR/USD hovers at 1.1600 as muted CPI data fails to alter Fed stance – Crypto News

-

Business1 week ago

Trump Picks SEC Crypto Counsel Michael Selig to Lead CFTC Amid Crypto Oversight Push – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPump.Fun Rallies 10% After Acquisition Of Trading Terminal Padre – Crypto News

-

Technology1 week ago

Analyst Eyes Key Support Retest Before a Rebound for Ethereum Price Amid $93M ETF Outflows and BlackRock Dump – Crypto News

-

Business1 week ago

Ripple Explores New XRP Use Cases as Brad Garlinghouse Reaffirms Token’s ‘Central’ Role – Crypto News

-

others1 week ago

Tether’s Stablecoin 1.0 Era Is Over – Now the Industry Needs 2.0 – Crypto News

-

De-fi1 week ago

De-fi1 week agoAave Labs Acquires Stable Finance to Expand DeFi Access – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKyrgyzstan Launches Stablecoin While Confirming Future CBDC – Crypto News