others

Canadian Dollar claws back further ground against the US Dollar ahead of Wednesday’s US GDP figures – Crypto News

- The Canadian Dollar is seeing some lift on Tuesday as Crude Oil rebounds from early week swing low.

- Current Account figures from Canada and US quarterly GDP update on the docket for Wednesday.

- The US Dollar is down across the board on Tuesday, helping to bolster the Loonie.

The Canadian Dollar (CAD) is continuing to grind higher against the US Dollar (USD), driven by a general decline in the Greenback and a slight boost from Crude Oil prices recovering from Tuesday’s swing low.

The economic calendar is strictly mid-tier on Tuesday. Despite mixed results for US figures overall, market sentiment appears to be on the front foot with the USD receding slightly against its major currency peers.

Daily Digest Market Movers: Canadian Dollar sees bids, buoyed by broad market Greenback weakness

- The Canadian Dollar is extending against the US Dollar with mild bids on Tuesday.

- Crude Oil recovers from Tuesday’s low bids, WTI climbs 3% from $74.20 into $77.00.

- Broad markets are seeing a general softening in the Greenback, USD in the red against the entire swath of major currencies.

- Canadian third quarter Current Account slated for Wednesday, market forecasts expect a rebound in the headline figure from CAD $-6.63 billion to a surplus of CAD $1 billion.

- CAD trade balance to be overshadowed by US Gross Domestic Product (GDP) numbers in a side-by-side release schedule.

- US third quarter GDP expected to tick upward from 4.9% to 5% over the previous quarter.

- General market sentiment edging into risk appetite despite mixed US data on Tuesday.

- US Housing Price Index held steady in September at 0.6%, beating forecast decline to 0.4%.

- US CB Consumer Confidence improved in November, but October’s number sees downside revision.

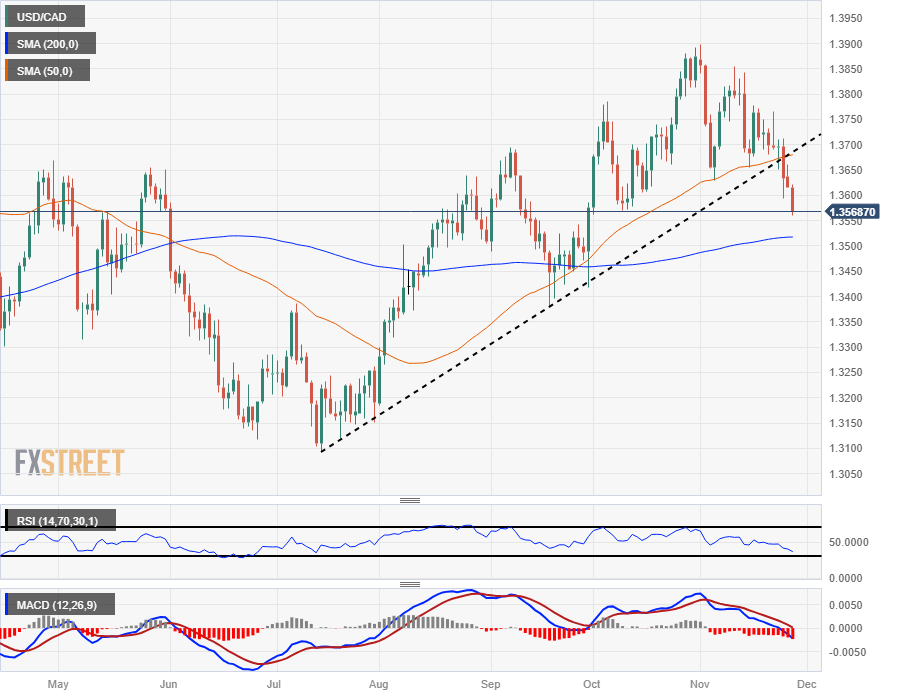

Technical Analysis: Canadian Dollar rebound grinds the USD/CAD back into 1.3600

The Canadian Dollar (CAD) is getting a push as the US Dollar (USD) recedes against the broad FX market, taking the USD/CAD back into the 1.3600 handle on Tuesday, sliding into 1.3570.

Intraday short pressure has the pair pulling away from near-term averages, accelerating declines with the 50-hour Simple Moving Average (SMA) and 200-hour SMA struggling to keep up with declining bids.

The 50-hour SMA is providing technical resistance from 1.3620, while the 200-hour SMA sees any near-term bullish rebounds capped at 1.3690.

The pair has closed either flat or in the red for the past eight trading days, and Tuesday’s declines see the USD/CAD declining further away from the 50-day SMA near 1.3680.

Further downside will see the USD/CAD challenging the 200-day SMA currently lifting from the 1.3500 handle, while any bullish pullbacks will face resistance from the last lower swing high into the 1.3800 price level.

Technical indicators are beginning to flash warning signs that the USD/CAD is approaching oversold conditions. The Relative Strength Index is approaching the lower boundary, while the Moving Average Convergence-Divergence (MACD) sees the signal lines crossing the midpoint into oversold territory.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.43% | -0.59% | -0.29% | -0.74% | -0.70% | -0.65% | -0.45% | |

| EUR | 0.43% | -0.15% | 0.14% | -0.30% | -0.24% | -0.21% | 0.01% | |

| GBP | 0.58% | 0.15% | 0.30% | -0.14% | -0.08% | -0.06% | 0.17% | |

| CAD | 0.29% | -0.15% | -0.30% | -0.45% | -0.39% | -0.36% | -0.14% | |

| AUD | 0.73% | 0.30% | 0.14% | 0.42% | 0.04% | 0.09% | 0.35% | |

| JPY | 0.67% | 0.25% | 0.09% | 0.39% | -0.06% | 0.04% | 0.26% | |

| NZD | 0.64% | 0.22% | 0.06% | 0.35% | -0.09% | -0.03% | 0.24% | |

| CHF | 0.42% | -0.01% | -0.16% | 0.14% | -0.32% | -0.26% | -0.22% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

USD/CAD Hourly Chart

USD/CAD Daily Chart

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off” refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

-

Blockchain7 days ago

Blockchain7 days agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoStop panicking about AI. Start preparing – Crypto News

-

others1 week ago

others1 week agoUS Heiress Slaps Billion-Dollar Lawsuit on Banks for Allegedly Aiding the Looting of Her $350,000,000 Trust Fund – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMakinaFi hit by $4.1M Ethereum hack as MEV tactics suspected – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

others1 week ago

others1 week agoPBOC sets USD/CNY reference rate at 6.9843 vs. 6.9929 previous – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Cryptocurrency1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent? – Crypto News

-

Business1 week ago

Japan Set to Launch First Crypto ETFs as Early as 2028: Nikkei – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRYO Digital Announces 2025 Year-End Milestones Across Its Ecosystem – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Technology2 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

others1 week ago

U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty – Crypto News

-

others1 week ago

others1 week ago478,188 Americans Warned After Hackers Strike Government-Related Firm Handling Sensitive Personal Data – Crypto News

-

Technology1 week ago

Crypto Events to Watch This Week: Is the Market Entering a New Recovery Phase? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Won’t Return to Binance, Bullish on Bitcoin Supercycle – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Slips Further As Bears Target Deeper Support Zones – Crypto News

-

Technology1 week ago

Technology1 week agoIs TikTok still down in the United States? Check current status – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThe productivity bull case for almost everything – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News