others

Canadian Dollar regains lost ground after GDP data beats expectations – Crypto News

- Canadian Dollar is regaining lost ground after upbeat Canadian GDP data.

- US Dollar looks weak despite good US Jobless claims, upward revision of Q4 GDP.

- The focus is now on Friday’s PCE Prices Index and Fed Powell’s speech.

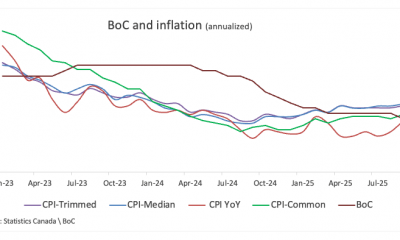

The Canadian Dollar (CAD) is trading higher for the fourth consecutive day on Thursday, yet with price action contained within previous ranges. Canada’s Gross Domestic Product bounced up strongly in January with preliminary estimations for February pointing to further economic expansion. These figures have restored confidence in Canada’s economic outlook, cooling off market expectations of imminent BoC rate cuts.

In The US, the larger-than-expected decline in US Weekly Jobless Claims and the upwardly revised Q4 Gross Domestic Product have been unable to provide a meaningful impact to the US Dollar. The Greenback is paring previous gains after having opened Thursday on a strong note, following hawkish remarks from Fed Governor Waller.

The US Dollar Index, which measures the value of the USD against a basket of the most traded currencies, is barely changed on the day after having whipsawed back and forth. Investors are czutious with all eyes on Friday’s US PCE Prices Index and a speech by Federal Reserve (Fed) Chair Jerome Powell at a monetary policy conference in San Francisco. Traders are looking for further clues about the central bank’s monetary policy plans.

Daily digest market movers: USD/CAD retreats as the Canadian economic outlook improves

- The Canadian Dollar is moderately bullish on its way to complete a four-day winning streak, favoured by upbeat Canadian data.

- Canadian GDP expanded at a 0.6% pace in January, beating expectations of 0.4% growth and following a 0.1% contraction in December.

- US Jobless Claims declined to 210K in the week of March 22 from 212K in the previous week against market expectations of an increase to 215K.

- Continuous Jobless claims have increased to 1.189M from 1.795M in the previous week, offsetting the impact of the upbeat headline reading.

- The final reading of the Q4 US GDP has been revised to a 3.4% growth from the 3.2% expansion previously estimated.

- Futures markets are pricing a 55% chance that the Fed will start cutting rates in June, down from levels above 60% on Wednesday, CME Group FedWatch Tool shows.

- Fed Governor Christopher Waller warned that there is no rush to start cutting rates, which has poured some cold water on the market consensus of three rate cuts in 2024.

- The highlight of the week is that the core PCE Prices Index is expected to have risen at a 2.8% yearly pace and 0.4% on the monthly rate in February, from 2.8% and 0.3%, respectively, in January.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the weakest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.15% | -0.08% | -0.41% | 0.08% | 0.06% | 0.21% | -0.50% | |

| EUR | -0.15% | -0.23% | -0.54% | -0.09% | -0.10% | 0.05% | -0.65% | |

| GBP | 0.07% | 0.22% | -0.32% | 0.15% | 0.15% | 0.28% | -0.42% | |

| CAD | 0.37% | 0.52% | 0.30% | 0.45% | 0.43% | 0.58% | -0.12% | |

| AUD | -0.08% | 0.07% | -0.13% | -0.47% | 0.01% | 0.13% | -0.57% | |

| JPY | -0.06% | 0.10% | -0.13% | -0.41% | 0.03% | 0.14% | -0.54% | |

| NZD | -0.21% | -0.05% | -0.29% | -0.60% | -0.12% | -0.11% | -0.69% | |

| CHF | 0.48% | 0.63% | 0.41% | 0.11% | 0.55% | 0.54% | 0.70% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: The USD is under increasing bearish pressure, heading to 1.3520

The USD/CAD is under increasing bearish traction after having been rejected at 1.3610 on its way to 1.3520 support area. The RSI has dipped below the 50 level, which suggests that sellers are in control.

The broader picture is still moderately positive, with the pair trading within a slightly bullish channel. A break of 1.3460 would negate this view. On the upside, resistance levels are 1.3615 and 1.3630.

USD/CAD 4-Hour Chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

De-fi7 days ago

De-fi7 days agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Accumulation Patterns Show Late-Stage Cycle Maturity, Not Definite End: CryptoQuant – Crypto News

-

Technology1 week ago

Ethereum Supercycle Strengthens as SharpLink Gaming Withdraws $78.3M in ETH – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

others1 week ago

Platinum price recovers from setback – Commerzbank – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

De-fi7 days ago

De-fi7 days agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

De-fi1 week ago

De-fi1 week agoNearly Half of US Retail Crypto Holders Haven’t Earned Yield: MoreMarkets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Technology7 days ago

Technology7 days agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

Business7 days ago

Business7 days agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

Technology1 week ago

Technology1 week agoInstagram finally lets you relive every Reel you’ve watched with ‘Watch History’ feature – Crypto News

-

Business1 week ago

Trump Tariffs: Secretary Bessent Declares ‘Fantastic’ Trump–Xi Talks, Bitcoin Breaks $113,000 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago‘Moments of the Unknown’: Justin Aversano Shares Globetrotting Love Letter to Humanity – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bitcoin Stock-To-Flow ModelIsn’t the Best BTC Forecast Model: Analyst – Crypto News

-

others1 week ago

GBP flat vs. USD with notably muted reaction to retail sales & PMI data – Scotiabank – Crypto News