others

Canadian Dollar trims into the upside on Wednesday as markets await US PPE and Retail Sales – Crypto News

- Canadian Dollar pulls back to even against US Dollar midweek.

- Canada brings little data of note to the table.

- US PPE, Retail Sales on offer for Thursday.

The Canadian Dollar (CAD) found some room on the upside at the midweek inflection point as investors await Thursday’s US Producer Price Index (PPI) and Retail Sales figures. The CAD continues to wrestle with the US Dollar (USD), but the Canadian Dollar is on pace to be one of the strongest performers this week as the only major currency entirely in the green.

Go figure! Canada’s high-performance week comes when there’s no meaningful Canadian data on offer. Canadian Manufacturing Sales for January, slated for Thursday, are expected to recover to 0.4% from the previous -0.7%. Canadian Housing Starts come on Friday, expected to tick up slightly to 230K from 223.6K. Neither print is expected to draw much attention, if any.

After Thursday’s US PPE and Retail Sales, Friday will wrap things up with another round of University of Michigan Consumer Sentiment and Expectation prints for March. UoM Consumer Sentiment is forecast to hold steady at 76.9, while UoM Consumer Inflation Expectations last showed US consumers expected annual inflation to land somewhere around 2.9%.

Canadian Dollar price this week

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies this week. Canadian Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.14% | 0.40% | -0.16% | -0.10% | 0.54% | 0.24% | -0.06% | |

| EUR | 0.13% | 0.53% | -0.04% | 0.03% | 0.68% | 0.37% | 0.08% | |

| GBP | -0.39% | -0.52% | -0.56% | -0.49% | 0.16% | -0.14% | -0.44% | |

| CAD | 0.17% | 0.03% | 0.56% | 0.06% | 0.67% | 0.40% | 0.10% | |

| AUD | 0.09% | -0.04% | 0.49% | -0.07% | 0.64% | 0.33% | 0.04% | |

| JPY | -0.53% | -0.68% | 0.09% | -0.72% | -0.64% | -0.30% | -0.61% | |

| NZD | -0.24% | -0.38% | 0.16% | -0.41% | -0.34% | 0.30% | -0.30% | |

| CHF | 0.04% | -0.07% | 0.44% | -0.10% | -0.05% | 0.59% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Technical analysis: USD/CAD stuck into week’s lows as Canadian Dollar fights back

The Canadian Dollar (CAD) started Wednesday on the front foot, finding gains against the majority of its major currency peers before slightly softening during the American trading session. At the time of writing, the CAD is down around a sixth of a percent against the Australian Dollar (AUD) and tipping into the red against the Euro (EUR) but still within a tenth of a percent of the day’s opening bids. The CAD is up around a fifth of a percent against the US Dollar and has gained around a sixth of a percent against both the Swiss Franc (CHF) and the Japanese Yen (JPY).

USD/CAD slipped back into the week’s low bids as the Canadian Dollar found firmer footing, setting a new low for the week near 1.3460. The pair is still on the high side of last week’s swoon into 1.3420, and near-term price action has a technical ceiling priced in at the 200-hour Simple Moving Average (SMA) near 1.3520.

Daily candles continue to get hung up on the pair’s 200-day SMA at 1.3478, and directional momentum remains limited despite a recent pattern of higher highs. A supply zone is priced in just above the 1.3400 handle.

USD/CAD hourly chart

USD/CAD daily chart

Central banks FAQs

Central Banks have a key mandate which is making sure that there is price stability in a country or region. Economies are constantly facing inflation or deflation when prices for certain goods and services are fluctuating. Constant rising prices for the same goods means inflation, constant lowered prices for the same goods means deflation. It is the task of the central bank to keep the demand in line by tweaking its policy rate. For the biggest central banks like the US Federal Reserve (Fed), the European Central Bank (ECB) or the Bank of England (BoE), the mandate is to keep inflation close to 2%.

A central bank has one important tool at its disposal to get inflation higher or lower, and that is by tweaking its benchmark policy rate, commonly known as interest rate. On pre-communicated moments, the central bank will issue a statement with its policy rate and provide additional reasoning on why it is either remaining or changing (cutting or hiking) it. Local banks will adjust their savings and lending rates accordingly, which in turn will make it either harder or easier for people to earn on their savings or for companies to take out loans and make investments in their businesses. When the central bank hikes interest rates substantially, this is called monetary tightening. When it is cutting its benchmark rate, it is called monetary easing.

A central bank is often politically independent. Members of the central bank policy board are passing through a series of panels and hearings before being appointed to a policy board seat. Each member in that board often has a certain conviction on how the central bank should control inflation and the subsequent monetary policy. Members that want a very loose monetary policy, with low rates and cheap lending, to boost the economy substantially while being content to see inflation slightly above 2%, are called ‘doves’. Members that rather want to see higher rates to reward savings and want to keep a lit on inflation at all time are called ‘hawks’ and will not rest until inflation is at or just below 2%.

Normally, there is a chairman or president who leads each meeting, needs to create a consensus between the hawks or doves and has his or her final say when it would come down to a vote split to avoid a 50-50 tie on whether the current policy should be adjusted. The chairman will deliver speeches which often can be followed live, where the current monetary stance and outlook is being communicated. A central bank will try to push forward its monetary policy without triggering violent swings in rates, equities, or its currency. All members of the central bank will channel their stance toward the markets in advance of a policy meeting event. A few days before a policy meeting takes place until the new policy has been communicated, members are forbidden to talk publicly. This is called the blackout period.

-

Technology6 days ago

Technology6 days agoBest 5G phones under ₹10,000 in July 2025: Infinix Hot 60, Samsung M06 and more – Crypto News

-

Cryptocurrency1 week ago

Scaling the Future: Bitcoin.ℏ’s 10,000 TPS Advantage with Hedera Hashgraph – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH to Lead BTC Over Next 6 Months, Says Galaxy CEO – Crypto News

-

Technology1 week ago

Why is Shiba Inu Price Up Today? – Crypto News

-

others6 days ago

Japan CFTC JPY NC Net Positions rose from previous ¥103.6K to ¥106.6K – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoTether Gold (XAUt) Market Cap Soars as Gold Hits Record Highs in 2025 – Crypto News

-

others1 week ago

others1 week agoArthur Hayes-Backed Altcoin Outpaces Crypto Market Amid Launch of New Partnership With Anchorage Digital – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH to Lead BTC Over Next 6 Months, Says Galaxy CEO – Crypto News

-

others1 week ago

others1 week agoUS Dollar finds support amid Fed uncertainty and tariff talks – Crypto News

-

Technology6 days ago

Technology6 days agoWho is Shengjia Zhao? ChatGPT co-creator named Chief Scientist at Meta’s Superintelligence Labs – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin Cash up 7% as bulls defy BTC dump, eye gains on rising volume – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFriday charts: Crazy train investing – Crypto News

-

Technology1 week ago

Technology1 week ago‘Screwed up’: Sam Altman warns against using ChatGPT as your lawyer or therapist – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoMarket update: Bitcoin rises after US-EU announce framework trade agreement – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin and Ethereum ETFs Pull in Record-High $11.2 Billion in July – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoOpenAI rolls out ‘Study Mode’ in ChatGPT: What is it? How to use? All your questions answered… – Crypto News

-

De-fi1 week ago

De-fi1 week agoWindtree Therapeutics Plans $520 Million Raise, 99% for BNB, Secures $500M Equity Line, Uses Kraken Custody – Crypto News

-

Business1 week ago

Buy DexScreener Reactions – Boost Legends: Guide + $5 Bonus – Crypto News

-

De-fi6 days ago

De-fi6 days agoETH Unstaking Queue Hits Record High, Led by Justin Sun-Linked Addresses – Crypto News

-

others5 days ago

‘Sit Tight With Bitcoin’ Robert Kiyosaki Predicts Great Depression 2.0 – Crypto News

-

Business5 days ago

Ethereum Breaks $3,900 as SharpLink Makes Another $295M ETH Purchase – Crypto News

-

Business5 days ago

Breaking: US SEC Delays Launch Of Truth Social’s Bitcoin ETF And Grayscale’s Solana ETF – Crypto News

-

others4 days ago

others4 days agoBlockchain Gaming Is Growing Up – What’s Behind the Sector’s Quiet Comeback – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNY, Goldman Launch Blockchain Solution – Crypto News

-

De-fi1 week ago

De-fi1 week agoGoldman Sachs, BNY to Launch Tokenized Money Market Fund – Crypto News

-

Metaverse1 week ago

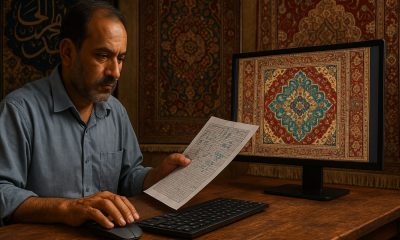

Metaverse1 week agoHow AI can weave a future for Kashmir’s centuries old carpet industry – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTea App That Claimed to Protect Women Exposes 72,000 IDs in Epic Security Fail – Crypto News

-

Technology6 days ago

Technology6 days agoIndias startup wave merges AI with tradition for smarter daily solutions – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoZK breakthroughs, onchain comebacks and stablecoin shakeups – Crypto News

-

Technology5 days ago

Solayer Launches USDC-Powered Hotel Booking Platform To Give Crypto Travel a Boost – Crypto News

-

others5 days ago

others5 days agoEUR/USD dives as the US Dollar outperforms with all eyes on the Fed decision – Crypto News

-

Technology4 days ago

Technology4 days agoSpotify hits 276M subscribers and strong user growth in Q2, but revenue and profit fall short of targets – Crypto News

-

Technology3 days ago

Technology3 days agoCoinbase exchange targets alleged cybersquatter in lawsuit – Crypto News

-

Business3 days ago

Stablecoins Won’t Boost Treasury Demand, Peter Schiff Warns – Crypto News

-

Blockchain2 days ago

Blockchain2 days agoSEC Crypto ETFs Ruling Brings Structural Fix, Not Retail Shakeup – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoXRP inflows drop 95% since July spike, while Chaikin data signals possible rally – Crypto News

-

De-fi6 days ago

De-fi6 days agoBank of America Says U.S. Lenders Ready Stablecoin Launches – Crypto News

-

Technology5 days ago

Just In: $111B Brokerage Giant Interactive Brokers Explores Stablecoin for Funding – Crypto News

-

others5 days ago

Breaking: PayPal to Let Merchants Accept Payments in Over 100 Cryptocurrencies – Crypto News

-

Business3 days ago

Business3 days agoChase Launches $4 Million Grant Program as Restaurants Struggle – Crypto News

-

Technology3 days ago

Technology3 days agoIs AI causing tech worker layoffs? Thats what CEOs suggest, but the reality is complicated – Crypto News

-

Business2 days ago

Breaking: Solana ETFs Near Launch as Issuers Update S-1s With Fund Fees – Crypto News

-

Technology2 days ago

Coinbase to Offer Tokenized Stocks and Prediction Markets in U.S. – Crypto News

-

Blockchain21 hours ago

Blockchain21 hours agoBank of America Sees Interest in Tokenization of Real-World Assets – Crypto News

-

others1 week ago

Court Approves $1.9B Reserve Release, Enabling Next FTX Distribution – Crypto News

-

Business1 week ago

Elon Musk’s Tesla Reports $284 Million Gain On Bitcoin Holdings – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoOpenAI finally rolls out ChatGPT Agent after week-long delay: How it works – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNasdaq-listed Wellgistics Health adopts XRP Ledger for real-time payments – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSpot Ether ETFs Hit $453M in Inflows, Extend 16-Day Streak – Crypto News

-

others1 week ago

others1 week agoArthur Hayes-Backed Altcoin Outpaces Crypto Market Amid Launch of New Partnership With Anchorage Digital – Crypto News