De-fi

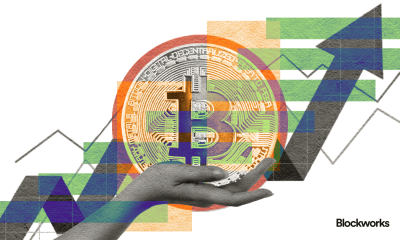

Crypto Markets Navigate Resistance Zones with ETF Flows in Flux – Crypto News

Investor sentiment seems cautious ahead of key policy events, with Bitcoin’s next move likely to shift markets, according to Glassnode.

Cryptocurrency markets showed mixed signals as investor caution grew ahead of major policy events expected today, including a Federal Reserve rate decision and a White House crypto report.

Large-cap crypto assets are mostly flat over the past 24 hours, while total crypto market cap slid to approximately $3.92 trillion, down 4.1% on the day, per CoinGecko data. Exchange-wide trading volume declined to approximately $138 billion in the past 24 hours.

Bitcoin (BTC) continues to trade sideways this week, trading just under $118,000, flat on both the daily and weekly timeframes. The leading cryptocurrency spike to as high as $118,644 earlier today before retracing.

Bitcoin has remained range-bound in recent weeks, and analysts at Glassnode said in a report yesterday that a break above or below this range could reshape market dynamics.

“A confirmed breakout beyond this zone could shift market dynamics, bringing the $141K region into focus,” Glassnode wrote in the repor, noting this level could trigger aggressive profit-taking.

Ethereum (ETH) — which today marks its ten year anniversary since launch — is also flat on the day, up just under 1% to trade around $3,800. The largest altcoin is up almost 5% on the week, and over 50% over the past month.

Among other large-cap altcoins, the price of XRP saw no change on the day, still trading above the $3 mark, but down 5% over the past week, losing some of its gains this month. Solana (SOL) is trading around $179, down 1.5% over the past day and nearly 7% on the week, also continuing to reverse some of its July growth. Last week, SOL broke over the $200 mark for the first time since February.

As for liquidations, roughly $217 million in leveraged crypto positions were wiped out over the past day, according to CoinGlass. Ethereum led 24-hour liquidations with $46.3 million, while other altcoins made up nearly $46 million of the total.

Bitcoin Awaits Catalyst

Coinbase noted in its monthly market positioning report for July that speculative positioning across large-cap tokens has intensified, buoyed by inflows into the U.S.-listed spot crypto exchange-traded funds (ETFs) and rising short-term holder activity. Still, signs of resistance are building.

“ETH upside faces strong resistance: a July spike in ask liquidity 2–5% above mid aligned with its local top and now forms a strong sell wall,” the exchange’s analysts said, adding that Bitcoin’s order book is more balanced and awaiting “new catalysts rather than entrenched order-book pressure.”

Despite price weakness, Coinbase pointed to improving on-chain fundamentals. Transfer activity, transaction counts, and fee generation are all trending upward, helping push its composite adoption index toward cycle highs. Stablecoin balances have also risen, a sign that sidelined capital may return once sentiment shifts, the analysts said.

ETF Interests Reverse

ETF flows offered mixed signals yesterday. Spot Bitcoin ETFs saw a sharp slowdown in net inflows, dropping from $157 million on Monday to just under $80 million on Tuesday. Ethereum ETFs, by contrast, rebounded to $218.64 million in inflows, up from $65.14 million the day before, according to SoSoValue data.

Capital is shifting just as a federal working group formed by U.S. President Donald Trump reportedly released a much-anticipated crypto policy report today, calling on regulators to clarify rules around digital asset trading and custody. The report urges Congress to authorize the CFTC to oversee spot markets for non-security tokens and recommends broader use of safe harbor provisions to foster innovation, according to Bloomberg.

FOMC Meeting

Ahead of the Federal Reserve’s meeting later today, markets largely expect officials to keep interest rates steady at 4.25%-4.50%, marking a likely fifth consecutive pause.

However, internal divisions appear to be growing, with Governors Christopher Waller and Michelle Bowman reportedly inclined to dissent in favor of a 25 basis-point cut, a rare move that could signal emerging uncertainty within the committee.

Konstantin Anissimov, CEO of trading platform Currency, described the moment as pivotal for digital assets in a commentary for The Defiant.

“Bitcoin’s surge past $117,000, driven by the U.S.-EU trade deal, the Fed’s July report promoting Bitcoin integration and infrastructure access, and reinforced by record ETF inflows, reflects growing institutional confidence in crypto as a macro hedge,” Anissimov said, adding that with traditional brokers exploring stablecoin issuance and Ethereum-native treasuries expanding DeFi’s reach, “the convergence of regulation, infrastructure, and innovation is accelerating.”

-

Technology1 week ago

Technology1 week agoEngineers are chasing ₹30 lakh offers—but not from startups – Crypto News

-

Technology1 week ago

Technology1 week agoEinride Raises $100 Million for Road Freight Technology Solutions – Crypto News

-

Blockchain2 days ago

Blockchain2 days agoIt’s About Trust as NYSE Owner, Polymarket Bet on Tokenization – Crypto News

-

others1 week ago

David Schwartz To Step Down as Ripple CTO, Delivers Heartfelt Message to XRP Community – Crypto News

-

Technology1 week ago

Fed’s Goolsbee Cites Inflation Worries in Case Against Further Rate Cuts – Crypto News

-

others1 week ago

Ireland AIB Manufacturing PMI increased to 51.8 in September from previous 51.6 – Crypto News

-

Technology1 week ago

Breaking: BNB Chain Account Hacked With Founder CZ Shown Promoting Meme Coin – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXPL, Not XRP: Why Are Whales Shoveling Ripple’s Rival? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin’s rare September gains defy history: Data predicts a 50% Q4 rally to 170,000 dollars – Crypto News

-

Technology1 week ago

Technology1 week agoCAKE eyes 60% rally as PancakeSwap hits $772B trading all-time high – Crypto News

-

Technology1 week ago

Technology1 week agoiQOO 15 key specifications leaked ahead of launch: Here’s what to expect – Crypto News

-

Technology1 week ago

Breaking: BNB Chain Account Hacked With Founder CZ Shown Promoting Meme Coin – Crypto News

-

Technology1 week ago

Technology1 week agoUS SEC weighs tokenised stock trading on crypto exchanges – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWatch These Key Bitcoin Metrics as BTC Price Prepares for ‘Big Move’ – Crypto News

-

others1 week ago

Japan Industrial Production (YoY) declined to -1.3% in August from previous -0.4% – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Bullish Pattern That Suggests New Highs – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump Pulls Brian Quintenz Nomination for CFTC – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slips as U.S. Government Shutdown Looms – Crypto News

-

Technology1 week ago

Technology1 week agoAltcoins today: Perpetual tokens shed over $1.3B as ASTER, AVNT, and APEX tumble – Crypto News

-

others1 week ago

Japan Tankan Large All Industry Capex climbed from previous 11.5% to 12.5% in 3Q – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHorizen (ZEN) gains 12% to break above $7 – Crypto News

-

Business1 week ago

SUI Price Eyes $4.5 as Coinbase Futures Listing Sparks Market Optimism – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks rose from previous ¥-1747.5B to ¥-963.3B in September 26 – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle Nano Banana trend: 50 AI prompts to transform men’s selfies into retro-golden Durga Puja portraits – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWho is Alexandr Wang? Meta AI chief and 28-year-old billionaire urges teens to spend ‘all their time’ on this activity – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Founder Dumps Billions In These Meme Coins, Is This A Repeat Of Shiba Inu In 2021? – Crypto News

-

Technology1 week ago

Technology1 week agoChainlink and Swift allow banks to access blockchain through existing systems – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoMetaplanet Expands Bitcoin Holdings To Over 30K BTC – Details – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUSDT, USDC Dominance Falls To 82% Amid Rising Competition – Crypto News

-

Technology5 days ago

Technology5 days agoWhat Arattai, Zoho’s homegrown messaging app offers: Key features, how to download, top FAQs explained – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDX Terminal Tops NFT Sales Count in September as Base Dominates Top 10 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDX Terminal Tops NFT Sales Count in September as Base Dominates Top 10 – Crypto News

-

Technology1 week ago

Breaking: SEC Moves To Allow On-Chain Stock Trading Alongside Crypto Amid Tokenization Push – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSolana ETF issuers gear up for SEC approval as soon as next week: Sources – Crypto News

-

De-fi1 week ago

De-fi1 week agoBitcoin Split Over Proposed Upgrade That Could Censor Transactions – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTapzi Presale Offers Potential 185% Returns as Crypto Markets Rally – Crypto News

-

others1 week ago

Japan Tankan Non – Manufacturing Outlook registered at 28, below expectations (29) in 3Q – Crypto News

-

others1 week ago

BONK Price Rally Ahead? Open Interest Jumps as TD Buy Signal Flashes – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAmazon is overhauling its devices to take on Apple in the AI era – Crypto News

-

Technology1 week ago

XRP Ledger Rolls Out MPT Standard for Real-World Asset Tokenization – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThe factors set to spur another ‘Uptober’ for BTC – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoBlackRock launches AI tool for financial advisors. Its first client is a big one. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBREAKING: Bitcoin Reclaims $120K. Is ATH Next? – Crypto News

-

others1 week ago

others1 week agoUSD/JPY returns below 147.00 amid generalized Dollar weakness – Crypto News

-

others1 week ago

Fed’s Lorie Logan Urges Caution on Further Rate Cuts Citing Inflation Risks – Crypto News

-

Business1 week ago

Nasdaq-Listed Fitell Adds Pump.fun’s PUMP To Supplement Solana Treasury – Crypto News

-

Technology7 days ago

Tech Giant Samsung Taps Coinbase To Provide Crypto Access, Driving Adoption – Crypto News

-

Business6 days ago

REX-Osprey Files For ADA, HYPE, XLM, SUI ETFs as Crypto ETF Frenzy Heats Up – Crypto News

-

Technology6 days ago

Technology6 days agoGemini Nano Banana hacks: How to make AI-powered handwritten Diwali 2025 invites, reveals Google – Crypto News

-

Technology6 days ago

Expert Predicts SHIB Rally as Shiba Inu Restores Shibarium After $4M Hack Shutdown – Crypto News