De-fi

Decoding DeFi Risks: Exploring the Data Behind $50B+ in DeFi Losses – Crypto News

According to IntoTheBlock, a staggering $58.78 billion was lost to DeFi exploits between 2020 and 2023.

The DeFi space has created a myriad of opportunities for its participants – from six figures airdrops, to permissionless access to credit. Through tokenized ownership systems on-chain, DeFi applications amassed over $70B in deposits within less than a decade.

The growth of the DeFi space has been remarkable, but has also been accompanied by an unfortunate rise in exploits, leading to substantial capital losses. According to IntoTheBlock, a staggering $58.78 billion was lost to DeFi exploits between 2020 and 2023, reflecting the vulnerabilities inherent in this burgeoning ecosystem.

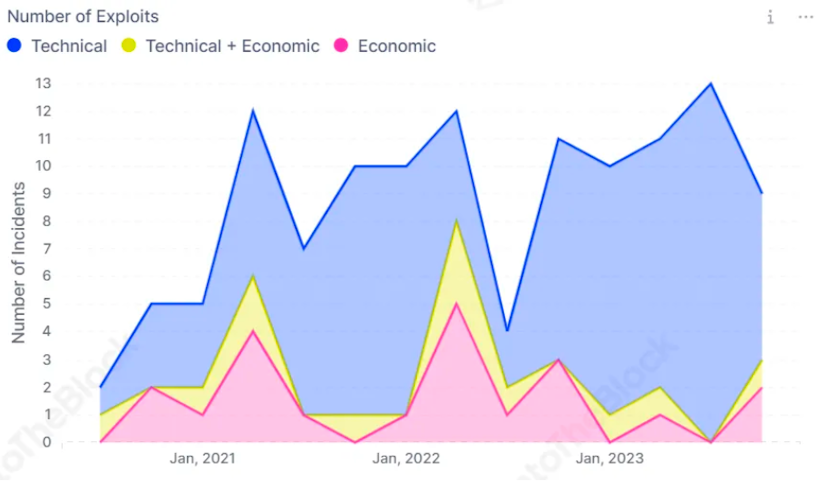

Source: IntoTheBlock DeFi Exploits Perspectives

The year 2021 witnessed a notable rise in value lost, with nearly $4 billion succumbing to exploits. However, the situation escalated dramatically in 2022, witnessing a staggering $53.5 billion in losses. The total amount lost decreased substantially to $1B in 2023, as there was no systemic collapse like Terra’s and less bridge exploits. Although the losses dipped in 2023, the challenges posed by these risks remain a significant hurdle for wider DeFi adoption.

The nature of these losses can vary significantly. Not all of these are considered “exploits” by the common definition, but they are all subject to a fault cracking – either from someone purposefully causing it or the underlying system being fragile – leading to depositors losing their funds. The factors behind these losses can be broadly categorized within two categories:

Technical Risks

These arise from potential vulnerabilities in a protocol’s code, leaving room for exploitation by internal or external actors. Infamous incidents such as The DAO hack, executed through a re-entrancy attack, and the Ronin Network bridge exploit, a breach in a multi-sig wallet, exemplify how technical risks can lead to malicious capital extraction. These also include infamous rug pulls where developers have access to deposits unbeknownst to users.

Economic Risks

These stem from imbalances in the supply/demand dynamics of a protocol, resulting in losses for depositors. Economic risks can emerge from market activity, price manipulation, governance controls, or flawed mechanism design. Examples include the Terra/UST collapse, where supply minting failed to sustain UST’s peg, and oracle manipulation attacks, where attackers artificially inflate an asset’s price to bypass borrow limitations

Source: IntoTheBlock DeFi Exploits Perspectives

As it’s pictured above, the majority of incidents leading to losses in DeFi comes from technical risk factors. On a quarterly basis, there are on average 6 technical exploits of over $1M happening in DeFi since 2020, making up about 73% of all incidents. In terms of losses, however, a staggering $53B has been lost due to economic risks.

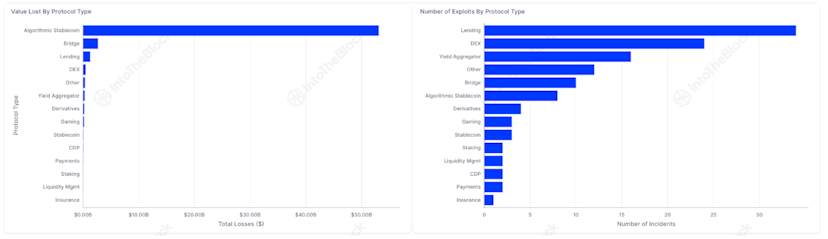

The type of risk exploited often aligns with a protocol’s category, such as algorithmic stablecoins collapsing primarily due to economic factors, while bridges, being complex from a developer standpoint, fall victim to technical hacks.

Source: IntoTheBlock DeFi Exploits Perspectives

Algorithmic stablecoins stand out as the primary source of losses in DeFi, surpassing losses from all other categories combined. Outside of Terra’s $50B losses, Iron Finance and Neutrino also led to hundreds of millions of losses for this category. On the other hand, lending protocols, although exploited more frequently in terms of incidents, contribute to a smaller portion of the overall losses.

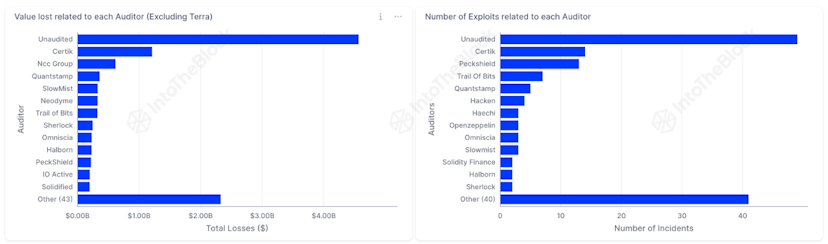

These are factors worth considering for any user looking to deploy capital into DeFi. Similarly, another key factor to consider when reviewing a protocol is how many times it has been audited.

Source: IntoTheBlock DeFi Exploits Perspectives

Unaudited protocols have been exploited 50 times and led to over $4.5B in losses for DeFi users. Then there are auditors with a better track record than others, which is why it is typically worth looking for protocols with more than one auditor prior to depositing assets.

After depositing, unfortunately there is typically little users can do to protect themselves against technical risks. Even if they have advanced knowledge of solidity and other smart contract programming languages, technical exploits usually happen within one block making them very difficult to mitigate.

On the other hand, economic risks can often be more foreseeable and manageable both for the user and the protocol developers. De-pegging events arise from market movements, typically accompanied by weak incentive assumptions. Bad debt resulting from “highly profitable strategies” also tend to come from hours of artificial price activity in order to manipulate oracles’ data. Impermanent loss can also be actively monitored and potentially even hedged.

This mitigable nature of economic risks arguably makes them more important to monitor for active DeFi users. Through IntoTheBlock’s Institutional DeFI Unlocked report, we shed some light on the nature of these risks and indicators to track to manage risk in DeFi. Ultimately, through this report and the newly-released DeFi Risk Radar platform, we aim to educate users at scale and drive broader usage of DeFi building on the back of more transparent risk management data.

-

Blockchain1 week ago

Blockchain1 week agoOn-Chain Tokenization for Payments Professionals – Crypto News

-

others1 week ago

others1 week agoBillionaire Barry Silbert Says This Is the Next Big Investment Theme for Crypto Assets – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP bulls eye $2.60 – One move can trigger a major squeeze – Crypto News

-

others1 week ago

others1 week agoGBP/USD retreats from YTD high past 1.34 on Fed turmoil – Crypto News

-

others7 days ago

Cantor Partners With Tether, SoftBank, Bitfinex For $3 Billion Bitcoin Bet – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoDogecoin ETF? 21Shares files as crypto market sees 12% rally – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoin unit bias ‘absolutely destroying’ crypto newbies — Samson Mow – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCardano Price Safeguards $0.600 Support, Upside Momentum Weakens – Crypto News

-

Business1 week ago

Expert Says Solana Price To $2,000 Is Within Reach, Here’s How – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBybit CEO: Two-Thirds of Funds From $1.4B Lazarus Group Hack Still Traceable – Crypto News

-

Technology1 week ago

Peter Schiff Predicts Gold Will Soar As Fed Cuts Rates, Will Bitcoin Price Follow? – Crypto News

-

others7 days ago

others7 days agoAustralian Dollar receives support as private sector activity expands in April – Crypto News

-

Technology7 days ago

Technology7 days agoAWS, Microsoft Slow Down Data Center Deployments – Crypto News

-

others6 days ago

others6 days agoTests 99.00 support after pulling back from nine-day EMA – Crypto News

-

Technology6 days ago

Technology6 days agoHashKey, Bosera partner to launch world’s first tokenized money market ETFs – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP climbs on risk appetite as Trump Fed stance lift crypto rally – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFARTCOIN Returns to Top 100 Alts After 10% Surge, BTC Stays Calm at $85K (Weekend Watch) – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEvening Workouts Could Be Disrupting Your Sleep, New Study Finds – Crypto News

-

Cryptocurrency1 week ago

Elizabeth Warren Warns Stock Market Will Crash If Trump Fires Powell, Will Crypto Market Crash Too? – Crypto News

-

Business1 week ago

XRP, Bitcoin, Ethereum Price Prediction: $100M Shorts Wiped as Crypto Market Bounces 2.89% – Crypto News

-

others1 week ago

MSTR Stock Price Surge on $556M Bitcoin Purchase, But Analysts Warn of Crash, Here’s Why – Crypto News

-

Technology1 week ago

European Central Bank Claims Trump’s Crypto Push to Impact Europe Economy – Crypto News

-

Business7 days ago

Quickswap Founder Shares What it Takes to Build a Successful DEX – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoAnalyst holds $5 target for Pi Network ahead of major token release – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoBuilding trust in Agentic AI and the future of enterprise solutions – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoStrike’s Mallers to head firm seeking superior Bitcoin play to MSTR – Crypto News

-

Technology6 days ago

Metaplanet Acquires 145 Bitcoin, Bringing Total Holdings To 5,000 BTC – Crypto News

-

others1 week ago

others1 week agoControversial Exchange eXch To Shutter in May Amid Allegations the Project Laundered Crypto Stolen in Bybit Hack – Crypto News

-

others1 week ago

others1 week agoEUR/USD climbs as US Dollar weakens on trade tensions – Crypto News

-

Technology1 week ago

What Next For Crypto Market As Trump Signals Potential End To US-China Trade War? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP bulls eye $2.60 – One move can trigger a major squeeze – Crypto News

-

Technology1 week ago

Technology1 week agoUK’s Lomond school pioneers Bitcoin payment for tuition The Block – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump Tariffs Spark Panic Selling – Crypto News

-

De-fi1 week ago

De-fi1 week agoDive Into Lending, Borrowing, and Real World Assets with Maple Finance: Sid Powell – Crypto News

-

Cryptocurrency1 week ago

Cathie Wood’s Ark Invest Gains First Exposure to Solana With 3iQ ETF Bet – Crypto News

-

Business1 week ago

Paul Atkins Officially Sworn In As SEC Chair, Here’s What To Expect – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Rally Ahead? Analysts Say These Key Indicators Look Bullish – Crypto News

-

Business1 week ago

Is Galaxy Digital Selling Ethereum And Buying Solana On Binance? – Crypto News

-

others1 week ago

others1 week agoGalaxy Executive Predicts That US Government Will Accumulate Bitcoin This Year To Boost BTC Strategic Reserve – Crypto News

-

Technology7 days ago

Ethereum Price Reverse Below $1,700 as Galaxy Digital Dumps $106M ETH for Solana – Crypto News

-

Cryptocurrency7 days ago

Over $120 Million Chainlink Exit Exchanges, What Is Happening? – Crypto News

-

Technology7 days ago

Technology7 days agoGrayscale moves to convert Digital Large Cap Fund into ETF – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoColorado sees just 80 crypto tax payments in 3 years – Crypto News

-

Technology6 days ago

Technology6 days agoALOGIC Echelon wireless keyboard and mouse review: Quiet, capable, and convenient – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoGalaxy Digital secures FCA approval to offer derivatives trading in the UK – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoWill Litecoin hit $100? Trump’s tariff pause, ETF hopes fuel debate – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Targets $33 To $50 By September 2027, Research Firm Says – Crypto News

-

others6 days ago

others6 days agoXRP, Solana, DOGE and Others Among 72 Different ETF Applications Waiting for SEC Approval: Report – Crypto News

-

Technology5 days ago

Technology5 days agoGadgets for every classroom quest: Grab up to 60% off on laptops, tablets, headphones and more – Crypto News

-

others5 days ago

others5 days agoWorried uncertainty may cause layoffs – Crypto News