others

DJIA drops over 0.5% after Fed meeting – Crypto News

- The Dow Jones Industrial Index falls on Thursday but outperforms NASDAQ, S&P 500.

- Federal Reserve dot plot raises interest rate forecasts for 2024, 2025.

- Cisco attempts to buy Splunk for $28 billion.

- Powell says majority of Fed governors favor another hike in 2023.

- Initial Jobless Claims of 201K came in well below consensus.

The Dow Jones Industrial Average (DJIA) is down over 0.5% on Thursday, at the time of writing, as the entire equity market recedes for a second day. The decline comes after the Federal Reserve meeting on Wednesday, when the US central bank once again paused interest rates but raised the specter of another hike before year end.

Dow component Cisco (CSCO) announced plans to buy Splunk (SPLK) for $28 billion. The deal values Splunk at a 32% premium to Wednesday’s closing price. On the other hand, Cisco’s share price fell nearly 5% on the news.

The more value-oriented Dow has so far been outperforming its index cousins this week. The NASDAQ Composite and S&P 500 have both fallen by more than 1% on Thursday.

Dow Jones News: Fed delivers most hawkish pause possible

As predicted far and wide, the Federal Reserve left interest rates parked in the range of 5.25% to 5.5%. The Dow Jones advanced in the lead up to Wednesday’s Federal Open Market Committee presser, but the entire market caved once it saw the Fed’s dot plot.

The dot plot is just the colloquial term for the Summary of Economic Projections (SEP) report that shows individual Fed governors’ forecasts for interest rates in the future. A big surprise was that about two-thirds of voting governors think the bank will raise rates again before the year is out. In total, 12 governors estimated that 2023 ends 25 basis points higher than the current range, while seven governors forecast rates staying put.

Still, the CME Group’s FedWatch Tool has only ticked up from 29% to a 31.5% chance that the central bank raises rates at the November 1 meeting. The forecast for a 25 bps hike at the December 31 meeting likewise has only risen by 2 percentage points to 39%.

The market seems less focused on 2023 rates and more worried that the Fed thinks rates will remain higher for longer. In the previous meeting, the dot plot showed consensus among governors for interest rates falling by 100 basis points by the end of 2024. The September version, however, showed a mere 50 basis point cut. What’s more, the new SEP has rates coming down more slowly in 2025 than earlier projections.

This new hawkish demeanor from the Fed’s Powell comes on the back of higher-than-expected Consumer Price Index (CPI) and Producer Price Index (PPI) data that showed an inflationary environment more stubborn than before.

Essentially, the equity market is in decline as institutional investors bail out of stocks for the greater certainty of Treasuries. The 2-year Treasury saw yields rise nearly 2% early Thursday to a level not seen in decades. If there is any silver lining, it is that the more growth-oriented NASDAQ is beginning to underperform the less interest rate-sensitive Dow Jones index.

Initial Jobless Claims arrive lower than consensus

The Initial Jobless Claims for the week ending September 15 were reported before market open on Thursday. The topline figure of 201K was well below consensus of 225K, as well as the previous week’s print of 221K. It seems the economy, and the labor market is doing better than economists expected.

Continuing Jobless Claims for the week ending September 8 also performed better than the average forecast. Continuing Jobless Claims printed at 1.662 million, lower than the previous report for 1.683 million.

After the market opens, data on US Existing Home Sales Change for August will be released. The consensus expects an improving picture after the previous month’s -2.2% print.

On Friday, the S&P Global PMIs for Manufacturing and Services will be released. Both are expected to improve by 10 basis points to 48 and 50.6, respectively.

Dot Plot FAQs

The “Dot Plot” is the popular name of the interest-rate projections by the Federal Open Market Committee (FOMC) of the US Federal Reserve (Fed), which implements monetary policy. These are published in the Summary of Economic Projections, a report in which FOMC members also release their individual projections on economic growth, the unemployment rate and inflation for the current year and the next few ones. The document consists of a chart plotting interest-rate projections, with each FOMC member’s forecast represented by a dot. The Fed also adds a table summarizing the range of forecasts and the median for each indicator. This makes it easier for market participants to see how policymakers expect the US economy to perform in the near, medium and long term.

The US Federal Reserve publishes the “Dot Plot” once every other meeting, or in four of the eight yearly scheduled meetings. The Summary of Economic Projections report is published along with the monetary policy decision.

The “Dot Plot” gives a comprehensive insight into the expectations from Federal Reserve (Fed) policymakers. As projections reflect each official’s projection for interest rates at the end of each year, it is considered a key forward-looking indicator. By looking at the “Dot Plot” and comparing the data to current interest-rate levels, market participants can see where policymakers expect rates to head to and the overall direction of monetary policy. As projections are released quarterly, the “Dot Plot” is widely used as a guide to figure out the terminal rate and the possible timing of a policy pivot.

The most market-moving data in the “Dot Plot” is the projection of the federal funds rate. Any change compared with previous projections is likely to influence the US Dollar (USD) valuation. Generally, if the “Dot Plot” shows that policymakers expect higher interest rates in the near term, this tends to be bullish for USD. Likewise, if projections point to lower rates ahead, the USD is likely to weaken.

Dow Jones Industrial Average forecast

The Dow Jones appears to be in pullback mode. The index has not reached a new high since August 1, nearly two months ago. The futures market shows the Dow crossing below the 32,291 low from September 6. With the DJIA now plumbing the line near 34,250, the next stop may be the August 25 low at 34,029. A true downtrend will need to break to a lower low below that 34,029 level, however. That is why 33,700 seems like a solid bet at the moment.

Dow Jones Industrial Average daily chart

It does appear that investors should have foreseen the current pullback. Dow Theory tells us that we should watch out for periods where the Dow Jones Industrial Average pulls away from the Dow Transport Index (DJT), and that is exactly what took place mid-summer. In the chart below, the DJT advanced well above the DJIA, which it normally travels with in near lock-step.

Dow Theory says that when this relationship gets out of whack, a reversal in trend is likely to come next. Sure enough, that seems to be taking place right in front of use.

DJT/DJIA 5-year chart

-

Technology5 days ago

Technology5 days agoVisual effects veteran Ed Ulbrich joins AI company Moonvalley – Crypto News

-

Technology5 days ago

Technology5 days agoVisual effects veteran Ed Ulbrich joins AI company Moonvalley – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoWhy Sandeep Nailwal Is Betting on Himself as Polygon CEO – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAI Deepfakes Drove 40% of High-Value Crypto Fraud Last Year: Report – Crypto News

-

De-fi5 days ago

De-fi5 days agoEthereum Staking Hits Record 35 Million ETH, Locking 28% of Supply – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoHyperliquid price outlook amid Eyenovia’s $50M HYPE treasury strategy – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin Cash price forecast: BCH steady despite profit taking – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoCan BNB Punch Through The Ceiling Or Will 640 Catch The Fall? – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoCan BNB Punch Through The Ceiling Or Will 640 Catch The Fall? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBitcoin Pepe presale nears major milestone ahead of Fed decision – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoShib Alpha Layer Marks End Of Meme Era – Crypto News

-

Technology5 days ago

Technology5 days ago5 star window ACs built for efficient cooling, quiet performance, and long-term power savings: Top 8 picks – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoPEPE drops 20%, yet whales just bought 531B tokens – Here’s why – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoBinance, OKX Set Transparency Standard with PoR Reports as Coinbase Lags: CQ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoBarbie maker Mattel partners with OpenAI to launch AI-powered toys in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDeFi’s top DAOs have huge treasuries – Yet they’re blind to THESE… – Crypto News

-

Technology1 week ago

Technology1 week agoInfinix aims to be known as gaming-first brand, eyes tier 2, tier 3 cities: India CEO – Crypto News

-

others7 days ago

others7 days agoGBP/USD rebounds above 1.36 as Israel-Iran conflict deepens – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoJPMorgan Chase Says Deposit Token Is ‘Superior’ to Stablecoins – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoTruth Social files for a Bitcoin and Ethereum ETF – Crypto News

-

others5 days ago

United States 4-Week Bill Auction fell from previous 4.08% to 4.06% – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days ago$100,000 Bitcoin on Thin Ice as Major Death Cross Nears – Crypto News

-

others1 week ago

others1 week agoThis Dogecoin Rival Could Go Higher Amid Increased Whale Activity, Says Analytics Platform Santiment – Crypto News

-

others1 week ago

others1 week ago65-Year-Old Forced Out of Retirement After Losing ‘Everything’ in Elaborate Bank Fraud Scam – Crypto News

-

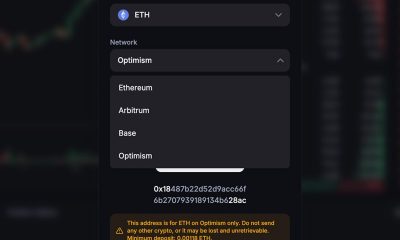

De-fi1 week ago

De-fi1 week agoUniswap Launches Smart Wallets with One-Click Swaps, Bundled Transactions Powered by Alchemy – Crypto News

-

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-400x240.jpg)

![DIS Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/06/DIS-Elliott-Wave-technical-analysis-Video-Crypto-News-80x80.jpg) others5 days ago

others5 days agoDIS Elliott Wave technical analysis [Video] – Crypto News

-

others5 days ago

others5 days agoTAC Raises $11.5M to Bring DeFi to Telegram’s Billion-User Ecosystem – Crypto News

-

Technology5 days ago

Technology5 days agoGoogle Pixel 10 series may feature dual speakers and SIM tray shift, leak hints – Crypto News

-

Technology5 days ago

Technology5 days agoTrump Adviser David Sacks Says China Adept at Evading Chip Curbs – Crypto News

-

De-fi5 days ago

De-fi5 days agoTokenized Treasuries Surge to $5.6 Billion, Fueling Growth in RWAs: CoinGecko – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBillionaire Snaps Up $100M Of Trump Coin After Investigation Ends – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle Search is fading. The whole internet could go with it. – Crypto News

-

De-fi1 week ago

De-fi1 week agoAnthony Pompliano to Lead ProCapBTC $750 Million Bitcoin Vehicle: FT – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAmazon turns to nuclear energy to power AI facility – Crypto News

-

Technology1 week ago

Technology1 week ago97% of Foxconn’s iPhone exports from India now headed to the US amid soaring China tariffs – Crypto News

-

others1 week ago

others1 week agoFormer Crypto Executive Appointed To Serve As SEC’s Director of Trading and Markets – Crypto News

-

Technology1 week ago

Technology1 week agoBig tech on a quest for ideal AI device – Crypto News

-

others1 week ago

others1 week agoAnalytics Platform Warns Bitcoin Is ‘Stalling’ Below Major Resistance Level, Says Breakout Won’t Happen Until This Happens – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKlein Funding and Bybit Partner to Launch a New Era of Crypto Prop Trading – Crypto News

-

Technology7 days ago

Technology7 days agoMark Zuckerberg teases Meta smart glasses with Oakley—What’s coming on June 20? – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoHow Low Can Cardano Go? Analyst Maps Final Crash Target – Crypto News

-

De-fi5 days ago

De-fi5 days agoIran’s Largest Crypto Exchange Nobitex Hacked for Over $80 Million Amid Israeli-Iran Conflict – Crypto News

-

others5 days ago

others5 days agoAlex Mashinsky Barred From Receiving Any Assets From Celsius Bankruptcy Claims – Crypto News

-

Cryptocurrency4 days ago

Cryptocurrency4 days agoAERO price jumps 20% as it defies crypto downturn – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoBarbie maker Mattel partners with OpenAI to launch AI-powered toys in 2025 – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle, Apple clash with Meta over age checks on App Stores: All you need to know – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin falls to $103K, options skew hits 3-month low as mideast tensions drive oil prices higher – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago7 Solana ETF Issuers File S-1, Analyst Doubts Next Week Approval – Crypto News

-

others1 week ago

others1 week agoPosts weekly loss, despite Friday rebound to 0.8100 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAltcoin Season Index dips to 26: Is Bitcoin dominance fading, or just pausing? – Crypto News