others

Do CBDCs (Central Bank Digital Currencies) Threaten Bitcoin – Crypto News

HodlX Guest Post Submit Your Post

The invention of Bitcoin was a technological breakthrough that disrupted the status quo. When Bitcoin was first created, central banks thought they could safely ignore it.

As Bitcoin adoption gained momentum, central banks were forced to pay attention and try to understand what Bitcoin means for the roles of central banks and the technology they use.

In recent years, central banks have converged on the point of view that there are aspects of Bitcoin that they can and should incorporate into their processes and underlying software.

CBDC (central bank digital currency) is a catch-all term for a central bank-issued currency that incorporates elements of cryptocurrencies into its operating model.

Since money is already digital, why are governments considering CDBCs

Central bankers and government officials claim CBDCs promote financial inclusion by offering the unbanked easy access to safe money.

They also state that CBDCs will increase payment efficiencies, lower transaction costs and make it easier for governments to enact monetary and fiscal policy.

In addition to these claims, CBDCs offer governments two benefits that should not be ignored CBDCs increase the state’s financial power over citizens, and they serve as a surface-level competitor for private sector innovations like Bitcoin.

Implementing a CBDC risks destabilizing large sectors of the economy, which explains why people are uneasy about the idea in countries like the United States.

Further, they represent a mild technological upgrade to fiat money not a breakthrough in monetary technology like Bitcoin.

CBDCs are still the same inflationary fiat currencies as before, albeit fully digital and less private.

In contrast, consumers are drawn to Bitcoin because of its unique monetary qualities and its censorship resistance.

Fortunately, CBDCs are not a threat to Bitcoin. In fact, CBDCs may even hasten Bitcoin’s adoption.

What are CBDCs

In the United States, the Federal Reserve creates dollars. These dollars consist of a mix of physical cash and reserve balances held by banks at the Fed.

Consumers use a combination of physical cash and digital dollars represented as deposits in their bank accounts.

However, digital dollars held in consumer bank accounts differ from those held by banks at the Federal Reserve.

Digital dollars in consumer bank accounts actually represent claims to dollars banks hold with the Fed.

Consumers cannot directly use these dollars because only financial institutions can access them.

We do not notice the difference between digital dollars claims to reserve balances and actual dollars because the US banking system is currently solvent and secure enough that the distinction has no day-to-day consequences for now.

Pre-CBDC banking model in the US

CBDCs differ from digital dollars because they are actual dollars produced by the Fed, not claims to dollars held by banks at the Federal Reserve.

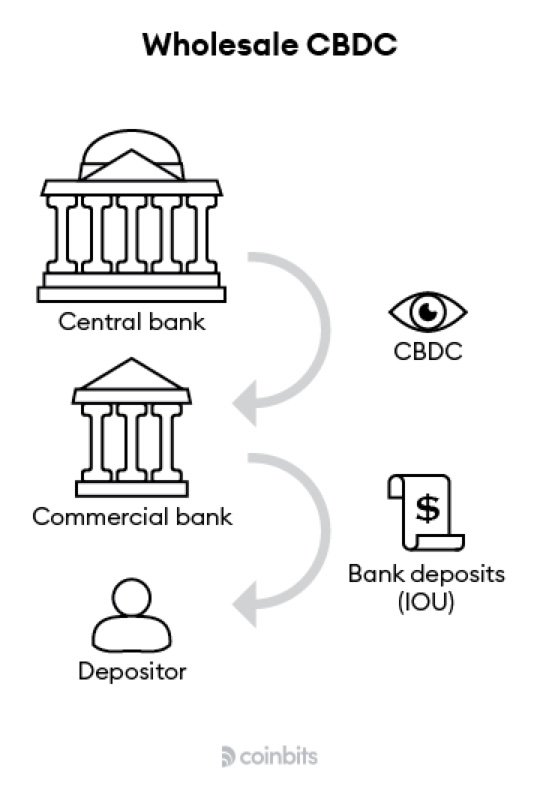

There are two avenues for central banks when implementing CBDCs wholesale and retail.

Under a wholesale model, CBDCs emulate bank reserves. The CBDC would be the monetary good that is deposited in the accounts that banks and other financial institutions hold at the Federal Reserve.

Banks would then provide a representation of those dollars, likely rehypothecated, in consumer bank accounts.

Wholesale CDBC model

As Nik Bhatia describes in ‘Layered Money,’

“Central banks could issue a digital currency in the form of wholesale reserves, which would only be accessible to banks… The digital reserves option has the potential to modernize financial infrastructure for the banking system, but it won’t impact how society interacts with money.”

In contrast, retail CBDCs would serve as digital cash for consumers. Think of a FedWallet app that lets you spend CBDCs just like any other cryptocurrency.

While the wholesale model would not significantly change the status quo, the retail route would upend the mechanics of the current banking system.

Retail CBDC model

Differences between the retail and wholesale models matter. As illustrated above, with a retail CBDC, Americans would have a direct bank account with the Fed without commercial intermediaries.

Given the unpredictable impact a retail CBDC would have on the American banking system, the Federal Reserve is focused on developing a wholesale CBDC instead.

Contrasting with that approach, however, the Biden-Harris administration reported on the feasibility of a CBDC system in the US and suggested there may be a growing political appetite for retail CBDCs.

The report states that “all should be able to use the CBDC system” and “the CBDC system should expand equitable access to the financial system.”

Since the wholesale model does not expand access to the financial system, the Biden-Harris report signals that politicians intend to explore the retail option.

CBDCs face problems

Business lending

CBDCs face competing goals. An important function of commercial banks is directing funds toward investment projects through loans.

If CBDCs successfully divert funds from the private financial system, entrepreneurs risk losing access to capital as CBDCs crowd out traditional banks.

Therefore, CBDCs would either compel governments to assume the lending role of commercial banks or reduce businesses’ access to capital.

Further, governments are ill-equipped to make investment decisions. When they do, the economy is impeded at best and severely damaged at worst.

Academics provide a solution to this problem of directing investment in an economy run on a retail CBDC, namely, to offer low CBDC interest rates to disincentivize large-scale CBDC accumulation.

However, this raises a question f citizens must be disincentivized from using CBDCs for one of the key use cases for money, why introduce them? The answer is unclear.

This inherent contradiction might explain why over two-thirds of public comment letters in response to the Federal Reserve’s proposal for a CBDC view the idea negatively.

Privacy

By removing commercial banks as financial mediators, CBDCs offer governments exclusive control over each citizen’s bank account.

Government officials no longer have to work with commercial banks they can limit, censor or stop financial transactions for any reason.

This is why CBDCs raise red flags for privacy-minded individuals.

Today, in China, DCEP (Digital Currency/Electronic Payments) allows the People’s Bank of China to surveil citizens’ everyday transactions.

Combining the DCEP with China’s social credit system gives the government the power to interact directly with consumer bank accounts based on political preference.

Even in Canada, which is not overtly authoritarian, Prime Minister Justin Trudeau froze the bank accounts of people who participated in or even financially supported protests against mandated COVID-19 vaccinations.

The programmability of CBDCs is also concerning. They allow central bankers to program monetary policy directly into the money people use every day.

For example, facing an economic crisis, central banks could decide to change the code for dollars so that they expire if they aren’t spent within an allotted time frame, forcing people to spend them on consumption to ‘stimulate’ the economy.

Government officials seem to be unaware of these risks or at least unwilling to discuss them. Instead, CBDC proponents praise their potential for programmability and surveillance.

Even putting aside privacy drawbacks, the consumer case for CBDCs is unclear. They do not alleviate financial problems, such as inflation, nor do they promote financial inclusion.

They also do not represent a technological breakthrough because the mix of technologies that they rely upon is already utilized by the Bitcoin network.

As William Luther and Andrew Bailey note,

“The standard case for a CBDC rests on the mistaken idea that we need new digital money for our new digital world. Much of our money is already digital though commercial bank deposits and transfers are recorded on computers, not paper ledgers.”

Bitcoin till better, not going away

In ‘American Banker,’ Rob Blackwell describes the threat this way,

“If bankers are not careful, they may find themselves on the losing end as they watch the Fed create an alternative to federally insured deposits.”

One can assume the commercial banking lobby will oppose CBDCs in full force, introducing another hurdle.

Further, while commercial banks are generally unpopular with consumers, it is questionable whether consumers would prefer interacting with central banks distant monolithic institutions that are all but guaranteed to have even worse customer service.

While central bankers write papers and pontificate about digital currency consumers do not want, Bitcoin adoption will continue for one reason it is simply the best form of money ever invented.

CBDCs do not threaten Bitcoin. In fact, insofar as they introduce additional risk, uncertainty and privacy concerns to the current financial system, the advent of CBDCs may even fuel further adoption of Bitcoin.

David Waugh is a business development and communications specialist at Coinbits. He previously served as the managing editor at the American Institute for Economic Research.

Follow Us on Twitter Facebook Telegram

Check out the Latest Industry Announcements

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

-

others1 week ago

Japan Foreign Investment in Japan Stocks up to ¥528.3B in December 12 from previous ¥96.8B – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus 15R vs Pixel 9a: Which phone is the best buy under ₹50,000? Display, camera, processor and more compared – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoThis Week in Stablecoins: Winning the Back Office – Crypto News

-

Technology5 days ago

Technology5 days agoApple iPhone 16 price drops to ₹40,990 in Croma’s Cromtastic December Sale: How the deal works – Crypto News

-

Technology5 days ago

Technology5 days agoApple iPhone 16 price drops to ₹40,990 in Croma’s Cromtastic December Sale: How the deal works – Crypto News

-

Business5 days ago

XRP Holders Eye ‘Institutional Grade Yield’ as Ripple Engineer Details Upcoming XRPL Lending Protocol – Crypto News

-

others6 days ago

others6 days agoAustralian Dollar loses as US Dollar advances before Michigan Sentiment Index – Crypto News

-

Business6 days ago

DOGEBALL Presale: A Boost to Bring P2E Games Back into the Spotlight – Crypto News

-

others5 days ago

XRP Holders Eye ‘Institutional Grade Yield’ as Ripple Engineer Details Upcoming XRPL Lending Protocol – Crypto News

-

Technology5 days ago

Technology5 days agoApple iPhone 16 price drops to ₹40,990 in Croma’s Cromtastic December Sale: How the deal works – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoLitecoin Follows Bitcoin’s Momentum, But Resistance Looms At $79.60 – Crypto News

-

Technology5 days ago

Technology5 days agoApple iPhone 15 price drops to ₹36,490 in Croma Cromtastic December Sale: How the deal works – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCapital gets selective – Blockworks – Crypto News

-

others1 week ago

Low-Fee vs. High-Leverage – How to Choose the Optimal Exchange for Your Trading Strategy? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBlockchain’s Institutional Future Is Private and Permissioned – Crypto News

-

Business5 days ago

125 Crypto Firms Mount Unified Defense as Banks Push to Block Stablecoin Rewards – Crypto News

-

Technology5 days ago

Michael Saylor Sparks Debate Over Bitcoin’s Quantum Risk as Bitcoiners Dismiss It as ‘FUD’ – Crypto News

-

Technology1 week ago

Technology1 week agoUS Puts Tech Deal With UK on Hold – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCiti Says Identity Is the New Gatekeeper for Financial Blockchains – Crypto News

-

others1 week ago

others1 week agoJapanese Yen strengthens as BoJ rate hike speculation grows – Crypto News

-

Metaverse1 week ago

How companies are using AI to squeeze more from your wallet – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin on Track For 4th Annual Decline Despite Crypto Adoption – Crypto News

-

Business5 days ago

Ethereum Faces Selling Pressure as BitMEX Co-Founder Rotates $2M Into DeFi Tokens – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoIs ETH Ready for Sustained Recovery or Another Rejection Looms? – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoCrypto Market Sentiment Not Fearful Enough For Bottom: Santiment – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoCrypto Market Sentiment Not Fearful Enough For Bottom: Santiment – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoLitecoin Follows Bitcoin’s Momentum, But Resistance Looms At $79.60 – Crypto News

-

Technology4 days ago

Technology4 days agoSamsung Galaxy S25 Ultra price drops to ₹69,999 at Croma Cromtastic December Sale? Here’s how the deal works – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHow Blockchain Works – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoSpaceX has two aces up its sleeve in the battle to put AI data centers in space – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin and Ethereum Wobble as US Reports Highest Unemployment Rate Since 2021 – Crypto News

-

others1 week ago

others1 week agoSEC Crypto Roundtable Questions Whether Americans Can Transact Without Surrendering Privacy – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy quantum computing is becoming a real concern for Bitcoin – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoMastercard, BlackRock Join Middle East-Focused Blockchain Effort – Crypto News

-

Technology6 days ago

Technology6 days agoFrom chibi to plushie: 7 Must-try AI portraits you can create with GPT Image 1.5 – Crypto News

-

Technology6 days ago

Technology6 days agoFrom chibi to plushie: 7 Must-try AI portraits you can create with GPT Image 1.5 – Crypto News

-

Business6 days ago

Breaking: VanEck Discloses Fees and Staking Details for its Avalanche ETF – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoCoinbase Launches Service to Help Businesses Create Tokens – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBTC at $143K, ETH above $4000: Citi issues bullish price forecasts as crypto market continues to struggle – Crypto News

-

Business6 days ago

Bitcoin Price Alarming Pattern Points to a Dip to $80k as $2.7b Options Expires Today – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI Tool of the Week: Transform marketing concepts instantly. – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBlackRock’s IBIT Ranks 6th in ETF Flows Despite Negative Returns – Crypto News

-

others5 days ago

others5 days agoElliott Wave, seasonality, and cycles indicate more upside – Crypto News

-

others5 days ago

others5 days agoElliott Wave, seasonality, and cycles indicate more upside – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBlockchain and AI Vibe-Coding To Dethrone Amazon Web Servies: Crypto exec – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoBanks Need XRP To Be Pricier—Here’s Why A Finance Expert Says So – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoXRP Could Add Zero If Rally Is Short-Lived – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus 15R and OnePlus Pad Go 2 launching in India tomorrow: How to watch live-stream, expected price, specs and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCan Bitcoin Bulls Spark a $95,000 BTC Price Rebound? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCan Bitcoin Bulls Spark a $95,000 BTC Price Rebound? – Crypto News