Cryptocurrency

Energy is the master resource but it could be Bitcoin that reigns supreme – Crypto News

Nothing shines a light on the importance of energy as much as a fast-approaching winter. When the temperature drops, the scarcity of energy becomes obvious and global efforts to preserve it begin.

This year, the fight for energy is more aggressive than it’s ever been.

The fiscal and monetary policies set in place during the COVID-19 pandemic caused dangerous inflation in almost every country in the world. The quantitative easing that set out to curb the consequences of the pandemic resulted in a historically unprecedented increase in the M2 money supply, This decision diluted the purchasing power and led to an increase in energy prices, sparking a crisis that is set to culminate this winter.

CryptoSlate Analysis has shown that the EU will most likely be the one hit the hardest by the energy crisis.

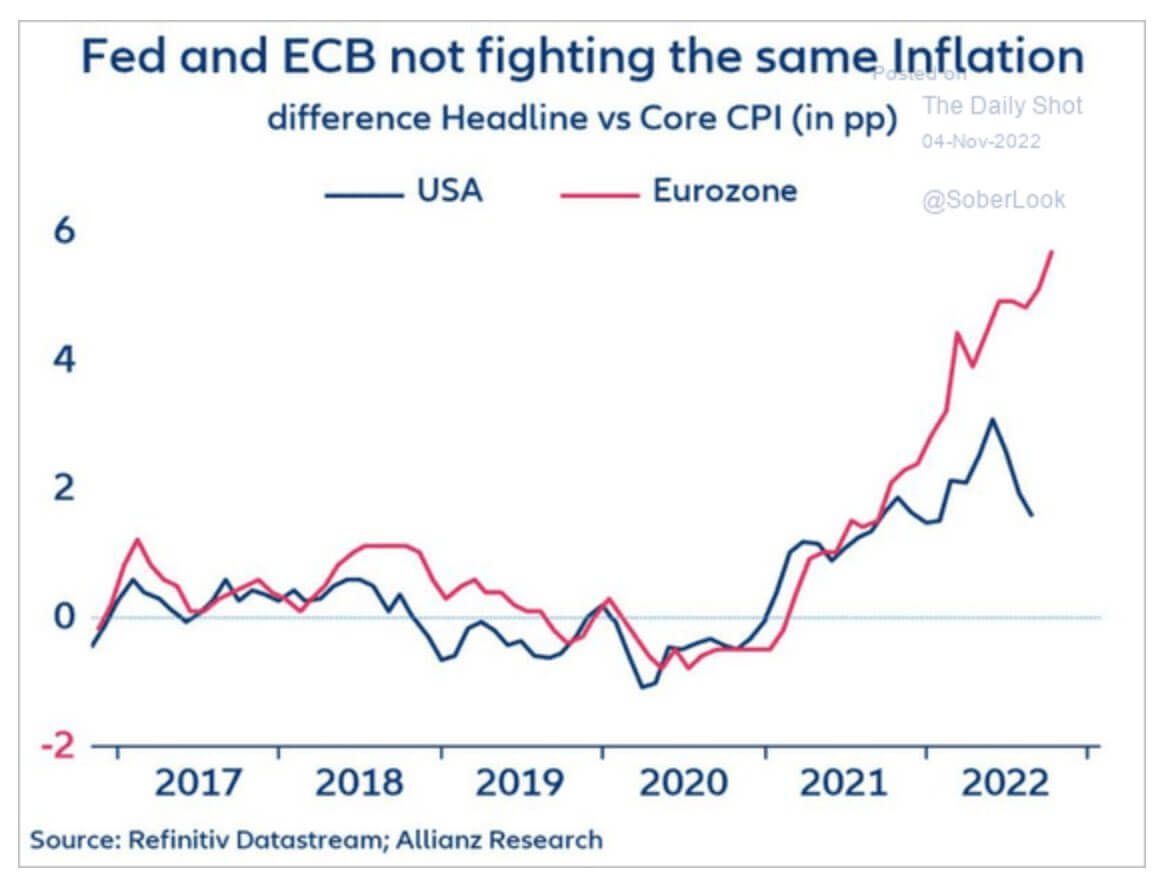

The European Central Bank (ECB) has been struggling to keep core inflation down this year. The Core Consumer Price Index (CPI) began to increase substantially in 2021 due to the pandemic both in the US and the EU

The US has seen its Core CPI decrease sharply since its culmination in February and posted better-than-expected results last month. However, Core CPI in the Eurozone has continued to increase throughout the year and currently shows no sign of stopping.

A similar increase in Core CPI can also be seen in Japan and the UK One of the factors that may have contributed to their monetary instability is a lack of investment and support for commodities like oil and gas. Widespread efforts to switch to renewable sources of energy led to a decrease in oil and gas purchases in the EU and the UK

In contrast, the US and Russia have been investing heavily in oil and gas and promoting innovation in the field.

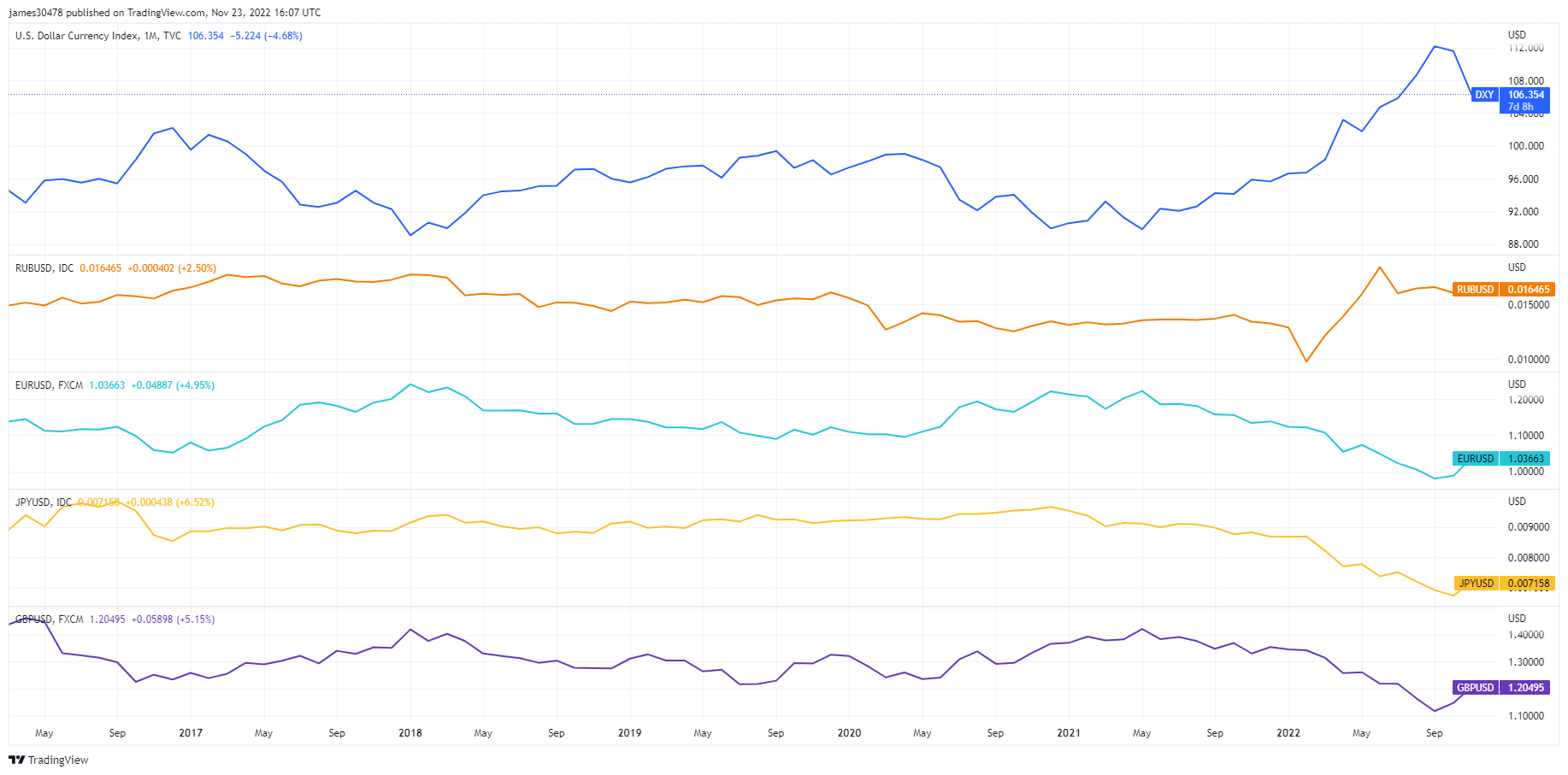

Looking at the value of fiat currencies against the US dollar further confirms this effect.

The Russian Ruble and the DXY have both increased in value in the past two years, while the euro, British poundand Japanese Yen have all seen their Dollar value decrease.

With rising inflation and a seriously weakened currency, the EU will have a hard time competing for oil and gas on the global market. Natural gas producers warning that almost all long-term contracts for natural gas coming out of the US have been sold out until 2026. Until then, when a new wave of natural gas supply is expected to come, the EU will have to compete with Asia for the limited supply. and swallow the high gas price.

All of this uncertainty could have a positive effect on Bitcoin. While the broader crypto market struggles to remain afloat after the FTX fallout, Bitcoin has positioned itself as a pillar of stability in a market plagued with bad actors. Devalued fiat currencies could push retail investors away from safe-haven assets like gold and commodities and toward an asset like Bitcoin.

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoVanEck’s Solana ETF nears launch after SEC 8-A filing – Details – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoVanEck’s Solana ETF nears launch after SEC 8-A filing – Details – Crypto News

-

De-fi1 week ago

De-fi1 week agoZEC Jumps as Winklevoss‑Backed Cypherpunk Reveals $100M Zcash Treasury – Crypto News

-

Business6 days ago

December Fed Meeting 2025: Rate Cut or Hold? Key levels to Watch – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow Strive’s $162M Bitcoin bet could make it the next MicroStrategy – Crypto News

-

De-fi6 days ago

De-fi6 days agoKraken’s xStocks Hit $10B in Total Trading Volume – Crypto News

-

others6 days ago

December Fed Meeting 2025: Rate Cut or Hold? Key levels to Watch – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin faces quantum risk: why SegWit wallets may offer limited protection – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSquare Enables Bitcoin Payments for Sellers – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoYour deep research tool may save you time, but can it save you embarrassment? – Crypto News

-

others1 week ago

Breaking: Canary XRP ETF Gets Approval with 8-A Filing to List on Nasdaq – Crypto News

-

De-fi1 week ago

De-fi1 week agoXPL Rallies After Plasma Reveals Collaboration with Daylight Energy – Crypto News

-

De-fi1 week ago

De-fi1 week agoSKY Surges 14% as Savings TVL Passes $4 Billion – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUAE makes Bitcoin wallets a crime risk in global tech crackdown – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoClaude Desktop is your new best friend for an organized PC – Crypto News

-

De-fi1 week ago

De-fi1 week agoMonad Faces Community Backlash After Unveiling Tokenomics – Crypto News

-

others1 week ago

others1 week agoGold retreats from three-week high but retains bullish outlook – Crypto News

-

De-fi1 week ago

De-fi1 week agoThreshold Network Upgrades tBTC Bridge to Link Institutional Bitcoin with DeFi – Crypto News

-

De-fi1 week ago

De-fi1 week agoEthereum Sees First Sustained Validator Exit Since Proof-of-Stake Shift – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP’s Big Moment? Why Nov. 13 Could Be the Day Ripple Investors Have Waited For – Crypto News

-

De-fi1 week ago

De-fi1 week agoTrump Tokens Outperform After US President Teases ‘Tariff Dividends’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoFoxconn reports strong Q3 profit driven by AI server boom, teases OpenAI announcement – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin (BTC) battles macro headwinds despite improved ETF inflows – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAI-driven phishing scams and hidden crypto exploits shake Web3 security – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoWhy the Future of Blockchain Payments Could Stay Narrow – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoBlackRock XRP ETF Speculation Hit New Highs As XRPC Performance Shocks Markets – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar loses ground despite stronger Westpac Consumer Confidence – Crypto News

-

others1 week ago

Bitcoin News: BTC Exchange Reserves Fall as Tether Mints $1B USDT – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Resumes Uptrend Amid Renewed Market Optimism and Whale Activity – Crypto News

-

De-fi1 week ago

De-fi1 week agoInstitutional Sentiment is Turning Bearish on Crypto: Sygnum – Crypto News

-

Cryptocurrency1 week ago

Can Dogecoin Price Hold Above $0.17 Amid Weekly Surge? – Crypto News

-

Technology1 week ago

Technology1 week agoChinas cryptoqueen jailed in UK over $6.6 billion Bitcoin scam – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Path To $1 Million Clears With OG Sellers Fading: Weisberger – Crypto News

-

Technology1 week ago

Breaking: USDC Issuer Circle Explores Native Token for Arc Network – Crypto News

-

others1 week ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

Business1 week ago

Hyperliquid Halts Deposits and Withdrawals Amid POPCAT Liquidation Saga – Crypto News

-

De-fi1 week ago

De-fi1 week agoFlare TVL Nears Record High as Firelight Teases XRP Liquid Staking – Crypto News

-

De-fi7 days ago

De-fi7 days agoXRP Surges as First US Spot ETF Debuts on Nasdaq – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Drops to $94,000 Following Second-Largest Daily ETF Outflows – Crypto News

-

De-fi6 days ago

De-fi6 days agoBitcoin Drops to $94,000 Following Second-Largest Daily ETF Outflows – Crypto News

-

Technology4 days ago

Technology4 days agoPerplexity faces harsh crowd verdict at major San Francisco AI conference: ‘Most likely to flop’ – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoTLC Coin Price Prediction 2026, 2030, &2040: Trillioner Forecast » InvestingCube – Crypto News

-

Business1 week ago

Arthur Hayes Buys UNI as CryptoQuant CEO Says Supply Shock ‘Inevitable’ for Uniswap – Crypto News

-

Business1 week ago

U.S. Government Shutdown Set to End as House Panel Approves Senate Funding Deal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMatthew McConaughey, Michael Caine Team Up With ElevenLabs to Recreate Their Voices Using AI – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMajor Ethereum Upgrade Scheduled for December – Crypto News

-

Business1 week ago

Death Cross Triggers Sell Signals for Cardano Price— Will ADA Retest $0.50? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Slips After Rebound, Struggling to Keep Momentum Above $3,500 – Crypto News

-

others1 week ago

others1 week agoXAG/USD remains near 54.00 due to improved market sentiment – Crypto News

![Cosmos [ATOM] rallies 11%, but $3 remains a sore point - Here's why](https://dripp.zone/news/wp-content/uploads/2025/11/Cosmos-ATOM-rallies-11-but-3-remains-a-sore-point-400x240.jpg)

![Cosmos [ATOM] rallies 11%, but $3 remains a sore point - Here's why](https://dripp.zone/news/wp-content/uploads/2025/11/Cosmos-ATOM-rallies-11-but-3-remains-a-sore-point-80x80.jpg)