others

EUR/GBP shifts below 0.8600 as German Deflation fades longer-term hawkish ECB bets – Crypto News

- EUR/GBP has turned sideways after slipping below 0.8600 as German inflation decelerated significantly.

- German deflation has faded long-term hawkish ECB bets.

- BoE Mann said the gap between the headline and core inflation in the UK is more persistent than in the US and the Euro area.

The EUR/GBP The pair has shifted its auction below the round-level support of 0.8600 after a perpendicular sell-off in the Asian session. The cross was heavily sold on Wednesday after German inflation softened more than anticipated.

German economy which is already in recession after reporting contraction in Gross Domestic Product (GDP) figures for two consecutive quarters, reported deflation for May by 0.2%, which could be the outcome of weak retail demand and higher interest rates from the European Central Bank (ECB). The annual preliminary German Harmonized Index of Consumer Prices (HICP) surprisingly softened to 6.3% vs. the estimates of 6.8% and the earlier release of 7.6%.

ECB President Christine Lagarde announced that more than one interest rate hike is appropriate to tame Eurozone inflation. However, fresh incoming data is fading longer-term hawkish ECB bets. However, ECB policymaker Madis Muller cited on Wednesday, “It is very likely that the ECB will hike by 25 bps more than once as core inflation is still stubborn.”

Going forward, euro zone Inflation (May) will remain in the spotlight. Analysts at Societe Generale cited “We expect the May inflation data to deliver another massive decline in headline inflation from 7% yoy in April to 6% in May. Meanwhile, we think easing goods inflation will help core inflation fall from 5.6% to 5.5%, with a downside risk of 5.4% – which is set to increase the pressure on the ECB to do more rate hikes.”

Meanwhile, sticky United Kingdom inflation would keep forcing the Ban of England (BoE) to remain hawkish for a longer period. UK’s inflation softened to 8.7% in April but is expected to miss UK PM Rishi Sunak’s promise of halving inflation by year-end as food inflation is still hovering near 46 years high and labor shortages will remain a concern.

BOE Monetary Policy Committee (MPC) member Catherine Mann noted on Wednesday that the gap between the headline and core inflation in the UK is more persistent than in the US and the Euro area, as reported by Reuters. She further added that firms will use it if they have high pricing power and said that they will remain on a path that has an “awful a lot of volatility.”

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoStop panicking about AI. Start preparing – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCourt Crushes Lawsuit Against Ripple – Crypto News

-

Blockchain22 hours ago

Blockchain22 hours agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Business1 week ago

XRP Payments Utility Expands as Ripple Launches Treasury Platform – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Laundering On Centralized Exchanges Declines: Report – Crypto News

-

others1 week ago

others1 week agoFundstrat’s Tom Lee Says Earnings Growth, Dollar Weakness Primed To Drive Stocks Higher – Here’s His Target – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Business1 week ago

Strategic Bitcoin Reserve: South Dakota Introduces Bill to Invest in BTC as U.S. States Explore Crypto – Crypto News

-

Business1 week ago

Trump’s Crypto Adviser Confirms Probe Into Alleged Theft From U.S. Crypto Reserve – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid: The frontend wars – Blockworks – Crypto News

-

Technology1 week ago

Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem – Crypto News

-

others1 week ago

others1 week agoCrypto Exchange Kraken Announces DeFi-Level Yields for Users in US, EU and Canada – Crypto News

-

Technology4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others2 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNB Chain’s Prediction Markets Soar As Volume Crosses $20B – Crypto News

-

Technology1 week ago

Trump Speech in Iowa Today: Possible Impact on Stocks and Crypto Market – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin, Ethereum, Crypto News & Price Indexes – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Breaks Back To $3K As Traders Question Follow-Through – Crypto News

-

others1 week ago

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago4 In 10 US Merchants Now Accept Crypto – Crypto News

-

Business1 week ago

XRP Price Prediction After Ripple Treasury launch – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft shares slide as AI spending surges – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMetaplanet boosts forecasts despite Bitcoin write-down clouding annual results – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH price prediction as Ethereum prepares for ERC-8004 mainnet rollout – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI Tool of the Week: When translation understands context – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

Metaverse5 days ago

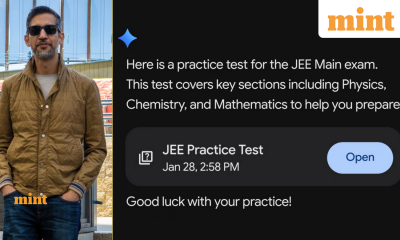

Metaverse5 days agoGoogle Gemini launches JEE Main mock test papers: IIT Kharagpur alumnus Sundar Pichai goes nostalgic, ‘If I could…’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

Business4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology3 days ago

GLXY Stock Price Falls as Mike Novogratz’s Galaxy Digital Reports $482 Million Q4 Loss – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoBitcoin Unrealized Losses Reach 22% – Still No Capitulation Phase – Crypto News

-

Technology2 days ago

Technology2 days agoEmbedded Payments Help SaaS as AI Reshapes Workflows – Crypto News