others

EUR/USD hovers at 1.1600 as muted CPI data fails to alter Fed stance – Crypto News

EUR/USD is poised to finish the week with losses of 0.21% yet it remains above the 1.16 figure for the third straight day, capped on the upside by key resistance levels after US data might not deter the Fed from cutting rates.

Euro supported by upbeat PMIs; Moody’s warning on France limits upside momentum

Inflation data in the US would not move the needle in favor of Fed hawks, missing estimates to the downside, though it remains far from the central bank 2% goal. After that, S&P Global showed that the economy shows signs of strength as manufacturing and services flash PMIs, expanded in October.

Meanwhile, the University of Michigan (UoM) closed the docket for the day amid the US government shutdown reaching its twentieth fourth day, revealing that US consumers are growing slightly pessimistic, while estimating that prices could continue to rise.

Of late, the Greenback trimmed some of its gains as the Trump administration launched a trade investigation whether China complied with a limited trade agreement reached in 20202 during President Donald Trump’s first term, revealed Bloomberg.

In Europe, HCOB Flash Purchasing Managers Indices (PMIs) in October, improved from 49.8 to 50, and from 51.3 to 52.6, respectively. Both prints exceeded forecasts, an indication that business activity is picking up as demand jumps.

As of writing, Moody’s Ratings changed France’s outlook to negative, affirms aa3 ratings, mentioned “France’s political instability risks hampering ability to address key policy challenges like elevated fiscal deficit, rising debt burden.”

Daily market movers: EUR/USD holds firm despite solid US PMI data

- The US Dollar Index (DXY), which tracks the performance of the buck’s value against a basket of its rivals, is up 0.03% at 98.94, capping the EUR/USD’s advance.

- US Consumer Price Index (CPI) rose 3.0% in the 12 months through September, coming in just below forecasts of 3.1% and slightly higher than August’s 2.9% reading. The core CPI — which excludes food and energy — increased 3.0% year-over-year, down a tenth from the previous month.

- US business activity accelerated in October, marking the second-fastest pace so far this year, according to preliminary “flash” PMI data from S&P Global. The report also highlighted the strongest increase in new business seen in 2025 to date, underscoring continued resilience in private-sector output. The S&P Global Manufacturing PMI rose to 52.2 in October from 52.0 in September, signaling continued expansion in the sector. The Services PMI climbed to 55.2 from 54.2, marking a three-month high and underscoring solid momentum in business activity.

- The University of Michigan’s consumer sentiment index was revised down to 53.6 in October from the preliminary reading of 55.0, missing expectations of 55.1. One-year inflation expectations eased slightly to 4.6% from 4.7% in September, while the five-year outlook edged higher to 3.9% from 3.7%.

- The US central bank is expected to cut rates 25 basis points to the 3.75% – 4% range, with traders already pricing an additional 0.25% reduction for the December meeting.

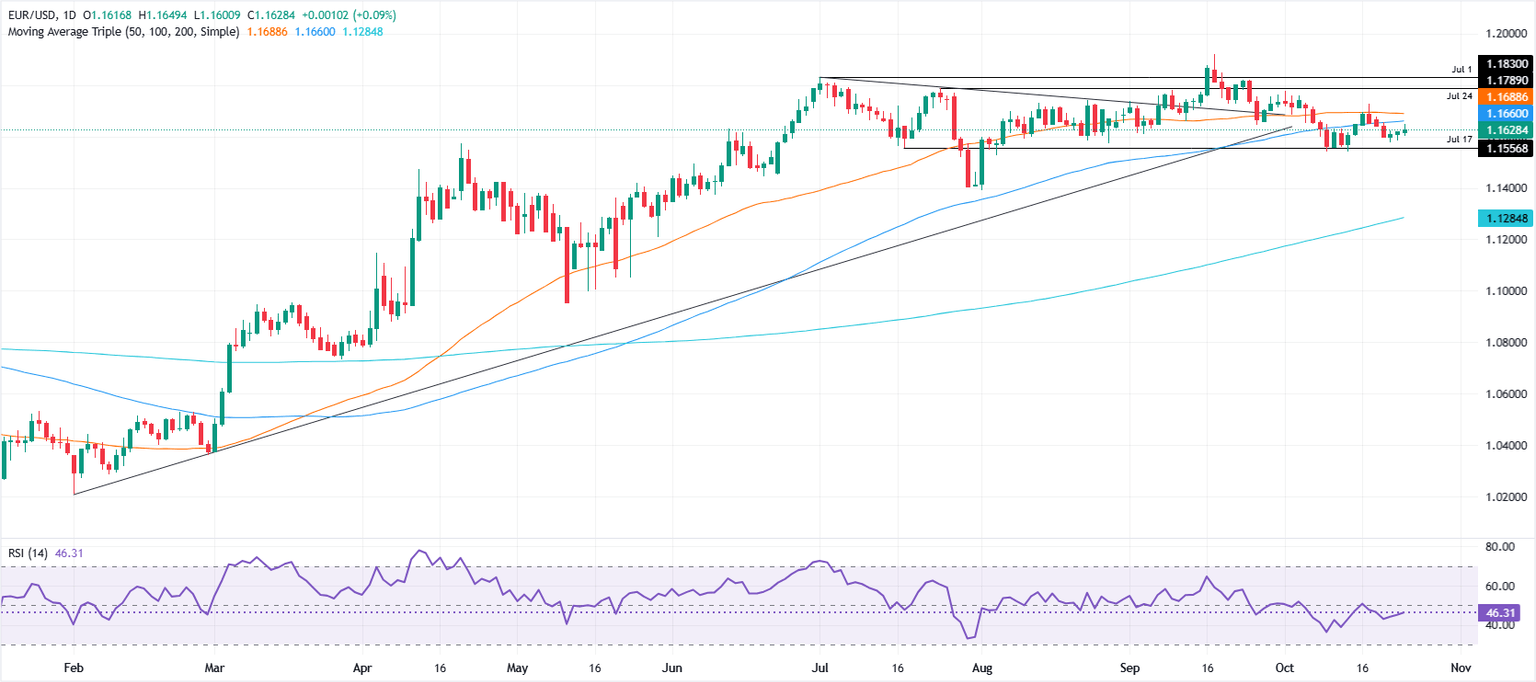

Technical outlook: EUR/USD consolidates, but slightly bullish

EUR/USD’s technical outlook has modestly improved but remains neutral as the pair trades beneath the confluence of the 20-day and 100-day Simple Moving Averages (SMAs) at 1.1653 and 1.1658, respectively. The Relative Strength Index (RSI) has slipped below the neutral 50 mark, suggesting growing bearish momentum.

Immediate support is seen at 1.1600, followed by 1.1550 and 1.1500. A clear break below this zone would expose the August 1 cycle low around 1.1391. On the upside, resistance remains aligned with the 20- and 100-day SMAs, while a decisive move above 1.1700 would open the way toward 1.1800 and the July 1 high at 1.1830.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Technology1 week ago

Technology1 week agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech is valued as if AI is the next smartphone. It isn’t. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin, Ethereum rebound following ‘largest single-day wipeout in crypto history’ – Crypto News

-

Technology5 days ago

Technology5 days agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWalmart teams with OpenAI for ChatGPT purchases. The retailer is ‘ahead of the curve’. – Crypto News

-

Business1 week ago

Nasdaq-Listed Webus Adopts XRP in New Tokenized Reward Platform, Eyes $20B Loyalty Market – Crypto News

-

Business1 week ago

Dogecoin Gets Major Utility Boost as Trump-Linked Thumzup Prepares DOGE Payments – Crypto News

-

others4 days ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are These Ripple (XRP) ETF Filings the Worst Idea Ever? Analyst Explains – Crypto News

-

Business1 week ago

Fed’s Stephen Miran Calls for Rapid Rate Cuts Amid U.S.-China Trade Tensions – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIs Wave 5 Still Coming or a New Bull Trend Emerging? – Crypto News

-

Technology1 week ago

XRP News: Ripple Strikes Deal with Absa, Expanding Custody Footprint To Africa – Crypto News

-

Business1 week ago

Pi Coin Price Gears for Recovery as DEX and AMM Launch Revives Utility Hopes – Crypto News

-

others1 week ago

Cardano’s Charles Hoskinson Addresses Allegations of Diverting Treasury Funds – Crypto News

-

others5 days ago

others5 days agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

others4 days ago

others4 days agoAUD/USD rises on US-China trade hopes, Fed rate cut outlook – Crypto News

-

Metaverse1 week ago

Metaverse1 week ago‘Erotica for verified adults’: OpenAI to allow mature content on ChatGPT; Sam Altman vows to treat adults like adults – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCelestia price reclaims $1 after crash to $0.27: TIA forecast – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoMint Explainer | Why Big Tech is rushing to build AI data centres across India – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa Says Stablecoins Are Powering ‘a New Lending Space’ – Crypto News

-

Business1 week ago

Building Through the Downturn – Why Smart Money Is Watching XYZVerse – Crypto News

-

Business1 week ago

Gold vs Bitcoin – Peter Schiff Declares BTC Has Failed as Digital Gold, CZ Reacts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGhana Moves Toward Crypto Regulation Amid Rising User Adoption – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto markets turn red after Trump threatens to halt cooking oil imports from China – Crypto News

-

others6 days ago

Shiba Inu Price Eyes Recovery as Burn Rate Jumps 10,785% – Can SHIB Hit $0.000016? – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump Confirms Meeting With Xi Jinping on Oct 31, Markets Rally in Response – Crypto News

-

Business5 days ago

How Will “Unusual” US CPI Inflation Data Release Could Impact Fed Rate Cut, Crypto Market? – Crypto News

-

Technology5 days ago

Technology5 days agoAWS says it has fixed the problem that crippled half the internet but many popular apps are still down – Crypto News

-

Technology4 days ago

Technology4 days agoAmazon Web Services outage: Here’s how many users are impacted and the downtime costs – Crypto News

-

others4 days ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

others1 week ago

others1 week agoEUR/GBP weakens to near 0.8700, French government plans to postpone pension reforms – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase Plans to List Surging BNB After Previously Delisting Binance Stablecoin – Crypto News

-

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg) others1 week ago

others1 week agoDow Jones holds onto recovery levels as investors focus on earnings – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Create A Meme Coin For Free On Solana – Crypto News

-

De-fi1 week ago

De-fi1 week agoLighter Distributes Points to Users Affected by Platform Outage – Crypto News

-

De-fi1 week ago

De-fi1 week agoSony Enters U.S. Crypto Banking Race Amid Growing Institutional Interest – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAll About AI Tech4Good Awards are back for the second edition. Apply Now! – Crypto News

-

others1 week ago

others1 week agoUSD/JPY strengthens as Trump’s softer stance on China boosts US Dollar demand – Crypto News

-

others7 days ago

Stripe-backed Tempo Hires Ethereum Researcher Dankrad Feist After $500M Funding – Crypto News

-

others6 days ago

others6 days agoGold crashes 2% from record high as Trump tempers threats on China – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoEthena (ENA) Price Outperforming: Only Reason – Crypto News

-

Technology6 days ago

Technology6 days agoPerplexity AI tops app charts on Google Play Store and Apple App Store, outpaces ChatGPT and Gemini – Crypto News

-

others6 days ago

others6 days agoWe should not cut rates every quarter, but rate-cutting cycle not over – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAster price tanks 20% as sell-off pressure hits altcoins – Crypto News

-

others5 days ago

others5 days agoAustralian Dollar pares gains as US Dollar steadies on easing US-China tensions – Crypto News

-

others5 days ago

BREAKING: 21Shares Amends S-1 for Spot Dogecoin ETF Approval – Crypto News

-

Business4 days ago

Binance Founder CZ Predicts Bitcoin Will Flip Gold’s $30 Trillion Market – Crypto News