others

Euro appears offered ahead of ECB-Fed event – Crypto News

- Euro starts Wednesday’s session slightly offered.

- Stocks in Europe opened the session with decent advance.

- EUR/USD hovers around the 1.0950 region amid a risk-off mood.

- Germany’s Consumer Confidence worsens in July.

- Investors will closely follow events from the ECB Forum.

The recent two-day advance of the Euro (EUR) was somewhat limited due to renewed buying interest in the US Dollar (USD), leading to a partial retracement of the weekly gains for EUR/USD, As a result, the pair revisited the 1.0930 region early in the morning on Wednesday during the European session.

The stronger performance of the US Dollar also provided some relief to the USD Index (DXY), which had experienced negative performance earlier in the week. The index approached the 55-day SMA around 102.60.

The immediate reaction in the currency market can also be attributed to the lack of a clear direction in both the US and German bond markets. This uncertainty occurs amid expectations of a quarter-point interest rate hike by both the European Central Bank (ECB) and the Federal Reserve (Fed) at their respective meetings in July.

The potential future actions of the Fed and the ECB in normalizing their monetary policies remain a topic of ongoing debate. This discussion takes place against the backdrop of increasing speculation about an economic slowdown on both sides of the Atlantic.

Regarding monetary policy, a notable event on Wednesday will be a Policy Discussion Panel at the ECB Forum on Central Banking in Sintra, Portugal. The panel will feature Jerome Powell and ECB President Christine Lagardeparticipating in the European afternoon.

In terms of data, consumer confidence in Germany, as measured by GfK, weakened to -25.4 for the month of July.

Across the Atlantic, the usual weekly Mortgage Applications tracked by the Mortgage Bankers Association (MBA) will be released, followed by preliminary figures for the Goods Trade Balance.

Daily digest market movers: Euro looks at ECB Forum for near-term direction

- The EUR runs out of steam on USD recovery.

- Germany’s Consumer Confidence disappoints expectations in July.

- ECB Lagarde-Fed Powell will take center stage later on Wednesday.

- ECB’s De Guindos favors a rate hike in July.

- ECB’s Vujcic leaves the door open to a September hike.

Technical Analysis: Euro looks supported by the 55-day SMA.

EUR/USD appears under pressure and should the selling bias gather impulse it could face initial support at the transitory 55-day SMA at 1.0883. A loss of this level exposes a deeper pullback to the June low at 1.0844 (June 23) ahead of the provisional 100-day SMA at 1.0814. South from here emerges the May low of 1.0635 (May 31) prior to the March low of 1.0516 (March 15) and the 2023 low of 1.0481 (January 6).

If bulls regain the upper hand, the next hurdle is then expected at the June peak of 1.1012 (June 22) prior to the 2023 high of 1.1095 (April 26), which is closely followed by the round level of 1.1100. North from here emerges the weekly top of 1.1184 (March 31, 2022), which is supported by the 200-week SMA at 1.1181, just before another round at 1.1200.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the crucial 200-day SMA, today at 1.0578.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially important, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net trade balance strengthens a currency and vice versa for a negative balance.

-

Blockchain1 week ago

Blockchain1 week agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse5 days ago

Metaverse5 days agoStop panicking about AI. Start preparing – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCourt Crushes Lawsuit Against Ripple – Crypto News

-

Blockchain21 hours ago

Blockchain21 hours agoPolymarket Taps Circle to Support Dollar-Denominated Settlements – Crypto News

-

Business1 week ago

XRP Payments Utility Expands as Ripple Launches Treasury Platform – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

others1 week ago

others1 week agoUS Dollar hits 2022 lows as ‘Sell America’ trade intensifies ahead of Fed’s decision – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

others1 week ago

others1 week agoMichael Saylor’s Strategy Buys Another $264,100,000 in Bitcoin (BTC) Amid Crypto Market Downturn – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Laundering On Centralized Exchanges Declines: Report – Crypto News

-

others1 week ago

others1 week agoFundstrat’s Tom Lee Says Earnings Growth, Dollar Weakness Primed To Drive Stocks Higher – Here’s His Target – Crypto News

-

others1 week ago

others1 week agoQXMP Labs Announces Activation of RWA Liquidity Architecture and $1.1 Trillion On-Chain Asset Registration – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoHow to avoid common AI pitfalls in the workplace – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Business1 week ago

Strategic Bitcoin Reserve: South Dakota Introduces Bill to Invest in BTC as U.S. States Explore Crypto – Crypto News

-

Business1 week ago

Trump’s Crypto Adviser Confirms Probe Into Alleged Theft From U.S. Crypto Reserve – Crypto News

-

Technology1 week ago

Technology1 week agoWhatsApp launches ‘Strict Account Settings’: How to enable the new lockdown-style mode? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHyperliquid: The frontend wars – Blockworks – Crypto News

-

Technology1 week ago

Solana Price Targets $200 as $152B WisdomTree Joins the Ecosystem – Crypto News

-

others1 week ago

others1 week agoCrypto Exchange Kraken Announces DeFi-Level Yields for Users in US, EU and Canada – Crypto News

-

Technology4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

others2 days ago

Crypto Market Bill Set to Progress as Senate Democrats Resume Talks After Markup Delay – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBNB Chain’s Prediction Markets Soar As Volume Crosses $20B – Crypto News

-

Technology1 week ago

Trump Speech in Iowa Today: Possible Impact on Stocks and Crypto Market – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin, Ethereum, Crypto News & Price Indexes – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Breaks Back To $3K As Traders Question Follow-Through – Crypto News

-

others1 week ago

Shiba Inu Price Outlook As SHIB Burn Rate Explodes 2800% in 24 Hours – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago4 In 10 US Merchants Now Accept Crypto – Crypto News

-

Business1 week ago

XRP Price Prediction After Ripple Treasury launch – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft shares slide as AI spending surges – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMetaplanet boosts forecasts despite Bitcoin write-down clouding annual results – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoETH price prediction as Ethereum prepares for ERC-8004 mainnet rollout – Crypto News

-

Technology1 week ago

Technology1 week agoEconomic Survey calls for age-based limits on social media access, urges curbs to tackle digital addiction – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Technology1 week ago

Technology1 week agoSAP Stock Sees Biggest Drop Since 2020 Over Cloud Concerns – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoAI Tool of the Week: When translation understands context – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoETH Staking Skyrockets as 30% of Total Supply Now Staked in Historic Move – Crypto News

-

Metaverse5 days ago

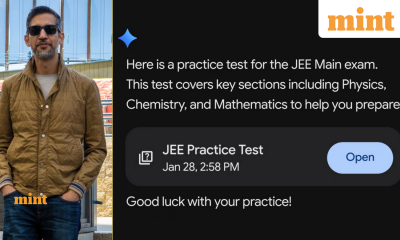

Metaverse5 days agoGoogle Gemini launches JEE Main mock test papers: IIT Kharagpur alumnus Sundar Pichai goes nostalgic, ‘If I could…’ – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoChiliz price drops 15% amid sharp altcoin pullback – Crypto News

-

Business4 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology3 days ago

GLXY Stock Price Falls as Mike Novogratz’s Galaxy Digital Reports $482 Million Q4 Loss – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoBitcoin Unrealized Losses Reach 22% – Still No Capitulation Phase – Crypto News

-

Technology2 days ago

Technology2 days agoEmbedded Payments Help SaaS as AI Reshapes Workflows – Crypto News