others

Euro keeps the offered bias unchanged on prevailing risk aversion – Crypto News

- The Euro looks markedly offered against the US Dollar.

- Stocks in Europe trade mostly on the defensive on Monday.

- EUR/USD retreats to the 1.0520 zone amidst USD buying.

- The USD Index (DXY) extends the rebound to the 106.50 zone.

- Industrial Production in Germany surprised to the downside.

The Euro (EUR) is displaying signs of renewed weakness against the US Dollar (USD), leading EUR/USD to drop to the 1.0520 zone following three consecutive sessions of gains on Monday.

In contrast, the Greenback is reclaiming ground lost and revisiting the 106.50 region when gauged by the USD Index (DXY) in response to the prevailing risk-off sentiment in the global markets at the beginning of the week.

Regarding monetary policy, investors anticipate that the Federal Reserve (Fed) will maintain its interest rates at their current levels for the remainder of the year. Simultaneously, there is speculation in the market about the possibility of the European Central Bank (ECB) pausing its policy, despite inflation levels surpassing the bank’s target and mounting concerns about the potential for a future recession or stagflation in the European region.

A look at the speculative community notes that speculators trimmed further their EUR net longs positions to levels last seen in late October 2022 in the week to October 3, as per the latest CFTC Positioning report.

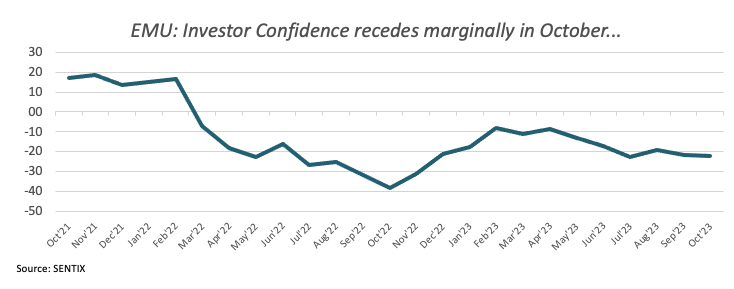

On the domestic calendar, Industrial Production in Germany contracted at a monthly 0.2% in August, while the Investor Confidence eased a tad to -21.9 when tracked by the Sentix Index for the current month.

The US docket will be empty on Columbus Day holiday, while investors’ attention is expected to be on speeches by Dallas Fed President Lorie Logan (voter, hawk), FOMC Governor Michael Barr (permanent voter, centrist) and FOMC Governor Philip Jefferson (permanent voter, centrist).

Daily digest market movers: Euro gives away gains on USD-buying

- The EUR abandons the area of recent peaks against the USD.

- German 10-year bund yields drop to monthly lows.

- Investors see the Fed refraining from moving on rates in the next months.

- Markets believe the ECB will pause its rate hike campaign.

- ECB policy maker Martins Kazaks favoured an impasse at the bank’s hiking cycle.

- German Industrial Production adds to recession fears.

- Speculation on FX intervention in USD/JPY remains firm.

- Oil jumps on Israel-Hamas conflict.

Technical Analysis: Euro faces the next support of note at 1.0448

EUR/USD resumes the downside and corrects lower from peaks around 1.0600.

The continuation of selling pressure on EUR/USD might result in a review of the 2023 low at 1.0448 seen on October 3, with a challenge of the crucial round mark of 1.0400. If this level is breached, it may pave the way for a retest of the lows of 1.0290 (November 30, 2022) and 1.0222 (November 21, 2022).

If the pair gains momentum, it may aim for the next upward hurdle at 1.0617 from September 29, followed by the important 200-day SMA at 1.0823. If this level is breached, the August 30 high at 1.0945 and the psychological hurdle of 1.1000 may be tested. If the pair breaks beyond the August 10 peak of 1.1064, it might reach the July 27 high of 1.1149 and perhaps the 2023 peak of 1.1275 from July 18.

As long as the EUR/USD remains below the 200-day SMA, additional negative pressure is possible.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany’s economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany’s economy strengthens, it can bolster the Euro’s value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro’s strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact’ following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond’s price, and it is therefore considered a more accurate reflection of return. A decline in the bund’s price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSatoshi-Era Bitcoin Whale Moves Another $2.42 Billion, What’s Happening? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoRipple and Ctrl Alt Team to Support Real Estate Tokenization – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoIt’s a Statement, Says Bitfinex Alpha – Crypto News

-

others1 week ago

others1 week agoEUR/USD recovers with trade talks and Fed independence in focus – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds Surge As Powell’s Future Hangs In The Balance – Crypto News

-

Business7 days ago

XLM Is More Bullish Than ETH, SOL, And XRP, Peter Brandt Declares – Crypto News

-

others1 week ago

Bitcoin Critic Vanguard Becomes Strategy’s (MSTR) Largest Shareholder – Crypto News

-

Business1 week ago

Pepe Coin Rich List June 2025: Who’s Holding Highest PEPE as it Nears Half a Million Holders? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWhy voice is emerging as India’s next frontier for AI interaction – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoAnarchy, crime and stablecoins – Blockworks – Crypto News

-

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-400x240.webp)

![Stellar [XLM] bulls exhausted after rally - Is a pullback nearby?](https://dripp.zone/news/wp-content/uploads/2025/07/Stellar-XLM-bulls-exhausted-after-rally-Is-a-pullback.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStellar [XLM] bulls exhausted after rally – Is a pullback nearby? – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News

-

Cryptocurrency1 week ago

Fed’s Hammack Raises Inflation Concerns Amid Push For Interest Rate Cut – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago1inch price forecast: 1INCH hits 7-month high after double digit gains – Crypto News

-

others1 week ago

others1 week agoTop Crypto Exchange by Trading Volume Binance Announces Airdrop for New Ethereum (ETH) Ecosystem Altcoin – Crypto News

-

others1 week ago

others1 week agoVanEck Details Key Drivers Boosting Bitcoin Price, Including Corporate Treasury Demand, ETF Flows and More – Crypto News

-

Business1 week ago

XRP Lawsuit Update: Ripple Paid $125M in Cash, Settlement Hinges on Appeal – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin trades near $119K after new all-time high; Coinbase rebrands wallet to ‘Base App’ – Crypto News

-

Technology6 days ago

“Decentralized Ponzi Scheme”- Gold Bug Peter Schiff Slams Landmark Crypto Bills – Crypto News

-

Business1 week ago

CME XRP Futures Hit $1.6B In Total Trading Volume Since Launch – Crypto News

-

Technology1 week ago

XLM Price Forecast: Why Stellar Lumens May Crash After 80% Rally in Last 7 Days – Crypto News

-

others1 week ago

others1 week agoScammer Drains $10,000,000 From IRS in International Tax Fraud and Identity Theft Scheme: DOJ – Crypto News

-

Business1 week ago

Ethereum Price Prediction- Bulls Target $3,700 As ETH Treasury Accumulation Soars – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

others1 week ago

others1 week agoGBP/USD rallies on US PPI dip and Trump’s potential Powell removal – Crypto News

-

Cryptocurrency1 week ago

Russia’s $85 Billion Sberbank to Launch Crypto Custody Services – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoCalifornia Sheriffs Believe 74-Year-Old’s Disappearance Linked to Son’s Crypto Fortune – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoShytoshi Kusama Breaks Silence on New SHIB AI Whitepaper and Transformed Future – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAltseason heats up, but Bitcoin could face short-term pullback – How? – Crypto News

-

Blockchain3 days ago

Blockchain3 days agoInstitutional Demand Surges As Ethereum Sets New Inflow Records – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHypercharged Exposure to XRP and Solana Now Available With These Two ETFs – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoNothing Burger or Crypto Catalyst? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoNvidia’s Jensen Huang says AI ‘fundamental like electricity’, praises Chinese models as ‘catalyst for global progress’ – Crypto News

-

Business1 week ago

$800 Billion JPMorgan To Rival Tether, Circle, and Ripple In Stablecoin Race – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitMine Shares Rallied After Peter Thiel Investment. – Crypto News

-

others1 week ago

Crypto Exchange Hack: BigONE Users Lose A Massive $27 Million In Recent Exploit – Crypto News

-

De-fi1 week ago

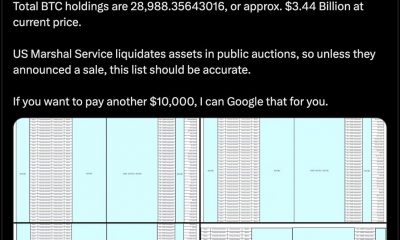

De-fi1 week agoU.S. Marshals Peg Federal Bitcoin Holdings at 28,988 Tokens Worth $3.4 B – Crypto News

-

De-fi7 days ago

De-fi7 days agoU.S. House Passes Clarity, GENIUS, and Anti-CBDC Acts With Historic Bipartisan Support for Crypto – Crypto News

-

Technology6 days ago

Technology6 days agoMalicious code found in fake coding extensions used to steal crypto – Crypto News

-

De-fi6 days ago

De-fi6 days agoBNB Chain Teases New Blockchain with Privacy Features to Compete With Crypto Exchanges – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoXRP Price Spikes to Record Highs As Momentum Signals Extended Gains – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoWhy Bitcoin self-custody is declining in the ETF era – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUS House passes three key crypto bills; market reaction muted as Bitcoin dips – Crypto News

-

Technology6 days ago

Breaking: GENIUS Act Becomes First Major Crypto Legislation as Trump Signs Bill – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

De-fi6 days ago

De-fi6 days agoCrypto Market Cap Hits $4 Trillion Milestone as US House Passes Landmark Bills – Crypto News

-

others4 days ago

Why Is The Crypto Market Rising Today? – Crypto News

-

Technology1 week ago

Technology1 week agoV Guard INSIGHT-G BLDC fan review: Cool performer with a premium look – Crypto News