others

Euro regains balance and targets 1.0800 and beyond ahead of ECB speak – Crypto News

- The Euro shifts its focus to the 200-day SMA against the US Dollar.

- Stocks in Europe keeps the optimism unchanged on Monday.

- The bullish view in USD Index (DXY) looks limited near 104.50.

- German yields add to Friday’s advance at the beginning of the week.

- US markets will be closed on Monday due to Labor Day holiday.

- Germany’s trade surplus shrank to €15.9B in July.

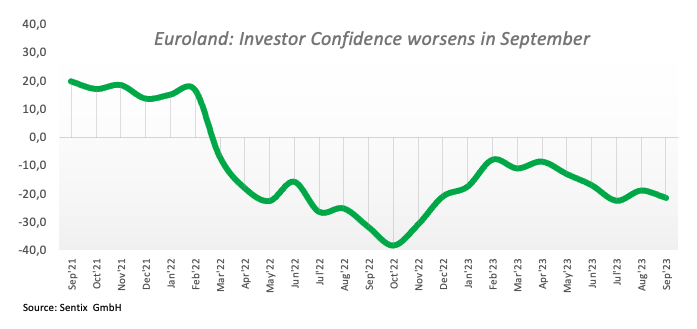

- The EMU Sentix Index surprised to the downside in September.

- ECB’s President Christine Lagarde to speak later in the session.

The Euro (EUR) has regained some upward momentum against the US Dollar (USD), which has allowed EUR/USD to reestablish itself above the significant 1.0800 level as the week began.

Conversely, the Greenback is facing some downward pressure, retreating to the 104.00 range as indicated by the USD Index (DXY). This decline comes as investors continue to analyze the mixed results from the US jobs report released on Friday, which showed an increase of +187K jobs.

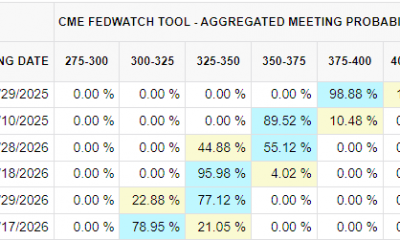

Meanwhile, confidence in the Federal Reserve’s decision to pause its interest rate hikes for the remainder of the year remains strong. There is also emerging speculation that interest rate cuts may not occur until March 2024. On the other hand, the European Central Bank (ECB) is grappling with considerable uncertainty regarding potential rate decisions beyond the summer, with market discussions centered on the possibility of stagflation.

From the speculative community, net longs in the single currency shrank to levels last seen in early July during the week ended on August 29, according to the CFTC positioning report.

US markets will be closed on Monday due to the Labor Day holiday. The European calendar saw the German trade surplus fall to €15.9 billion in July, while the Investor Confidence gauged by the Sentix index worsened to -21.5 for the current month.

In addition, ECB President Christine Lagarde and Board members Fabio Panetta, Philip Lane, and Frank Elderson will also speak on Monday.

Daily digest market movers: Euro looks to gather some firm upside traction

- The EUR manages to regain part of the ground lost against the USD.

- Trading conditions are expected to remain thin due to the US holiday.

- Investors’ attention should shift to ECB-speak later on Monday.

- Lower inflation, cooling labour market support the Fed’s pause on rates.

- Markets expect the Fed to keep rates unchanged in the next few months.

- The ECB appears divided regarding an interest rate hike later in the month.

Technical Analysis: Euro faces the next hurdle near 1.0950

EUR/USD picks up some pace and manages to retest the 1.0800 region, just ahead of the key 200-day SMA (1.0817).

Further recovery in EUR/USD is expected to target the critical 200-day SMA at 1.0817. North from here, bulls should meet last Wednesday’s top of 1.0945 ahead of the interim 55-day SMA at 1.0961, prior to the psychological 1.1000 barrier and the August 10 monthly top at 1.1064.

Once the latter is cleared, spot could challenge July 27 peak at 1.1149. If the pair surpasses this region, it could alleviate some of the downward pressure and potentially visit the 2023 peak of 1.1275 seen on July 18. Further up comes the 2022 high at 1.1495, which is closely followed by the round level of 1.1500.

The resumption of the downward bias could motivate the pair to initially revisit the August 25 low of 1.0765. The breach of this level exposes the May 31 low of 1.0635, prior to the March 15 low of 1.0516 and the 2023 low at 1.0481 seen on January 6.

Furthermore, sustained losses are likely in EUR/USD once the 200-day SMA is breached in a convincing fashion.

German economy FAQs

The German economy has a significant impact on the Euro due to its status as the largest economy within the Eurozone. Germany’s economic performance, its GDP, employment, and inflation, can greatly influence the overall stability and confidence in the Euro. As Germany’s economy strengthens, it can bolster the Euro’s value, while the opposite is true if it weakens. Overall, the German economy plays a crucial role in shaping the Euro’s strength and perception in global markets.

Germany is the largest economy in the Eurozone and therefore an influential actor in the region. During the Eurozone sovereign debt crisis in 2009-12, Germany was pivotal in setting up various stability funds to bail out debtor countries. It took a leadership role in the implementation of the ‘Fiscal Compact’ following the crisis – a set of more stringent rules to manage member states’ finances and punish ‘debt sinners’. Germany spearheaded a culture of ‘Financial Stability’ and the German economic model has been widely used as a blueprint for economic growth by fellow Eurozone members.

Bunds are bonds issued by the German government. Like all bonds they pay holders a regular interest payment, or coupon, followed by the full value of the loan, or principal, at maturity. Because Germany has the largest economy in the Eurozone, Bunds are used as a benchmark for other European government bonds. Long-term Bunds are viewed as a solid, risk-free investment as they are backed by the full faith and credit of the German nation. For this reason they are treated as a safe-haven by investors – gaining in value in times of crisis, whilst falling during periods of prosperity.

German Bund Yields measure the annual return an investor can expect from holding German government bonds, or Bunds. Like other bonds, Bunds pay holders interest at regular intervals, called the ‘coupon’, followed by the full value of the bond at maturity. Whilst the coupon is fixed, the Yield varies as it takes into account changes in the bond’s price, and it is therefore considered a more accurate reflection of return. A decline in the bund’s price raises the coupon as a percentage of the loan, resulting in a higher Yield and vice versa for a rise. This explains why Bund Yields move inversely to prices.

The Bundesbank is the central bank of Germany. It plays a key role in implementing monetary policy within Germany, and central banks in the region more broadly. Its goal is price stability, or keeping inflation low and predictable. It is responsible for ensuring the smooth operation of payment systems in Germany and participates in the oversight of financial institutions. The Bundesbank has a reputation for being conservative, prioritizing the fight against inflation over economic growth. It has been influential in the setup and policy of the European Central Bank (ECB).

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech is valued as if AI is the next smartphone. It isn’t. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin, Ethereum rebound following ‘largest single-day wipeout in crypto history’ – Crypto News

-

Technology1 week ago

Technology1 week agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

others1 week ago

Four Meme and BNB Partner on $45M ‘Rebirth Support’ Airdrop, First Batch Set to Begin – Crypto News

-

Technology1 week ago

Technology1 week agoCrypto investors brace for more swings after $19 billion liquidation – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWalmart teams with OpenAI for ChatGPT purchases. The retailer is ‘ahead of the curve’. – Crypto News

-

Business1 week ago

Nasdaq-Listed Webus Adopts XRP in New Tokenized Reward Platform, Eyes $20B Loyalty Market – Crypto News

-

Business1 week ago

Dogecoin Gets Major Utility Boost as Trump-Linked Thumzup Prepares DOGE Payments – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoPowell speech steadies crypto market: Fed hints at slower balance-sheet runoff – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are These Ripple (XRP) ETF Filings the Worst Idea Ever? Analyst Explains – Crypto News

-

Business1 week ago

Fed’s Stephen Miran Calls for Rapid Rate Cuts Amid U.S.-China Trade Tensions – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoIs Wave 5 Still Coming or a New Bull Trend Emerging? – Crypto News

-

Technology5 days ago

Technology5 days agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

others4 days ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago$23 Billion XRP Milestone Spotlighted by CME Group: Details – Crypto News

-

Technology1 week ago

Technology1 week agoAMD strengthens AI push: Oracle to deploy 50,000 MI450 AI chips in data centers starting 2026 – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Continues to Offer Superior Returns and Diversification: Franklin Templeton – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBeyond Bitcoin: How Asia’s new crypto playbook is breaking from the west – Crypto News

-

Business1 week ago

Pi Coin Price Gears for Recovery as DEX and AMM Launch Revives Utility Hopes – Crypto News

-

Technology1 week ago

XRP Price Crashes as Whales Dump 2.23B Tokens — Is $2 the Next Stop? – Crypto News

-

others1 week ago

others1 week agoSeems ‘prudent’ to cut rates further given lower inflation risks – Crypto News

-

Metaverse1 week ago

Metaverse1 week ago‘Erotica for verified adults’: OpenAI to allow mature content on ChatGPT; Sam Altman vows to treat adults like adults – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCelestia price reclaims $1 after crash to $0.27: TIA forecast – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoMint Explainer | Why Big Tech is rushing to build AI data centres across India – Crypto News

-

Technology1 week ago

XRP News: Ripple Strikes Deal with Absa, Expanding Custody Footprint To Africa – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa Says Stablecoins Are Powering ‘a New Lending Space’ – Crypto News

-

Business1 week ago

Building Through the Downturn – Why Smart Money Is Watching XYZVerse – Crypto News

-

Business1 week ago

Gold vs Bitcoin – Peter Schiff Declares BTC Has Failed as Digital Gold, CZ Reacts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGhana Moves Toward Crypto Regulation Amid Rising User Adoption – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoCrypto markets turn red after Trump threatens to halt cooking oil imports from China – Crypto News

-

others7 days ago

Cardano’s Charles Hoskinson Addresses Allegations of Diverting Treasury Funds – Crypto News

-

others1 week ago

others1 week agoEUR/GBP weakens to near 0.8700, French government plans to postpone pension reforms – Crypto News

-

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg) others1 week ago

others1 week agoDow Jones holds onto recovery levels as investors focus on earnings – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions – Crypto News

-

De-fi7 days ago

De-fi7 days agoLighter Distributes Points to Users Affected by Platform Outage – Crypto News

-

De-fi7 days ago

De-fi7 days agoSony Enters U.S. Crypto Banking Race Amid Growing Institutional Interest – Crypto News

-

others6 days ago

Stripe-backed Tempo Hires Ethereum Researcher Dankrad Feist After $500M Funding – Crypto News

-

others4 days ago

others4 days agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

others3 days ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Continues to Offer Superior Returns and Diversification: Franklin Templeton – Crypto News

-

others1 week ago

Sui Price Targets $9.5 as Figure Brings SEC-Approved Yield Token YLDS to Sui – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase Plans to List Surging BNB After Previously Delisting Binance Stablecoin – Crypto News

-

De-fi1 week ago

De-fi1 week agoWhat Is a 51% Attack, and How Does It Work? – Crypto News

-

Metaverse7 days ago

Metaverse7 days agoAll About AI Tech4Good Awards are back for the second edition. Apply Now! – Crypto News

-

others7 days ago

others7 days agoUSD/JPY strengthens as Trump’s softer stance on China boosts US Dollar demand – Crypto News

-

De-fi6 days ago

De-fi6 days agoCoinbase Says It Plans to List BNB amid Binance Listing Fee Saga – Crypto News