Cryptocurrency

Fed ends 0.75% streak, opts for lower rate hike in December – Crypto News

The Federal Reserve bumped interest rates by half of a percentage point on Wednesday, putting an end to its streak of 75 basis point rate increases that started back in June.

The US central bank cited “robust” job growth and “modest” increases in spending and production. The move marks the Fed’s seventh successive The rate hike, a strategy it hopes will curb the highest inflation the country has seen in more than four decades, but analysts have said it will not end in a soft landing.

“Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher food and energy prices, and broader price pressures,” Federal Open Market Committee (FOMC) members wrote in a statements at the end of their two-day policy meeting. “The Committee anticipates that ongoing increases in the target range will be appropriate.”

Bitcoin initially rose on the news, which analysts say was mostly priced in, but the token promptly gave back those gains. Ether followed suit. The S&P 500 and Nasdaq Composite indexes lost 0.6% and 1%, respectively, immediately after the Fed released its decision.

Tuesday’s Consumer Price Index The reading settled traders’ nerves ahead of the rate decision when data pointed to slowing inflation. November’s year-over-year price increase came in at 7.1%, far higher than the Fed’s preferred 2% level, but still below the expected 7.3% figure.

Markets were happy the Fed moved as anticipated, but related gains have historically been short-lived, Tom Essaye, co-founder of Sevens Report Research, said.

“CPI coming in lower than expected for a second straight month, and falling decisively from the highs of earlier this year is clearly a macro positive, although it’s not enough, by itself, to spark a material and sustainable rally,” Essaye said.

“While the CPI report makes the idea of disinflation more concrete, 7.1% is still much too high and yesterday’s report really doesn’t change the calculus on when the Fed pivots — that’ll depend on growth and when inflation falls further,” he added.

The Fed has made clear it’s prepared to continue raising interest rates as needed in an effort to stem inflation.

“Today, we’ve just moved, I think probably into the very, very lowest level of what might be restrictive. And certainly in my view, in the view of the committee, there’s a ways to go,” Federal Reserve Chair Jerome Powell said in September after the central bank locked in its third 75 basis point increase.

This is a developing story and will be updated.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.

Can’t wait? Get our news the fastest way possible. Join us on Telegram,

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Technology1 week ago

Technology1 week agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech is valued as if AI is the next smartphone. It isn’t. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin, Ethereum rebound following ‘largest single-day wipeout in crypto history’ – Crypto News

-

Technology5 days ago

Technology5 days agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWalmart teams with OpenAI for ChatGPT purchases. The retailer is ‘ahead of the curve’. – Crypto News

-

Business1 week ago

Nasdaq-Listed Webus Adopts XRP in New Tokenized Reward Platform, Eyes $20B Loyalty Market – Crypto News

-

Business1 week ago

Dogecoin Gets Major Utility Boost as Trump-Linked Thumzup Prepares DOGE Payments – Crypto News

-

others4 days ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are These Ripple (XRP) ETF Filings the Worst Idea Ever? Analyst Explains – Crypto News

-

Business1 week ago

Fed’s Stephen Miran Calls for Rapid Rate Cuts Amid U.S.-China Trade Tensions – Crypto News

-

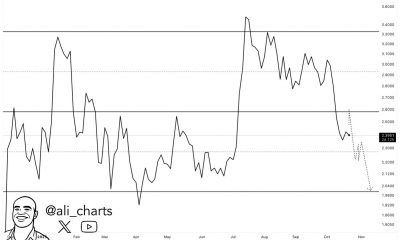

Cryptocurrency7 days ago

Cryptocurrency7 days agoIs Wave 5 Still Coming or a New Bull Trend Emerging? – Crypto News

-

Technology1 week ago

XRP News: Ripple Strikes Deal with Absa, Expanding Custody Footprint To Africa – Crypto News

-

Business1 week ago

Pi Coin Price Gears for Recovery as DEX and AMM Launch Revives Utility Hopes – Crypto News

-

others1 week ago

Cardano’s Charles Hoskinson Addresses Allegations of Diverting Treasury Funds – Crypto News

-

others4 days ago

others4 days agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

Metaverse1 week ago

Metaverse1 week ago‘Erotica for verified adults’: OpenAI to allow mature content on ChatGPT; Sam Altman vows to treat adults like adults – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCelestia price reclaims $1 after crash to $0.27: TIA forecast – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoMint Explainer | Why Big Tech is rushing to build AI data centres across India – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa Says Stablecoins Are Powering ‘a New Lending Space’ – Crypto News

-

Business1 week ago

Building Through the Downturn – Why Smart Money Is Watching XYZVerse – Crypto News

-

Business1 week ago

Gold vs Bitcoin – Peter Schiff Declares BTC Has Failed as Digital Gold, CZ Reacts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGhana Moves Toward Crypto Regulation Amid Rising User Adoption – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto markets turn red after Trump threatens to halt cooking oil imports from China – Crypto News

-

others6 days ago

Shiba Inu Price Eyes Recovery as Burn Rate Jumps 10,785% – Can SHIB Hit $0.000016? – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump Confirms Meeting With Xi Jinping on Oct 31, Markets Rally in Response – Crypto News

-

others4 days ago

others4 days agoAUD/USD rises on US-China trade hopes, Fed rate cut outlook – Crypto News

-

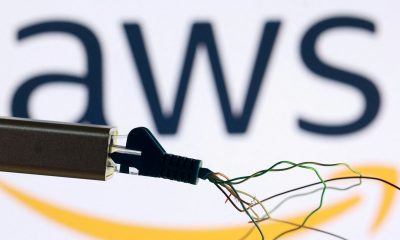

Technology4 days ago

Technology4 days agoAmazon Web Services outage: Here’s how many users are impacted and the downtime costs – Crypto News

-

others4 days ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

others1 week ago

others1 week agoEUR/GBP weakens to near 0.8700, French government plans to postpone pension reforms – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase Plans to List Surging BNB After Previously Delisting Binance Stablecoin – Crypto News

-

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg) others1 week ago

others1 week agoDow Jones holds onto recovery levels as investors focus on earnings – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Create A Meme Coin For Free On Solana – Crypto News

-

De-fi1 week ago

De-fi1 week agoLighter Distributes Points to Users Affected by Platform Outage – Crypto News

-

De-fi1 week ago

De-fi1 week agoSony Enters U.S. Crypto Banking Race Amid Growing Institutional Interest – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAll About AI Tech4Good Awards are back for the second edition. Apply Now! – Crypto News

-

others1 week ago

others1 week agoUSD/JPY strengthens as Trump’s softer stance on China boosts US Dollar demand – Crypto News

-

others7 days ago

Stripe-backed Tempo Hires Ethereum Researcher Dankrad Feist After $500M Funding – Crypto News

-

others6 days ago

others6 days agoGold crashes 2% from record high as Trump tempers threats on China – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoEthena (ENA) Price Outperforming: Only Reason – Crypto News

-

others6 days ago

others6 days agoWe should not cut rates every quarter, but rate-cutting cycle not over – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAster price tanks 20% as sell-off pressure hits altcoins – Crypto News

-

Business5 days ago

How Will “Unusual” US CPI Inflation Data Release Could Impact Fed Rate Cut, Crypto Market? – Crypto News

-

Technology4 days ago

Technology4 days agoAWS says it has fixed the problem that crippled half the internet but many popular apps are still down – Crypto News

-

Business4 days ago

Binance Founder CZ Predicts Bitcoin Will Flip Gold’s $30 Trillion Market – Crypto News

-

Business3 days ago

Solana Price Eyes $240 Recovery as Gemini Launches SOL-Reward Credit Card – Crypto News