others

Fed Minutes to show details of slower policy easing outlook in 2025 – Crypto News

- The Minutes of the Fed’s January 28-29 policy meeting will be published on Wednesday.

- Details surrounding the discussions on the decision to keep policy settings unchanged will be scrutinized by investors.

- Markets see virtually no chance of a 25 bps Fed rate cut in March.

The Minutes of the United States (US) Federal Reserve’s (Fed) January 28-29 monetary policy meeting will be published on Wednesday at 19:00 GMT. Policymakers decided to maintain the policy rate at the range of 4.25%-4.5% at the first meeting of 2025. However, the central bank removed earlier language suggesting inflation had “made progress” toward its 2% target, instead stating that the pace of price increases “remains elevated.”

Jerome Powell and co decided to hold policy settings unchanged after January meeting

The Federal Open Market Committee (FOMC) voted unanimously to keep the policy rate unchanged. The statement showed that officials expressed confidence that progress in reducing inflation will likely resume later this year but emphasized the need to pause and await further data to confirm this outlook.

In the post-meeting press conference, Fed Chairman Jerome Powell reiterated that they don’t need to be in a hurry to make any adjustments to the policy.

Commenting on the policy outlook earlier in the week, Philadelphia Fed President Patrick Harker said that the current economy argues for a steady policy for now. Similarly, Atlanta Fed President Raphael Bostic noted that the need for patience suggests that the next rate cut could happen later to give more time for information.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed Feb 19, 2025 19:00

Frequency: Irregular

Consensus: –

Previous: –

Source: Federal Reserve

When will FOMC Minutes be released and how could it affect the US Dollar?

The FOMC will release the minutes of the January 28-29 policy meeting at 19:00 GMT on Wednesday. Investors will scrutinize the discussions surrounding the policy outlook.

In case the publication shows that policymakers are willing to wait until the second half of the year before reconsidering rate cuts, the immediate reaction could help the US Dollar (USD) gather strength against its rivals. On the other hand, the market reaction could remain subdued and short-lived if the document repeats that officials will adopt a patient approach to further policy easing without providing any fresh clues on the timing.

According to the CME FedWatch Tool, markets currently see virtually no chance of a 25 basis point rate cut in March. Moreover, they price in a more than 80% probability of another policy hold in May. Hence, the market positioning suggests that the publication would need to offer very clearly hawkish language to provide a steady boost to the USD.

Eren Sengezer, European Session Lead Analyst at FXStreet, shares a brief outlook for the USD Index:

“The Relative Strength Index (RSI) indicator on the daily chart stays well below 50 and the index remains below the 20-day Simple Moving Average (SMA), highlighting a bearish bias in the short term.”

“On the downside, 106.30-106.00 aligns as a key support area, where the 100-day SMA and the Fibonacci 38.2% retracement of the October 2024 – January 2025 uptrend are located. If this support area fails, 105.00-104.90 (200-day SMA, Fibonacci 50% retracement) could be set as the next bearish target. Looking north, resistances could be spotted at 107.50-107.70 (20-day SMA, Fibonacci 23.6% retracement), 108.00 (50-day SMA) and 109.00 (round level).”

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

-

Technology1 week ago

Technology1 week agoChip Designer Arm Plans to Become Chip Manufacturer – Crypto News

-

Cryptocurrency3 days ago

Cryptocurrency3 days agoSUI eyes 24% rally as bullish price action gains strength – Crypto News

-

others6 days ago

others6 days agoJapanese Yen remains depressed amid modest USD strength; downside seems limited – Crypto News

-

Technology1 week ago

Technology1 week agoMacBook Air M3 15-inch model gets a ₹12,000 price drop on Amazon: Deal explained – Crypto News

-

Cryptocurrency2 days ago

Cryptocurrency2 days agoCoinbase scores major win as SEC set to drop lawsuit – Crypto News

-

others1 week ago

Japan Foreign Investment in Japan Stocks declined to ¥-384.4B in February 7 from previous ¥-315.2B – Crypto News

-

Technology1 week ago

Technology1 week agoPerplexity takes on ChatGPT and Gemini with new Deep Research AI that completes most tasks in under 3 minutes – Crypto News

-

Technology1 week ago

Technology1 week agoLava Pro Watch X with 1.44-inch AMOLED display, in-built GPS launched in India at ₹4,499 – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Set To Outshine Gold? Analyst Predicts 1,000% Surge – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAdvisers on crypto: Takeaways from another survey – Crypto News

-

others1 week ago

others1 week agoRemains subdued below 1.4200 near falling wedge’s lower threshold – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week ago0xLoky Introduces AI-powered Intel for Crypto Data & On-chain Insights – Crypto News

-

Technology1 week ago

Technology1 week agoFactbox-China’s AI firms take spotlight with deals, low-cost models – Crypto News

-

Technology1 week ago

Technology1 week agoMassive price drops on Samsung Galaxy devices: Up to ₹10000 discount on Watch Ultra, Tab S10 Plus, and more – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTether Acquires a Minority Stake in Italian Football Giant Juventus – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP To 3 Digits? The ‘Signs’ That Could Confirm It, Basketball Analyst Says – Crypto News

-

others1 week ago

others1 week agoAustralian Dollar jumps to highs since December on USD weakness – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: JioHotstar launched, Sam Altman vs Elon Musk feud intensifies, Perplexity takes on ChatGPT and more – Crypto News

-

Technology1 week ago

Technology1 week agoWhat will it take for India to become a global data centre hub? – Crypto News

-

Technology1 week ago

Technology1 week agoChatGPT vs Perplexity: Sam Altman praises Aravind Srinivas’ Deep Research AI; ‘Proud of you’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoNEAR Breaks Below Parallel Channel: Key Levels To Watch – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoWill BTC Rebound Or Drop To $76,000? – Crypto News

-

Blockchain7 days ago

Blockchain7 days agoXRP Price Settles After Gains—Is a Fresh Upside Move Coming? – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoHow AI will divide the best from the rest – Crypto News

-

Business6 days ago

Business6 days agoWhat Will be KAITO Price At Launch? – Crypto News

-

Business6 days ago

Business6 days agoElon Musk’s DOGE Launches Probe into US SEC, Ripple Lawsuit To End? – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoXRP Price Pulls Back From Highs—Are Bulls Still in Control? – Crypto News

-

Business5 days ago

Business5 days agoWhales Move From Shiba Inu to FXGuys – Here’s Why – Crypto News

-

Technology1 week ago

Technology1 week agoBest phones under ₹20,000 in February 2025: Poco X7, Motorola Edge 50 Neo and more – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoPopular Investor Says Memecoin More Superior With ‘World’s Best Chart’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWho is Satoshi Nakamoto, The Creator of Bitcoin? – Crypto News

-

Technology1 week ago

Technology1 week agoGrok 3 is coming! Elon Musk announces launch date, promises ‘smartest AI on Earth’ – Crypto News

-

Technology7 days ago

Technology7 days agoUnion Minister Ashwini Vaishnaw to launch India AI Mission portal soon, 10 companies set to provide 14,000 GPUs – Crypto News

-

others6 days ago

others6 days agoForex Today: What if the RBA…? – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoHayden Davis crypto scandal deepens as LIBRA memecoin faces fraud allegations – Crypto News

-

Technology5 days ago

Technology5 days agoLuminious inverters for your home to never see darkness again – Crypto News

-

Technology3 days ago

Technology3 days agoStellantis Debuts System to Handle ‘Routine Driving Tasks’ – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoStrange Love: why people are falling for their AI companions – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoYap-to-earn takes over Twitter – Blockworks – Crypto News

-

Technology1 week ago

Technology1 week agoCyber fraud alert: Doctor duped of ₹15.50 lakh via fake trading app; here’s what happened – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto narratives as we await next market move – Crypto News

-

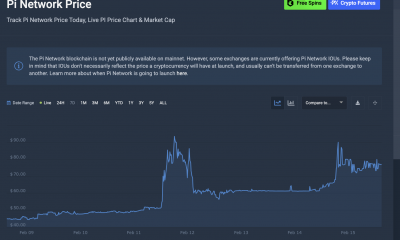

Business1 week ago

Business1 week agoHow Will It Affect Pi Coin Price? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGameStop Stock Price Pumps After Report of Bitcoin Buying Plans – Crypto News

-

Business6 days ago

Business6 days agoThese 3 Altcoins Will Help You Capitalize on Stellar’s Recent DIp – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoBitcoin Sees $430M in Outflows as Market Responds to Fed’s Hawkish Stance – Crypto News

-

Technology1 week ago

Technology1 week agoJioHotstar streaming platform launched, merging content from JioCinema and Disney+ Hotstar – Crypto News

-

Technology1 week ago

Technology1 week agoFormer Google CEO warns of ‘Bin Laden scenario’ for AI: ‘They could misuse it and do real harm’ – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoSomeone Just Won $100K in Bitcoin From a $50 Pack of Trading Cards – Crypto News

-

Technology1 week ago

Technology1 week agoSay goodbye to tangled cables: Stylish magnetic power banks keep your iPhone or Android charged on the go – Crypto News

-

Technology1 week ago

Technology1 week agoOpenAI board unanimously rejects Musk’s $97.4 billion takeover bid: ‘Not for sale’ – Crypto News