Cryptocurrency

Fetch.ai and Ocean Protocol move toward resolving $120M FET dispute – Crypto News

Key Takeaways

Why does this dispute matter?

Because the return of the 286M FET tokens could remove a major supply-overhang risk and restore trust in the AI-crypto alliance.

What changed this week?

During an X Space, both sides signaled willingness to settle, but no official agreement has been signed yet.

The long-running dispute between Fetch.ai and Ocean Protocol over roughly 286 million FET tokens [worth about $120 million] appears to be moving toward resolution.

The development surfaced during a community X Space, where Fetch.ai signaled willingness to settle. However, no official joint statement or signed agreement has been released, leaving the situation unresolved.

Background: A dispute that shook the “AI crypto alliance”

On 21 October, AMBCrypto reported that Fetch.ai accused Ocean Protocol Foundation of converting OCEAN tokens into FET.

They then moved a portion of the holdings to centralized exchanges, including Binance and market-maker GSR.

At the time, these transfers raised concerns about potential sell-pressure and intentional token dumping.

This triggered sharp community backlash and damaged trust across the AI-crypto coalition that previously included SingularityNET.

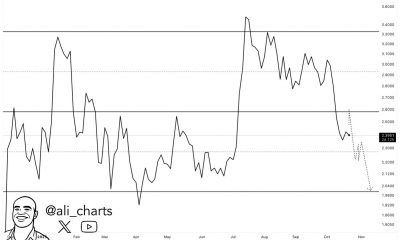

Since then, FET has suffered a steep decline, falling over 90% from its annual peak, and crashing to the $0.23–$0.26 range in recent trading.

The latest update: Ocean signals willingness to return FET tokens

During the X Space discussion, Fetch.ai signalled willingness to drop the lawsuit against Ocean Protocol if they returned the FET tokens.

Ocean Protocol reportedly indicated its readiness to return the FET tokens, provided it receives a formal written settlement proposal from Fetch.ai.

Fetch.ai representatives stated that they will withdraw legal claims if the tokens are returned in full.

For now, the arrangement remains conditional and informal. Additionally, there is no signed settlement document, and neither project has issued a formal public announcement.

This leaves the community cautiously optimistic, but not convinced.

Market reaction: FET stabilizes but remains deeply oversold

The FET price chart indicates that the token has entered deep oversold territory, with the RSI hovering near 27.

This is a historically significant region associated with reversal attempts. As of this writing, it was trading at around 0.27, with an increase of over 3%.

However, traders appear hesitant to position aggressively until the token-return details are clarified — particularly around:

- Where the returned tokens will be held

- Whether vesting/lockups will apply

- Who controls treasury governance in the future

Without these answers, supply-overhang risk remains a core concern.

What comes next?

If the agreement is finalized and tokens are returned under transparent lockup terms, the move could restore credibility and relieve sell-pressure fears on FET.

If negotiations stall — or if tokens re-enter circulation without controls — market confidence could weaken further.

For now, the market is waiting, and the alliance’s future hinges on whether the two teams can document and execute what they just signaled in public.

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStripe’s stablecoin biz seeks national bank trust charter – Crypto News

-

Technology1 week ago

Technology1 week agoApple launches MacBook Pro 14-inch with M5 chip in India, price starts at ₹1,69,900 – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoTech is valued as if AI is the next smartphone. It isn’t. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBitcoin, Ethereum rebound following ‘largest single-day wipeout in crypto history’ – Crypto News

-

Technology5 days ago

Technology5 days agoChatGPT remains the most popular chatbot globally but Google’s Gemini is catching up fast – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Business1 week ago

Pro Says Ethereum Price is a Buy Despite Rising Liquidations and BlackRock Selling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWalmart teams with OpenAI for ChatGPT purchases. The retailer is ‘ahead of the curve’. – Crypto News

-

Business1 week ago

Nasdaq-Listed Webus Adopts XRP in New Tokenized Reward Platform, Eyes $20B Loyalty Market – Crypto News

-

Business1 week ago

Dogecoin Gets Major Utility Boost as Trump-Linked Thumzup Prepares DOGE Payments – Crypto News

-

others4 days ago

‘Floki Is The CEO’: FLOKI Surges Over 20% After Elon Musk’s Name Drop – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Are These Ripple (XRP) ETF Filings the Worst Idea Ever? Analyst Explains – Crypto News

-

Business1 week ago

Fed’s Stephen Miran Calls for Rapid Rate Cuts Amid U.S.-China Trade Tensions – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoIs Wave 5 Still Coming or a New Bull Trend Emerging? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoBeyond Bitcoin: How Asia’s new crypto playbook is breaking from the west – Crypto News

-

Technology1 week ago

XRP News: Ripple Strikes Deal with Absa, Expanding Custody Footprint To Africa – Crypto News

-

Business1 week ago

Pi Coin Price Gears for Recovery as DEX and AMM Launch Revives Utility Hopes – Crypto News

-

others1 week ago

Cardano’s Charles Hoskinson Addresses Allegations of Diverting Treasury Funds – Crypto News

-

others4 days ago

others4 days agoRisk-off sentiment drives selective equity positioning – BNY – Crypto News

-

Metaverse1 week ago

Metaverse1 week ago‘Erotica for verified adults’: OpenAI to allow mature content on ChatGPT; Sam Altman vows to treat adults like adults – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCelestia price reclaims $1 after crash to $0.27: TIA forecast – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoMint Explainer | Why Big Tech is rushing to build AI data centres across India – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoChatGPT ‘adult model’ plan: OpenAI’s Sam Altman reacts to criticism, says ‘not elected moral police’ – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa Says Stablecoins Are Powering ‘a New Lending Space’ – Crypto News

-

Business1 week ago

Building Through the Downturn – Why Smart Money Is Watching XYZVerse – Crypto News

-

Business1 week ago

Gold vs Bitcoin – Peter Schiff Declares BTC Has Failed as Digital Gold, CZ Reacts – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoGhana Moves Toward Crypto Regulation Amid Rising User Adoption – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCrypto markets turn red after Trump threatens to halt cooking oil imports from China – Crypto News

-

others6 days ago

Shiba Inu Price Eyes Recovery as Burn Rate Jumps 10,785% – Can SHIB Hit $0.000016? – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump Confirms Meeting With Xi Jinping on Oct 31, Markets Rally in Response – Crypto News

-

others4 days ago

others4 days agoAUD/USD rises on US-China trade hopes, Fed rate cut outlook – Crypto News

-

Technology4 days ago

Technology4 days agoAmazon Web Services outage: Here’s how many users are impacted and the downtime costs – Crypto News

-

others4 days ago

Ethereum Price Targets $8K Amid John Bollinger’s ‘W’ Bottom Signal and VanEck Staked ETF Filing – Crypto News

-

others1 week ago

others1 week agoEUR/GBP weakens to near 0.8700, French government plans to postpone pension reforms – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCoinbase Plans to List Surging BNB After Previously Delisting Binance Stablecoin – Crypto News

-

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg) others1 week ago

others1 week agoDow Jones holds onto recovery levels as investors focus on earnings – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Slides for Second Day as Bitcoin Dips Amid Geopolitical Tensions – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Create A Meme Coin For Free On Solana – Crypto News

-

De-fi1 week ago

De-fi1 week agoLighter Distributes Points to Users Affected by Platform Outage – Crypto News

-

De-fi1 week ago

De-fi1 week agoSony Enters U.S. Crypto Banking Race Amid Growing Institutional Interest – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoAll About AI Tech4Good Awards are back for the second edition. Apply Now! – Crypto News

-

others1 week ago

others1 week agoUSD/JPY strengthens as Trump’s softer stance on China boosts US Dollar demand – Crypto News

-

others7 days ago

Stripe-backed Tempo Hires Ethereum Researcher Dankrad Feist After $500M Funding – Crypto News

-

others6 days ago

others6 days agoGold crashes 2% from record high as Trump tempers threats on China – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoEthena (ENA) Price Outperforming: Only Reason – Crypto News

-

others6 days ago

others6 days agoWe should not cut rates every quarter, but rate-cutting cycle not over – Crypto News

-

Cryptocurrency5 days ago

Cryptocurrency5 days agoAster price tanks 20% as sell-off pressure hits altcoins – Crypto News

-

Business5 days ago

How Will “Unusual” US CPI Inflation Data Release Could Impact Fed Rate Cut, Crypto Market? – Crypto News

-

Technology4 days ago

Technology4 days agoAWS says it has fixed the problem that crippled half the internet but many popular apps are still down – Crypto News

-

Business4 days ago

Binance Founder CZ Predicts Bitcoin Will Flip Gold’s $30 Trillion Market – Crypto News