Blockchain

GameStop (GME) Down Bad After Bitcoin News: Here’s The Catch – Crypto News

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

GameStop (NYSE: GME) suffered a sharp 25% drop yesterday, a sudden downturn that followed a 16% rally on March 26. The catalyst? A bold decision by the gaming retailer’s board to establish a Bitcoin treasury—joining the ranks of MicroStrategy, Metaplanet, and other corporations. Initially, the news sent GME shares soaring, as investors viewed the move as a bullish signal. However, the stock quickly reversed course and now finds itself in turbulent waters.

Investor optimism over GameStop’s Bitcoin play was palpable at first. The announcement sparked excitement similar to when MicroStrategy began accumulating Bitcoin. Yet the initial rally gave way to heavy selling pressure, erasing nearly $3 billion in market value. While the company has not fully detailed its strategy or timeline for Bitcoin acquisitions, the market’s whiplash response has prompted widespread debate.

GameStop’s ‘Convertible Arbitrage’ Factor

On X, analyst Han Akamatsu offered an explanation rooted in parallels to MicroStrategy’s past financing methods. He began by noting: “Let me explain to you why GameStop is falling today, as far as I understand based on my MSTR experience.”

According to Akamatsu, when MicroStrategy previously issued convertible notes, large institutional buyers used a strategy known as convertible arbitrage: “When MSTR issued convertible notes, institutional buyers used convertible arbitrage: They bought the bonds, shorted MSTR stock to hedge [and] waited for the bond to either convert or mature.”

He emphasized that this process created “artificial short pressure” on the stock—despite MicroStrategy’s own bullish outlook on Bitcoin. Akamatsu then referenced MicroStrategy’s 2021 issuance: “In 2021, MSTR issued $1.05B of 0% convertible notes, the stock dipped after the announcement due to hedging shorts, but later exploded when Bitcoin ripped and the arbitrage unspooled.”

Akamatsu went on to connect these dots to GameStop’s current situation: “GME is following the same blueprint now:Issue $1.3B in 0% convertibles, likely going to buy Bitcoin [and] institutions are now shorting GME to hedge.”

He pointed out that if GME or Bitcoin rises substantially, the short positions set up to hedge the convertibles could be unwound en masse: “If GME or BTC goes up a lot, the trade gets very interesting as we have a squeeze opportunity here.”

He further explained the typical ratio of shorts involved: “A common practice is to short 50–70% of the bond’s notional value in stock. They make money on the arbitrage between the bond conversion price and the stock price, even if the stock stays flat or drops.”

Finally, Akamatsu noted that the volume-weighted average price (VWAP) would influence the conversion price: “VWAP pricing window behavior, they’ll want the stock low to get favorable conversion. Conversion price will be based on GME’s VWAP […] from 1:00 PM to 4:00 PM EDT on the pricing day.”

Criticism Over the Risk

Some market watchers have criticized GameStop’s board for incurring what appears to be self-inflicted selling pressure. One user on X questioned whether Chairman Ryan Cohen (often referred to by the initials RC) had miscalculated: “Hi Han, great analysis as usual… however, nearly $3bn market value is wiped out today. RC should really ask himself if it is worth it or he miscalculated. The hedge is supposed to mitigate risk in nature. But itself creates much more risk.”

Akamatsu stood by his take, asserting: “Calculated and all going according to plan. If you’re not really into the MSTR playbook, I recommend you to check their strategy.”

In another post, Akamatsu drew comparisons to a setup he observed with Celsius Holdings (NASDAQ: CELH): “GME has a similar pattern with what CELH had when I claimed this was an easy 100% setup.”

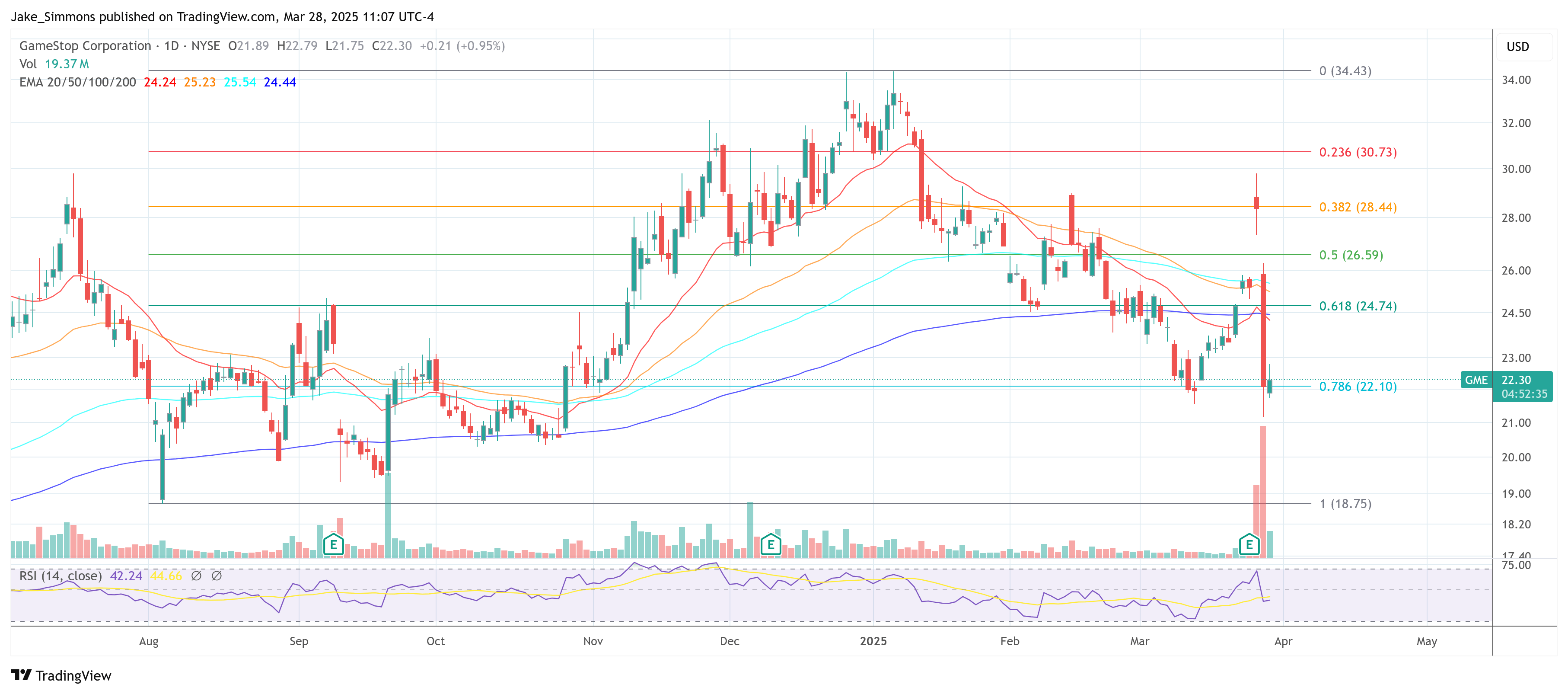

He referenced chart analyst Thomas Bulkowski’s work on wedge patterns, hinting that a retracement might offer a buying opportunity: “If GME starts retracing after that solid breakout, textbook Bulkowski says that 7/10 times price tests the wedge again and then has a greater takeoff.”

The analyst reassured traders not to panic if the stock dips further, stressing it could be a standard technical move: “So, if you see GME retrace … don’t panic as this will be normal. You’ll have another chance at a great entry when this tests the wedge again.” He concluded on a hopeful note: “I’m having my fingers crossed this will simply skyrocket.”

At press time, GME stood at $22.30.

Featured image created with DALL.E, chart from TradingView.com

-

Blockchain7 days ago

Blockchain7 days agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoStop panicking about AI. Start preparing – Crypto News

-

others1 week ago

others1 week agoUS Heiress Slaps Billion-Dollar Lawsuit on Banks for Allegedly Aiding the Looting of Her $350,000,000 Trust Fund – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse4 days ago

Metaverse4 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMakinaFi hit by $4.1M Ethereum hack as MEV tactics suspected – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

others1 week ago

others1 week agoPBOC sets USD/CNY reference rate at 6.9843 vs. 6.9929 previous – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Cryptocurrency1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent? – Crypto News

-

Business1 week ago

Japan Set to Launch First Crypto ETFs as Early as 2028: Nikkei – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRYO Digital Announces 2025 Year-End Milestones Across Its Ecosystem – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

others1 week ago

Jerome Powell Speech Tomorrow: What to Expect From Fed Meeting for Crypto Market? – Crypto News

-

Technology2 days ago

Fed Rate Cut Uncertainty Mounts as BLS Delays Jobs Report Amid Shutdown – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

others1 week ago

U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty – Crypto News

-

others1 week ago

others1 week ago478,188 Americans Warned After Hackers Strike Government-Related Firm Handling Sensitive Personal Data – Crypto News

-

Technology1 week ago

Crypto Events to Watch This Week: Is the Market Entering a New Recovery Phase? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Won’t Return to Binance, Bullish on Bitcoin Supercycle – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Slips Further As Bears Target Deeper Support Zones – Crypto News

-

Technology1 week ago

Technology1 week agoIs TikTok still down in the United States? Check current status – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoThe productivity bull case for almost everything – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News