others

GBP/USD – Risk appetite lifts the pair to seven-week high – Crypto News

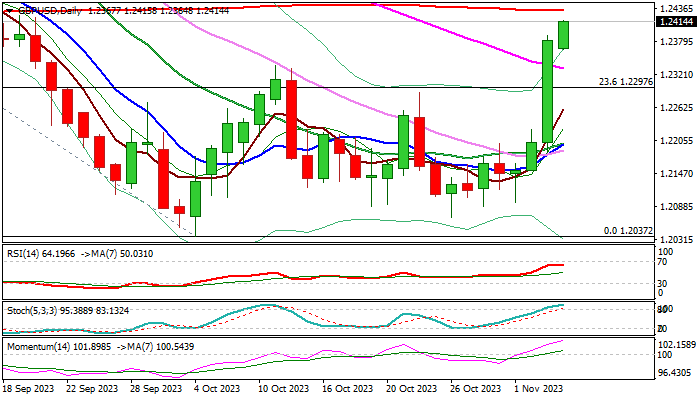

GBP/USD Forecast: Pound Sterling could face next resistance at 1.2440

Following a quiet Asian session, GBP/USD gathered bullish momentum and touched its highest level in 7 weeks above 1.2400 on Monday. The pair turned technically overbought but buyers could remain interested in case 1.2400 stays intact as support.

The Unemployment Rate in the US edged higher to 3.9% in October from 3.8% in December, with Nonfarm Payrolls increasing by a weaker-than-forecast 150,000 in that period. The US Dollar (USD) continued to weaken against its major rivals after October jobs report and GBP/USD registered impressive gains ahead of the weekend. Read more…

GBP/USD outlook: Risk appetite lifts the pair to seven-week high

GBPUSD bulls held grip at the start of the week and cracked psychological 1.2400 barrier, in attempts to extend Friday’s nearly 1.5% advance. Fresh risk appetite gave strong boost to sterling, in addition to BOE’s hawkish stance despite keeping rates on hold last week and warning signals from various sectors of the US economy and dovish steer from the central bank in response.

Last week’s advance and close above the ceiling of a multi-week consolidation range generated a signal of formation of a higher base (1.2040/70 zone) and possible stronger recovery. Read more…

Pound Sterling recovers further on higher risk appetite, UK GDP in focus

The Pound Sterling (GBP) looks set to deliver a fresh upside as the market mood is supportive for risk-sensitive assets. The GBP/USD pair is aiming for more upside as investors hope that the policy divergence between the Federal Reserve (Fed) and the Bank of England (BoE) will not widen further since they are both sufficiently restrictive to ensure price stability.

Further action in the Pound Sterling could be guided by the preliminary Q3 Gross Domestic Product (GDP) for 2023, which will be published later this week. Economists project a marginally negative Q3 GDP as UK firms cut heavily on workforce and inventories due to a poor demand environment. Read more…

-

Blockchain7 days ago

Blockchain7 days agoThe Quantum Clock Is Ticking on Blockchain Security – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWould you raise an AI pet? India’s new digital companions are here – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTether Launches Dollar-Backed Stablecoin USAT – Crypto News

-

Metaverse3 days ago

Metaverse3 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWould you raise an AI pet? India’s new digital companions are here – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoWould you raise an AI pet? India’s new digital companions are here – Crypto News

-

others1 week ago

others1 week agoUS Heiress Slaps Billion-Dollar Lawsuit on Banks for Allegedly Aiding the Looting of Her $350,000,000 Trust Fund – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoTrump-Backed WLFI Snaps Up 2,868 ETH, Sells $8M WBTC – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoUS Storm Smashes Bitcoin Mining Power, Sending Hash Rates Tumbling – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIs AI eating up jobs in UK? New report paints bleak picture – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump family-backed American Bitcoin achieves 116% BTC yield – Crypto News

-

Metaverse3 days ago

Metaverse3 days agoContext engineering and the Future of AI-powered business – Crypto News

-

Metaverse3 days ago

Metaverse3 days agoStop panicking about AI. Start preparing – Crypto News

-

Business1 week ago

New $2M Funding Reveals Ethereum Foundation’s New Threat – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoMakinaFi hit by $4.1M Ethereum hack as MEV tactics suspected – Crypto News

-

Technology1 week ago

Technology1 week agoHow Americans are using AI at work, according to a new Gallup poll – Crypto News

-

others1 week ago

others1 week agoPBOC sets USD/CNY reference rate at 6.9843 vs. 6.9929 previous – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver price defies market downturn, explodes 40% to new ATH – Crypto News

-

Metaverse3 days ago

Metaverse3 days agoContext engineering and the Future of AI-powered business – Crypto News

-

others1 week ago

New $2M Funding Reveals Ethereum Foundation’s New Threat – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoAAVE drops 10% – Assessing if $1 trillion in loans can spark rebound – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Cryptocurrency1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBitcoin Gets the Macro Bug as $87,000 Comes Into Play – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

Business1 week ago

Bitcoin Sentiment Weakens BTC ETFs Lose $103M- Is A Crash Imminent? – Crypto News

-

Business1 week ago

Japan Set to Launch First Crypto ETFs as Early as 2028: Nikkei – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRYO Digital Announces 2025 Year-End Milestones Across Its Ecosystem – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoRiver Crypto Token Up 1,900% in the Last Month—What’s the Deal? – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Business1 week ago

Experts Advise Caution As Crypto Market Heads Into A Bearish Week Ahead – Crypto News

-

Blockchain1 week ago

Blockchain1 week ago‘Most Reliable’ Bitcoin Price Signal Hints at a 2026 Bull Run – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Technology1 week ago

Bitcoin And XRP Price Prediction Ahead of FOMC Meeting Tomorrow, Jan 28 – Crypto News

-

Business1 week ago

Bitcoin Faces Renewed Volatility as Investors Explore Options Like Everlight – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoKalshi Expands Political Footprint with DC Office, Democratic Hire – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk says ‘WhatsApp is not secure’ amid Meta privacy lawsuit; Sridhar Vembu cites ‘conflict of interest’ – Crypto News

-

Technology1 week ago

Fed Rate Cut Odds in January Crash to 99% Ahead of Dollar Yen Intervention- Will BTC React? – Crypto News

-

Business1 week ago

Bitcoin and XRP Price At Risk As US Govt. Shutdown Odds Reach 73% – Crypto News

-

others1 week ago

U.S. Shutdown Odds Hit 78% as CLARITY Act Faces Fresh Uncertainty – Crypto News

-

others1 week ago

others1 week ago478,188 Americans Warned After Hackers Strike Government-Related Firm Handling Sensitive Personal Data – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCZ Won’t Return to Binance, Bullish on Bitcoin Supercycle – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana (SOL) Slips Further As Bears Target Deeper Support Zones – Crypto News