others

Gold extends correction as US Dollar remains resilient due to deepening global uncertainties – Crypto News

- Gold price extends a two-day losing spell as investors channel funds into the US Dollar.

- US recession fears recede sharply due to cooling inflationary pressures and stable job growth.

- Investors await the US ISM Services PMI data for August for fresh guidance.

Gold price (XAU/USD) continues its two-day losing streak on Wednesday as investors keep pumping money into the US Dollar due to deepening global recession fears. Investors underpinned the US Dollar as a safe haven as developing economies are facing the wrath of higher interest rates from Western central banks and potential upside risks of deflation to the Chinese economy.

Fundamentally, it doesn’t seem bad for the Gold price as the US Unemployment Rate rose sharply to 3.8% and wage growth slowed in August. Investors hope that the Federal Reserve (Fed) is done with hiking interest rates. Fed Governor Christopher Waller supported the view, citing the latest batch of economic data that has provided more room to the central bank to assess whether the cost of borrowing needs to be increased again.

Daily Digest Market Movers: Gold price weakens amid strength in the US Dollar

- Gold price resumes its downside journey, tests territory below the crucial support of $1,925.00 as investors underpin the US Dollar as a safe-haven asset amid deepening global uncertainties.

- The precious metal fails to find attention despite the Federal Reserve being expected to keep interest rates steady at 5.25-5.50% for the remaining year.

- As per the CME Fedwatch Tool, there is a 53% chance that interest rates will remain unchanged at 5.25%-5.50% by year-end.

- Fed Governor Christopher Waller said on Tuesday the latest batch of economic data has provided more room to the central bank to assess whether interest rates need to increase again. Fed Waller further added that he doesn’t see any trigger forcing further policy tightening.

- A higher Unemployment Rate and a slower wage growth rate for August are supportive catalysts that would allow Fed policymakers to deliver an unchanged interest rate decision.

- Contrary to Fed Waller, Cleveland Fed Bank President Loretta Mester said there is still a lot of time before the FOMC decision in late September and the central bank will get a lot of data and information by then.

- The US Dollar hovers near a fresh five-month high, marginally lower than 105.00. The Greenback is walking on thin ice as investors hope that the Fed is done with hiking interest rates further.

- US Factory Orders for July contracted sharply by 2.1% after expanding for four straight months, while investors forecasted 0.1% shrinkage. In June, the economic data expanded significantly by 2.3%.

- New Orders for manufactured goods were contracted due to a sharp decline in demand for durable goods as corporations banked on backlogs amid a weak demand outlook.

- On Wednesday, investors will keenly focus on the ISM Services PMI for August, which will be published at 14:00 GMT. Investors anticipate a nominal drop to 52.5 vs. 52.7 in July.

- Investors will also focus on commentary from Fed policymakers: Boston Fed President Susan Collins and Dallas Fed President Lorie Logan.

- Last week, the US ISM Manufacturing PMI for August remained stabilized but continued to stay below the 50.0 threshold, which signals contraction in economic activity.

- US firms stated that they are focusing more on sustaining margins, operating with the available labor force and inventories due to easing confidence in household spending.

- The US Dollar has been performing well as recession fears in the US economy recede due to the stable job market and cooling inflationary pressures. Analysts at Goldman Sachs see a 15% chance that the US economy will slide into a recession. Earlier, the expectations of a recession in the US economy reached at 20%.

- Meanwhile, discussions about US-China trade relations have also underpinned the US Dollar. US Commerce Secretary Gina Raimondo said on Tuesday, “Don’t expect any changes to US tariffs on China imposed by Trump.”

Technical Analysis: Gold price extends losing spree

Gold price extends its two-day losing streak, skids below Tuesday’s low of $1,925.37 as the US Dollar remains resilient due to the risk-off mood. The precious metal slips below the 20 and 50-day Exponential Moving Averages (EMAs). Selling interest in the yellow metal after a recovery move to near $1,950.00 indicates that investors considered the pullback as a fresh selling opportunity. The 200-day EMA will continue to act as a strong cushion for Gold bulls.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

-

Blockchain1 week ago

Blockchain1 week agoEthereum Price Performance Could Hinge On This Binance Metric — Here’s Why – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoFrench Exoskeleton Company Wandercraft Pivots to Humanoid Robots – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoOpenLedger Invests $25 Million to Combat ‘Extractive’ AI Economy – Crypto News

-

others6 days ago

others6 days agoGold price in India: Rates on June 10 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoDonald Trump Ready to Ditch His Tesla Amid Musk Feud? (Report) – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTrump-Elon feud Erupts, Crypto falls, Coinbase to list Fartcoin – Crypto News

-

others1 week ago

others1 week agoCanadian Dollar gives back gains despite upbeat jobs data – Crypto News

-

Technology1 week ago

Technology1 week agoGemini can now schedule tasks, send reminders and keep you on track: Here’s how it works – Crypto News

-

Technology5 days ago

Technology5 days agoCircle IPO shows strong crypto market investor demand – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft integrates AI shopping into Copilot app, bringing price tracking and smart comparisons – Crypto News

-

Technology1 week ago

Technology1 week agoWeekly Tech Recap: Resident Evil Requiem release date revealed, OnePlus 13s makes India debut and more – Crypto News

-

Technology1 week ago

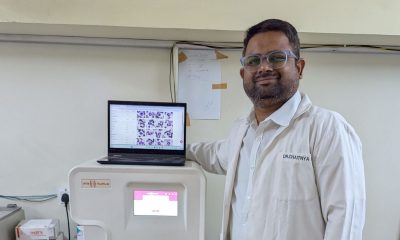

Technology1 week agoHow artificial intelligence caught leukaemia in Maharashtra’s Parbhani – Crypto News

-

Technology7 days ago

Technology7 days agoOpenAI CEO Sam Altman says AI is like an intern today, but it will soon match experienced software engineers – Crypto News

-

others1 week ago

others1 week agoGold prices fall as the USD extends gains post NFP – Crypto News

-

others1 week ago

others1 week agoWidely Followed Analyst Outlines Bullish Path for Bitcoin, Says BTC Will Battle Gold and ‘Never Look Back’ – Crypto News

-

Technology1 week ago

Technology1 week agoIndia targets indigenous 2nm, Nvidia-level GPU by 2030 – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoTRON: Who’s fueling TRX’s breakout? It’s not whales, here’s the answer! – Crypto News

-

others1 week ago

others1 week agoEUR/USD retreats from multi-week highs ahead of Eurozone GDP and consumption data – Crypto News

-

Technology1 week ago

Technology1 week agoBest juicer for home in 2025: Top 10 choices for your family’s good health from brands like Philips, Borosil and more – Crypto News

-

Technology1 week ago

Technology1 week agoOnePlus 13s review: A near-perfect compact phone, minus a few flagship perks – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

others6 days ago

others6 days agoStock Market Pullback in Sight As Several of America’s Problems Still Remain, Warns Former JPMorgan Strategist – Crypto News

-

Technology6 days ago

Technology6 days agoFather’s Day 2025 gift ideas: Smartwatch, Bluetooth speaker and more – Crypto News

-

others1 week ago

others1 week agoBitcoin Could Crash by Double-Digit Percentage Points in a ‘Quick Move’ if This Support Level Fails, Warns Crypto Trader – Crypto News

-

others1 week ago

others1 week agoGBP/USD slips as strong US jobs data cools Fed rate cut bets – Crypto News

-

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-400x240.webp)

![Stacks [STX] down 31% after Alex Protocol exploit - Details](https://dripp.zone/news/wp-content/uploads/2025/06/Stacks-STX-down-31-after-Alex-Protocol-exploit-Details.webp-80x80.webp) Cryptocurrency1 week ago

Cryptocurrency1 week agoStacks [STX] down 31% after Alex Protocol exploit – Details – Crypto News

-

others1 week ago

others1 week agoNew Yorkers Warned of Fake QR Codes Being Placed on Parking Meters That Steal Victims’ Payment Information – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoUnion completes trusted setup to pave the way for trustless cross-chain DeFi – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

Technology6 days ago

Technology6 days agoiOS 26’s Liquid Glass redesign met with backlash from Apple users: ‘Please tone it down’ – Crypto News

-

De-fi5 days ago

De-fi5 days agoResolv Stablecoin Protocol’s Token Debuts at $300 Million Valuation – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoDeutsche Bank Considers Digital Asset Projects – Crypto News

-

Technology7 days ago

Technology7 days agoBP Puts AI at the Heart of Its Efforts to Boost Performance – Crypto News

-

others6 days ago

Japan Money Supply M2+CD (YoY) increased to 0.6% in May from previous 0.5% – Crypto News

-

Technology4 days ago

Technology4 days agoCloud Giants Hit Slow Lane as Legacy Systems Stall Upgrades – Crypto News

-

Technology1 week ago

Technology1 week agoUK watchdog pushes Amazon to rein in misleading product ratings: Know what happened – Crypto News

-

others1 week ago

others1 week agoUS Trade Deficit Plummets by $76,700,000,000 in April Following the Rollout of Trump’s Tariffs – Crypto News

-

others1 week ago

others1 week agoS&P 500 reaches 6,000 for first time since February on NFP print – Crypto News

-

others1 week ago

others1 week agoMichael Saylor Doubling Down on Bitcoin Price Prediction As BTC Holds $100,000 Level – Crypto News

-

others7 days ago

others7 days agoAnalyst Says Bitcoin Has ‘Pretty Good’ Chance of Hitting Massive Price Target in 2026, Citing Three Technical Signals – Crypto News

-

Cryptocurrency7 days ago

Cryptocurrency7 days agoBitcoin trades near $107K despite national guard deployment in Los Angeles – Crypto News

-

Cryptocurrency6 days ago

Cryptocurrency6 days agoResistance Persists at $2,700 But Buyer Appetite Grows – Crypto News

-

others6 days ago

others6 days agoARK Invest’s Cathie Wood Unveils Massive Price Target for Tesla (TSLA) in Five Years Fueled by Robotaxi Platform – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoFranklin Templeton Debuts ‘Intraday Yield’ Feature for Benji – Crypto News

-

Technology5 days ago

Technology5 days agoOne Tech Tip: How to protect your 23andMe genetic data – Crypto News

-

Technology5 days ago

Technology5 days agoOnePlus Nord 5 and Nord CE 5 tipped to launch on 8 July with big battery upgrades and MediaTek chipsets – Crypto News

-

Business4 days ago

Business4 days agoDatabricks Projects $1 Billion Revenue From Data Warehouse Biz – Crypto News

-

Technology1 week ago

Technology1 week agoAustralia sets limits on crypto ATM use amid rising scam concerns – Crypto News