others

Gold pauses after hitting fresh all-time peak amid positive risk tone, stronger USD – Crypto News

- Gold price builds on the recent breakout momentum and touches a fresh record high on Monday.

- Reduced bets for a June Fed rate cut underpin the USD and might cap gains amid the risk-on mood.

- Dip-buying should limit any corrective slide ahead of the US CPI and the FOMC minutes this week.

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark and sticks to its intraday gains near the all-time peak during the early part of the European session on Monday. Expectations that the Federal Reserve (Fed) will start cutting rates in 2024, along with buying from the Chinese central bank, have been significant drivers of the precious metal’s blowout rally over the past two weeks or so. That said, extremely overstretched conditions on the daily chart hold back traders from placing fresh bullish bets amid easing geopolitical tensions and a positive risk tone, which tends to undermine the safe-haven precious metal.

Meanwhile, the upbeat US Nonfarm Payrolls (NFP) report released on Friday suggested that the Federal Reserve (Fed) may delay cutting interest rates and force investors to scale back their expectations rate cuts in 2024 to two from three. The outlook remains supportive of elevated US Treasury bond yields, which underpins the US Dollar (USD) and should further contribute to keeping a lid on the non-yielding Gold price. Traders might also prefer to wait for more cues about the Fed’s rate-cut path before positioning for the next leg of a directional move. Hence, the focus remains on the US consumer inflation figures and the FOMC minutes on Wednesday.

Daily Digest Market Movers: Gold price struggles to build on gains amid risk-on and stronger USD, bullish bias remains

- A buying spree by China’s central bank, along with expectations that lower US interest rates are on the horizon, pushed the Gold price to a fresh record high on the first day of a new week.

- Official data released Sunday showed that bullion held by the People’s Bank of China rose by 0.2% to 72.74 million troy ounces last month, marking the 17th consecutive month of increase.

- The markets have been pricing in an even chance that the Federal Reserve (Fed) will start its rate-cutting cycle at the June policy meeting, which further benefits the non-yielding yellow metal.

- The global risk sentiment got a boost after Israel withdrew more soldiers from southern Gaza and committed to fresh talks on a potential ceasefire, easing geopolitical tensions in the Middle East.

- The US Bureau of Labor Statistics (BLS) reported on Friday that Nonfarm Payrolls (NFP) increased by 303K in March vs the 200K expected and the previous month’s downwardly revised reading.

- Other details of the publication showed that the Unemployment Rate edged lower to 3.8% from 3.9% in February amid a rise in the Labor Force Participation Rate to 62.7% from 62.5% previously.

- The data forced investors to scale back their expectations for a total number of rate cuts in 2024 to two as against three rate cuts projected by the Fed, which pushes the US Treasury bond yields higher.

- The rate-sensitive two-year US government bond and the benchmark 10-year Treasury note surged to a four-month peak on Friday, underpinning the USD and capping gains for the commodity.

- Traders now look to the release of the US consumer inflation figures for March and the FOMC meeting minutes on Wednesday for cues about the Fed’s rate-cut path and a fresh directional impetus.

Technical Analysis: Gold price turns sideways after touching fresh record high, bulls turn cautious amid overbought RSI

From a technical perspective, Friday’s strong move up and acceptance above the $2,300 round-figure mark could be seen as a fresh trigger for bullish traders and support prospects for additional gains. That said, the Relative Strength Index (RSI) on the daily chart is flashing extremely overbought conditions. This, in turn, makes it prudent to wait for some near-term consolidation or a modest pullback before the next leg up. Nevertheless, the setup suggests that the path of least resistance for the Gold price is to the upside, and any corrective decline might still be seen as a buying opportunity.

Meanwhile, the Asian session low, around the $2,305-2,300 area, now seems to protect the immediate downside ahead of Friday’s swing low, around the $2,267-2,265 region. A convincing break below the latter might prompt some technical selling and drag the Gold price to the $2,223-2,222 zone en route to the $2,200 mark. The latter should act as a strong base for the XAU/USD, which, if broken decisively, might shift the near-term bias in favor of bearish traders and pave the way for a further depreciating move.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off” refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

-

Blockchain1 week ago

Blockchain1 week agoXRP Price Gains Traction — Buyers Pile In Ahead Of Key Technical Breakout – Crypto News

-

Technology1 week ago

Technology1 week agoSam Altman says OpenAI is developing a ‘legitimate AI researcher’ by 2028 that can discover new science on its own – Crypto News

-

De-fi1 week ago

De-fi1 week agoBittensor Rallies Ahead of First TAO Halving – Crypto News

-

Technology1 week ago

Technology1 week agoMicrosoft ‘tricked users into pricier AI-linked 365 plans,’ says Australian watchdog; files lawsuit – Crypto News

-

De-fi1 week ago

De-fi1 week agoAI Sector Rebounds as Agent Payment Systems Gain Traction – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoBig Iran Bank Goes Bankrupt, Affecting 42 Million Customers – Crypto News

-

Business1 week ago

Crypto Market Rally: BTC, ETH, SOL, DOGE Jump 3-7% as US China Trade Talks Progress – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoIBM Set to Launch Platform for Managing Digital Assets – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoSolana Eyes $210 Before Its Next Major Move—Uptrend Or Fakeout Ahead? – Crypto News

-

De-fi1 week ago

De-fi1 week agoREP Jumps 50% in a Week as Dev Gets Community Support for Augur Fork – Crypto News

-

Technology1 week ago

Technology1 week agoBenQ MA270U review: A 4K monitor that actually gets MacBook users right – Crypto News

-

others1 week ago

others1 week agoGBP/USD floats around 1.3320 as softer US CPI reinforces Fed cut bets – Crypto News

-

Technology7 days ago

Technology7 days agoGiving Nvidias Blackwell chip to China would slash USs AI advantage, experts say – Crypto News

-

others5 days ago

others5 days agoMETA stock has lower gaps to fill – Crypto News

-

Business1 week ago

Crypto ETFs Attract $1B in Fresh Capital Ahead of Expected Fed Rate Cut This Week – Crypto News

-

De-fi1 week ago

De-fi1 week agoCrypto Market Edges Lower While US Stocks Hit New Highs – Crypto News

-

others1 week ago

others1 week agoBank of Canada set to cut interest rate for second consecutive meeting – Crypto News

-

Business7 days ago

Business7 days agoStarbucks Says Turnaround Strategy Drives Growth in Global Sales – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWestern Union eyes stablecoin rails in pursuit of a ‘super app’ vision – Crypto News

-

others1 week ago

Pi Coin Gains Another 15% As Pi Network Joins ISO 20022 For Seamless Banking Integration – Crypto News

-

others1 week ago

Indian Court Declares XRP as Property in WazirX Hack Case – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP/BTC Retests 6-Year Breakout Trendline, Analyst Calls For Decoupling – Crypto News

-

De-fi7 days ago

De-fi7 days agoBitcoin Dips Under $110,000 After Fed Cuts Rates – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

Technology1 week ago

Technology1 week agoDonald Trump as Halo Master Chief? White House joins GameStop’s ‘End of Console Wars’ celebration – Crypto News

-

De-fi1 week ago

De-fi1 week agoMetaMask Fuels Airdrop Buzz With Token Claim Domain Registration – Crypto News

-

De-fi1 week ago

De-fi1 week agoTokenized Nasdaq Futures Enter Top 10 by Volume on Hyperliquid – Crypto News

-

others1 week ago

Is Changpeng “CZ” Zhao Returning To Binance? Probably Not – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoWhat Happens When You Don’t Report Your Crypto Taxes to the IRS – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoInside Bitwise’s milestone solana ETF launch – Crypto News

-

others1 week ago

Can ASTER Price Rebound 50% as Whale Activity and Bullish Pattern Align? – Crypto News

-

Technology1 week ago

Technology1 week agoSurvival instinct? New study says some leading AI models won’t let themselves be shut down – Crypto News

-

others1 week ago

others1 week agoGold weakens as US-China trade optimism lifts risk sentiment, focus turns to Fed – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoGold Price Forecast 2025, 2030, 2040 & Investment Outlook – Crypto News

-

Metaverse1 week ago

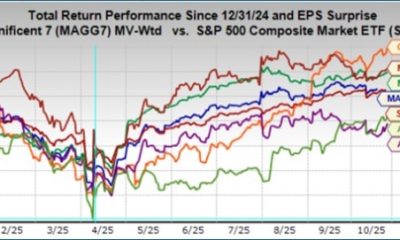

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoKERNEL price goes vertical on Upbit listing, hits $0.23 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoCitigroup and Coinbase partner to expand digital-asset payment capabilities – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoWhy Is Pi Network’s (PI) Price Up by Double Digits Today? – Crypto News

-

Metaverse1 week ago

Metaverse1 week agoIt isn‘t just AI. Earnings and the economy show the rally has legs. – Crypto News

-

Cryptocurrency1 week ago

Is Stock Tokenization Really Exploding? Not Even 0.01% – Crypto News

-

De-fi1 week ago

De-fi1 week agoCRO Jumps After Trump’s Truth Social Announces Prediction Market Partnership with Crypto.Com – Crypto News

-

Technology1 week ago

Breaking: $2.6B Western Union Announces Plans for Solana-Powered Stablecoin by 2026 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoVisa To Support Four Stablecoins on Four Blockchains – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoUSDJPY Forecast: The Dollar’s Winning Streak Why New Highs Could Be At Hand – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoXRP Reversal Sends Price Towards $1, DOGE Treasury to Go Public, Bitcoin Beats Gold, Binance’s CZ Pardoned — Top Weekly Crypto News – Crypto News

-

Cryptocurrency1 week ago

XRP News: Ripple-Backed Evernorth Amasses Over $1B in XRP Ahead of Nasdaq Listing – Crypto News

-

others1 week ago

others1 week agoPreviewing Mag 7 earnings: What investors should know – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoHayes’ Zcash ‘Vibe Check’ Sparks 30% Moonshot – Crypto News

-

Technology1 week ago

Pi Coin Price Jumps 24% as 10M Tokens Exit Exchanges – Can Bulls Sustain the Momentum? – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoCrypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000 – Crypto News