others

Gold price climbs back closer to over two-week high touched on Wednesday – Crypto News

- Gold price gains positive traction for the fourth successive day on Thursday.

- Sliding US bond yields weigh on the USD and benefit the non-yielding metal.

- Geopolitical risks and China’s economic woes remain supportive of the move.

Gold price (XAU/USD) attracts some buying for the fourth straight day on Thursday and moves back closer to over a two-week high, around the $2,056 area touched the previous day. The US Dollar (USD) struggles to capitalize on Wednesday’s post-FOMC bounce from a one-week trough amid a further decline in the US Treasury bond yields. This, along with persistent geopolitical risks stemming from conflicts in the Middle East and China’s economic woes, turn out to be a key factor lending some support to the safe-haven commodity. That said, the Federal Reserve’s (Fed) less dovish outlook on rates might cap the non-yielding yellow metal.

Investors now look to Thursday’s rather busy economic docket, highlighting the release of the flash Eurozone consumer inflation figures and the US ISM Manufacturing PMI, for some meaningful impetus. Furthermore, the Bank of England’s (BoE) monetary policy decision might infuse some volatility in the markets. Apart from this, the US bond yields, the USD price dynamics and the broader risk sentiment might contribute to producing short-term trading opportunities around the Gold price. The market focus will then shift to the closely-watched US monthly employment details, popularly known as the Nonfarm Payrolls (NFP) report on Friday.

Daily Digest Market Movers: Gold price draws support from sliding US bond yields, USD downtick and geopolitical risks

- The Federal Reserve signalled on Wednesday that it was getting closer to rate cuts and drags the US Treasury bond yields lower, prompting fresh US Dollar selling and lending support to the Gold price.

- As was expected, the Fed decided to leave the main interest-rate target unchanged at between 5.25%-5.5% at the end of a two-day meeting on Wednesday and indicated that the policy rate is likely at its peak.

- In the post-meeting press conference, Fed Chair Jerome Powell said that rate cuts would likely begin at some point this year, though pushed back strongly against expectations for any such move in March.

- The current market pricing indicates only about a 35% chance that the US central bank will cut interest rates in March, down from more than 60% before the Fed decision and nearly 90% a month ago.

- Investors remain worried that the deepening conflict in the Middle East could trigger a wider war, which, along with slowing economic growth in China, lends support to the safe-haven precious metal.

- The European Union hopes to launch a naval mission in the Red Sea within three weeks to help defend cargo ships against attacks by Houthi rebels, which are hampering trade and driving up prices.

- A private-sector survey released earlier this Thursday showed that business activity in China’s manufacturing sector expanded at a steady pace for the third successive month in January.

- Traders look to the flash Eurozone consumer inflation figures, the Bank of England policy decision and the US ISM Manufacturing PMI for some impetus ahead of the US NFP on Friday.

Technical Analysis: Gold price seems poised to appreciate further, $2,040-2,042 strong resistance breakout in play

From a technical perspective, strength beyond the $2,040-2,042 supply zone could be seen as a fresh trigger for bulls. Moreover, oscillators on the daily chart have just started gaining positive traction and support prospects for additional gains. That said, any further move up beyond the overnight swing high, around the $2,056 area, is likely to confront some resistance near the $2,065-2,066 zone ahead of the $2,078-2,079 region or the YTD peak. Some follow-through buying should allow the Gold price to aim back towards reclaiming the $2,100 round figure and climb further towards the next relevant hurdle near the $2,020 area.

On the flip side, the 50-day Simple Moving Average (SMA), currently pegged near the $2,031-2,030 area, now seems to act as an immediate strong support and a key pivotal point. A convincing break below the said support could drag the Gold price to the $2,012-2,010 area en route to the $2,000 psychological mark. Some follow-through selling might shift the bias in favour of bearish traders and expose the 100-day SMA support near the $1,980 region, before the XAU/USD eventually drops to the very important 200-day SMA, near the $1,965-1,964 area.

US Dollar price today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.07% | -0.06% | -0.03% | -0.06% | -0.23% | -0.35% | 0.04% | |

| EUR | 0.08% | 0.01% | 0.02% | 0.03% | -0.12% | -0.27% | 0.12% | |

| GBP | 0.07% | -0.01% | 0.01% | 0.02% | -0.13% | -0.28% | 0.11% | |

| CAD | 0.03% | -0.01% | 0.00% | 0.01% | -0.14% | -0.29% | 0.12% | |

| AUD | 0.06% | -0.03% | -0.02% | -0.01% | -0.16% | -0.30% | 0.12% | |

| JPY | 0.22% | 0.14% | 0.14% | 0.12% | 0.15% | -0.16% | 0.24% | |

| NZD | 0.34% | 0.30% | 0.30% | 0.32% | 0.30% | 0.12% | 0.40% | |

| CHF | -0.04% | -0.12% | -0.10% | -0.08% | -0.10% | -0.26% | -0.40% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

-

Technology3 days ago

Technology3 days agoChatGPT users are mass cancelling OpenAI subscriptions after GPT-5 launch: Here’s why – Crypto News

-

Technology1 week ago

Technology1 week agoMeet Matt Deitke: 24-year-old AI whiz lured by Mark Zuckerberg with whopping $250 million offer – Crypto News

-

Technology1 week ago

Binance to List Fireverse (FIR)- What You Need to Know Before August 6 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoAltcoin Rally To Commence When These 2 Signals Activate – Details – Crypto News

-

Cryptocurrency1 week ago

Cardano’s NIGHT Airdrop to Hit 2.2M XRP Wallets — Find Out How Much You Can Get – Crypto News

-

Technology1 week ago

Beyond Billboards: Why Crypto’s Future Depends on Smarter Sports Sponsorships – Crypto News

-

Technology1 week ago

Technology1 week agoBest computer set under ₹20000 for daily work and study needs: Top 6 affordable picks students and beginners – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoStablecoins Are Finally Legal—Now Comes the Hard Part – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Technology1 week ago

Technology1 week agoGoogle DeepMind CEO Demis Hassabis explains why AI could replace doctors but not nurses – Crypto News

-

Business1 week ago

Analyst Spots Death Cross on XRP Price as Exchange Inflows Surge – Is A Crash Ahead ? – Crypto News

-

De-fi7 days ago

De-fi7 days agoTON Sinks 7.6% Despite Verb’s $558M Bid to Build First Public Toncoin Treasury Firm – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoEthereum Hits Major 2025 Year Peak Despite Price Dropping to $3,500 – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

Blockchain1 week ago

Blockchain1 week agoXRP Must Hold $2.65 Support Or Risk Major Breakdown – Analyst – Crypto News

-

others1 week ago

Japan CFTC JPY NC Net Positions down to ¥89.2K from previous ¥106.6K – Crypto News

-

Technology1 week ago

Technology1 week agoOppo K13 Turbo, K13 Turbo Pro to launch in India on 11 August: Expected price, specs and more – Crypto News

-

Blockchain7 days ago

Shiba Inu Team Member Reveals ‘Primary Challenge’ And ‘Top Priority’ Amid Market Uncertainty – Crypto News

-

others7 days ago

others7 days agoBank of America CEO Denies Alleged Debanking Trend, Says Regulators Need To Provide More Clarity To Avoid ‘Second-Guessing’ – Crypto News

-

Technology6 days ago

Technology6 days agoOpenAI releases new reasoning-focused open-weight AI models optimised for laptops – Crypto News

-

Blockchain6 days ago

Blockchain6 days agoCrypto Market Might Be Undervalued Amid SEC’s New Stance – Crypto News

-

De-fi5 days ago

De-fi5 days agoCoinbase Pushes for ZK-enabled AML Overhaul Just Months After Data Breach – Crypto News

-

Technology1 week ago

Will The First Spot XRP ETF Launch This Month? SEC Provides Update On Grayscale’s Fund – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Sale deals on smartwatches: Up to 70% off on Samsung, Apple and more – Crypto News

-

others1 week ago

SharpLink Buys the Dip, Acquires $100M in ETH for Ethereum Treasury – Crypto News

-

De-fi1 week ago

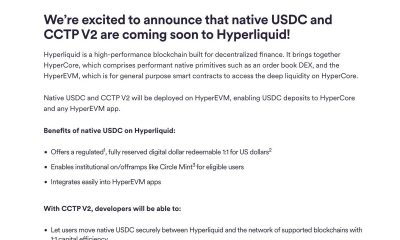

De-fi1 week agoCircle Extends Native USDC to Sei and Hyperliquid in Cross-Chain Push – Crypto News

-

Business1 week ago

Is Quantum Computing A Threat for Bitcoin- Elon Musk Asks Grok – Crypto News

-

Technology1 week ago

Technology1 week agoElon Musk reveals why AI won’t replace consultants anytime soon—and it’s not what you think – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoHow to Trade Meme Coins in 2025 – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoLido Slashes 15% of Staff, Cites Operational Cost Concerns – Crypto News

-

others1 week ago

others1 week agoIs Friday’s sell-off the beginning of a downtrend? – Crypto News

-

others1 week ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

Business1 week ago

Pi Network Invests In OpenMiind’s $20M Vision for Humanoid Robots- Is It A Right Move? – Crypto News

-

others7 days ago

MetaPlanet Launches Online Clothing Store As Part of ‘Brand Strategy’ – Crypto News

-

Metaverse6 days ago

Metaverse6 days agoChatGPT won’t help you break up anymore as OpenAI tweaks rules – Crypto News

-

Technology6 days ago

Technology6 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

Technology6 days ago

Technology6 days agoiPhone users alert! Truecaller to discontinue call recording feature for iOS from September 30. Here’s what you can do… – Crypto News

-

others6 days ago

others6 days agoUS President Trump issues executive order imposing additional 25% tariff on India – Crypto News

-

Business6 days ago

Analyst Predicts $4K Ethereum Rally as SEC Clarifies Liquid Staking Rules – Crypto News

-

Business5 days ago

XRP Price Prediction As $214B SBI Holdings Files for XRP ETF- Analyst Sees Rally to $4 Ahead – Crypto News

-

others5 days ago

others5 days agoEUR firmer but off overnight highs – Scotiabank – Crypto News

-

Blockchain5 days ago

Blockchain5 days agoTrump to Sign an EO Over Ideological Debanking: Report – Crypto News

-

De-fi5 days ago

De-fi5 days agoRipple Expands Its Stablecoin Payments Infra with $200M Rail Acquisition – Crypto News

-

others4 days ago

others4 days agoRipple To Gobble Up Payments Platform Rail for $200,000,000 To Support Transactions via XRP and RLUSD Stablecoin – Crypto News

-

Technology3 days ago

Technology3 days agoHumanoid Robots Still Lack AI Technology, Unitree CEO Says – Crypto News

-

Cryptocurrency3 days ago

DWP Management Secures $200M in XRP Post SEC-Win – Crypto News

-

Business1 week ago

Is Powell Next As Fed Governor Adriana Kugler Resigns? – Crypto News

-

Cryptocurrency1 week ago

Cryptocurrency1 week agoTron Eyes 40% Surge as Whales Pile In – Crypto News

-

Technology1 week ago

Technology1 week agoAmazon Great Freedom Festival Sale 2025 vs Flipkart Freedom Sale: Comparing MacBook deals – Crypto News

-

Business1 week ago

India’s Jetking Targets 21,000 Bitcoin By 2032 As CFO Foresees $1M+ Price – Crypto News

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-400x240.jpg)

![Nifty 50 Index Elliott Wave technical analysis [Video]](https://dripp.zone/news/wp-content/uploads/2025/05/Nifty-50-Index-Elliott-Wave-technical-analysis-Video-Crypto-80x80.jpg)